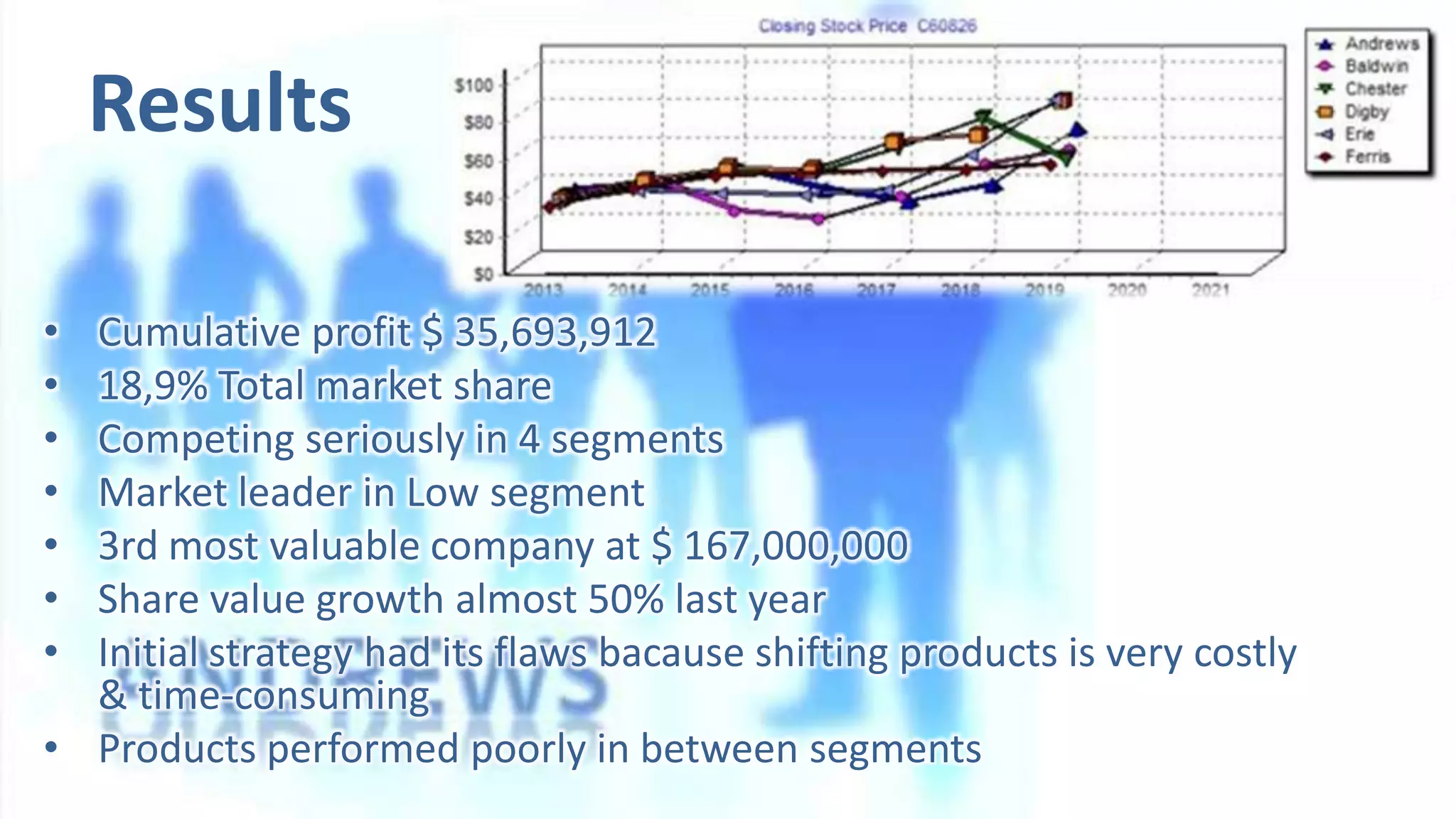

1) The document outlines Andrews Co.'s strategy to establish market leadership in the sensor industry through quality, low-cost products.

