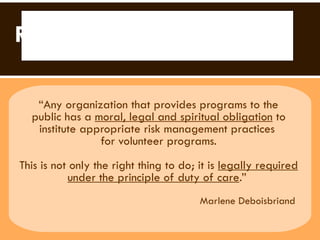

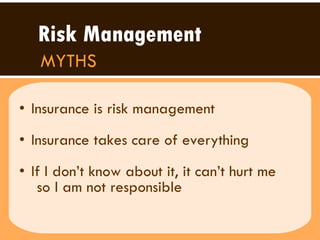

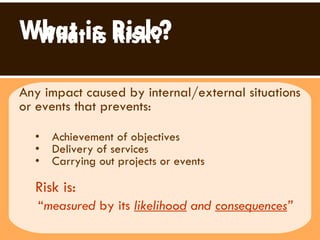

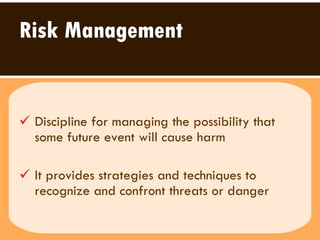

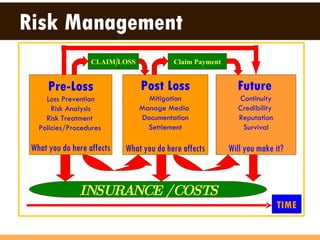

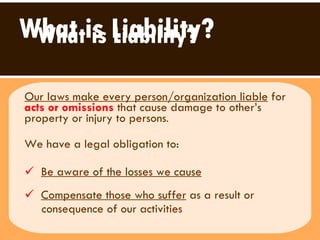

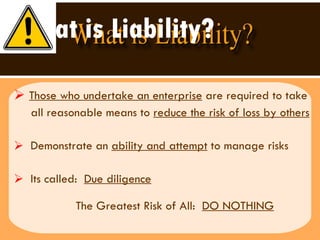

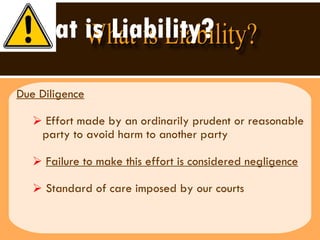

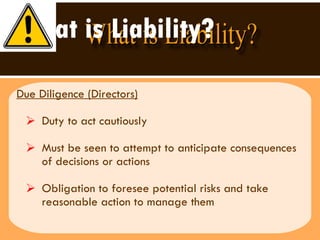

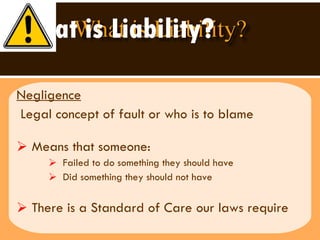

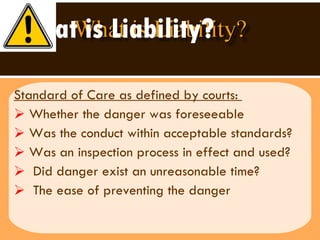

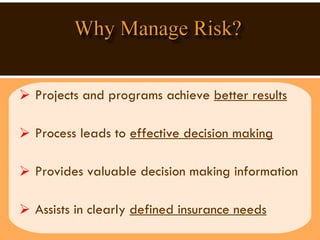

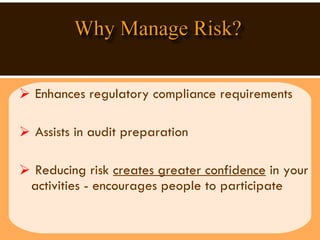

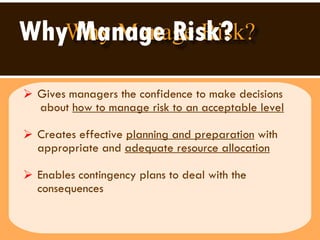

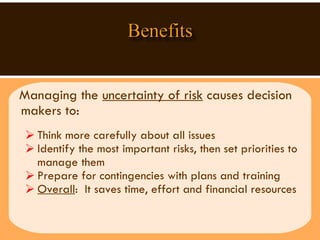

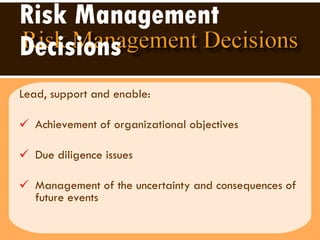

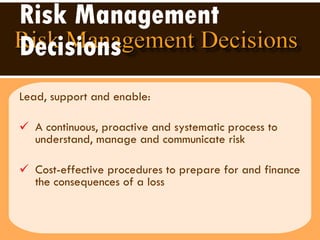

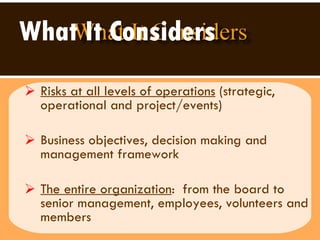

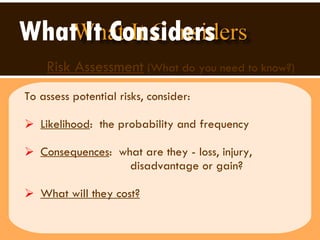

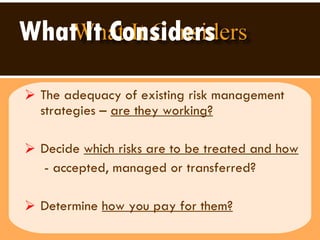

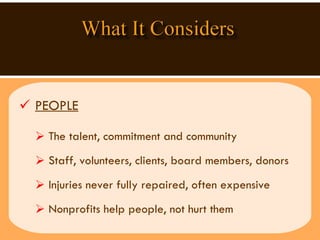

