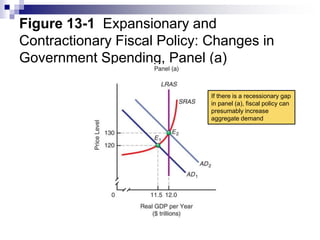

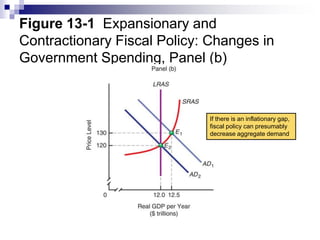

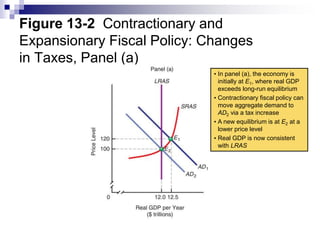

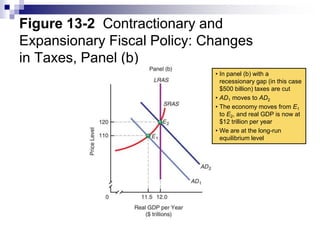

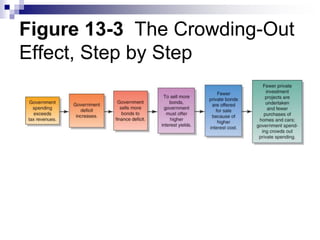

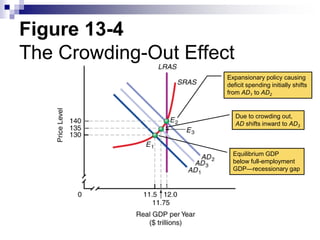

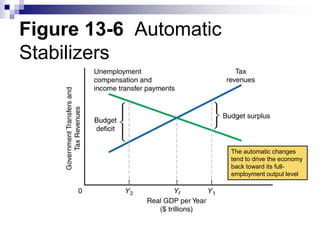

Fiscal policy involves discretionary changes to government spending and taxes to achieve economic goals like high employment, price stability, and economic growth. An increase in spending or tax cut expands aggregate demand, while a spending cut or tax increase contracts it. However, fiscal policy faces offsets like crowding out private investment. It also has long and variable time lags making timely responses difficult. Automatic stabilizers like unemployment insurance partially offset downturns. While fiscal policy may be ineffective in normal times, it can boost demand during severe downturns like the Great Depression.