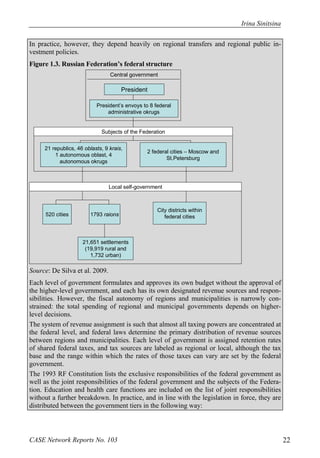

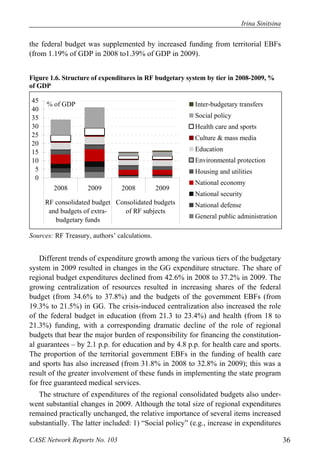

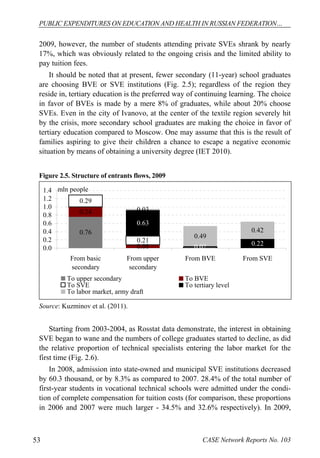

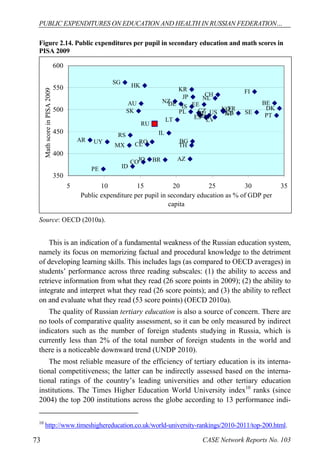

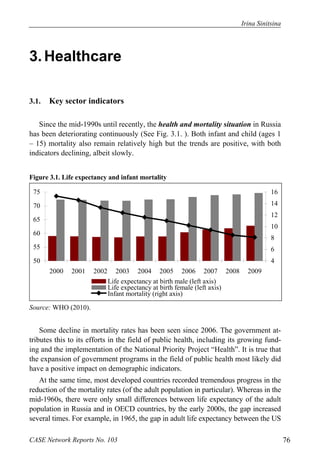

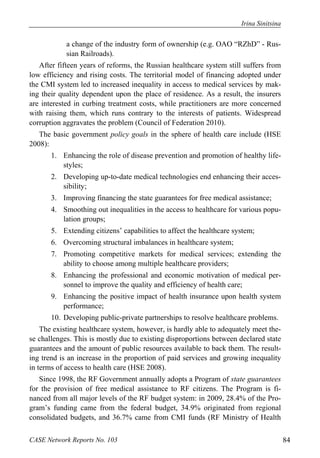

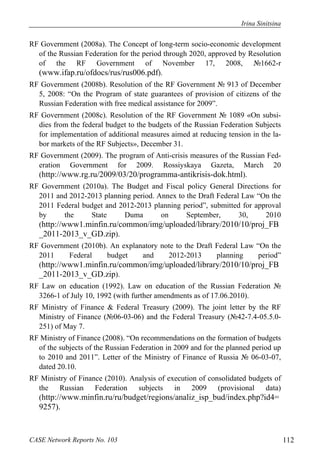

This document analyzes the impact of the 2008-2010 global financial crisis on funding and performance in Russia's healthcare and education sectors. It highlights increased expenditures relative to GDP, ongoing centralization of social service funding, and underlying inefficiencies that became evident during the crisis. The paper concludes with recommendations for improving transparency and performance in public service budgeting and financing.