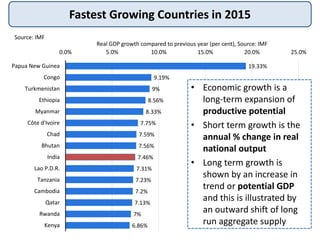

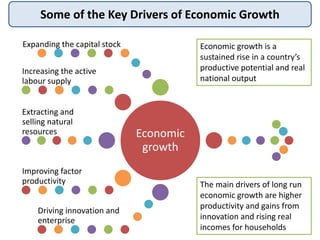

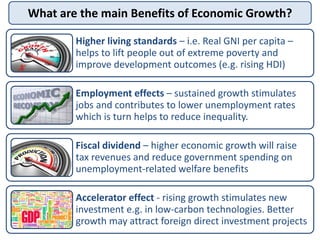

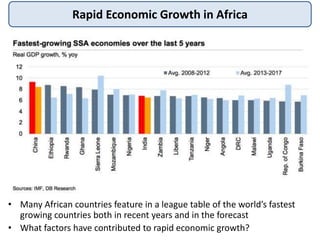

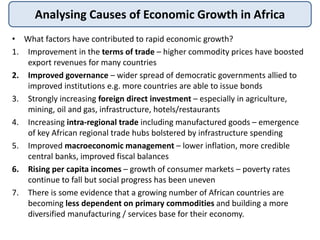

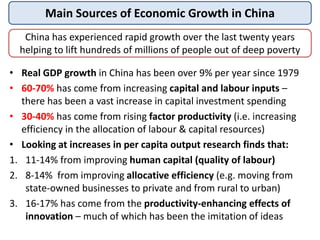

The document discusses economic growth in several countries and regions. It provides data showing some of the fastest growing countries in 2015, with Papua New Guinea having the highest growth rate at 19.33%. It also discusses factors that have contributed to rapid economic growth in many African countries in recent years, such as rising commodity prices and increasing foreign direct investment. The document analyzes sources of economic growth in China, finding that over 60% has come from increasing capital and labor inputs, while 30-40% has come from rising productivity.