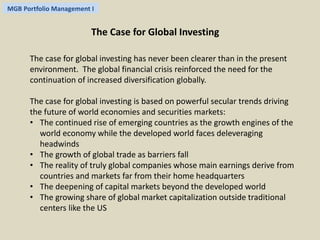

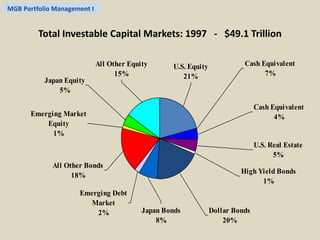

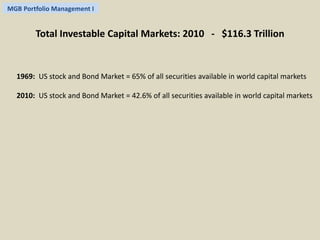

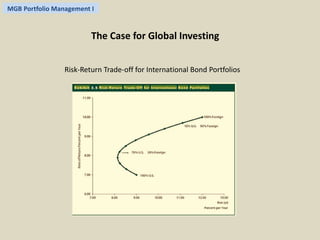

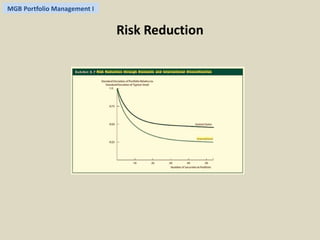

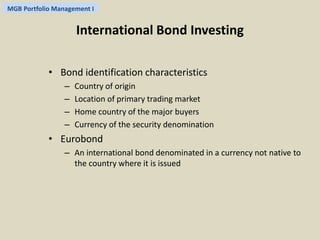

- The document discusses the case for global investing and diversifying investment portfolios internationally. It notes the growth of markets outside the US and developed world as reasons for global investing.

- It also discusses some of the challenges of international investing like currency risk and political uncertainty. However, fund managers still see benefits from diversifying beyond domestic markets given global economic trends.

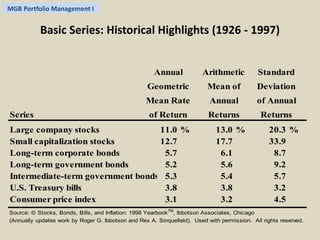

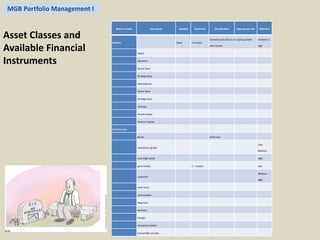

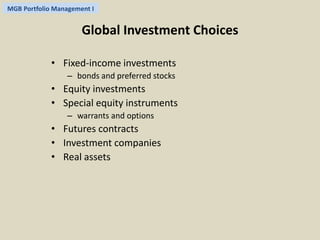

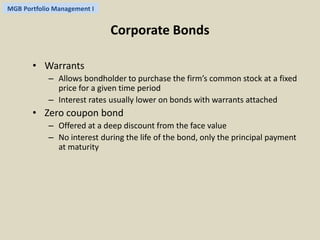

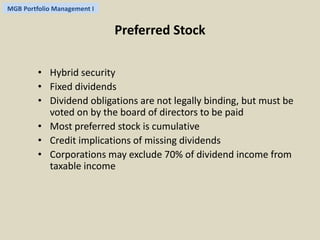

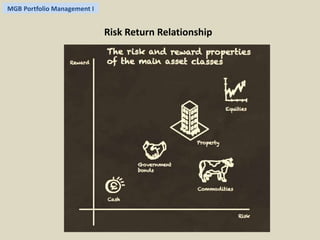

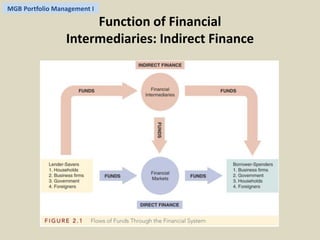

- The document provides examples of asset classes and financial instruments available for global investing including stocks, bonds, investment companies and real estate investment trusts.