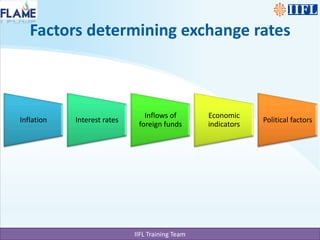

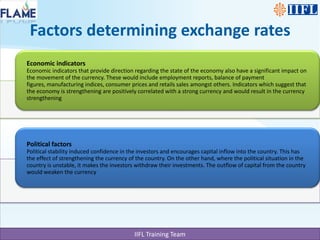

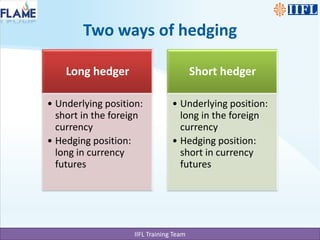

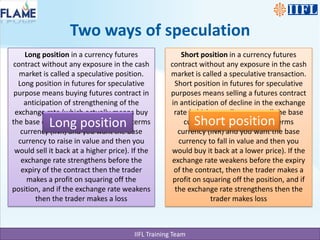

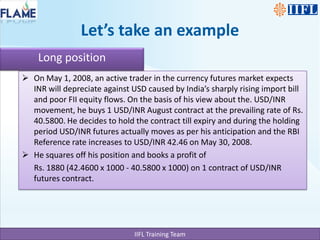

This document discusses currency trading strategies such as hedging, speculation, long positions, and short positions. Hedging involves taking an opposite position in the futures market to limit risk from unpredictable exchange rate changes. Speculation aims to profit from anticipated price changes by taking long positions if prices are expected to increase and short positions if they are expected to decrease. The document provides examples of traders profiting from correct long and short speculative positions in USD/INR currency futures contracts when their exchange rate predictions proved accurate.