This document discusses investment alternatives and methods for evaluating them, including present worth (PW) and annual worth (AW). It covers the following key points:

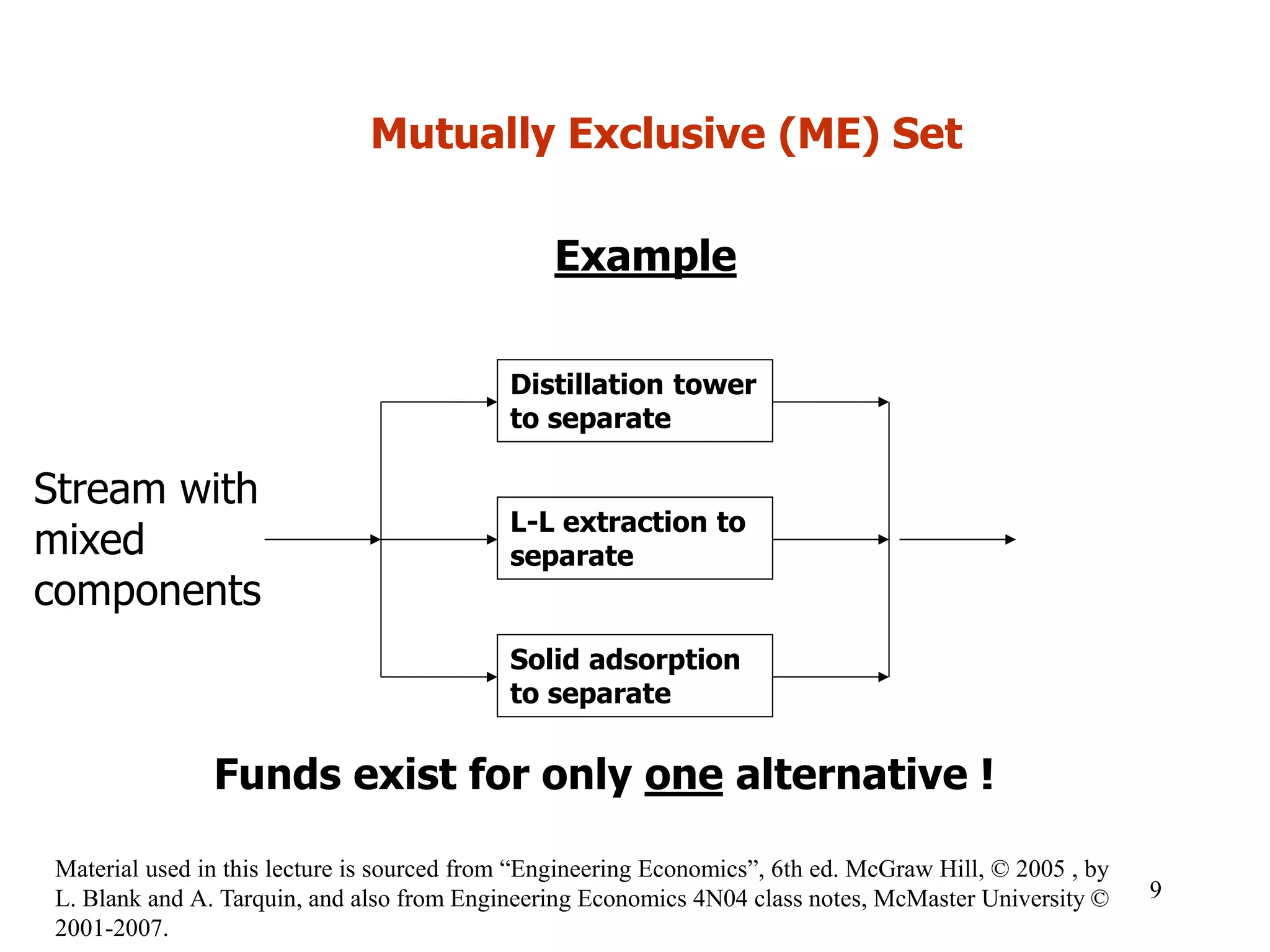

- There are four types of investment alternatives: mutually exclusive set, independent set, single project, and "do nothing" option.

