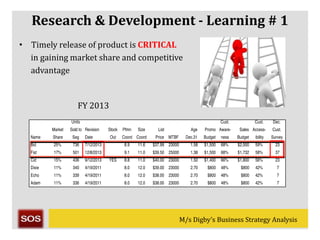

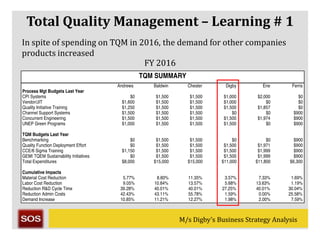

The document analyzes the business strategy of M/S Digby, focusing on its operations from 2012 to 2016 in the sensor market. Key areas discussed include production, sales and marketing, research and development, finance, and total quality management, highlighting learnings and challenges faced by the company. It provides insights into market shares, financial performance, and strategies for improvement in product positioning and cash management.