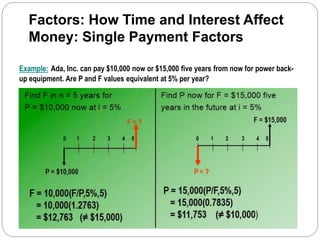

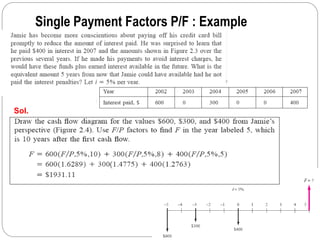

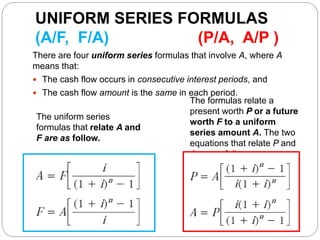

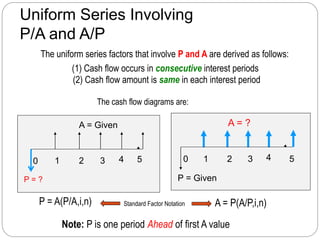

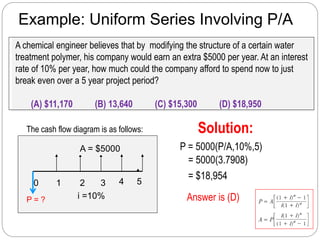

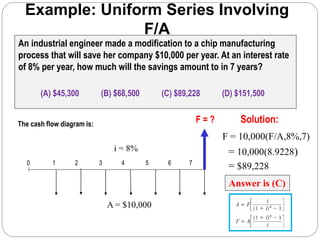

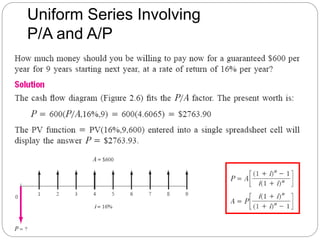

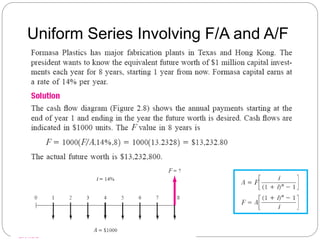

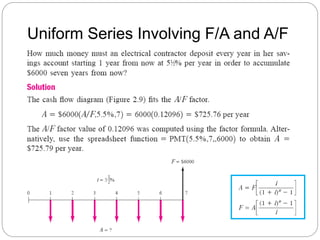

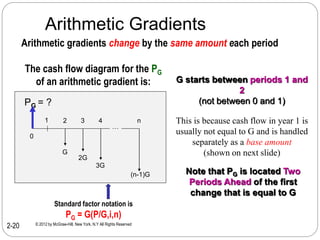

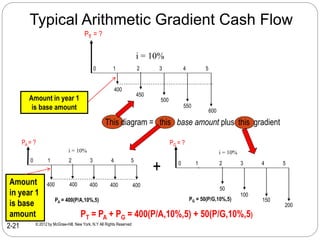

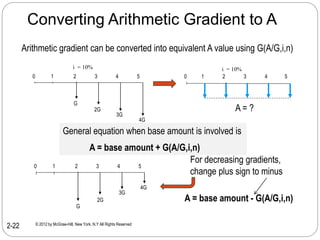

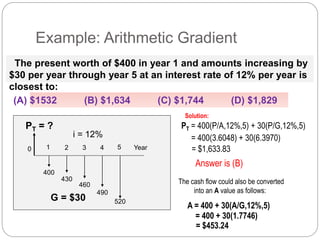

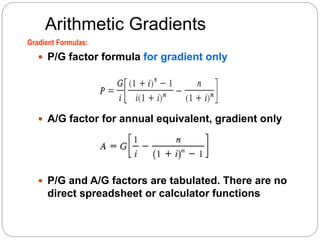

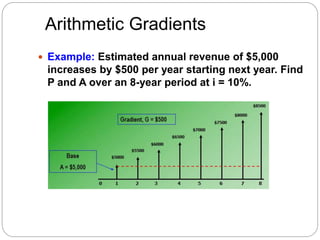

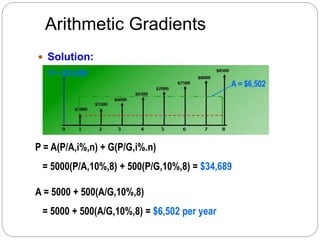

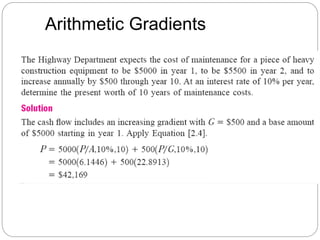

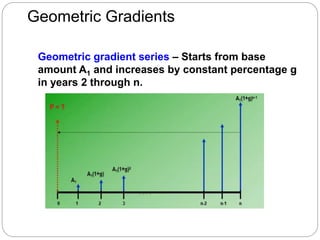

The document provides information on capital investment problems and cash flows, focusing on factors related to how time and interest affect money. It discusses single payment factors to find the future or present value of a single amount. It also covers uniform series factors to relate the present worth, future worth, or annual equivalent of a uniform series of cash flows. Finally, it examines gradient formulas, including arithmetic gradients where cash flows change by a constant amount each period, and geometric gradients where they change by a constant percentage each period. Formulas and examples are provided for each type of cash flow problem.