2) The company's value proposition is to strive for market leadership in the low segment by serving customers and continuously innovating top products.

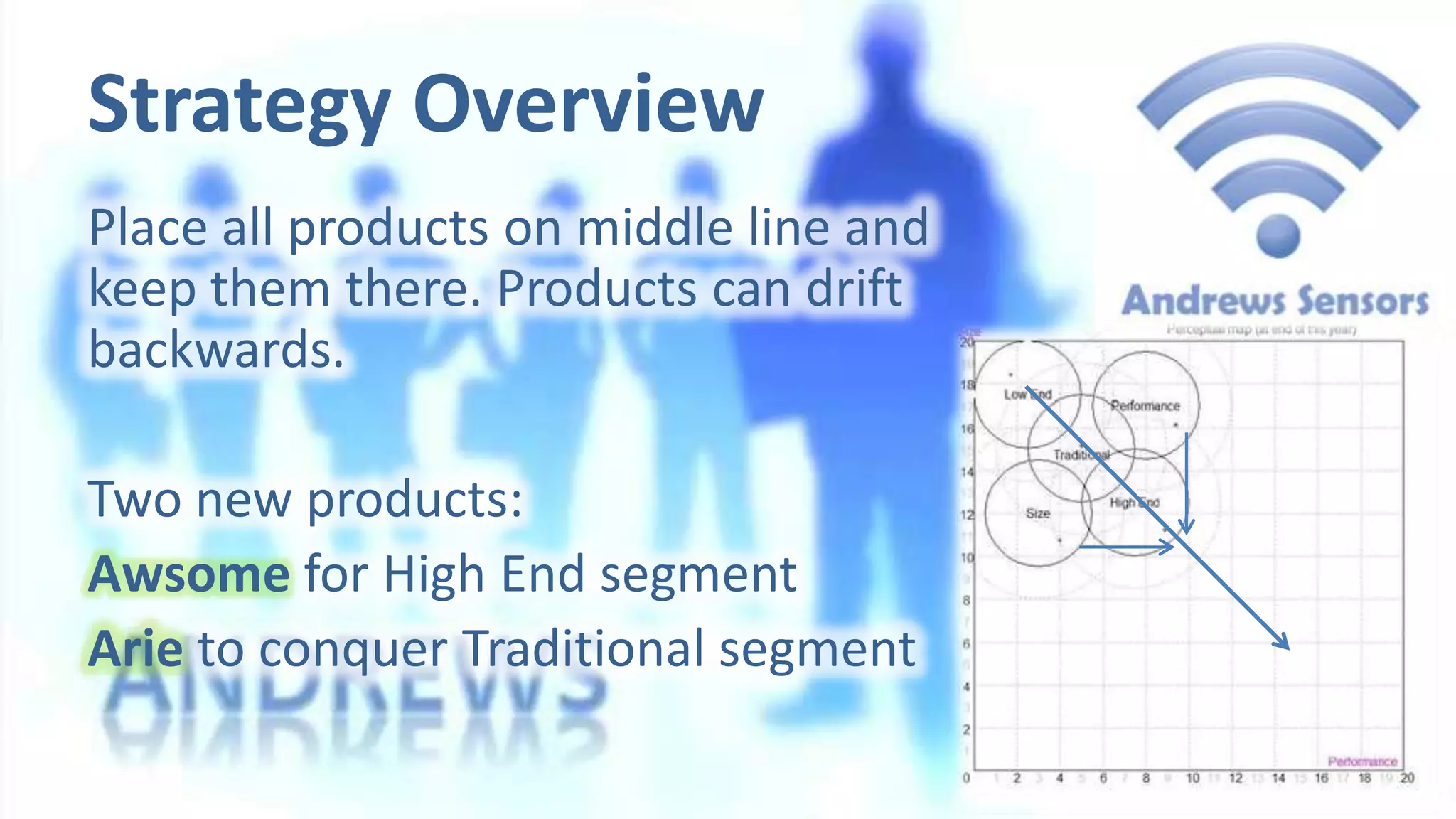