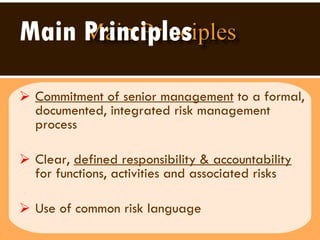

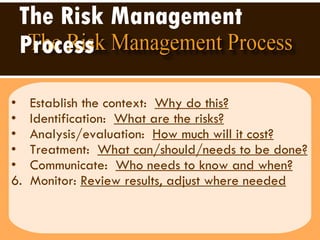

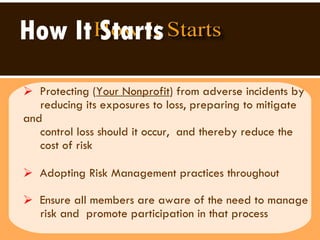

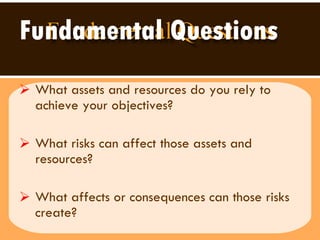

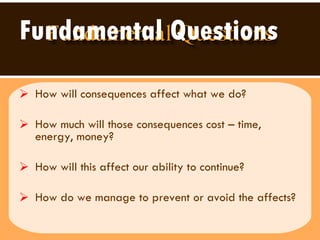

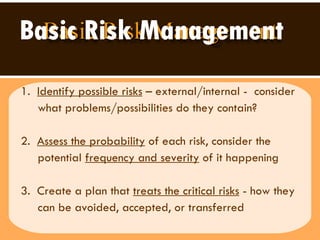

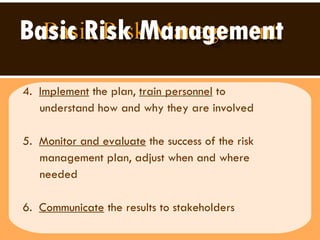

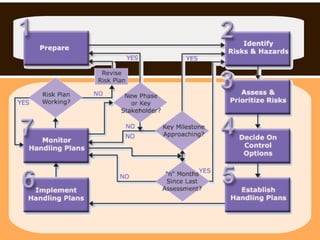

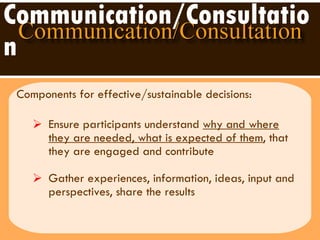

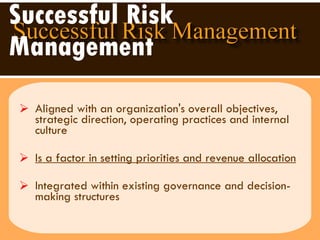

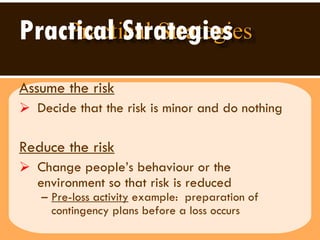

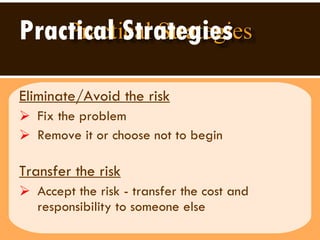

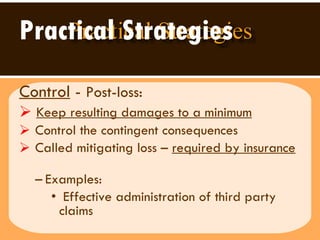

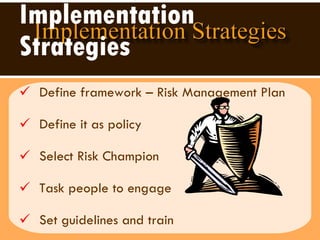

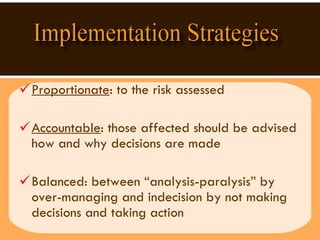

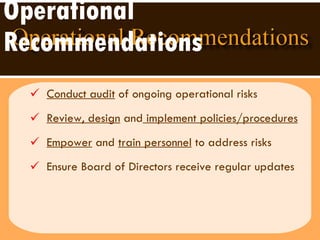

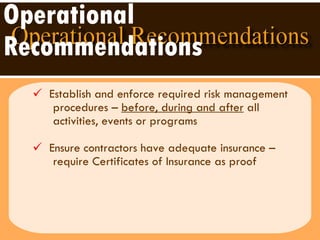

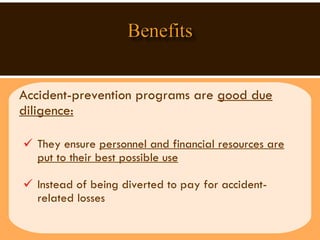

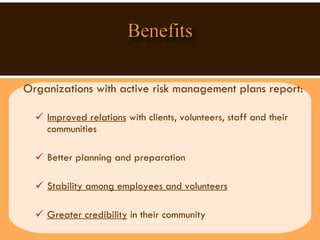

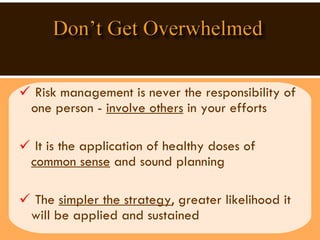

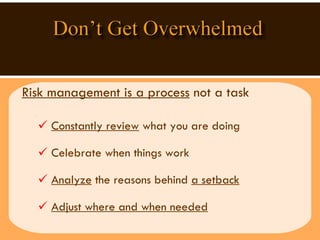

The document outlines the importance of risk management for organizations providing public programs, emphasizing the necessity of proactive practices to minimize potential liabilities and improve overall operational effectiveness. It discusses the processes involved in identifying, assessing, and treating risks while highlighting the legal obligations of organizations to manage risks responsibly. Key components include the establishment of clear accountability, ongoing training for personnel, and the integration of risk management into the organization’s overall strategy.

![Contact Information Don Radford Ph: 403-221-7165 Fax: 403-221-7077 M/A: 140, 6700 Macleod Trail SE Calgary, Alberta T2H 0L3 Email: [email_address]](https://image.slidesharecdn.com/riskmgmtvolpedia-090812164751-phpapp02/85/CAVR-2009-Risk-Management-PPT-84-320.jpg)