Embed presentation

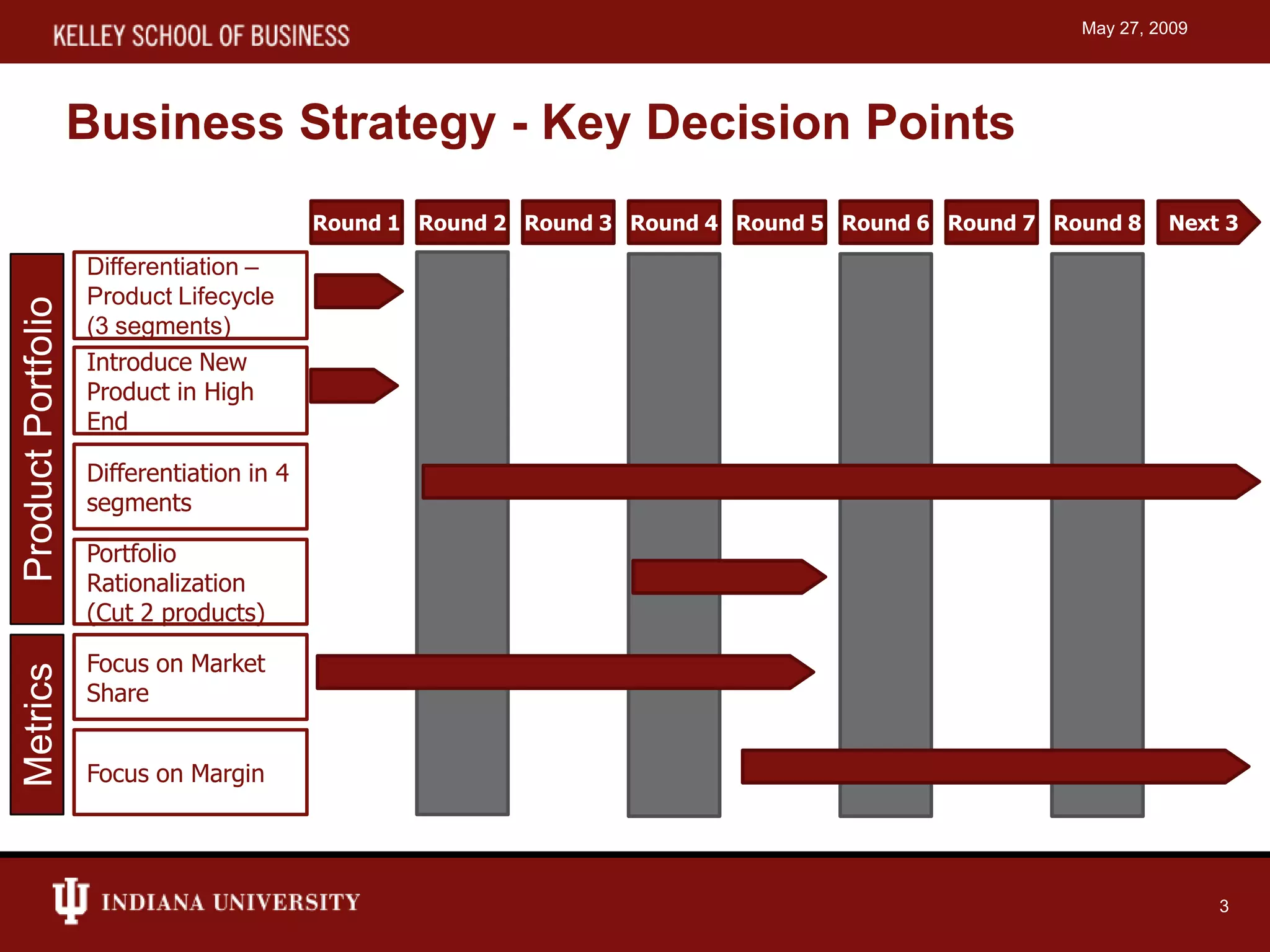