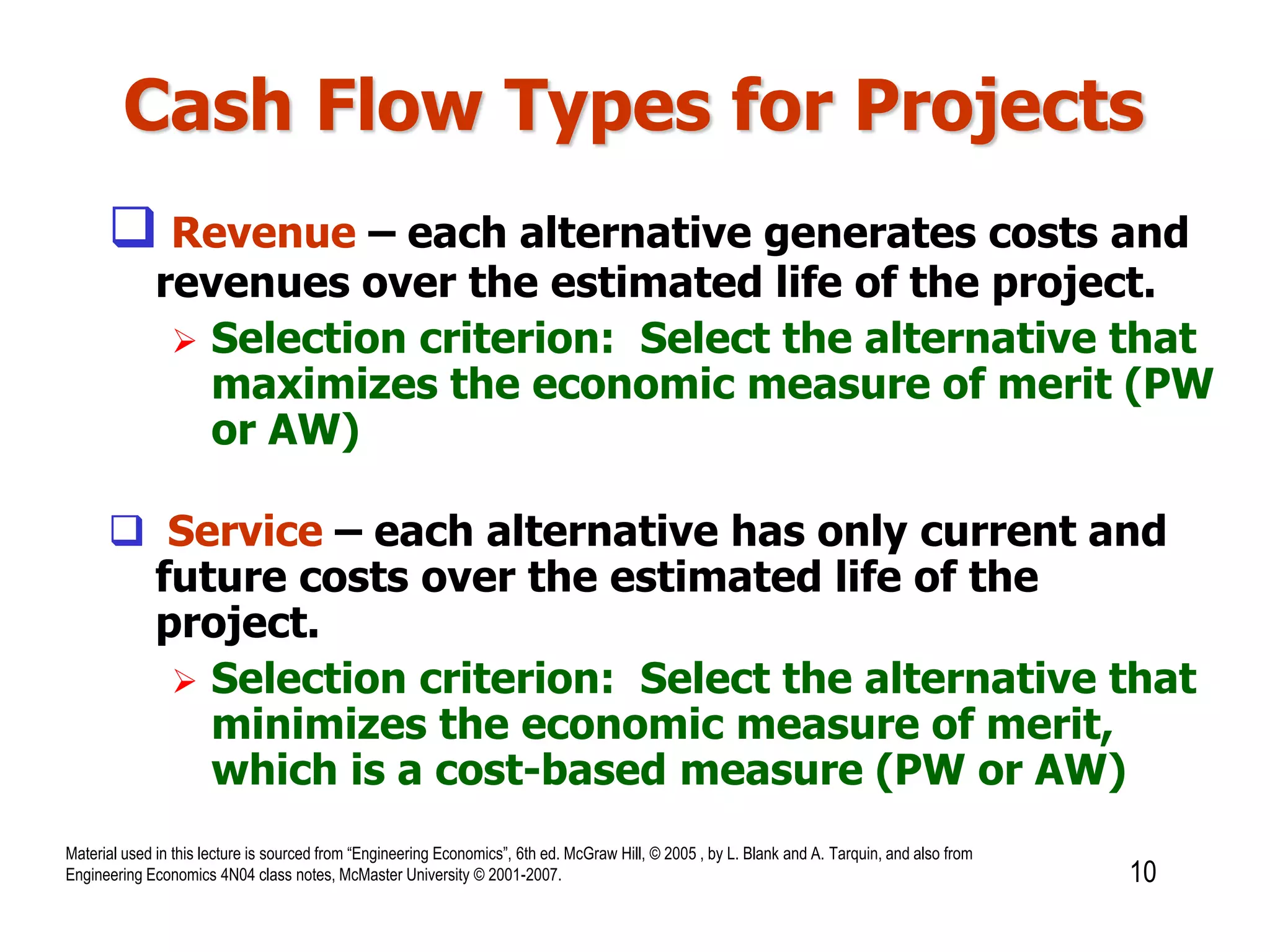

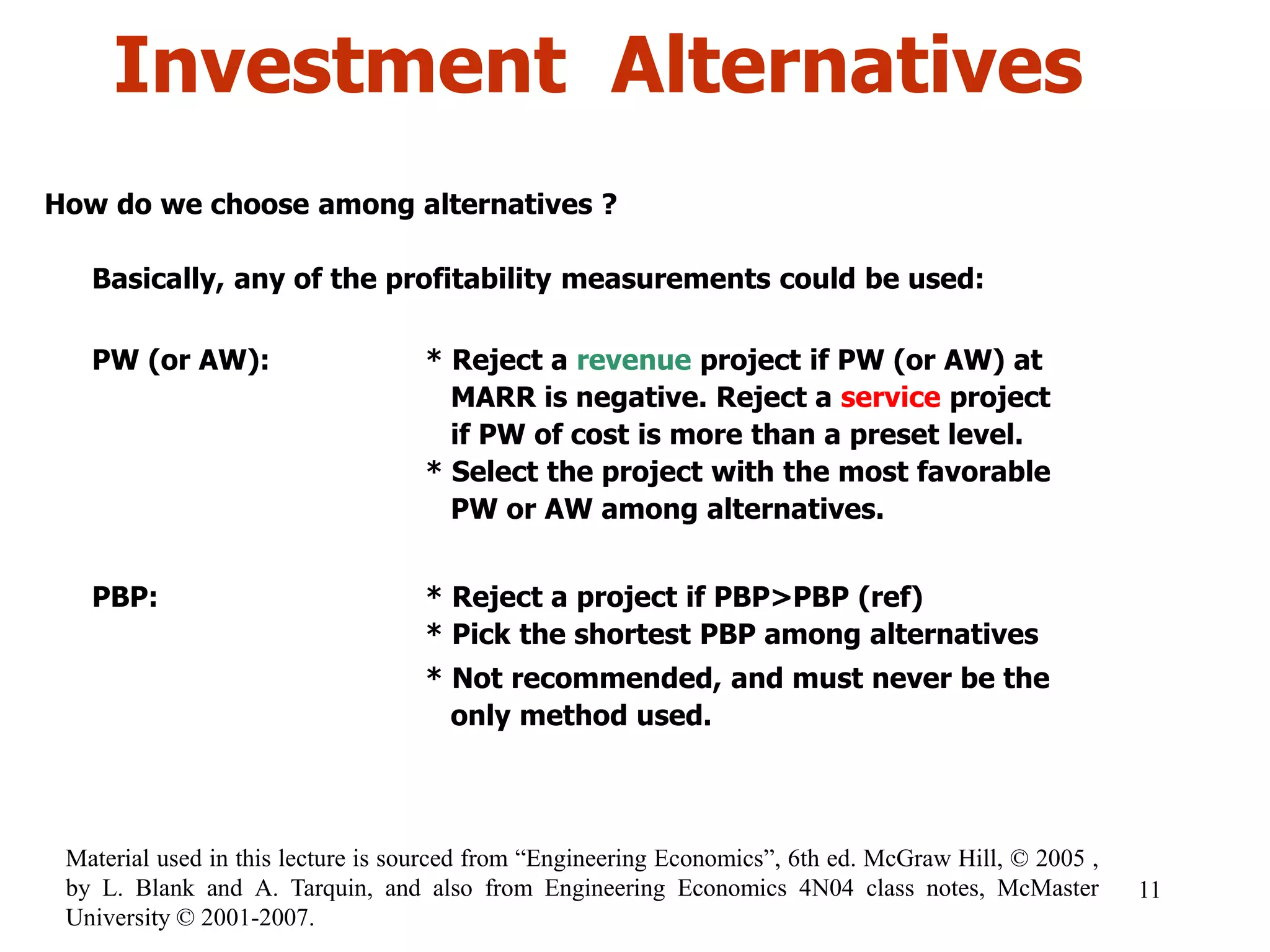

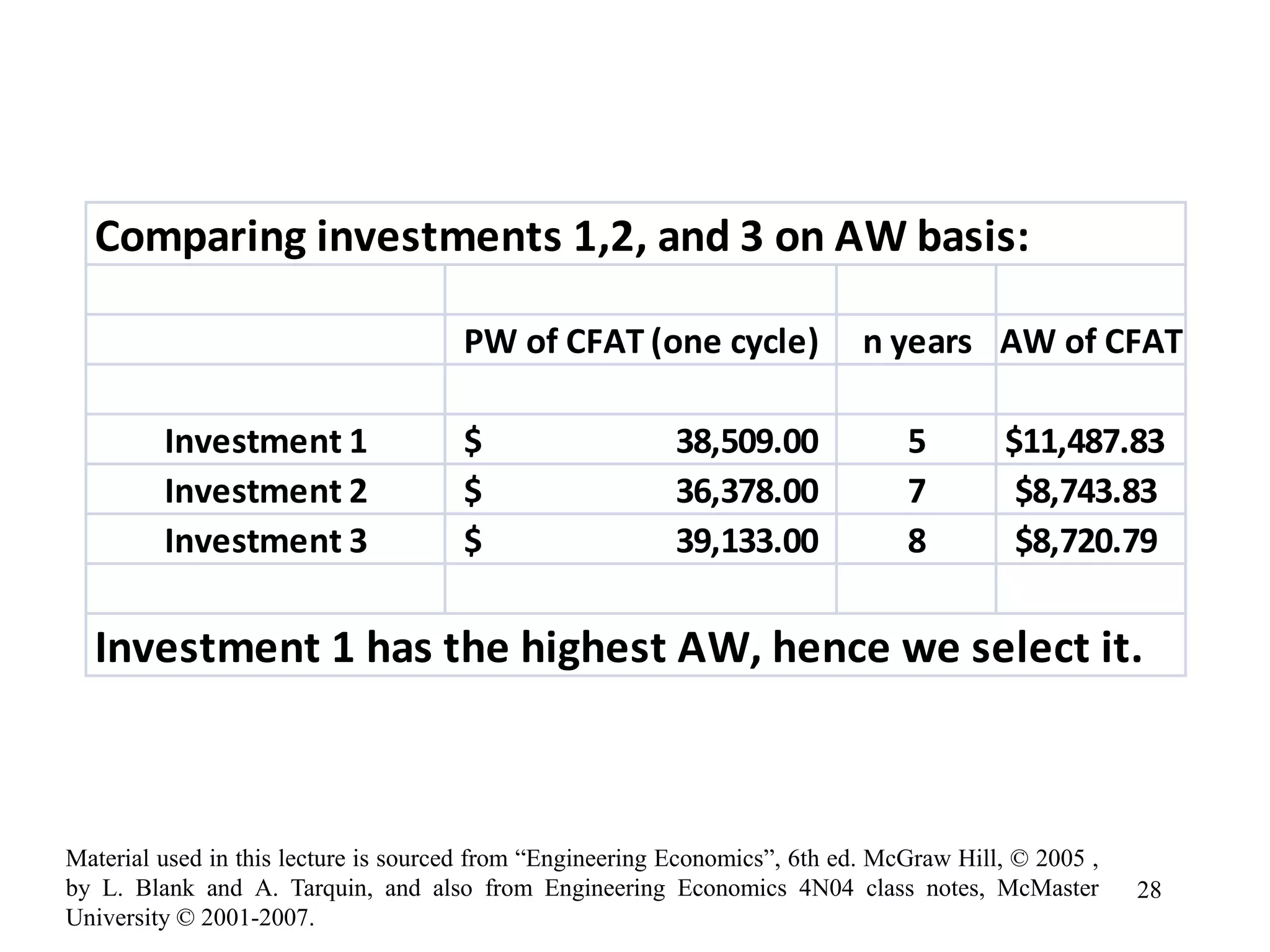

