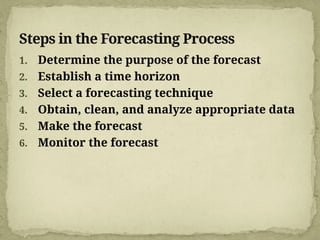

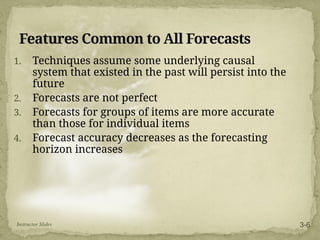

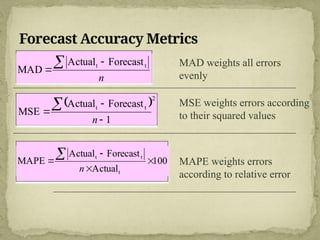

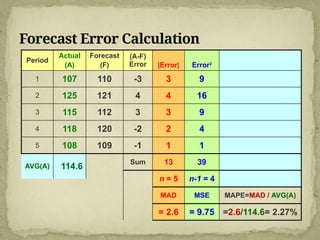

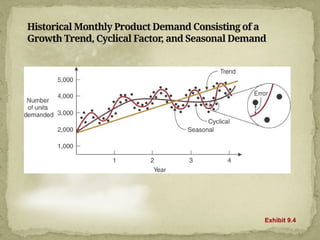

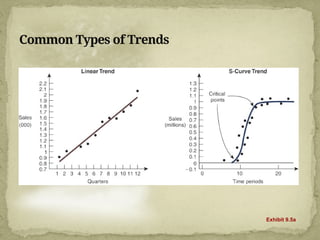

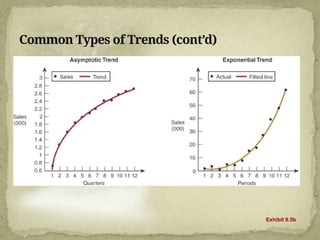

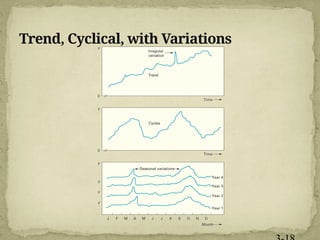

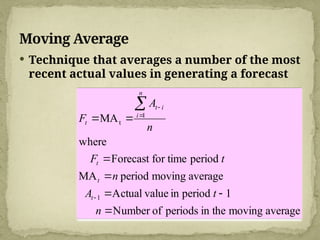

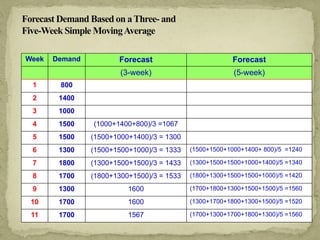

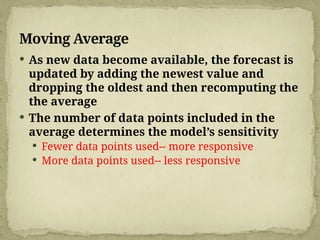

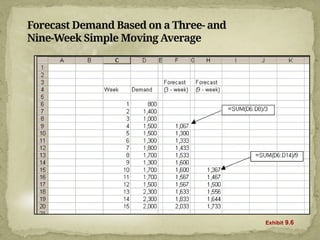

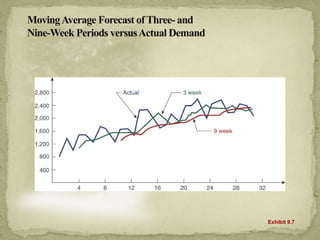

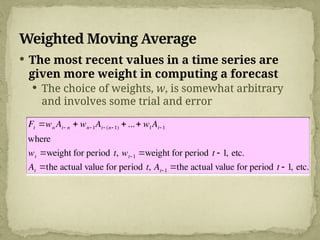

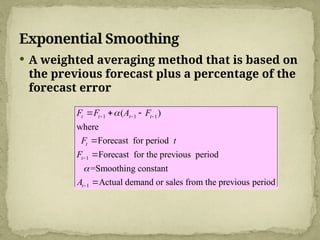

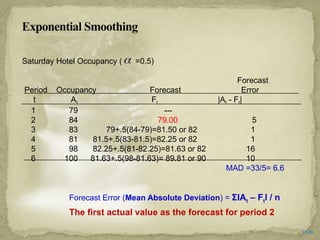

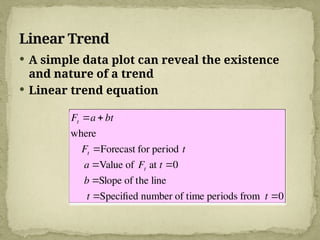

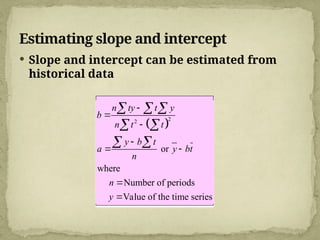

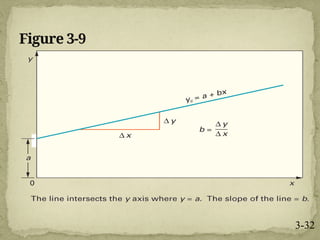