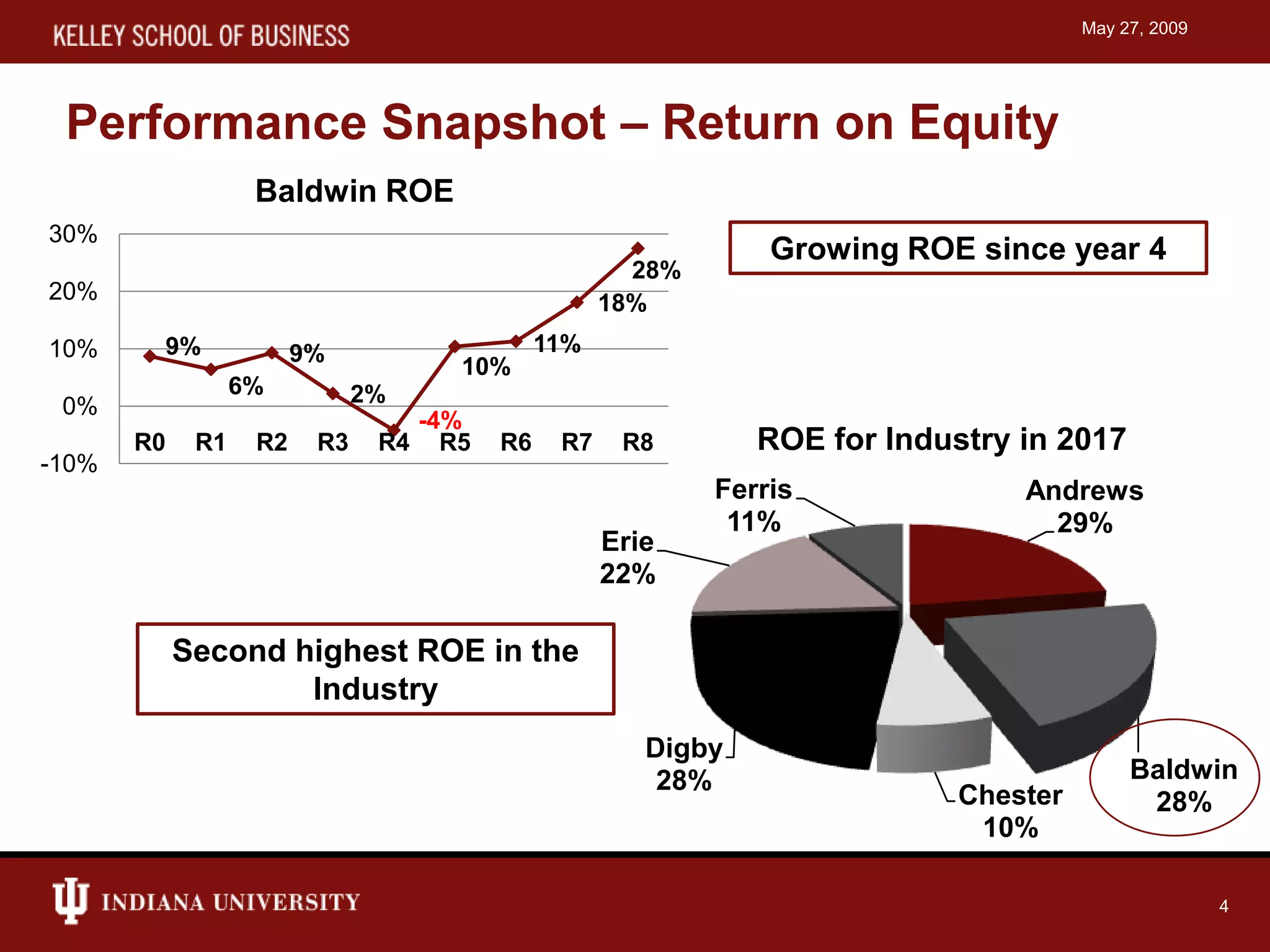

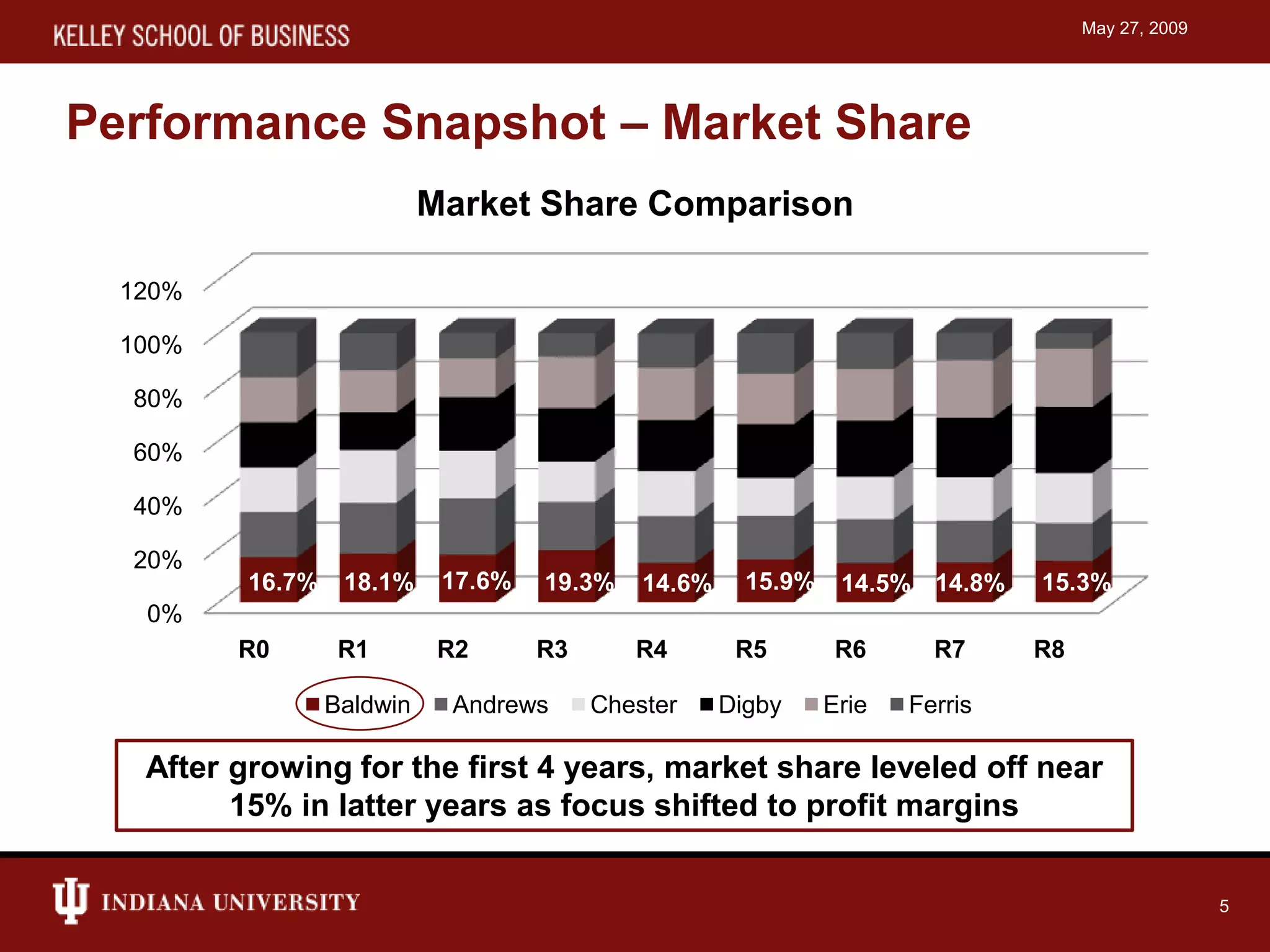