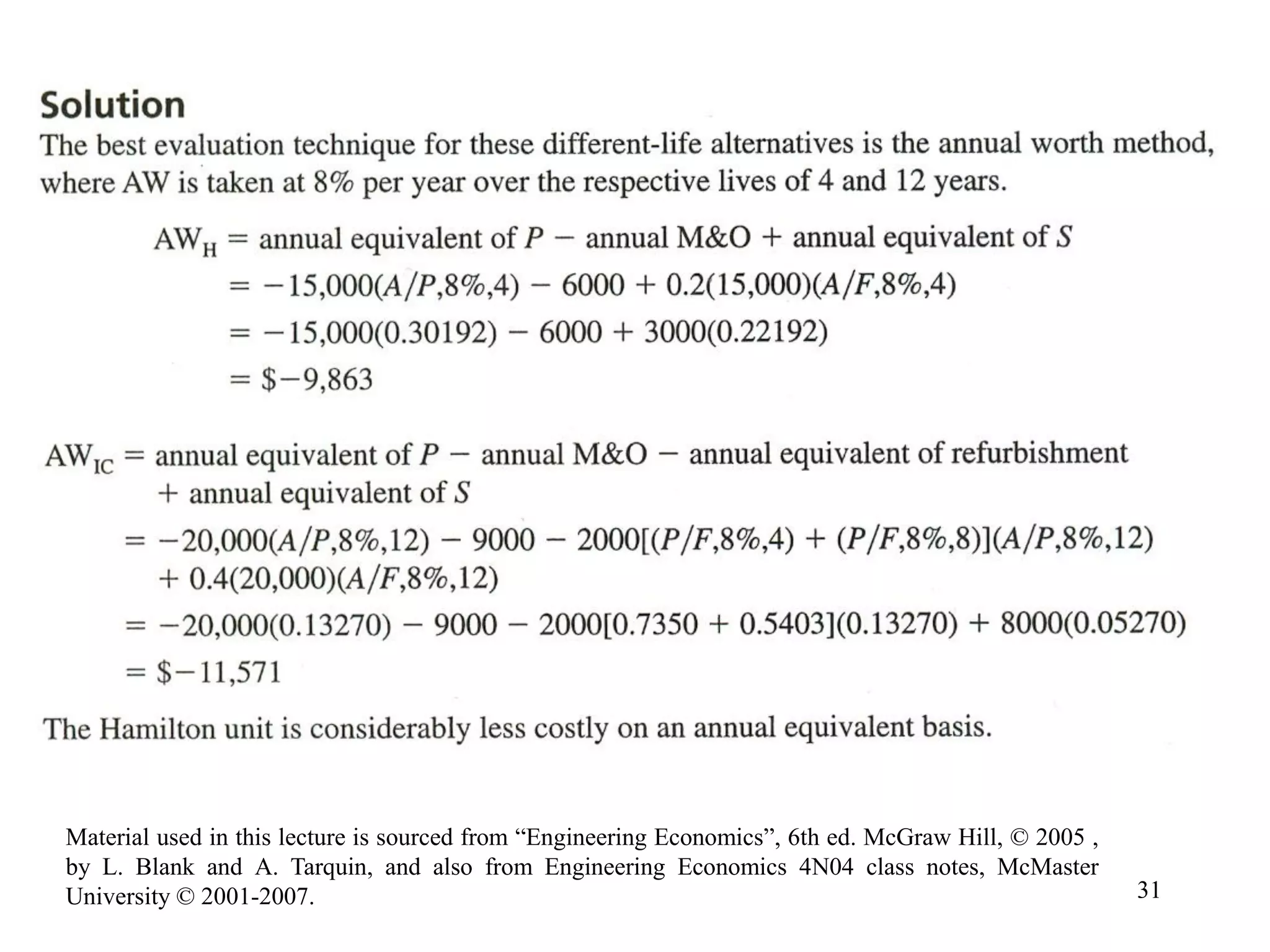

- PW and AW can both be used to evaluate alternatives, with PW preferred for revenue projects and AW for cost projects.

