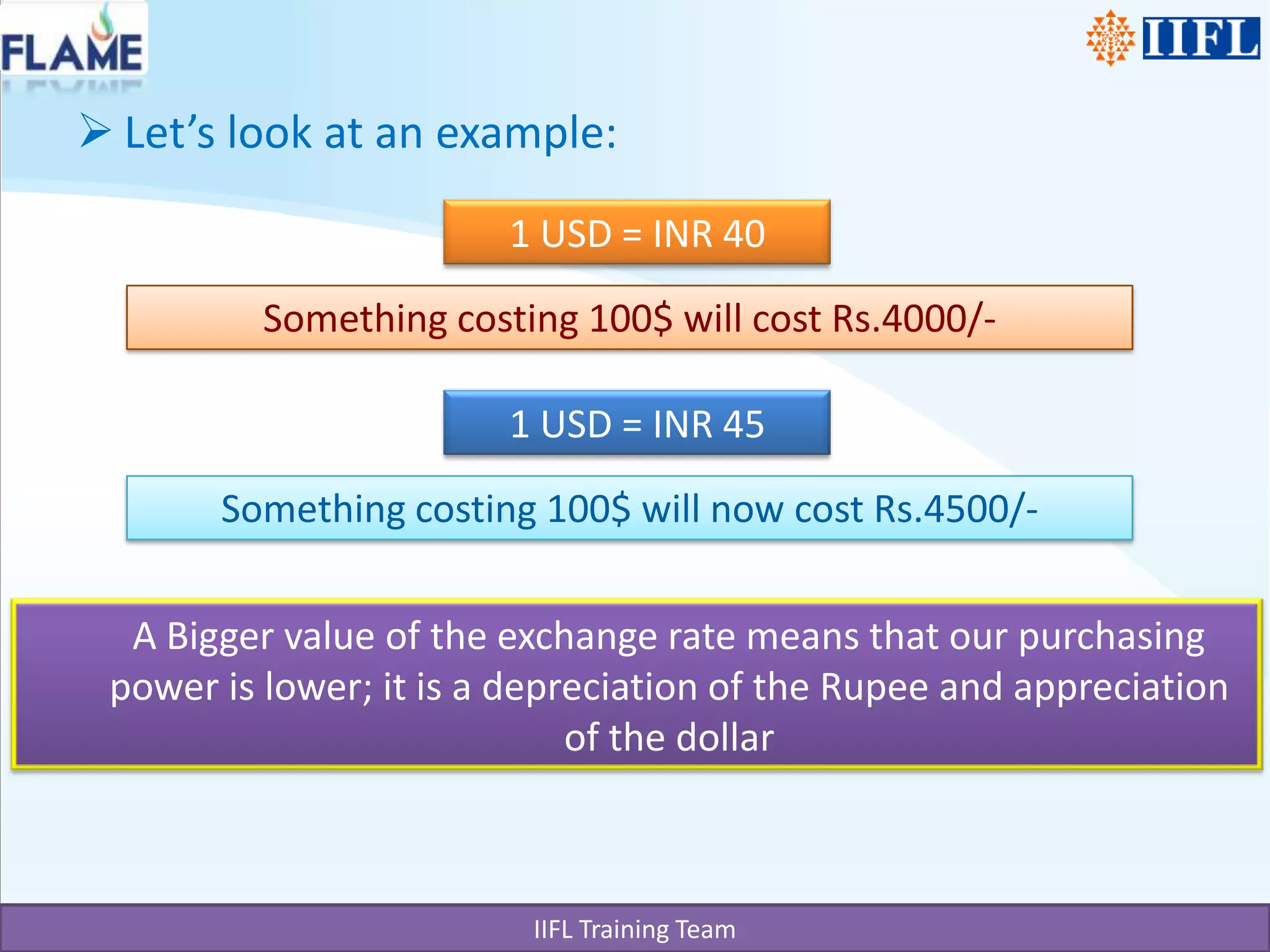

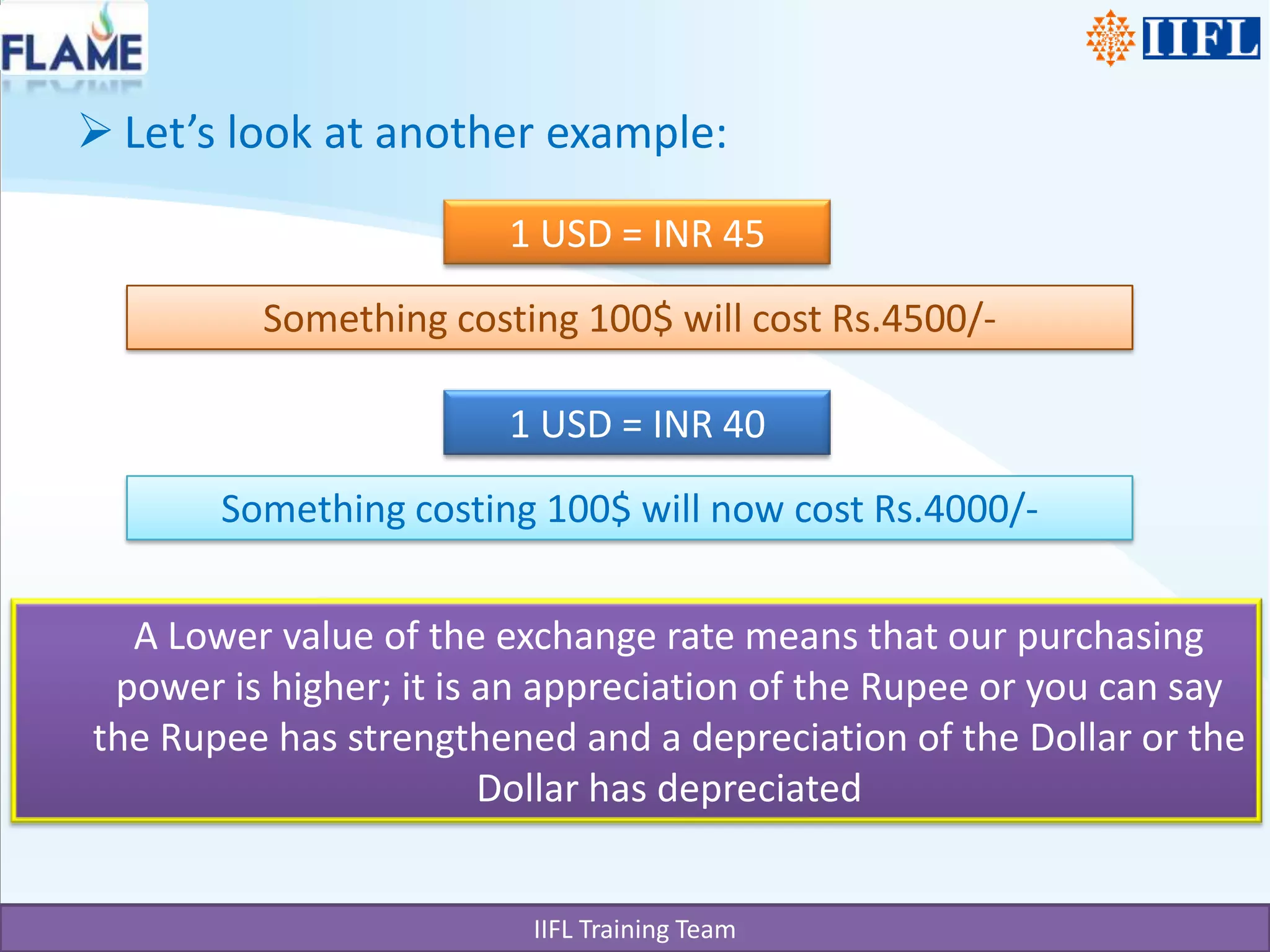

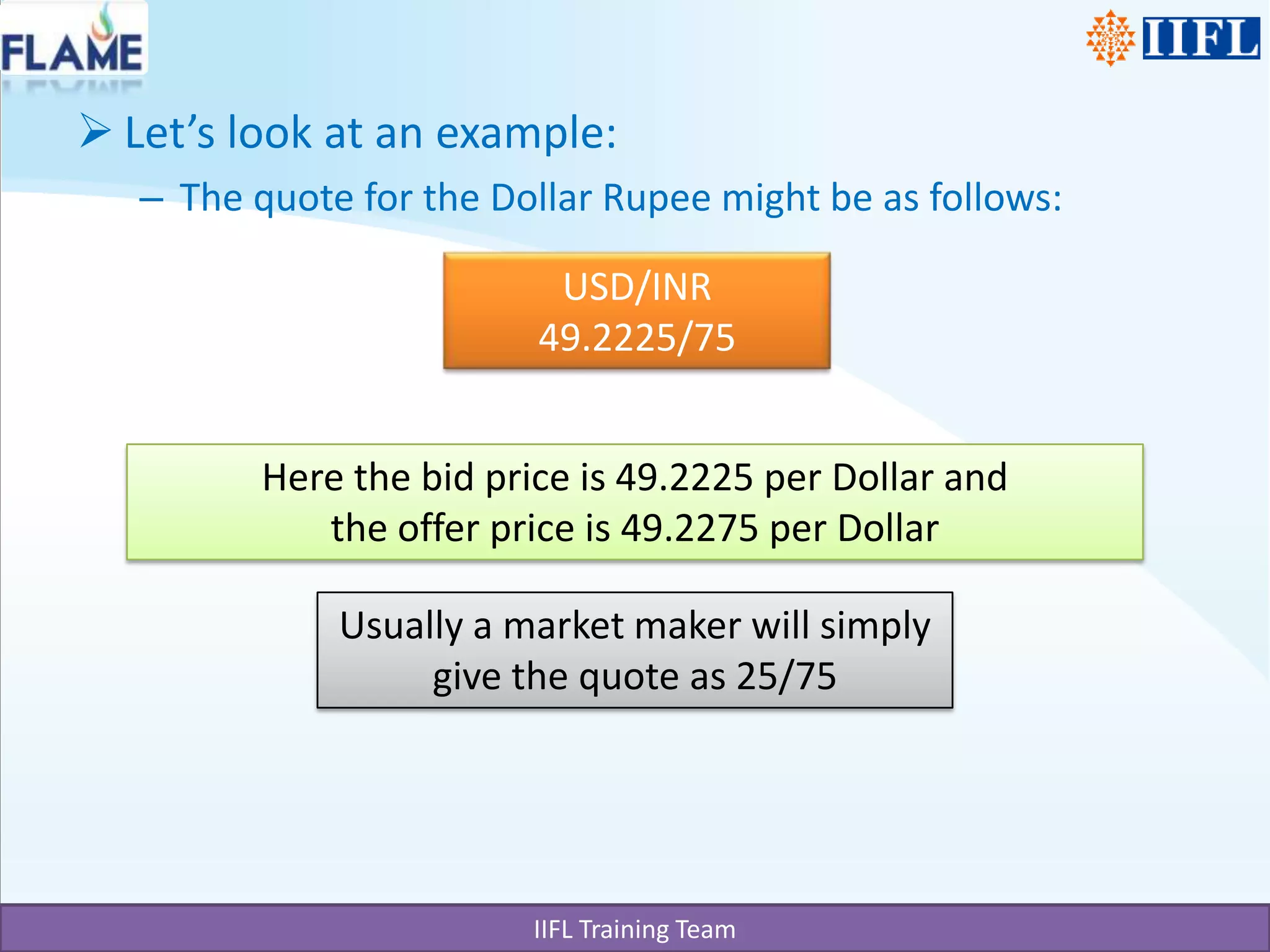