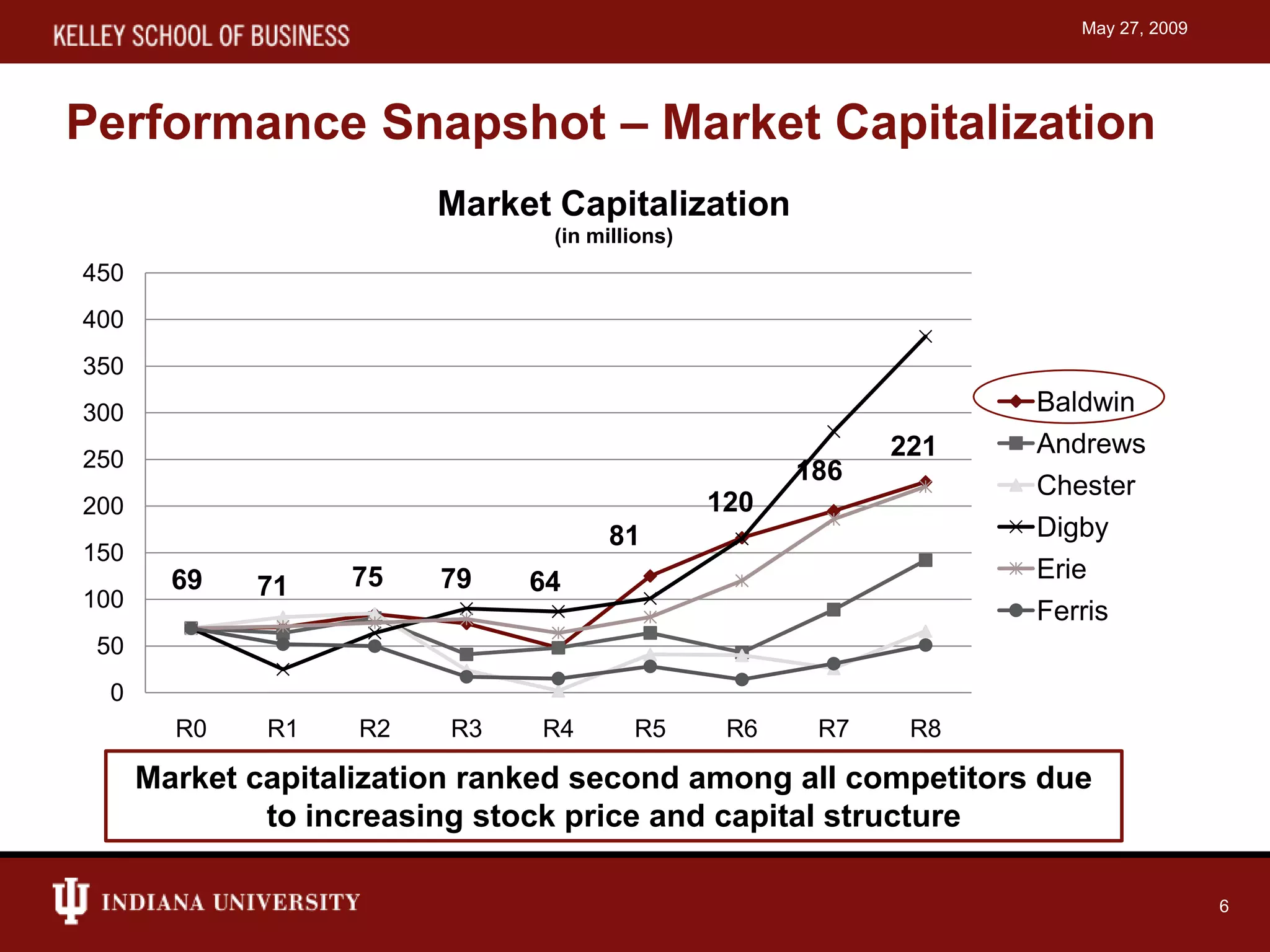

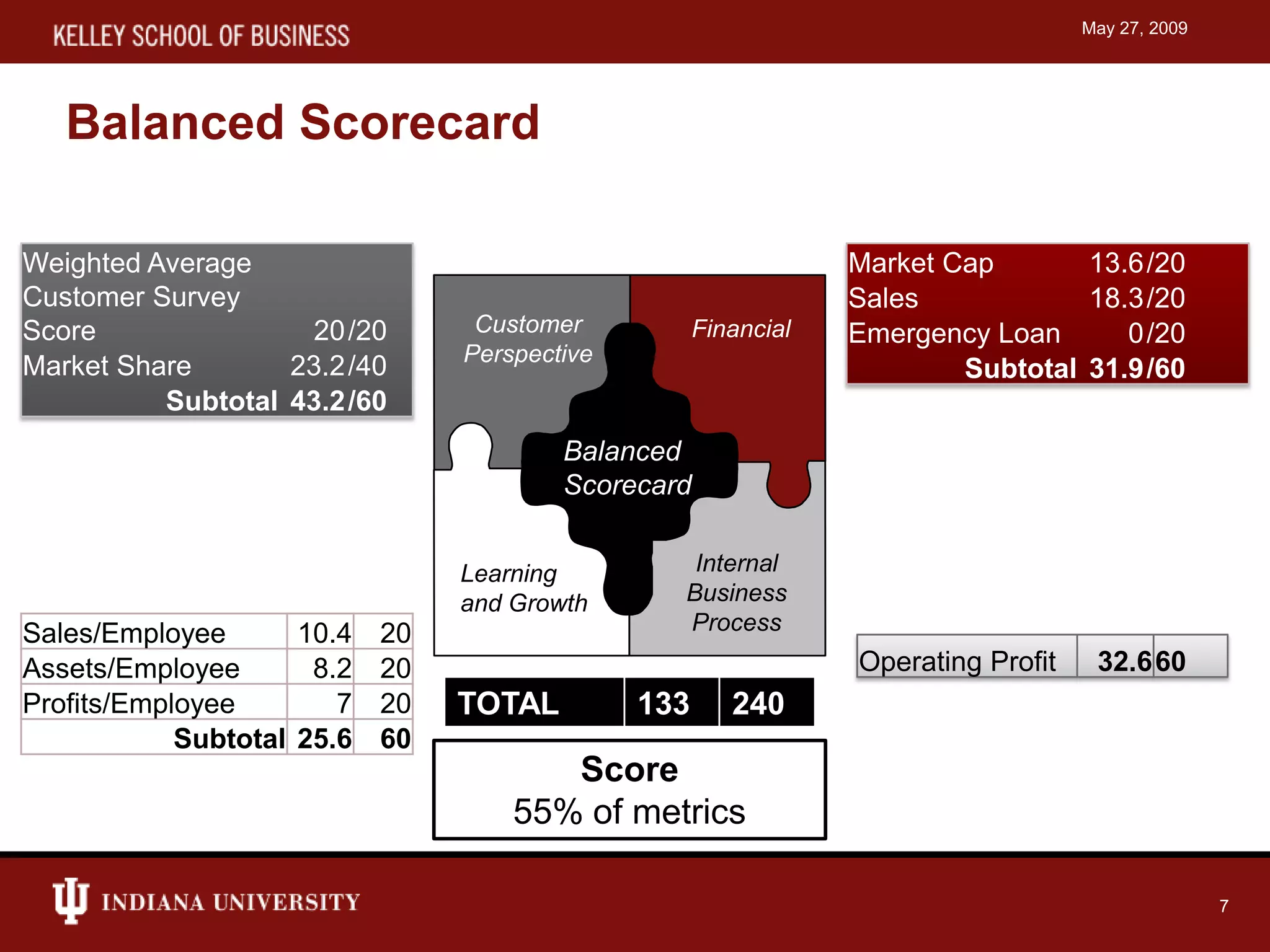