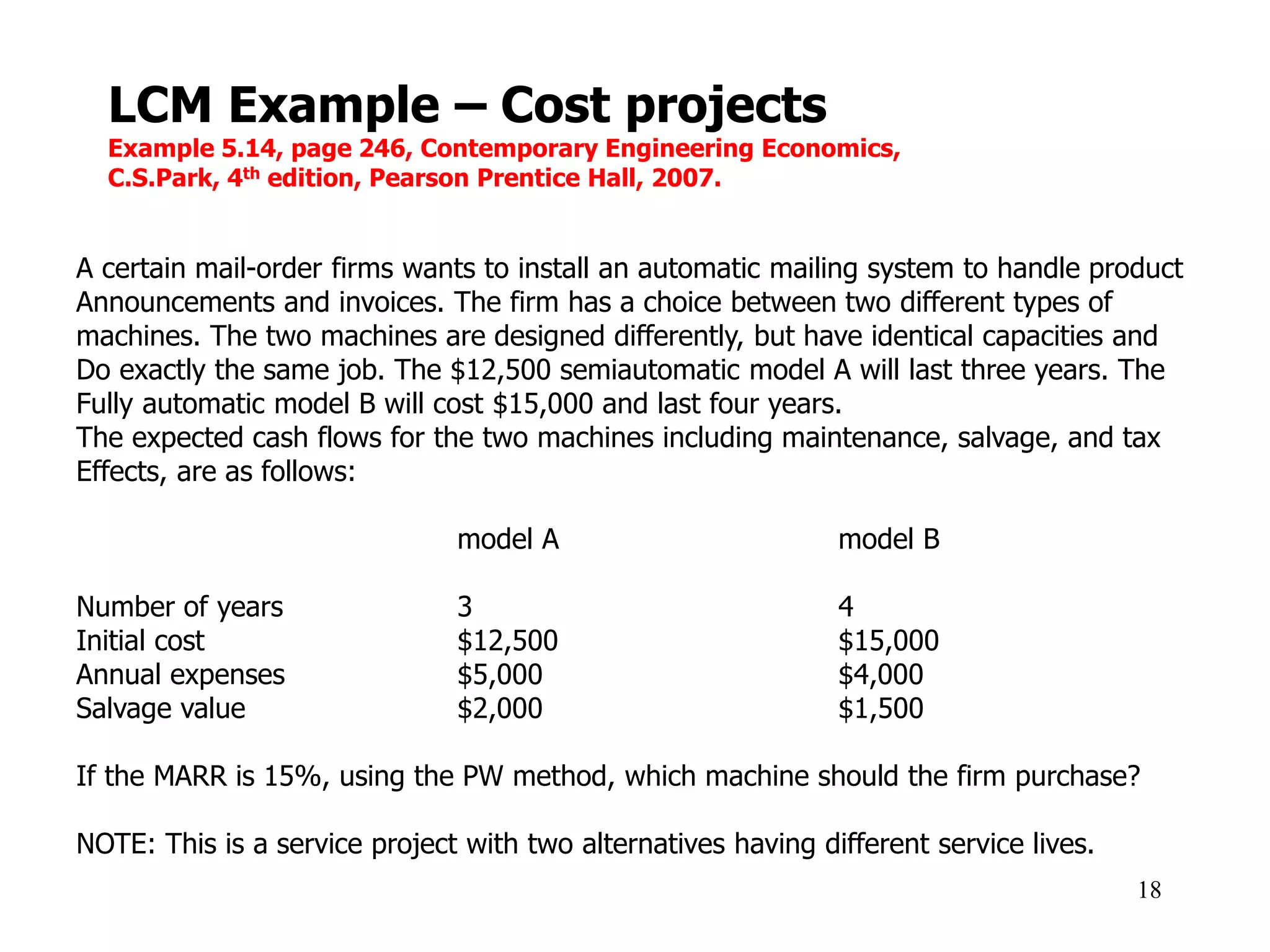

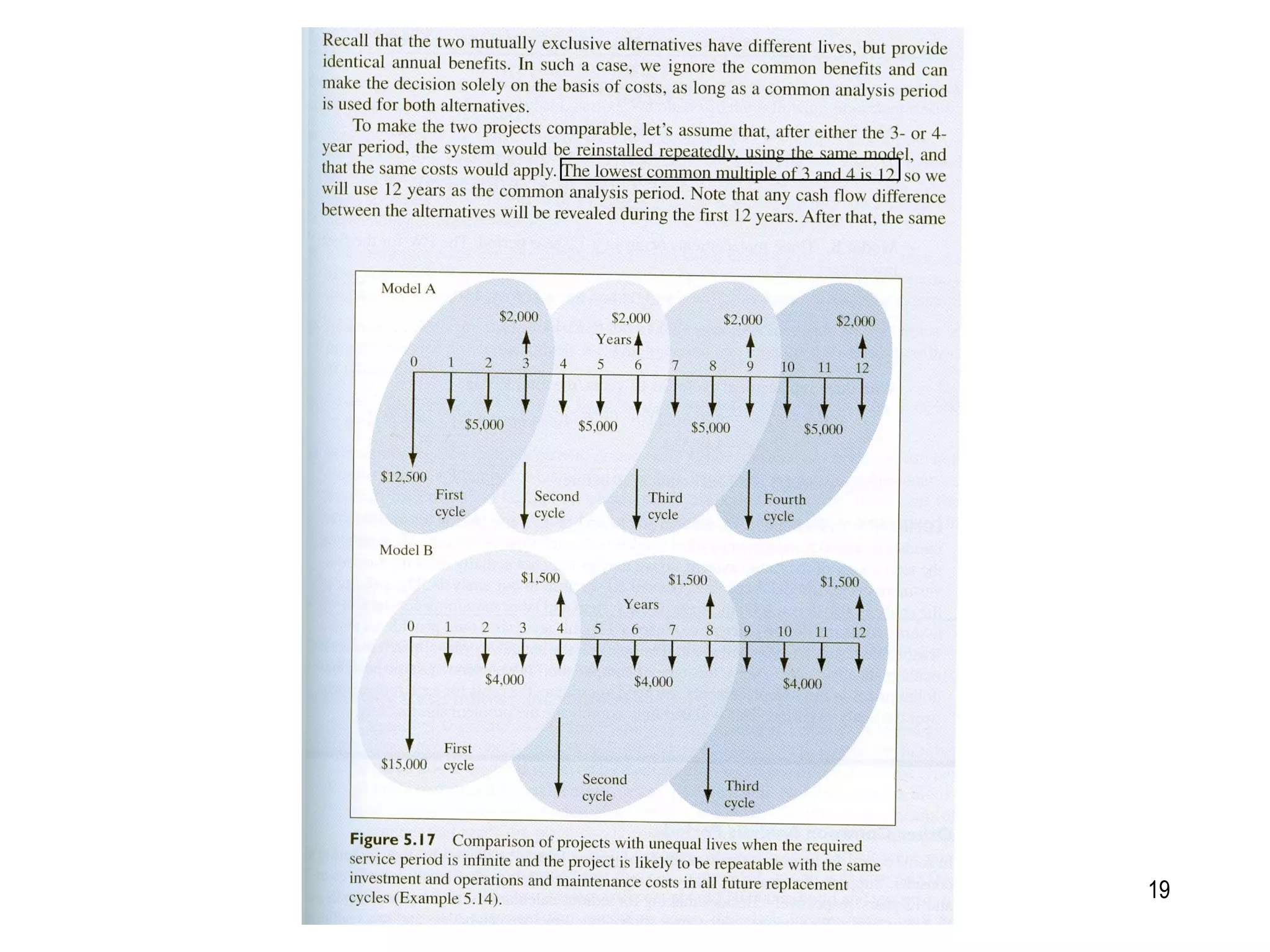

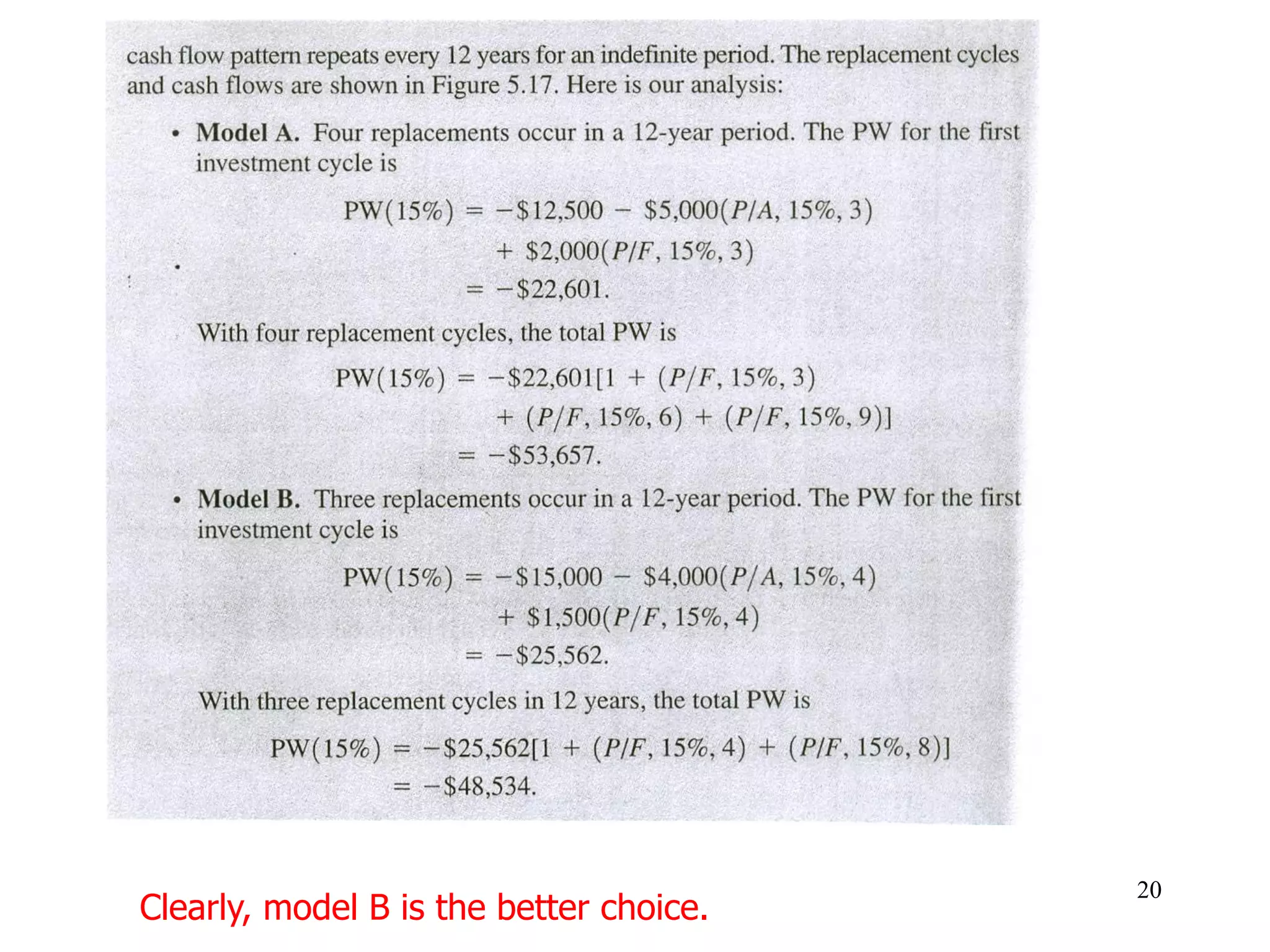

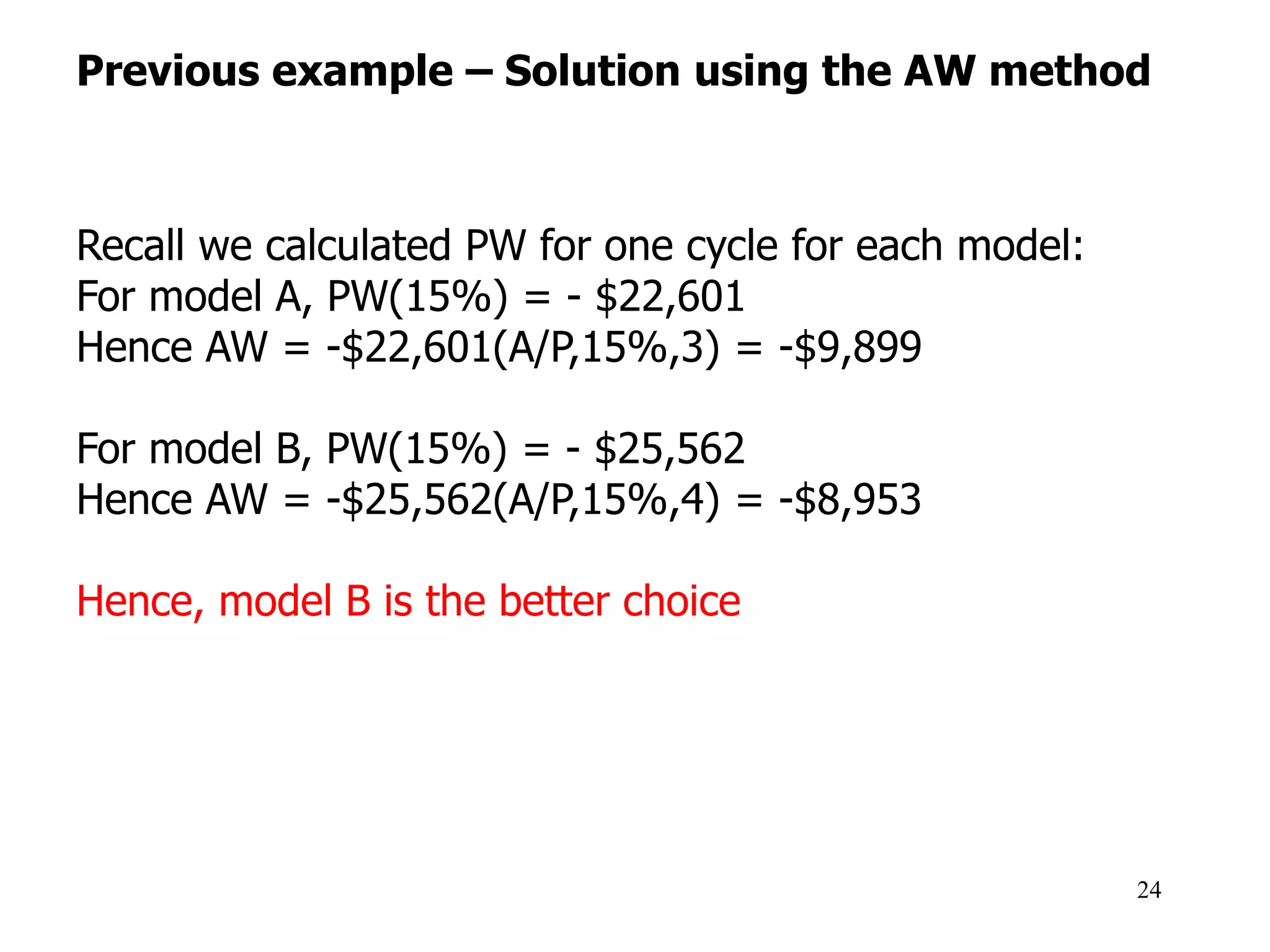