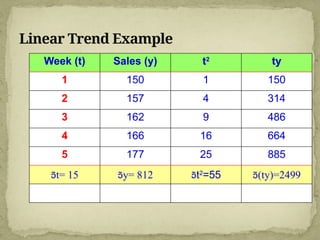

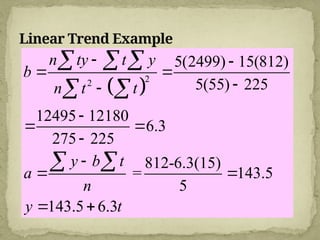

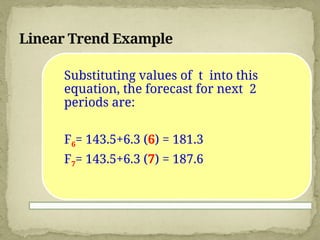

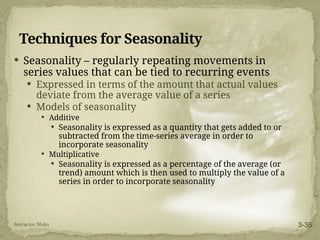

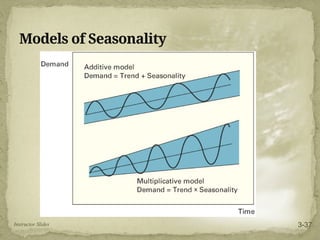

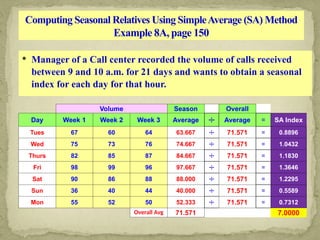

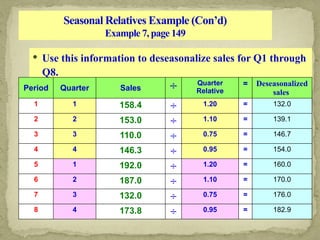

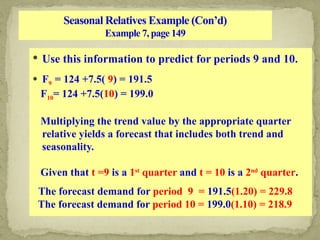

This document discusses forecasting techniques used to predict future values of variables like demand and resource availability. It outlines key forecasting aspects such as accuracy, method selection, and the importance of trends and seasonality, as well as various qualitative and quantitative approaches. Additionally, it provides formulas and examples for error calculation, moving averages, and seasonal adjustments, emphasizing the need for timely, accurate, and reliable forecasts.