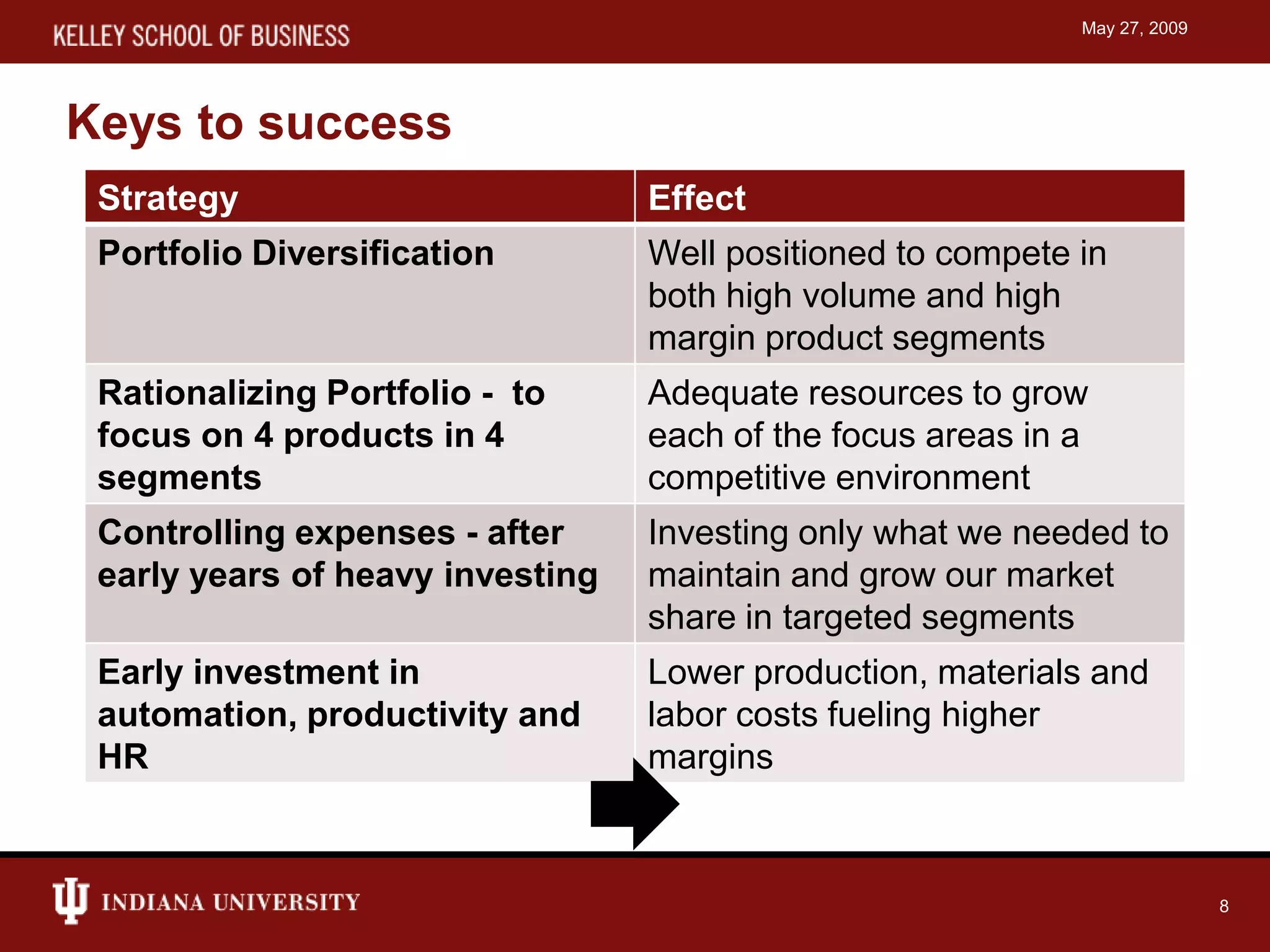

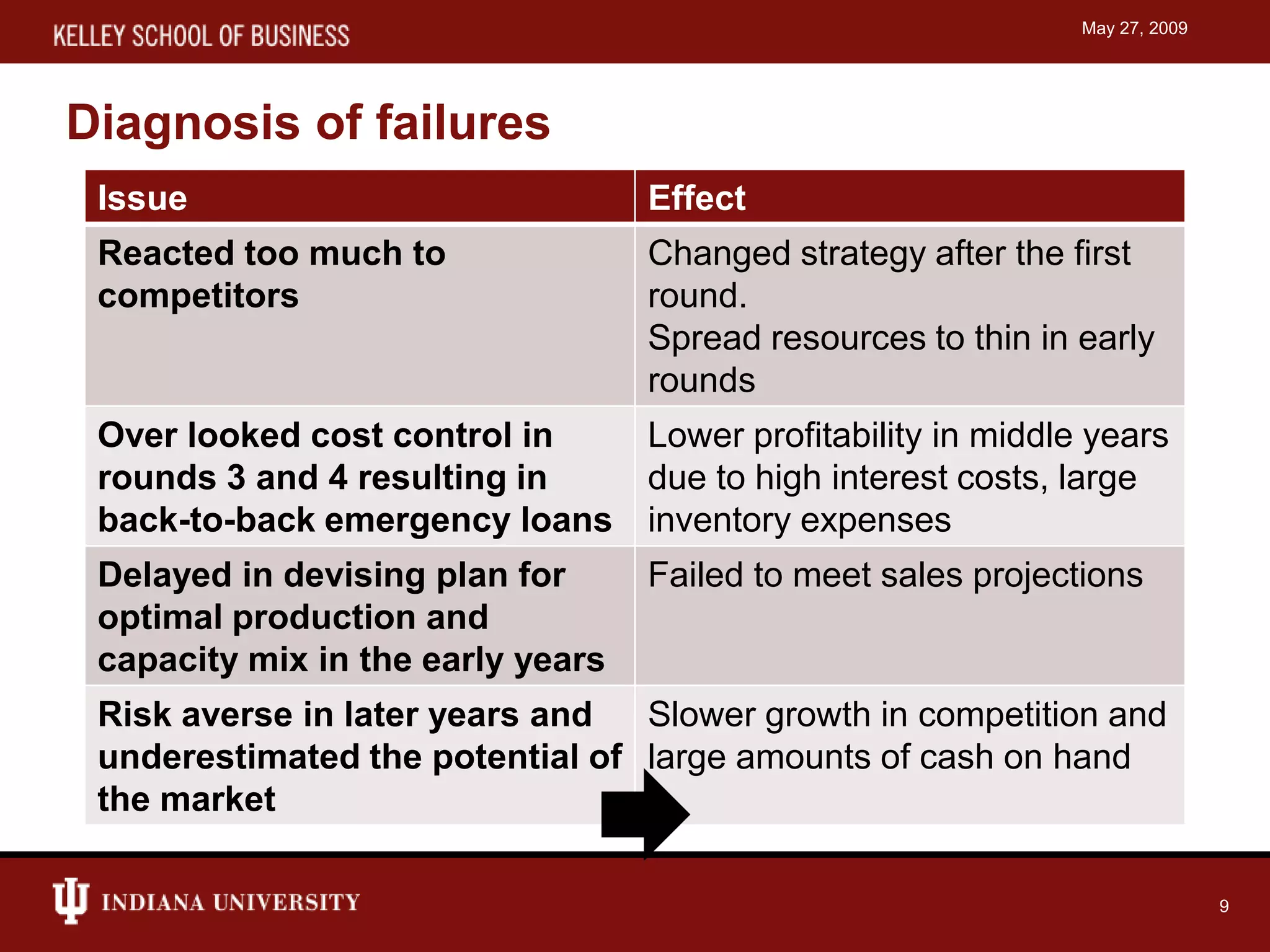