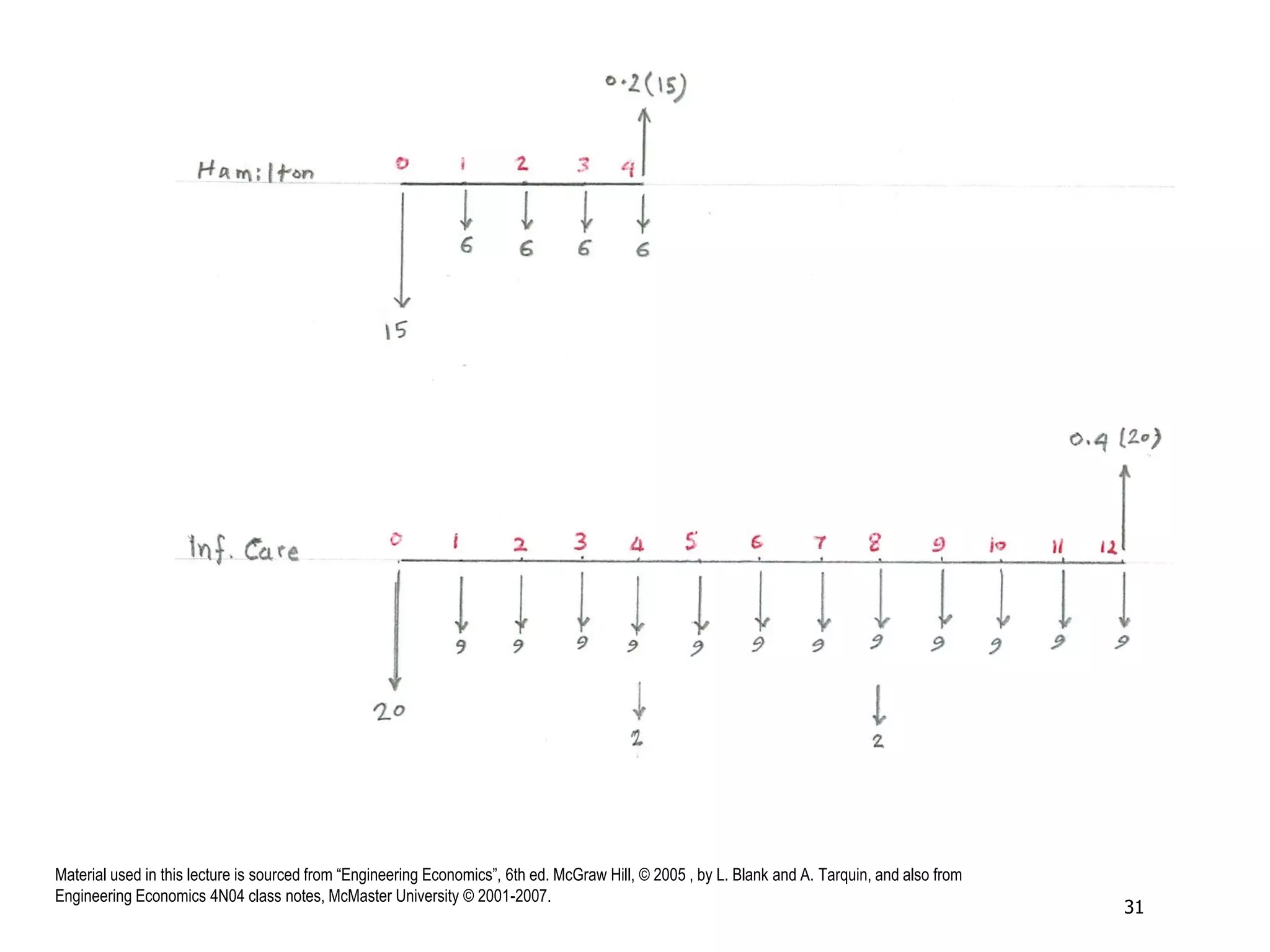

- When alternatives have different lives, the lowest common multiple approach is used to evaluate them over the same period for comparison.