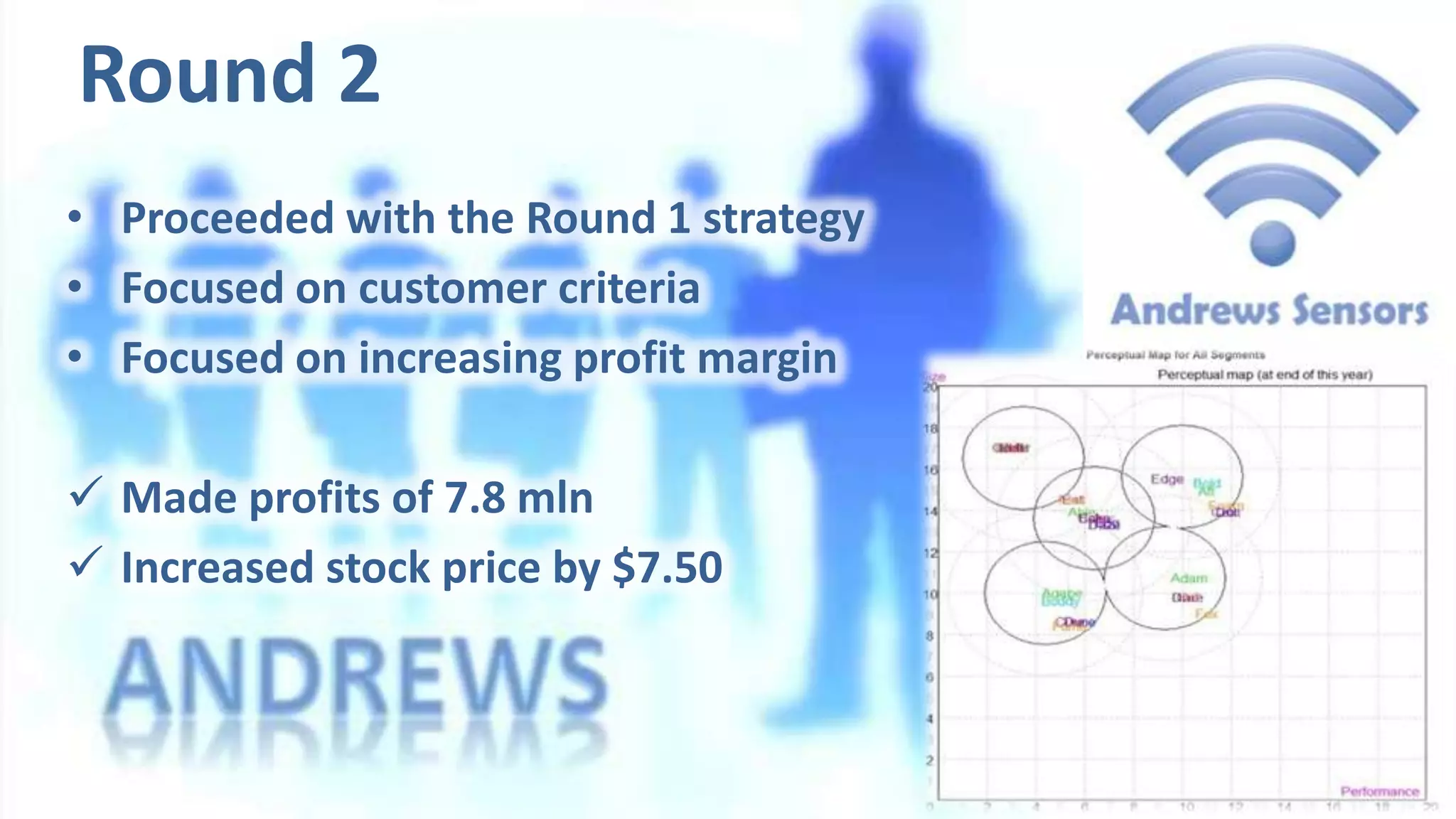

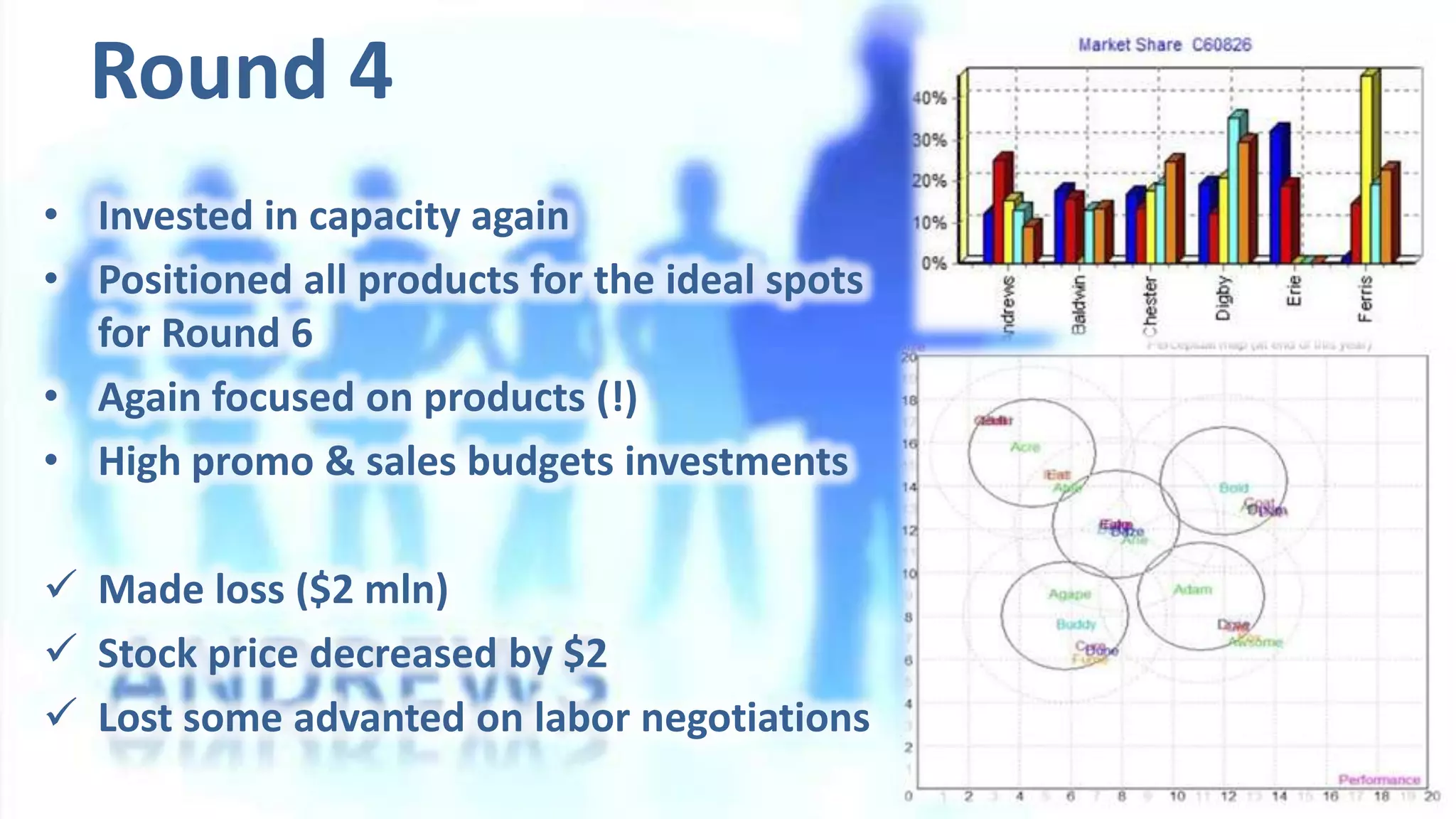

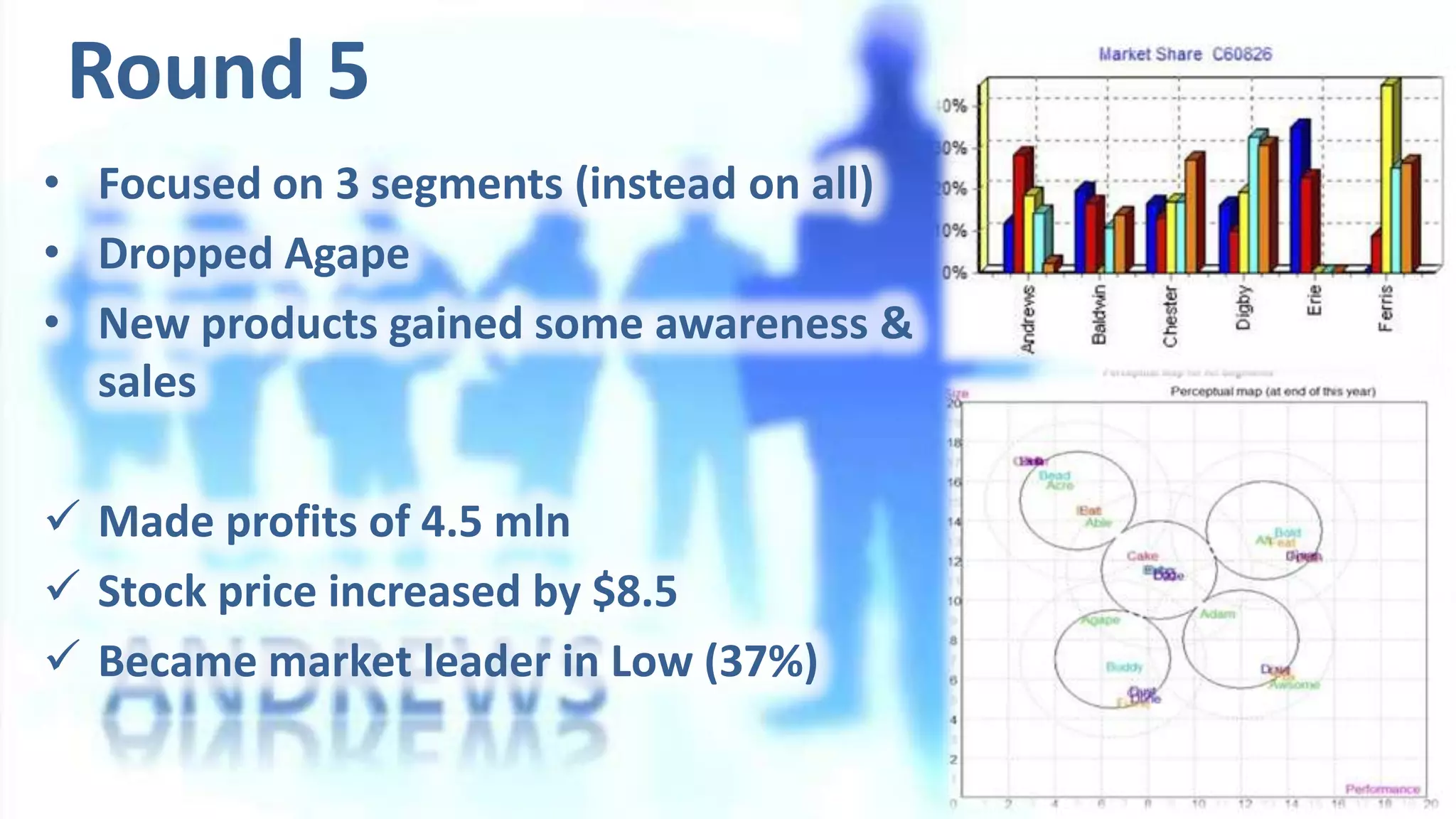

