The document discusses key indicators of a country's macro environment including gross domestic product, GDP deflator, consumer price index, sectoral shares of the economy, savings and investment rates, inflation rates, money supply, foreign trade, foreign exchange reserves, economic infrastructure, and social indicators; it also discusses factors that influence a country's competitiveness globally such as availability of skilled managers, total quality management practices, and treatment of labor.

![GDP Deflator: It is the numerical factor by which GDP

value at current prices discounted so that the impact of

increased prices in the valuation of GDP is removed and

the real GDP figure is arrived at.

GDP Rs 300bn -2002 ---Rs 390bn---2003

The general price level rises -20%

2002-Base year

Price index in 2002-100 ----120---2003

GDP Deflator 120/100=1.2

Real or inflation –adjusted GDP value for 2003

390/1.2=325bn

In nominal terms GDP rises by 30%[300-390]

But in real terms it is 8.3% [300-325]

Real GDP=Nominal GDP/GDP Deflator

Or GDP Deflator =Nominal GDP/Real GDP](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-3-320.jpg)

![• Agricultural Output: A dwindling agricultural sector can destabilise an

economy with far reaching consequences for the economy.

Agriculture:

Food for population

[lapses-food insecurity/food imports]

Raw materials to industry

Employment to masses

Agricultural stagnation:

In the face of rising population what would be the possible

consequences?

Inflation if how?

Agriculture, Industry and service sectors interface

Industry: electricity, seeds, fertilisers, pesticides and insecticides,

tractors, farm implements, etc as inputs .

Service sector: credit, transport, insurance, training and marketing

services.

Technical interpretation: Thus in economies where there is found

strong forward linkage of the agricultural sector,the level and rate of

growth of agriculture is taken as a key indicator of the macro

environment.](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-7-320.jpg)

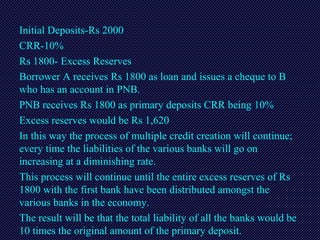

![Advancement of loans

Making ordinary loans: Undertaking/collateral security/an

account is created & total loan amount is credited to that

account.

Overdraft: Privileges granted to the customers of a bank

overdraw his account. [limit being fixed by the concerned

bank]

Cash-credit: Cash credits are loans, granted against the

borrower’s promissory notes guaranteed by two sureties at

least and often supported by a pledge of securities or

goods.

Discounting bills of exchange:

Holder of a bill of exchange

Commission is deducted

Face value of bills of exchange

At the time of maturity- bank receives final payment from the

party [initial; who submitted the bills of exchange]](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-30-320.jpg)

![Process of Discounting Bills of Exchange

Businessman A- Rs 60,000 [Delhi]

Goods purchased from B [Mumbai]

A Submitted the bill in his bank

After acceptance by the bank A sends to B

B deposits in his bank & his bank makes payment after deducting

the appropriate commission

At the time of maturity bank [A’s bank receives final payment

along with interest from A]](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-31-320.jpg)

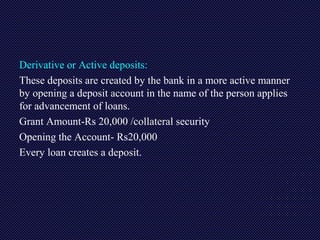

![Multiple Credit Creation:

Banks are not merely purveyors but also in an important sense,

manufacturers of money." Comment [Sayers]

Net addition to the total supply of money-Credit Creation

Deposits

Passive Active

Passive Deposits: Acceptance of deposits.

These deposits do not make any net addition to the stock of money in

the economy.

These deposits merely convert currency money into deposit money.

Do these primary or passive deposits carry any importance to the

bank?

Yes, as these deposits provide funds out of which the bank

makes loans and advances to its customers.](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-33-320.jpg)

![Increased Tax:

If 20%, then Net disposable income would be 4000.

[5000-20 % 5000]

Inflationary gap would be reduced by Rs 200 crores.

Increased Saving:

If 15% is saved then Net disposable income would be

4000-15% of 4000=Rs 3400

Inflationary gap would be further reduced to 3400-

3000=400

Increased Supply:

Existing supply can be increased to bridge the gap.](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-42-320.jpg)

![How the CPI is Calculated

• Assume that there are only three goods (instead of goods and

services in over 200 categories in the actual calculation) included in

the typical consumer's purchases and, in the base or the original

year, the goods had prices of $10.00, $20.00, and $30.00. The

typical consumer purchased ten of each good.

• In the current year, the goods' prices are $11, $24, and $33.

Consumers now purchase 12, 8, and 11 of each good.

• The CPI for the current year would be the quantities purchased in

the market basket in the base year (ten of each good) times their

prices in the current year divided by the quantities purchased in the

market basket in the base year times their prices in the base year.

• Thus [(10 x $11) + (10 x $24) + (10 x $33)] / [( 10 x $10) + (10 x

$20) + (10 x $30)] = $680 / $600 = 1.133. That is, prices in the

current year are 1.133 times the prices in the original year. Prices

have increased on average by 13.3 percent. The quantities are the

base year quantities in both the numerator and the denominator.

• By convention, the indexes are multiplied by 100 and reported as

113.3 instead of 1.133.

• The base year index simply divides the prices in the base year (times

the quantities in the base year) by the prices in base year (times the

quantities in the base year). The base-year index then is 1.00; or

multiplied by 100 equals 100.](https://image.slidesharecdn.com/29627227-indicators-of-macro-environment-101219021054-phpapp01/85/29627227-indicators-of-macro-environment-59-320.jpg)