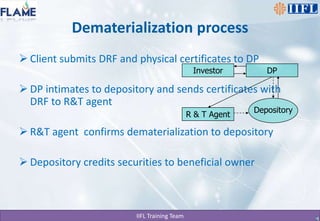

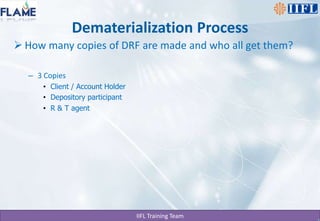

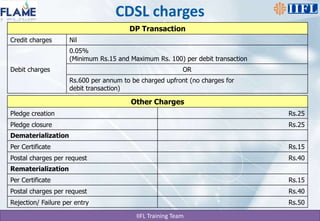

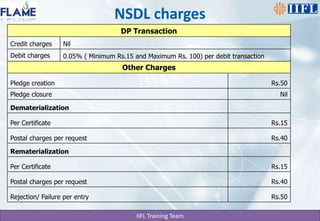

A depository holds securities electronically for investors through depository participants like banks and brokerages. Dematerialization converts physical shares into electronic form. Depository participants act as intermediaries between depositories and customers, maintaining account balances and facilitating transactions. The two main depositories in India are NSDL and CDSL, regulated by SEBI. Depositories provide safe custody of securities and allow electronic transfer of shares without physical movement, similar to how banks hold funds electronically.