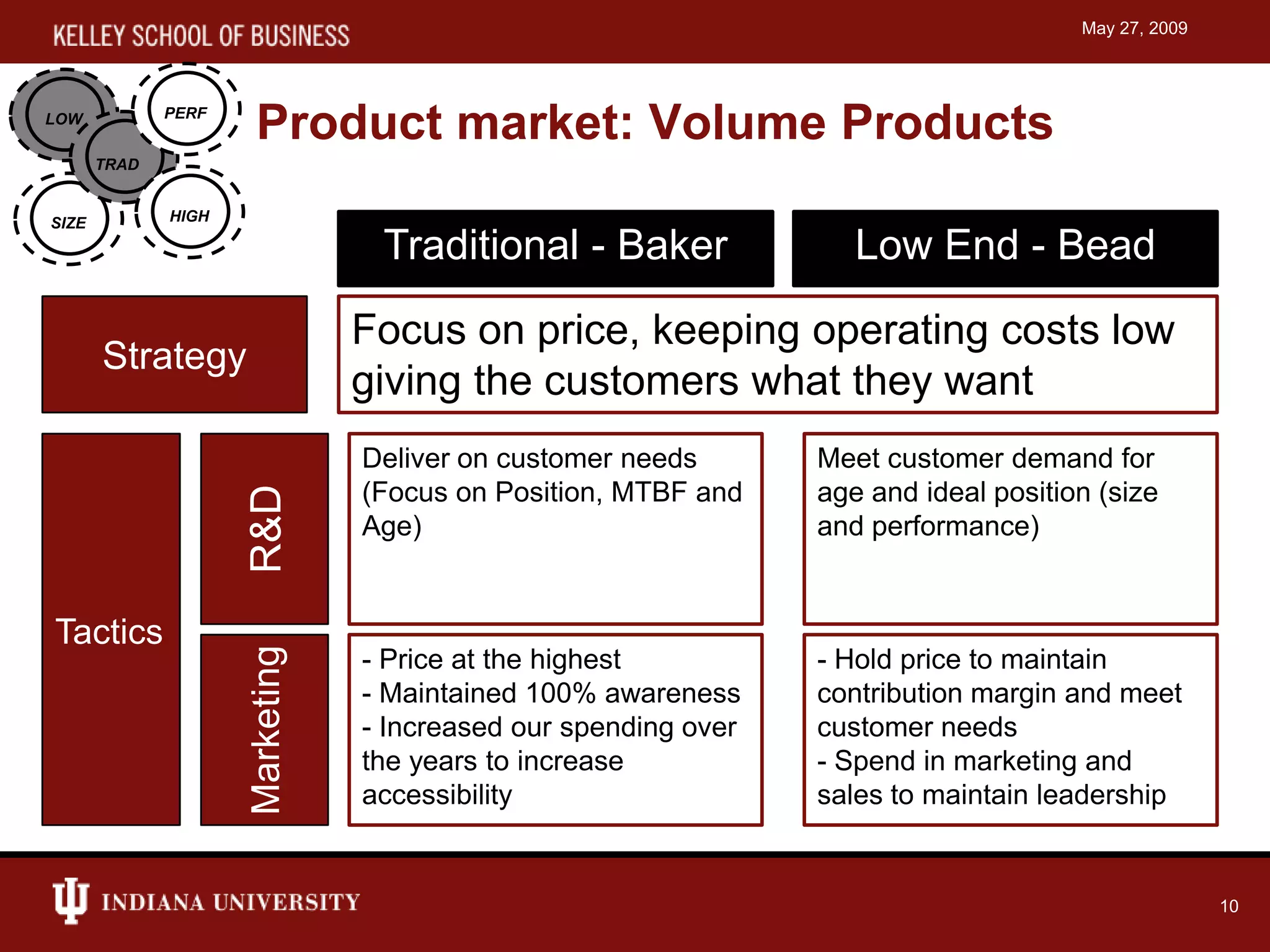

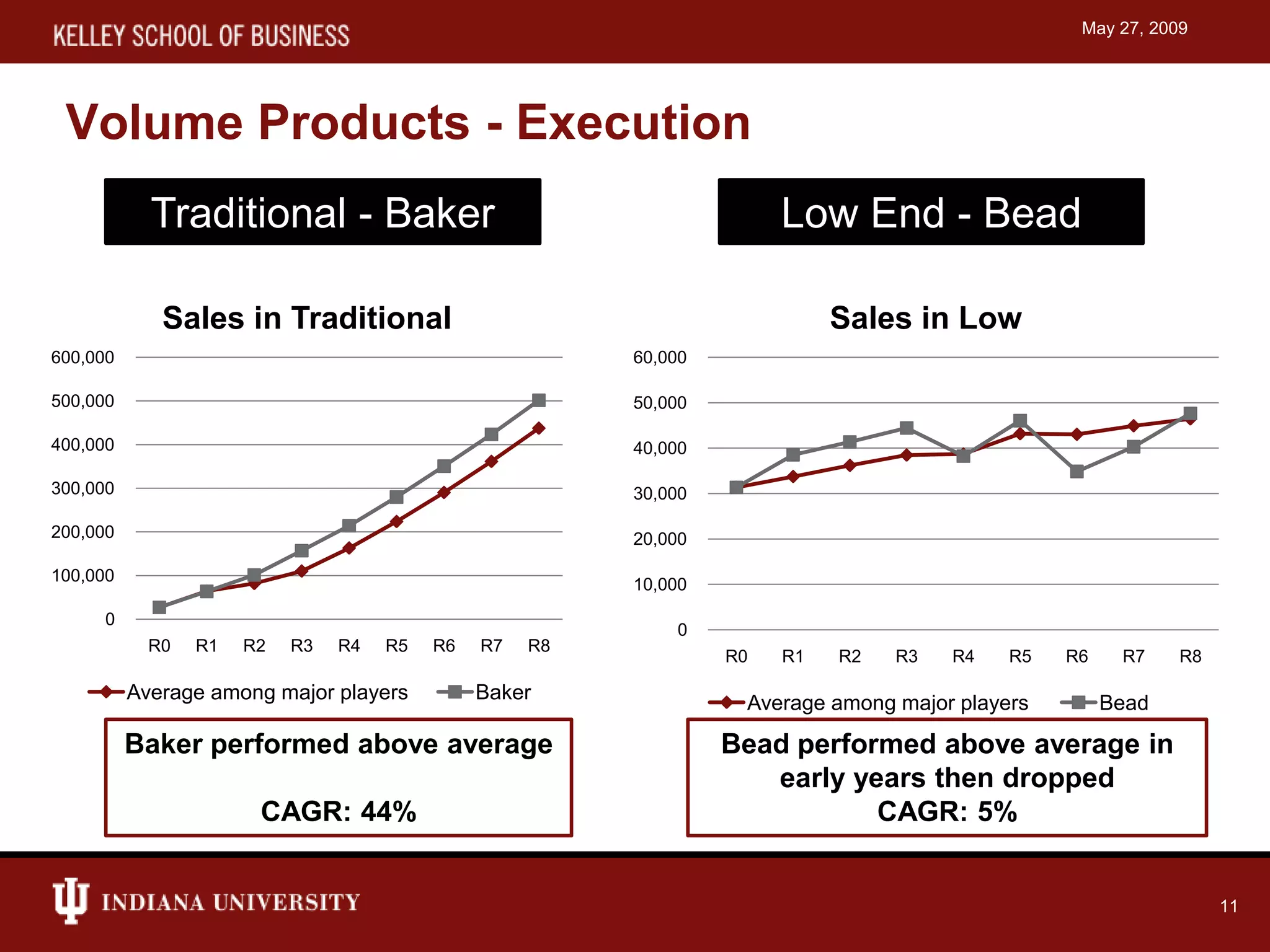

