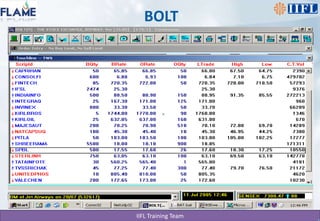

This document provides information on various intermediaries of the capital markets, including merchant bankers, registrar and transfer agents, custodians, stock exchanges, and stock brokers. It describes the roles of each intermediary, such as merchant bankers managing public issues and takeovers, registrar and transfer agents maintaining shareholder records and distributing benefits, custodians providing securities custody and account services, stock exchanges providing trading platforms, and stock brokers buying and selling securities on exchanges on behalf of clients. It also provides details on the two leading stock exchanges in India, the National Stock Exchange and Bombay Stock Exchange.

![R&T Agents-Registrar to issueThe R&T agents provide services to shareholders on behalf of issuers for:Management of public issue (Registrar to Issue)Managing corporate benefits like distribution of dividends, interest on debentures, bonus shares, rights etcShare transfer servicesMaintaining Register of Members [ROM]](https://image.slidesharecdn.com/equitybasics-intermediaries-110224230851-phpapp01/85/Equity-Basics-Intermediaries-4-320.jpg)