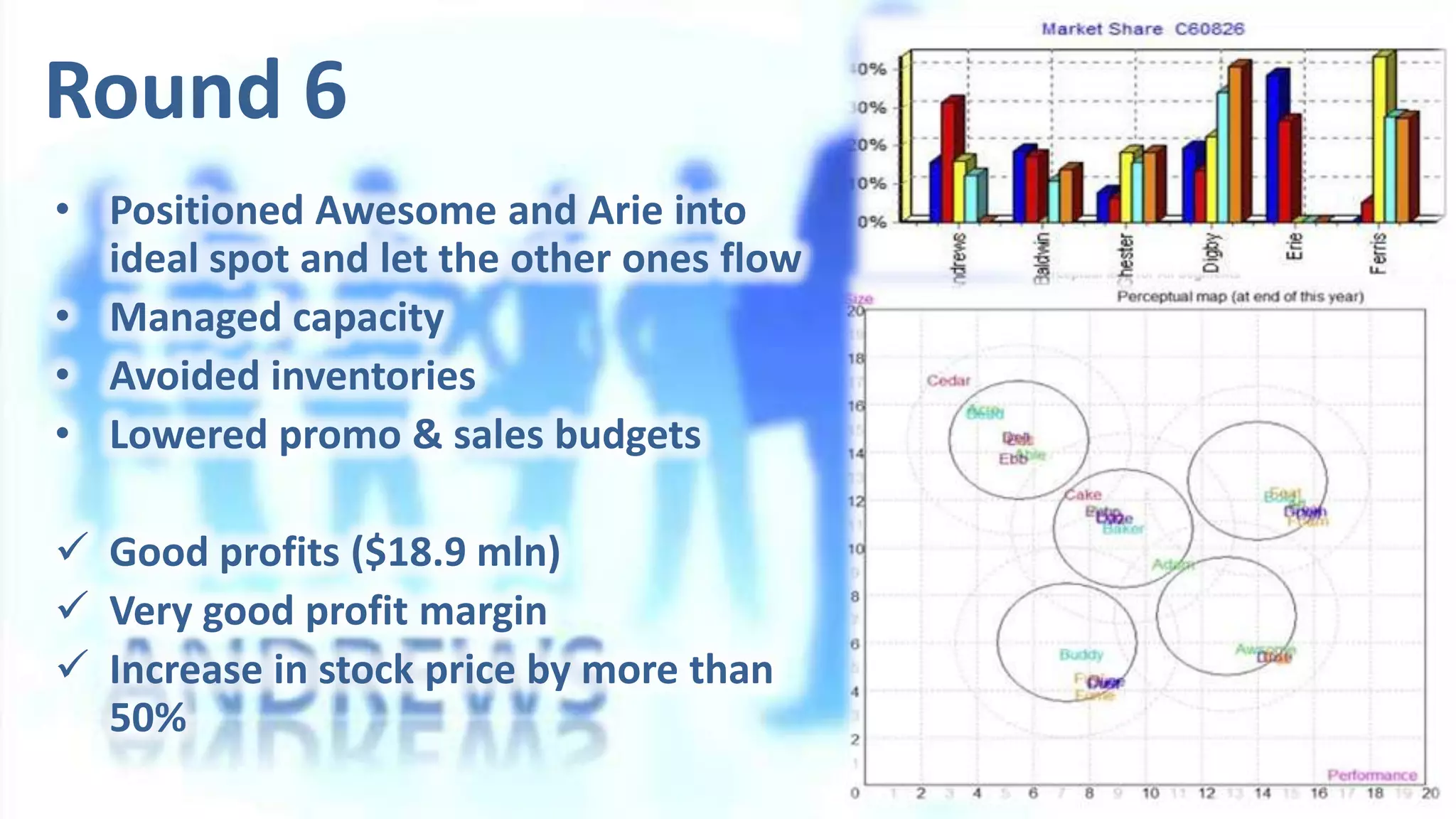

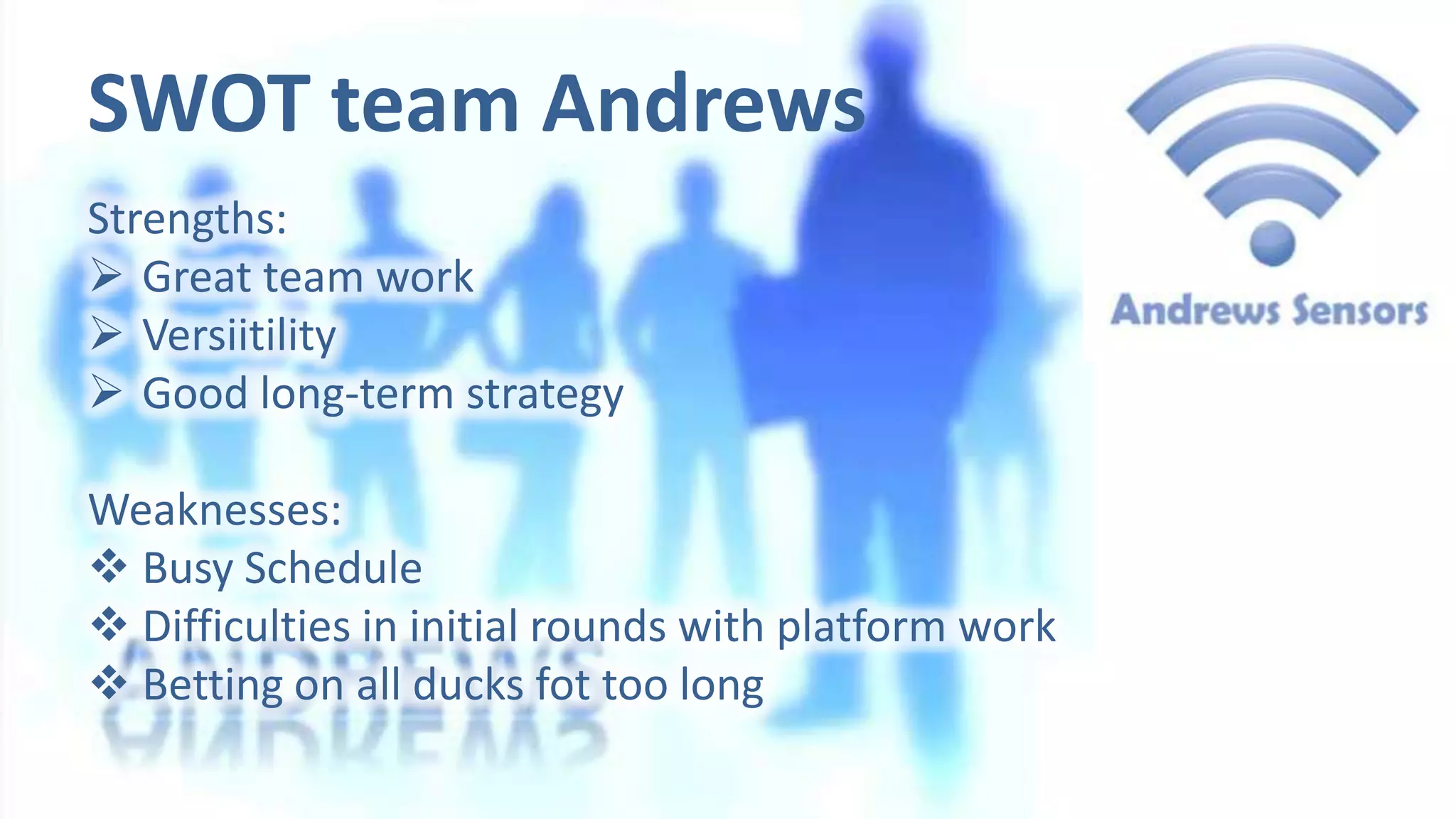

3) The initial strategy of placing all products in the middle and allowing drift was flawed, resulting in losses. The strategy shifted to focusing on key segments and products, leading to improved profits and market share gains.