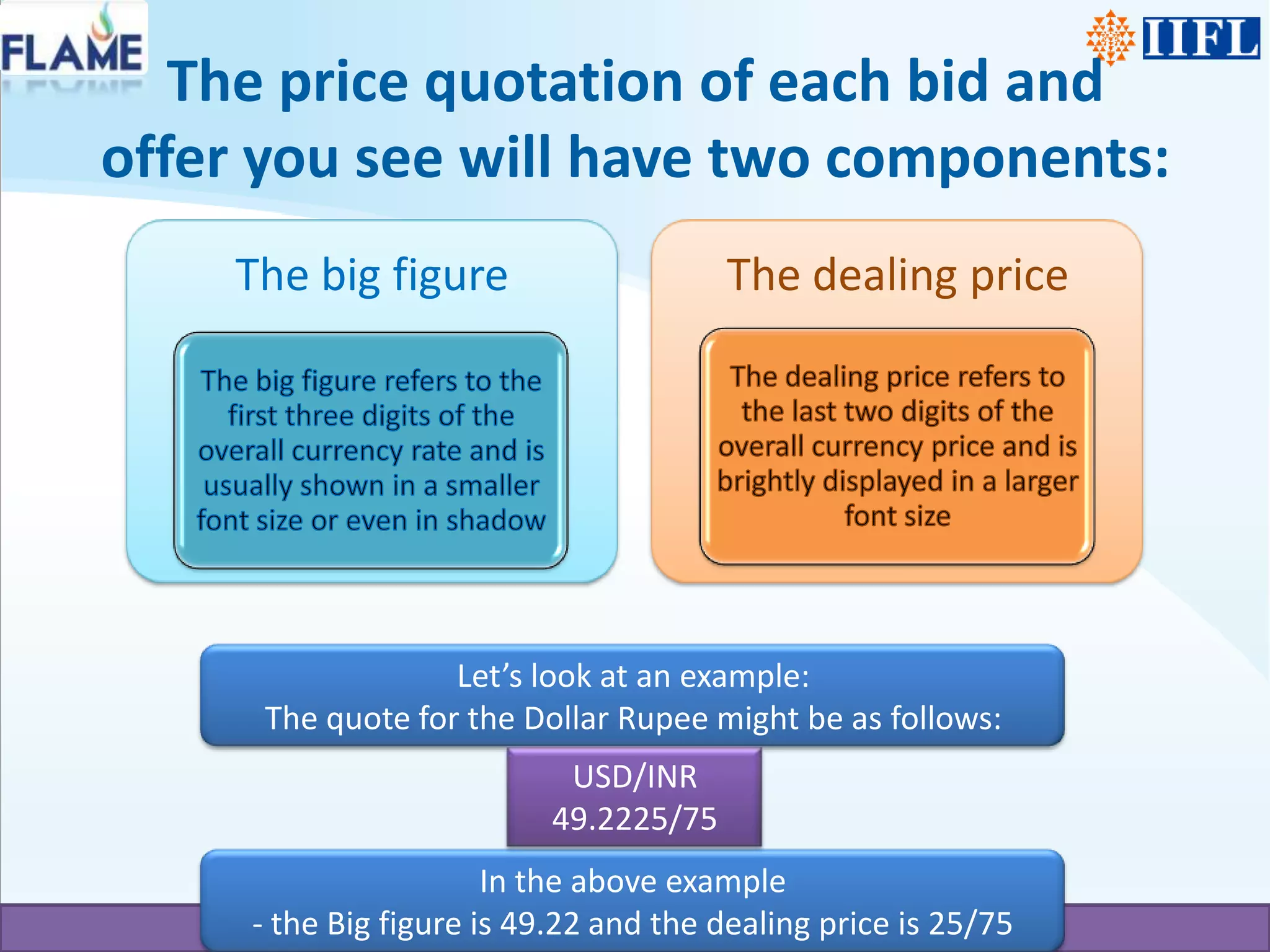

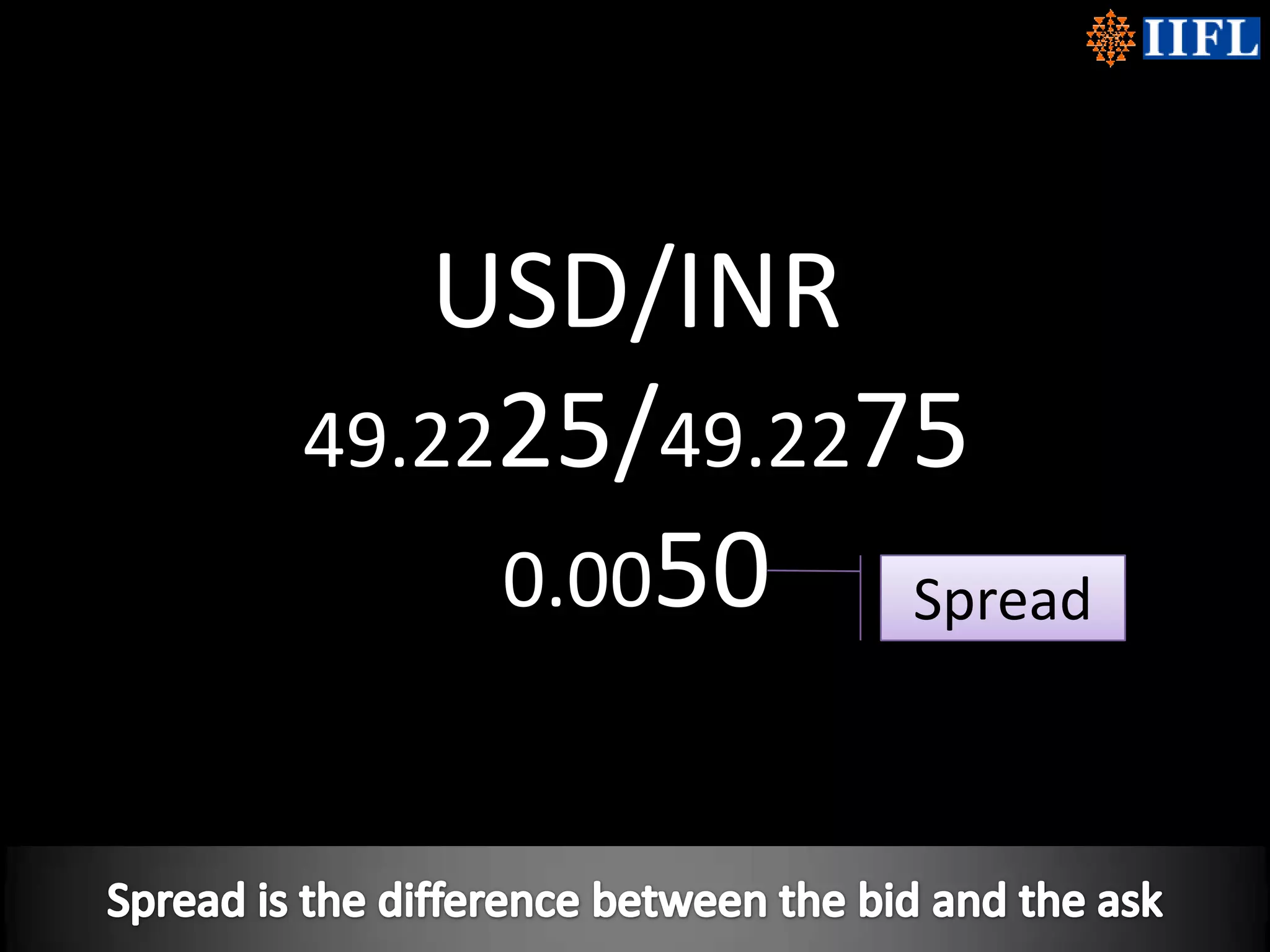

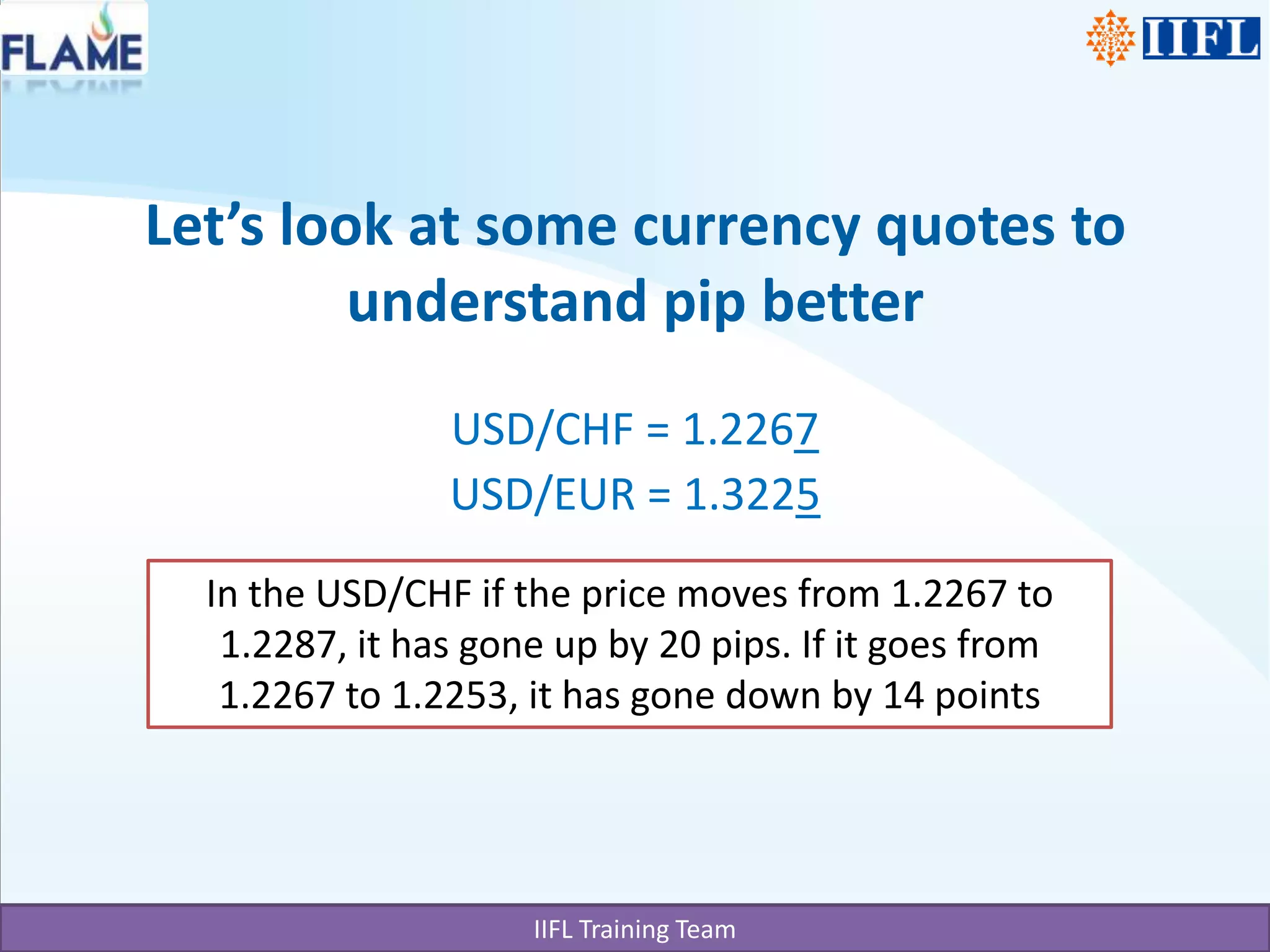

This document provides an introduction to currencies, exchange rates, and currency trading terminology. It explains that exchange rates fluctuate through appreciation and depreciation. Examples are given showing how currency values impact purchasing power. The terms bid and offer prices are defined as what you can sell and buy the base currency for. Spreads between bid and offer prices are explained. Pips, the smallest unit of price movement, are defined and examples given of pip calculations based on currency quote changes.