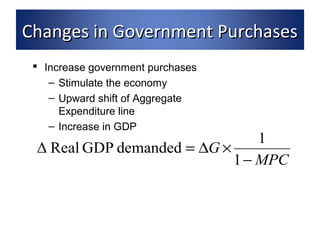

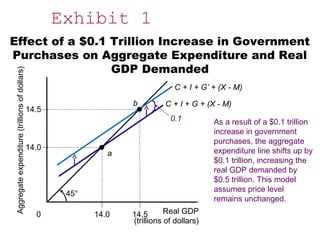

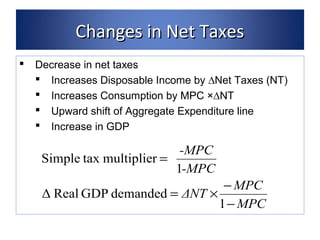

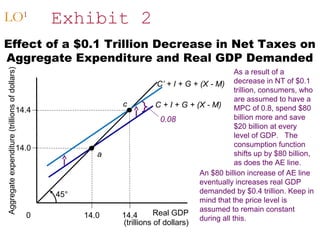

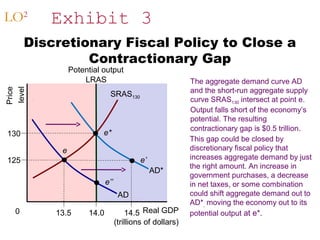

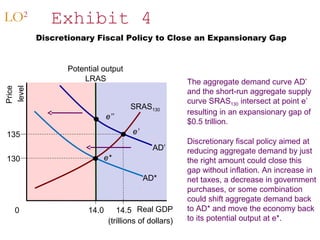

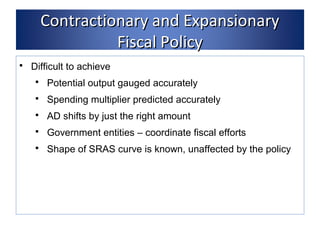

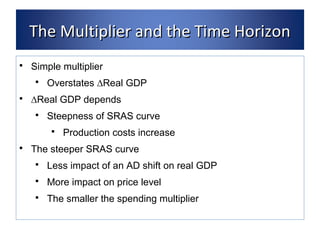

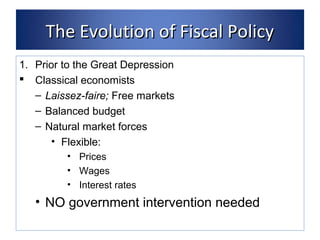

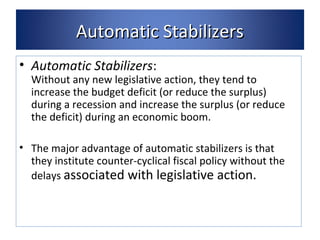

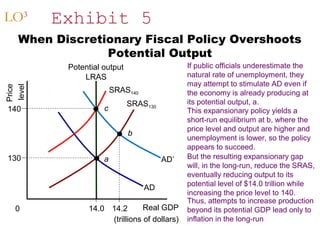

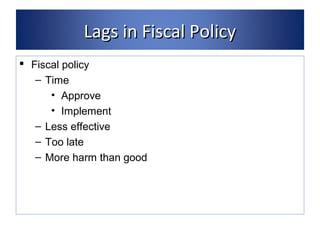

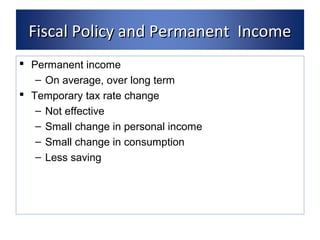

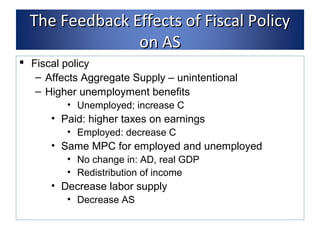

This document discusses fiscal policy theory and tools. It defines fiscal policy as government spending, transfers, taxes, and borrowing that affect macroeconomic variables. The two categories of fiscal policy tools are automatic stabilizers and discretionary policy. Automatic stabilizers automatically adjust to economic fluctuations, while discretionary policy requires deliberate manipulation of spending, transfers, and taxes. Expansionary policy increases aggregate demand and output, while contractionary policy decreases them.