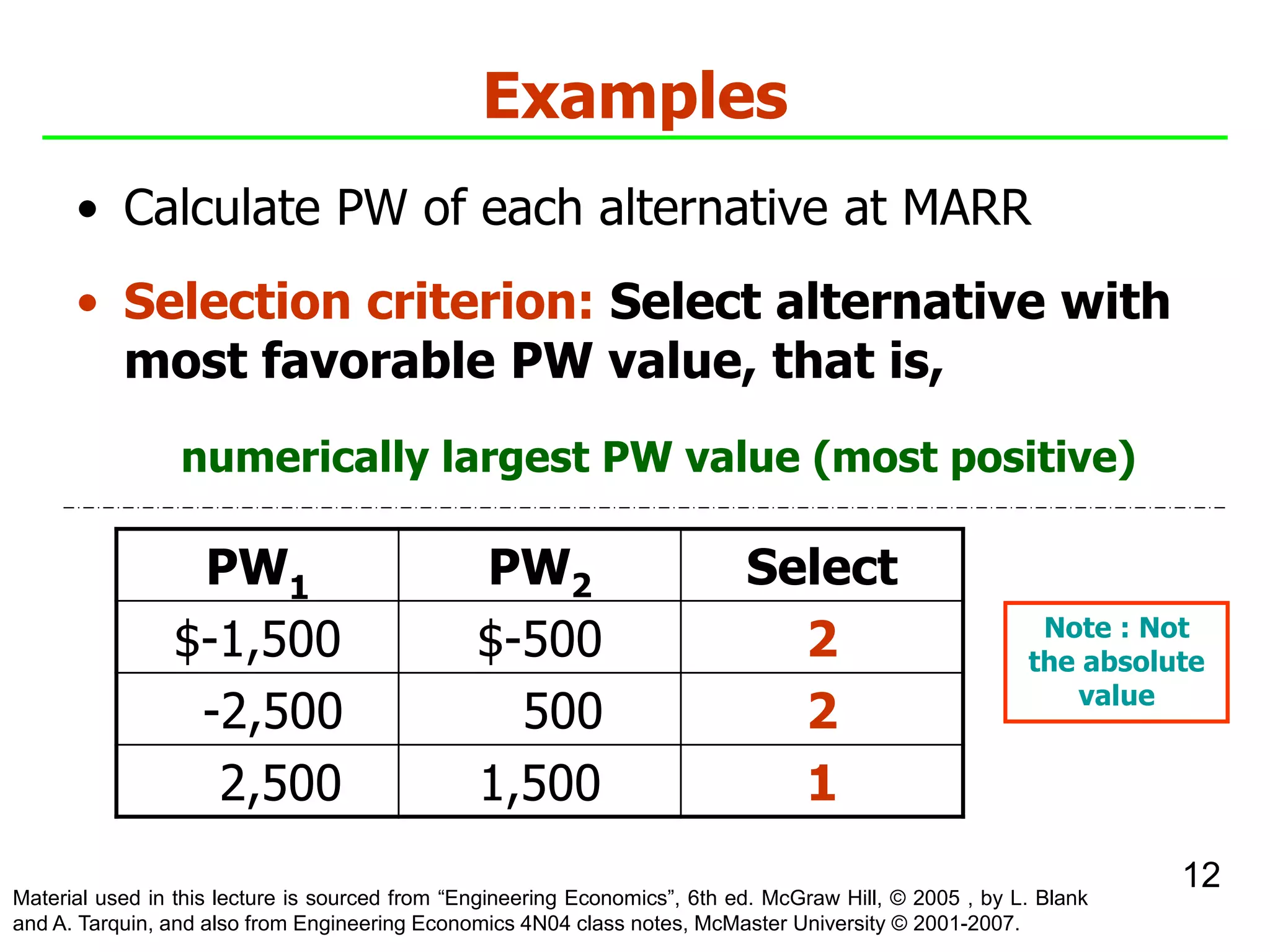

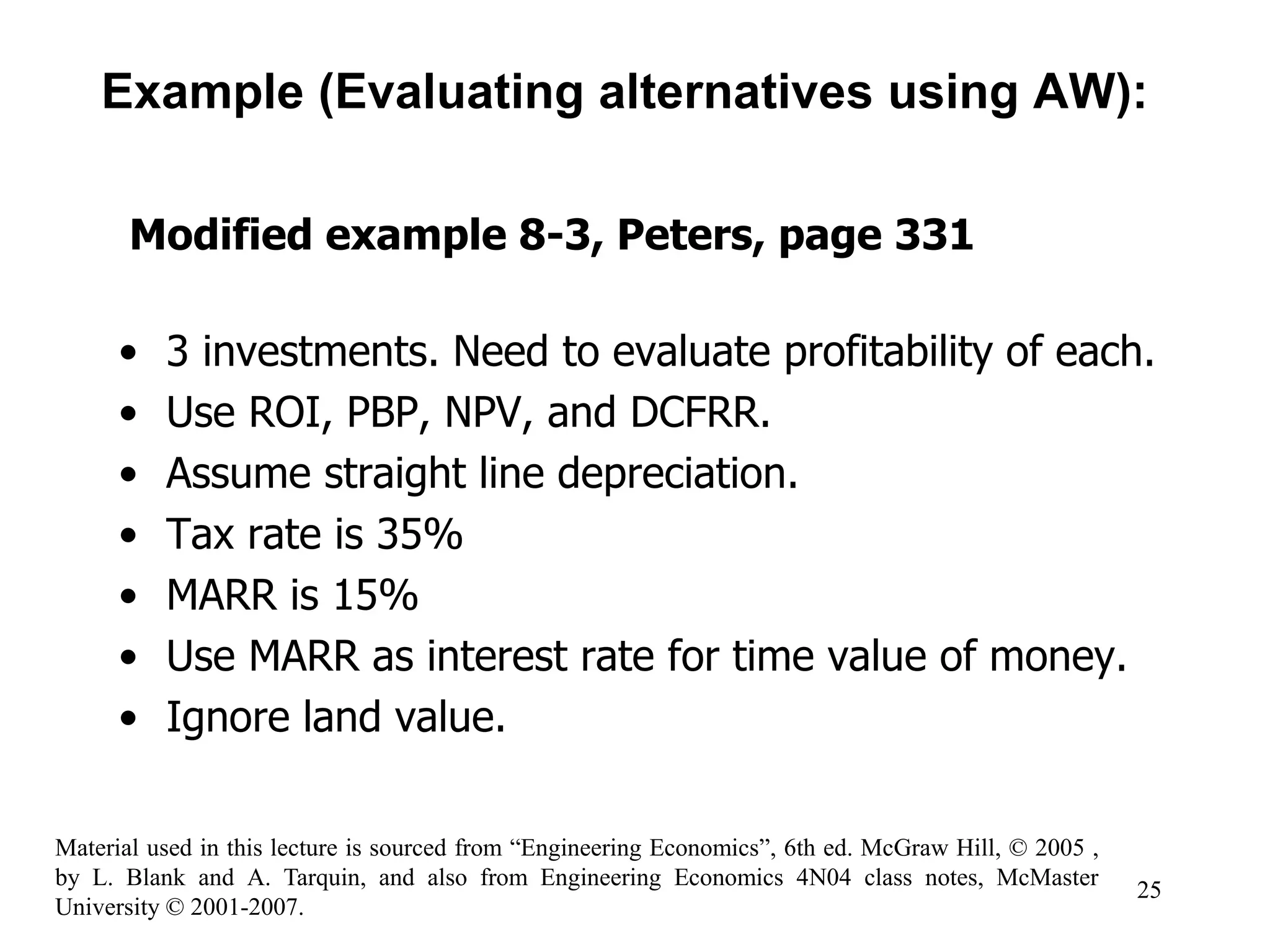

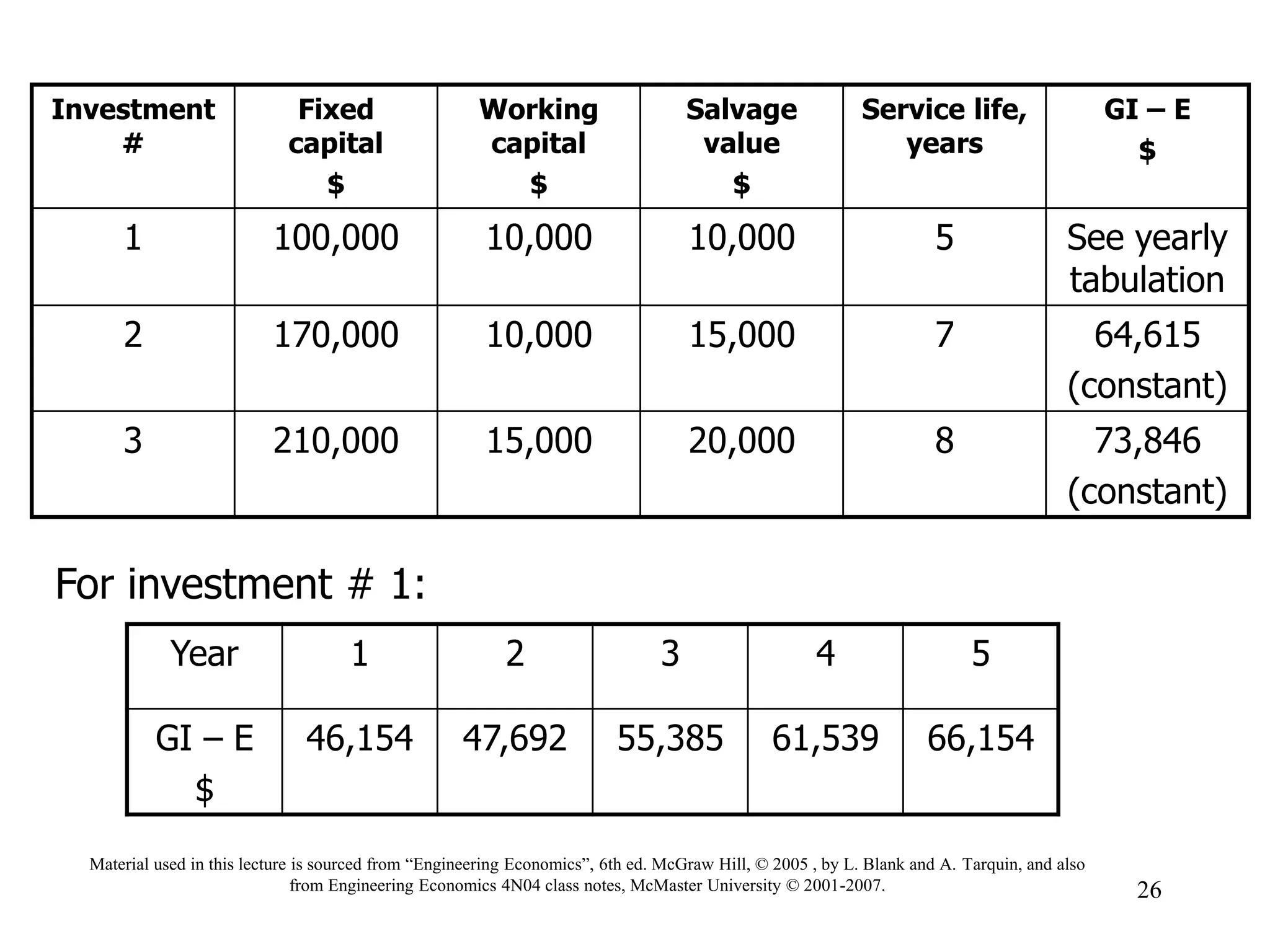