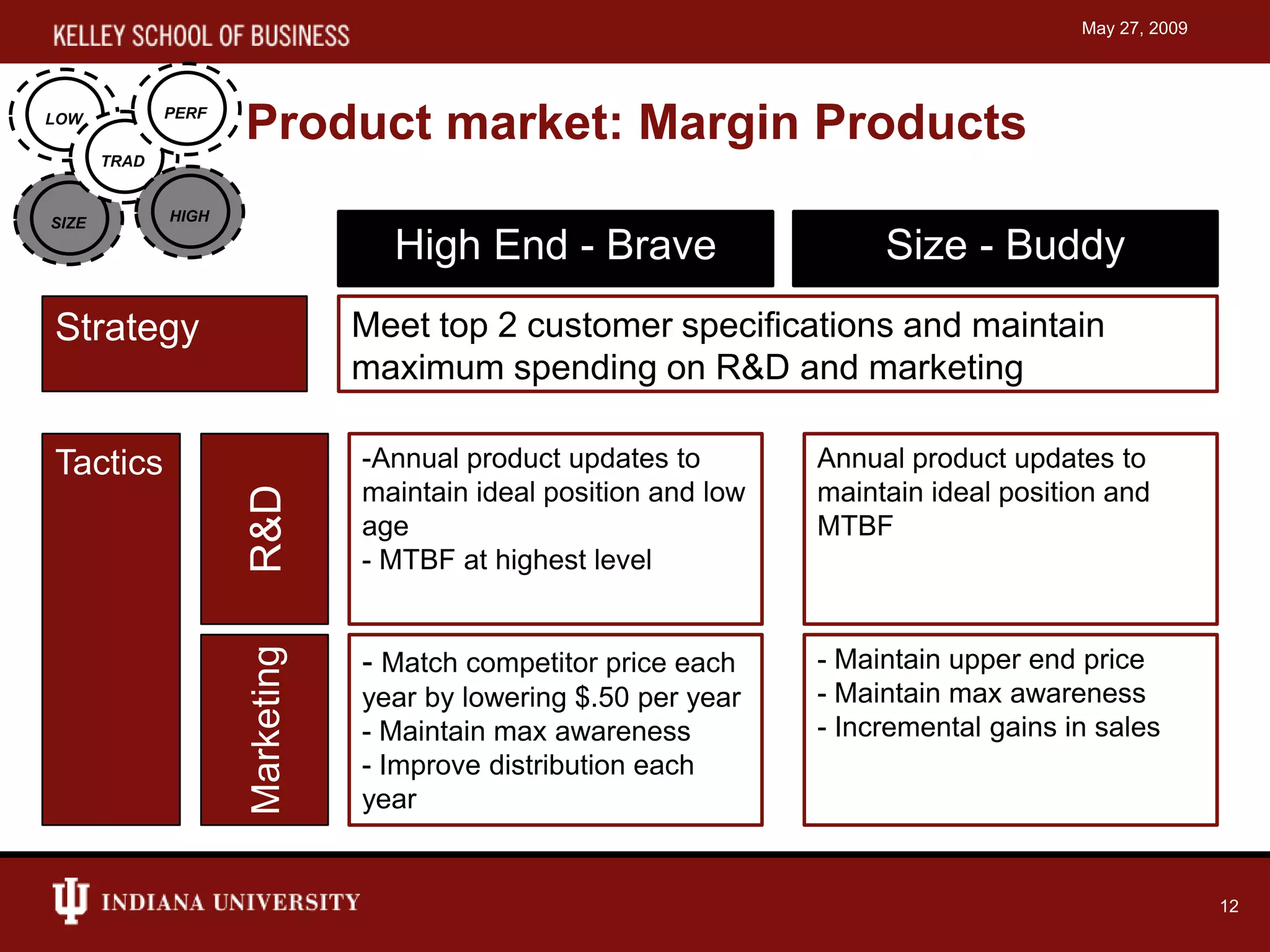

