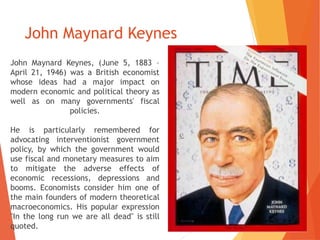

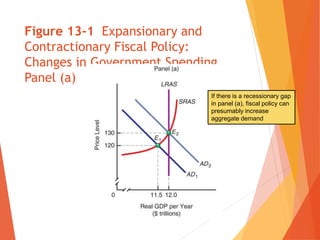

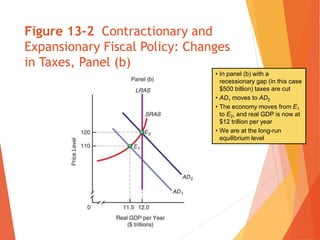

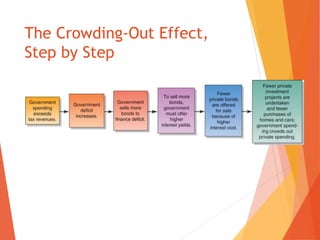

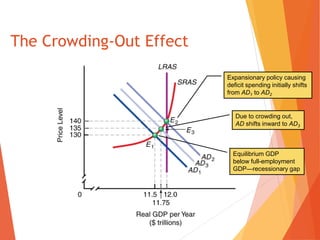

John Maynard Keynes was a British economist in the early 20th century whose ideas had a major impact on modern economic theory and government fiscal policy. He advocated for interventionist government policies using fiscal and monetary measures to mitigate the adverse effects of economic downturns. Keynesians believe the government can use changes in spending and taxes to influence aggregate demand and achieve goals like high employment and price stability. However, fiscal policy does not operate in isolation and may be offset by factors like crowding out of private sector spending or individuals anticipating future tax changes.