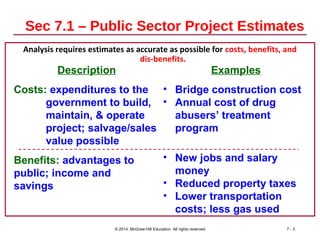

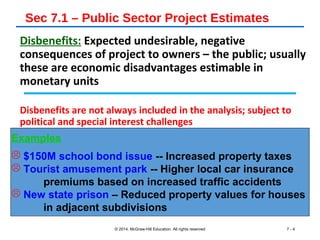

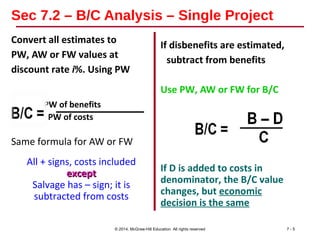

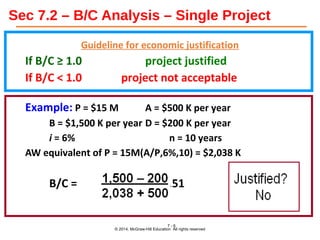

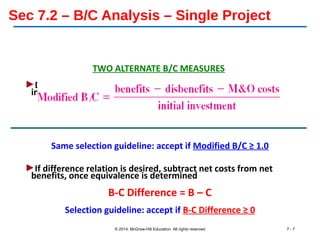

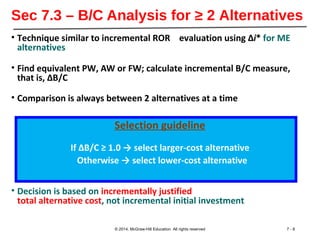

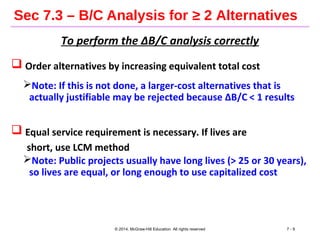

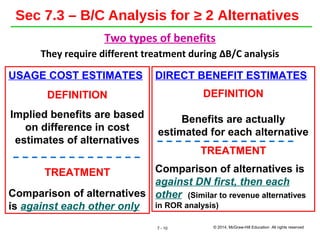

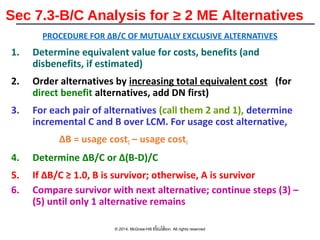

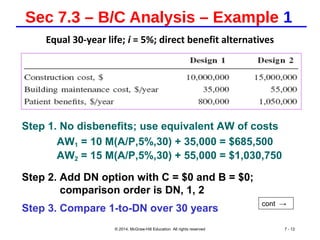

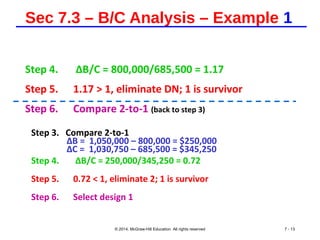

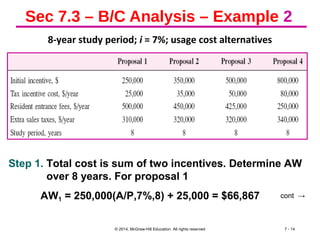

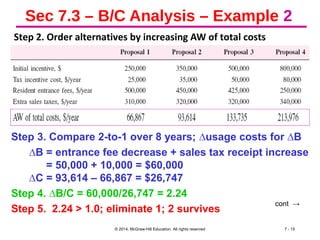

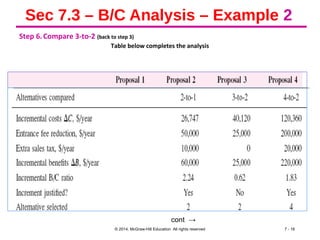

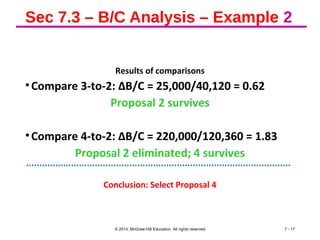

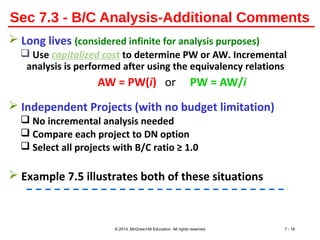

This document discusses benefit-cost analysis for public sector projects. It covers analyzing single projects and multiple alternatives. For single projects, the benefit-cost ratio is calculated by dividing the present worth of benefits by the present worth of costs. A ratio of 1 or greater means the project is justified. For multiple alternatives, alternatives are ordered by increasing cost and incremental benefit-cost ratios are calculated to determine which alternative is selected at each step. Direct benefits are compared to a do-nothing option first before being compared to each other. The document provides examples of applying these techniques.