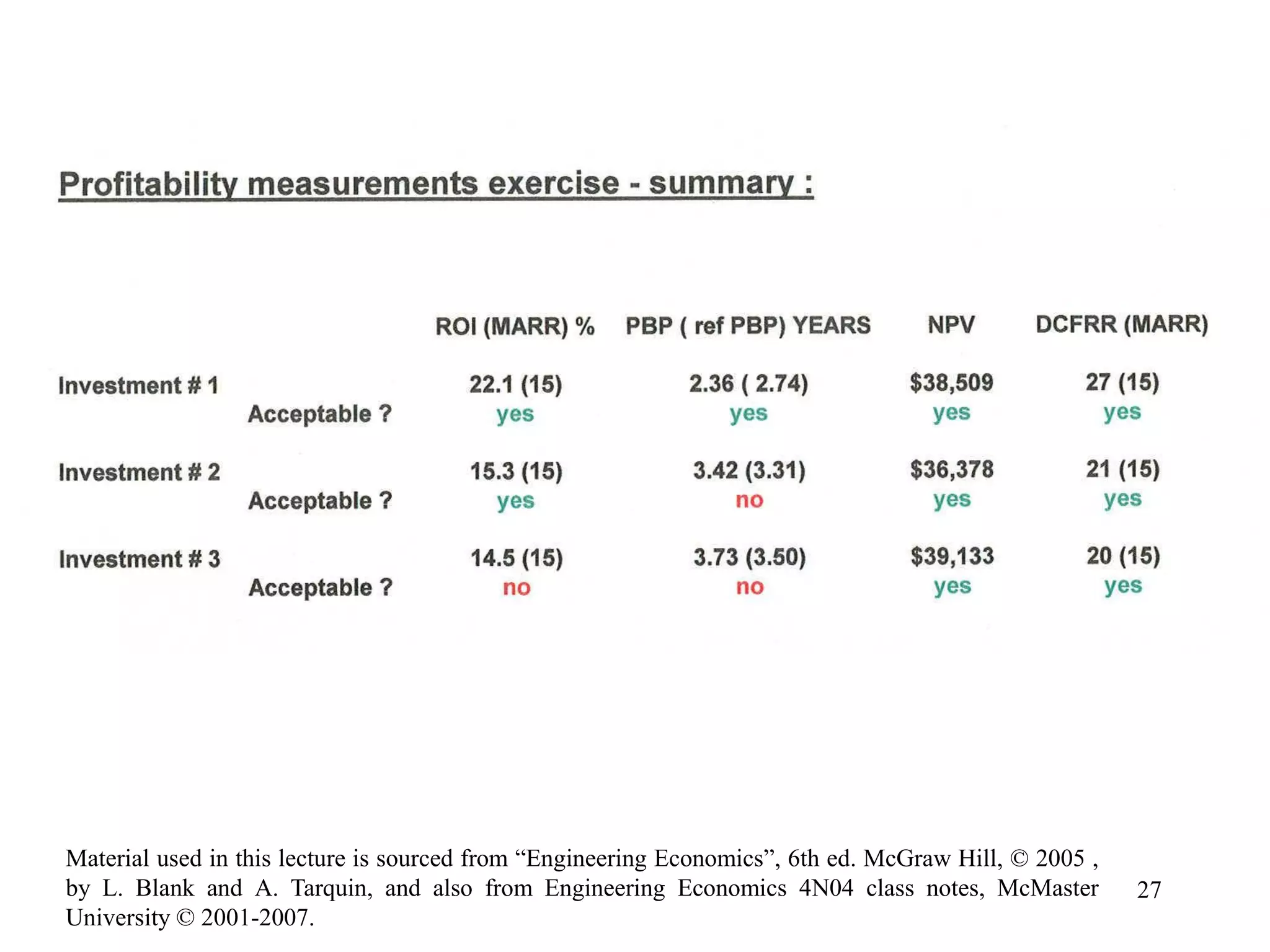

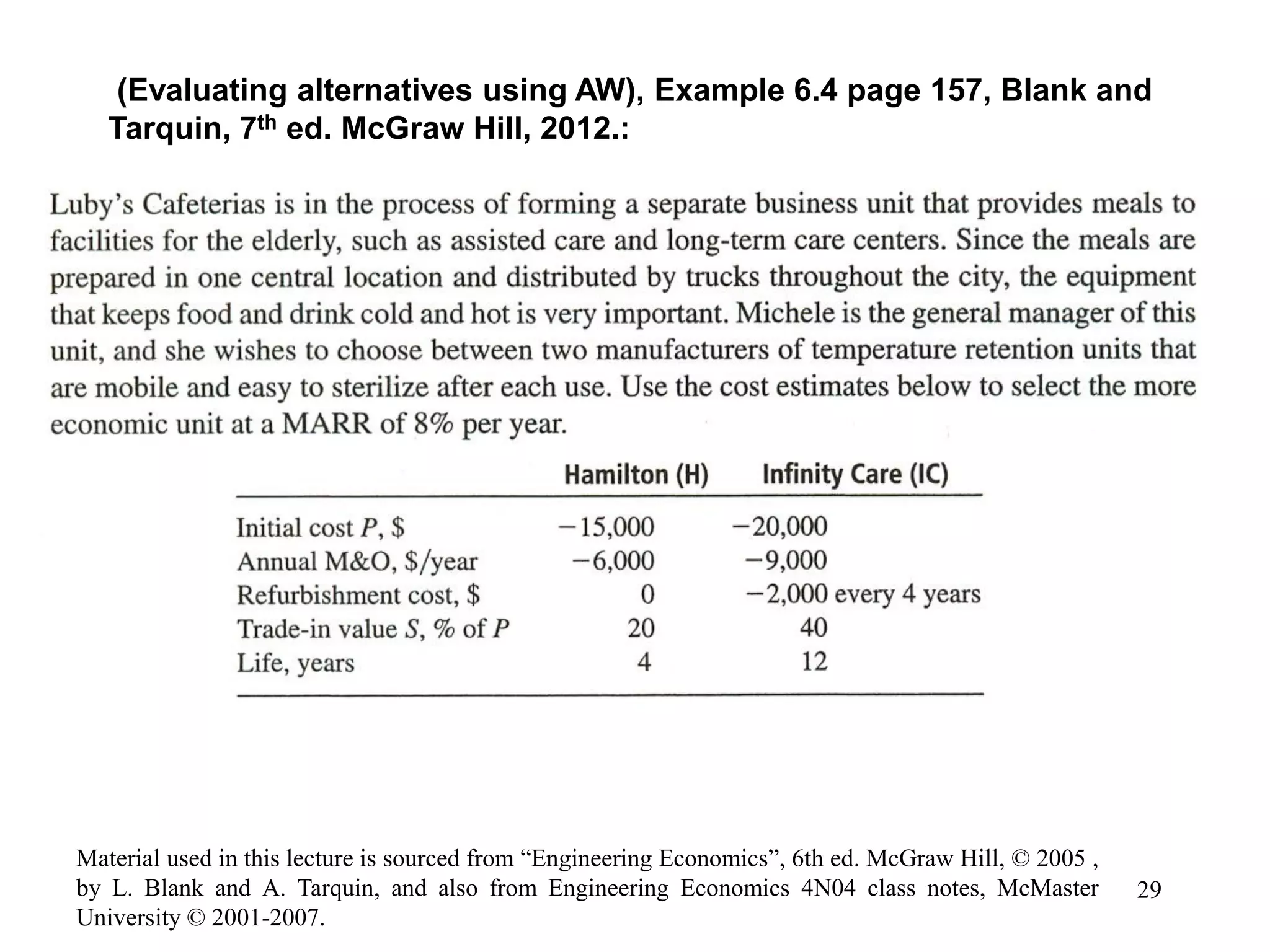

- Examples are provided to illustrate how to calculate PW and AW for alternatives and choose the most favorable option based on these measures.