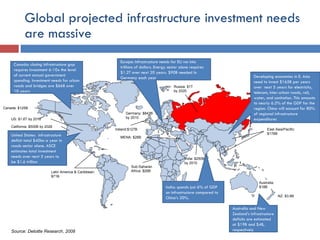

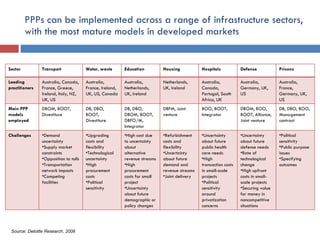

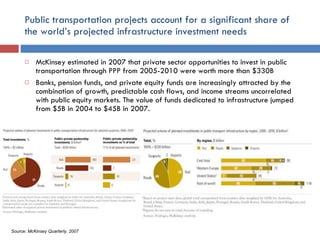

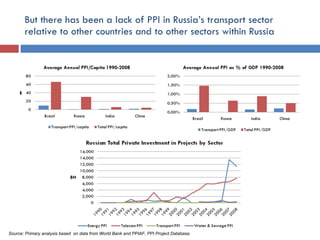

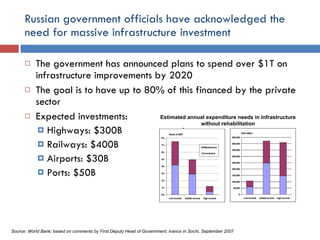

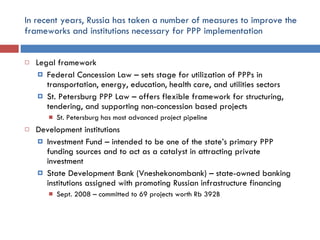

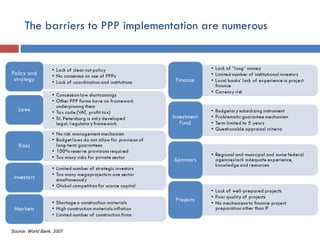

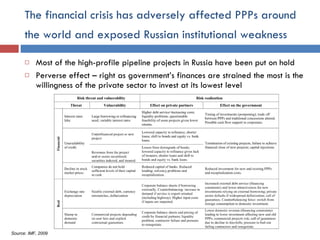

Russia needs massive investments in transport infrastructure but has seen relatively little private investment through public-private partnerships (PPPs) compared to other countries. The Russian government plans to spend over $1 trillion on infrastructure by 2020, with up to 80% financed by the private sector through PPPs. However, Russia still faces significant barriers to widespread PPP implementation, including an underdeveloped legal and institutional framework and lack of PPP experience and track record. The global financial crisis has further slowed PPP activity in Russia by reducing private sector appetite for infrastructure investments.