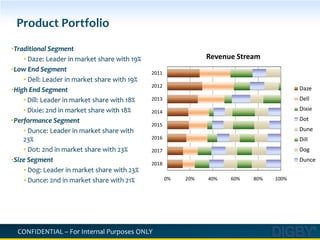

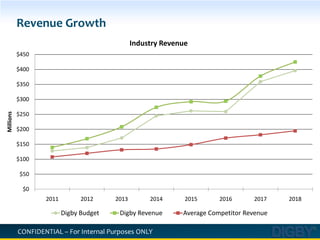

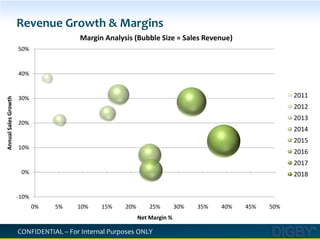

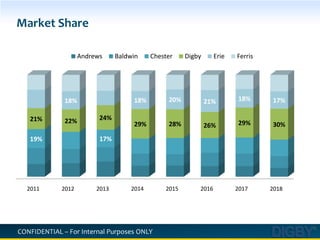

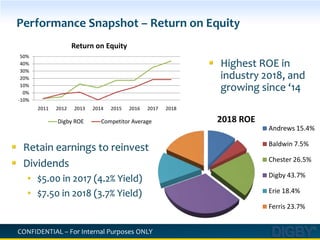

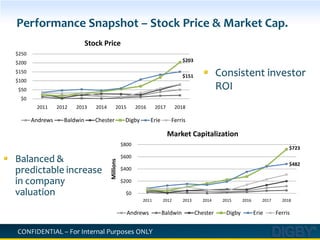

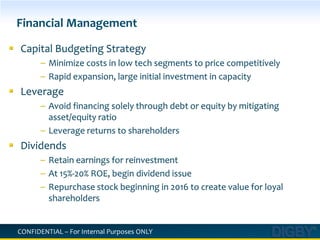

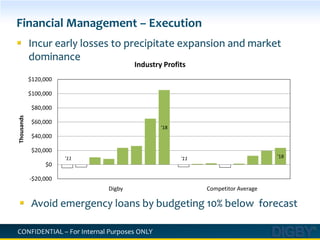

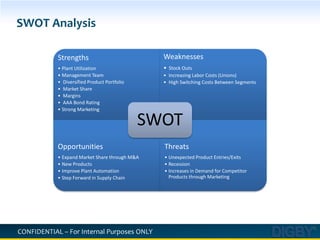

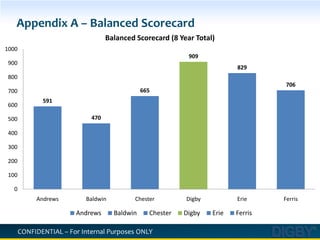

The DIGBY Corporation Board of Directors met on December 6, 2018 to review the company's vision, strategy, financial performance, and future outlook. DIGBY's vision is to provide customized products that perfectly match customer demands in the sensor industry. The company employs a broad differentiation strategy, operating as both a cost leader and quality leader across its product segments. DIGBY leads the market in several product segments and saw increased revenue, profits, and stock price in 2018. The Board believes the executive team should continue leading the company due to its strong growth, understanding of economic conditions, and time-tested success in managing diversified operations.