![Factors: How Time and Interest Affect

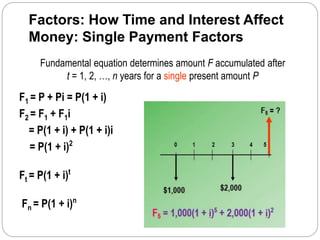

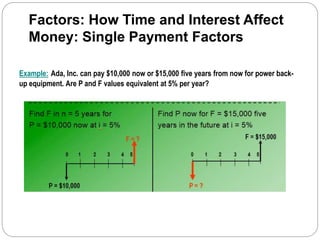

Money: Single Payment Factors

Find F, given P

Formula: F = P(1 + i)n

Notation: F=P(F/P,i%,n)

(1+i)n

= single-payment compound

amount factor

Spreadsheet: = FV(i%,n,,P)

Calculator: FV(i,n,A,P)

Find P, given F

Formula: P = F[1/(1 + i)n

]

Notation: P=F(P/F,i%,n)

1/(1+i)n

= single-payment present

worth factor

Spreadsheet: = PV(i%,n,,F)

Calculator: PV(i,n,A,F)](https://image.slidesharecdn.com/lo2b-factors-161011073604/85/Lo-2-b-factors-4-320.jpg)

![Find F, given P

Formula: F = P(1 + i)n

Notation: F=P(F/P,i%,n)

(1+i)n

= single-payment compound

amount factor

Spreadsheet: = FV(i%,n,,P)

Calculator: FV(i,n,A,P)

Find P, given F

Formula: P = F[1/(1 + i)n

]

Notation: P=F(P/F,i%,n)

1/(1+i)n

= single-payment present

worth factor

Spreadsheet: = PV(i%,n,,F)

Calculator: PV(i,n,A,F)

Factors: How Time and Interest Affect

Money: Single Payment Factors](https://image.slidesharecdn.com/lo2b-factors-161011073604/85/Lo-2-b-factors-5-320.jpg)

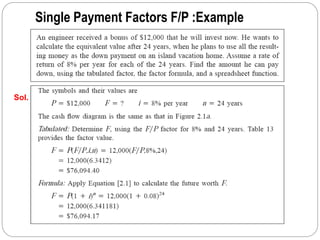

![Geometric Gradients

Geometric gradients change by the same percentage each period

0

1 2 3 n

A1

A 1(1+g)1

4

A 1(1+g)2

A 1(1+g)n-1

Pg = ?

There are no tables for geometric factors

Use following equation for g ≠ i:

Pg = A1{1- [(1+g)/(1+i)]n}/(i-g)

where: A1 = cash flow in period 1

g = rate of increase

If g = i, Pg = A1n/(1+i)

Note: If g is negative, change signs in front of both g values

Cash flow diagram for present worth

of geometric gradient

Note: g starts between

periods 1 and 2](https://image.slidesharecdn.com/lo2b-factors-161011073604/85/Lo-2-b-factors-28-320.jpg)

![Example: Geometric Gradient

Find the present worth of $1,000 in year 1 and amounts

increasing by 7% per year through year 10. Use an

interest rate of 12% per year.

(a) $5,670 (b) $7,333 (c) $12,670 (d) $13,550

0

1 2 3 10

1000

1070

4

1145

1838

Pg = ? Solution:

Pg = 1000[1-(1+0.07/1+0.12)10]/(0.12-0.07)

= $7,333

Answer is (b)

g = 7%

i = 12%

To find A, multiply Pg by (A/P,12%,10)](https://image.slidesharecdn.com/lo2b-factors-161011073604/85/Lo-2-b-factors-29-320.jpg)

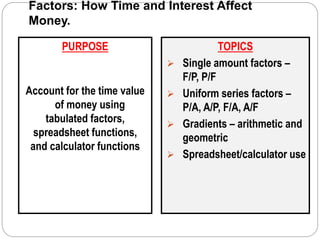

![Geometric gradient series

Gradient Formulas:

Present worth – No

tabulated factors

This is P for all cash

flows, including A1

Term in brackets is

(P/A,g,i%,n) factor

When g = i, relation

reduces to

P = A1[n/(1+i)]

Example: Payroll totals

$250,000 this year;

expected to grow at 5%

per year through year 5.

Find P at i = 12%.

Year 1: $250,000

Year 5: 250,000(1.05)4

= 303,876

= 250,000(3.94005)

= $985,013

Geometric Gradients](https://image.slidesharecdn.com/lo2b-factors-161011073604/85/Lo-2-b-factors-31-320.jpg)