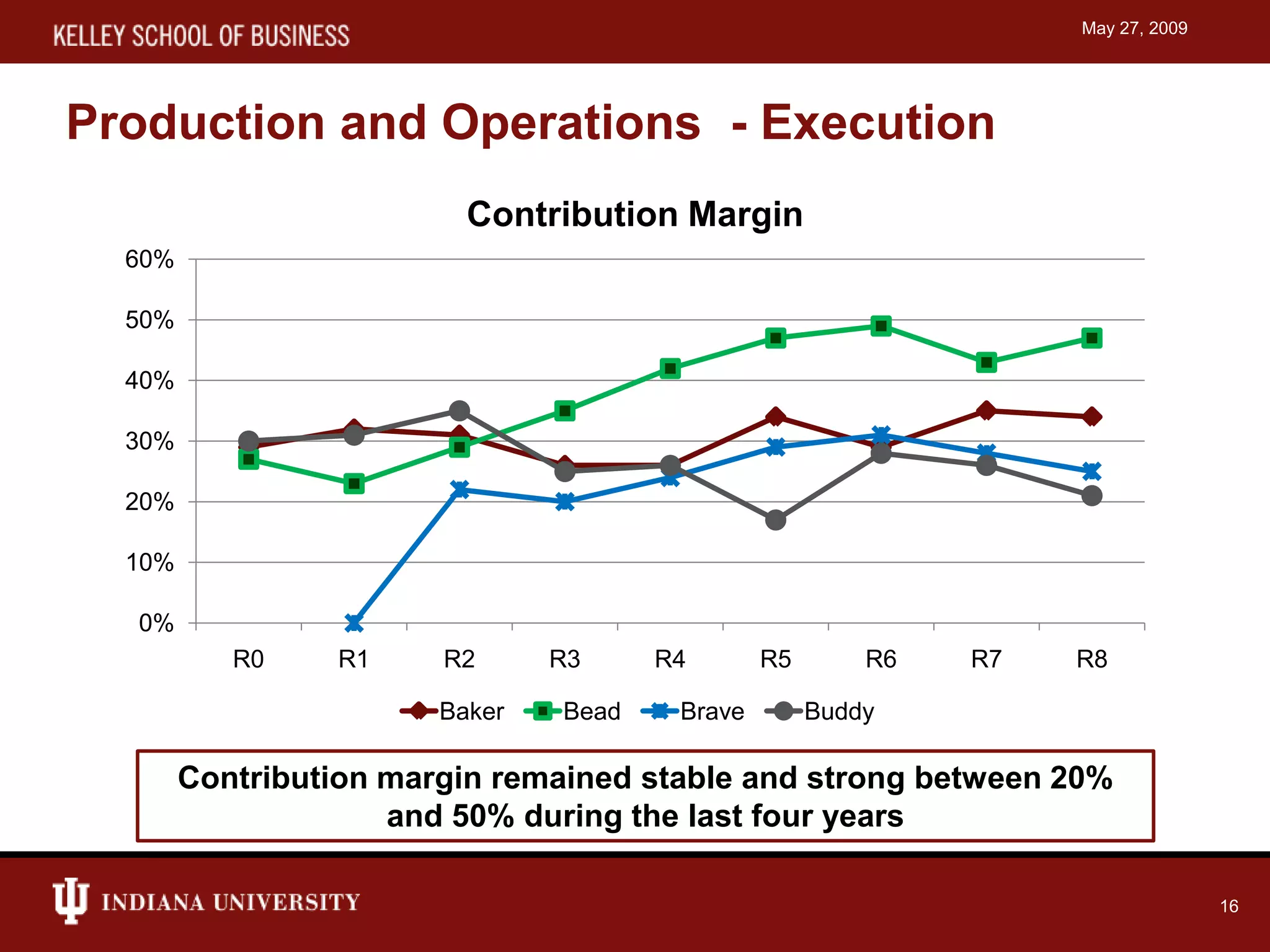

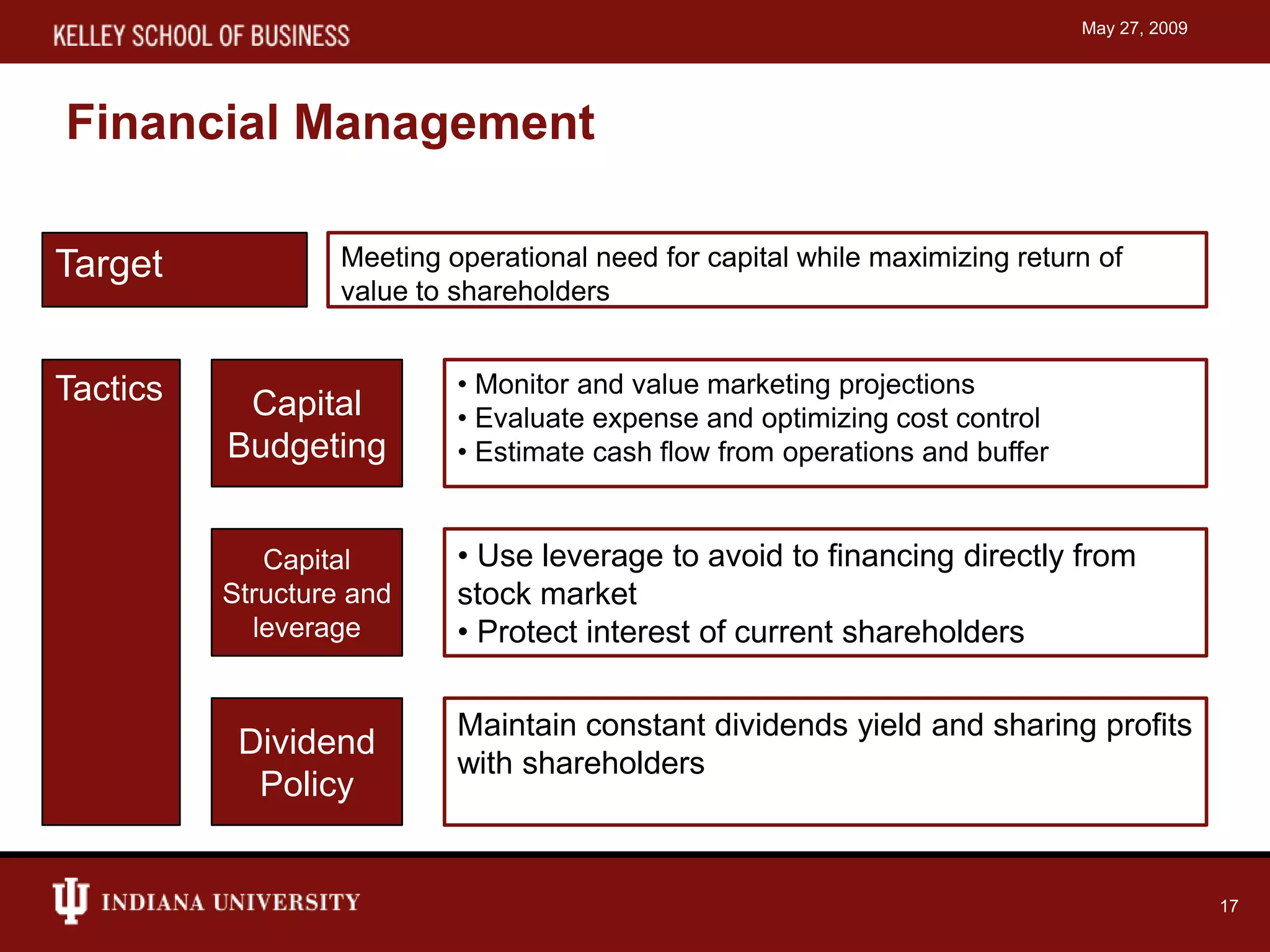

