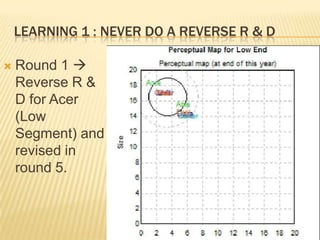

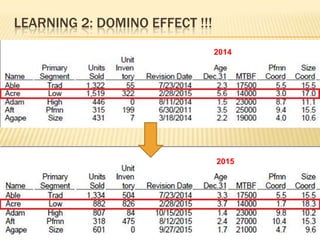

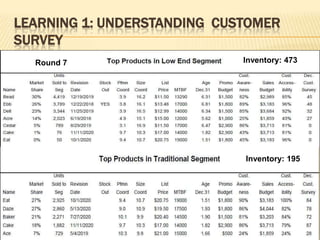

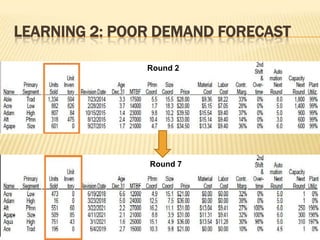

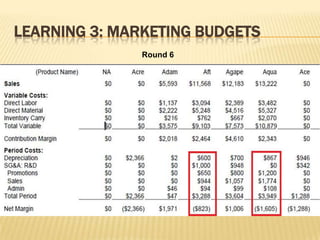

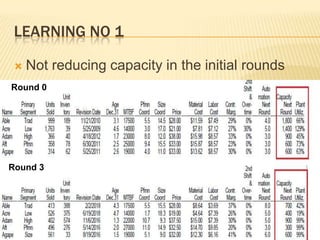

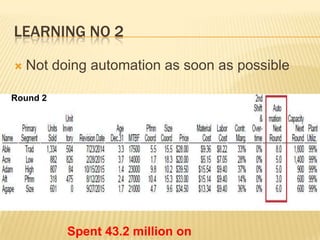

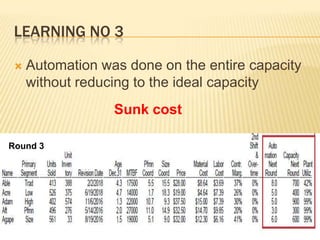

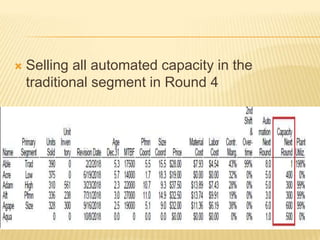

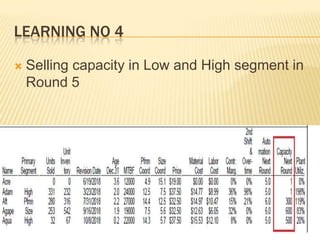

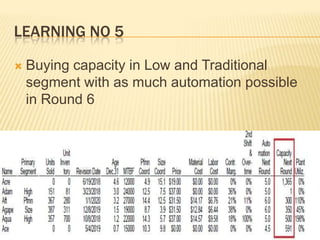

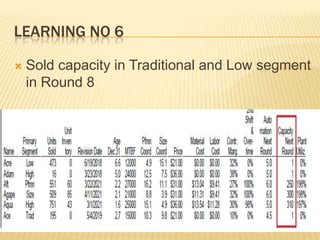

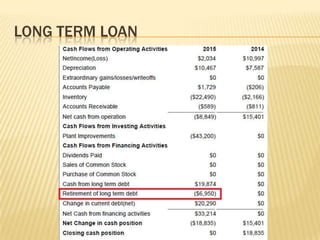

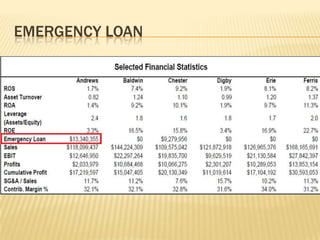

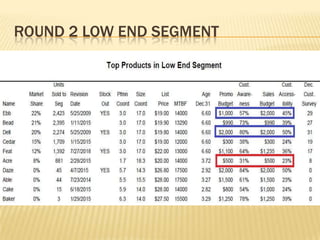

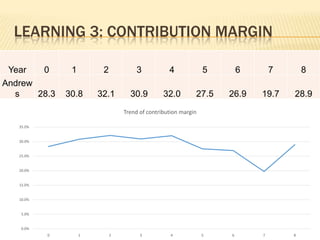

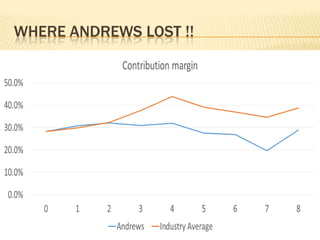

The document summarizes learnings from various departments of Andrews, including R&D, Marketing, Production, and Finance. Some key learnings include: 1) R&D is critical and products should meet market needs; 2) Understanding customer demand through surveys allows for better forecasting; 3) Automation should be done gradually and capacity reduced to optimal levels. Finance should support the business, not drive it, and contribution margins should be monitored versus competitors. Overall, decisions have long term impacts, so following instructions and monitoring competitors are important.