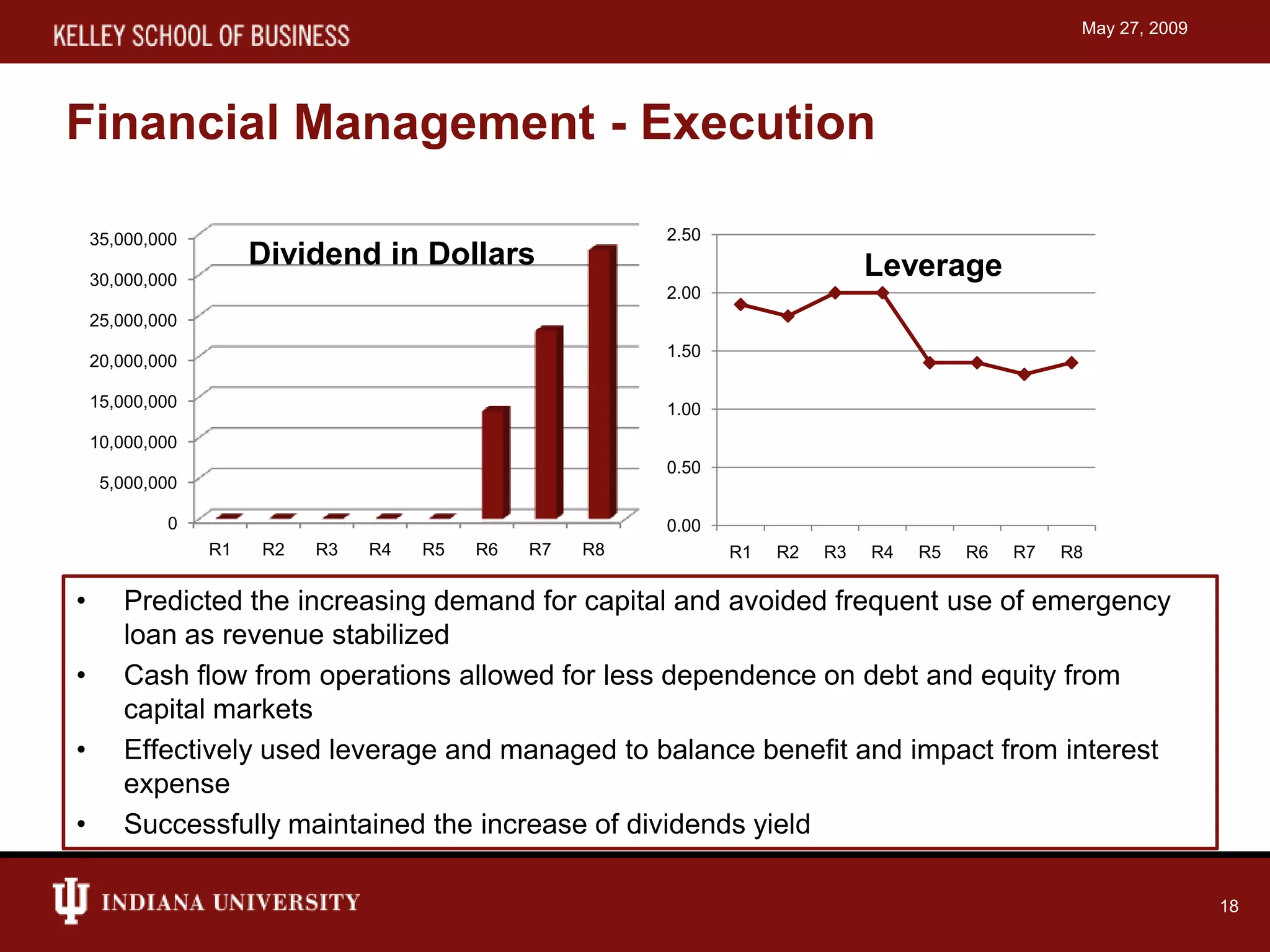

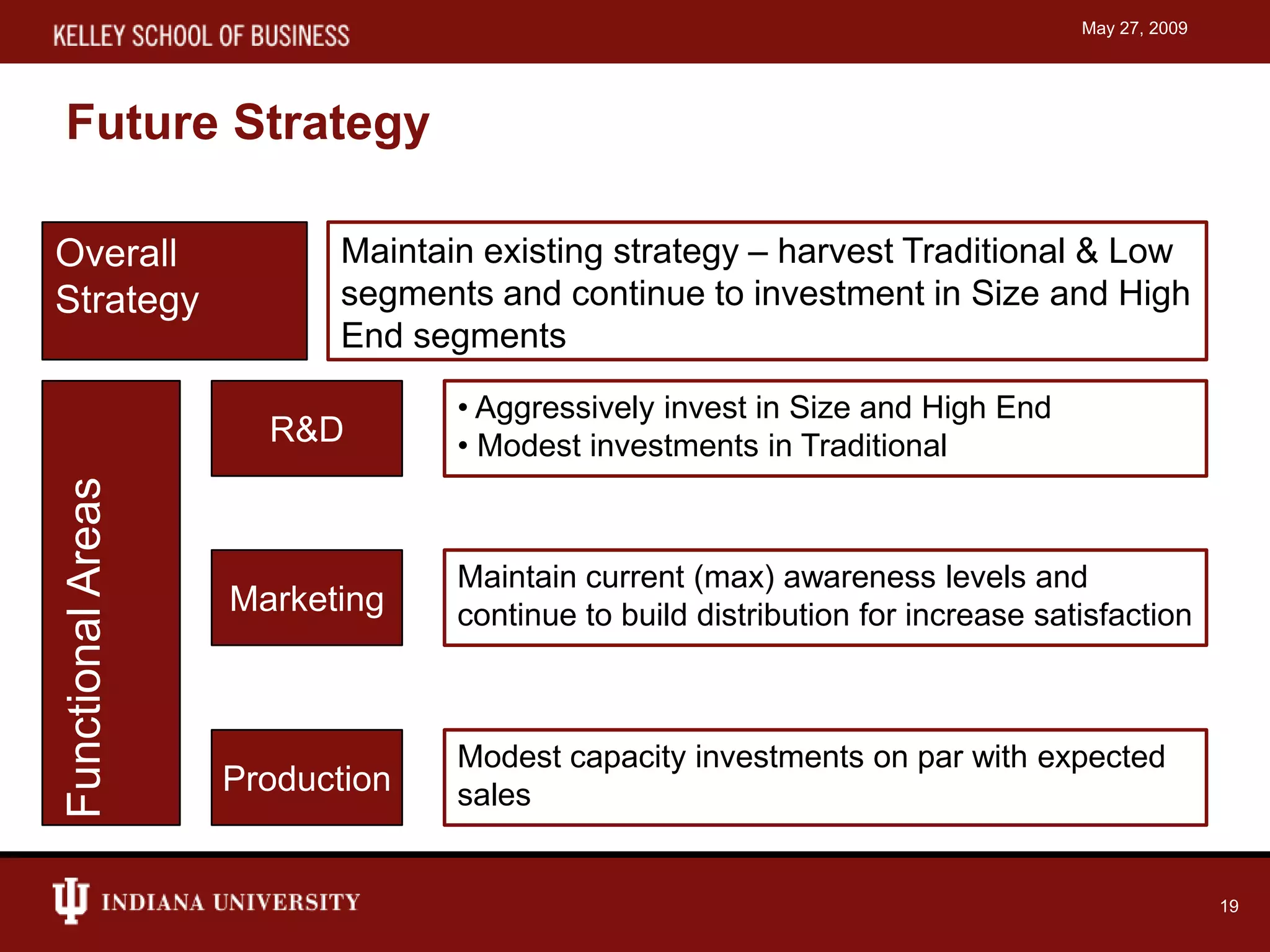

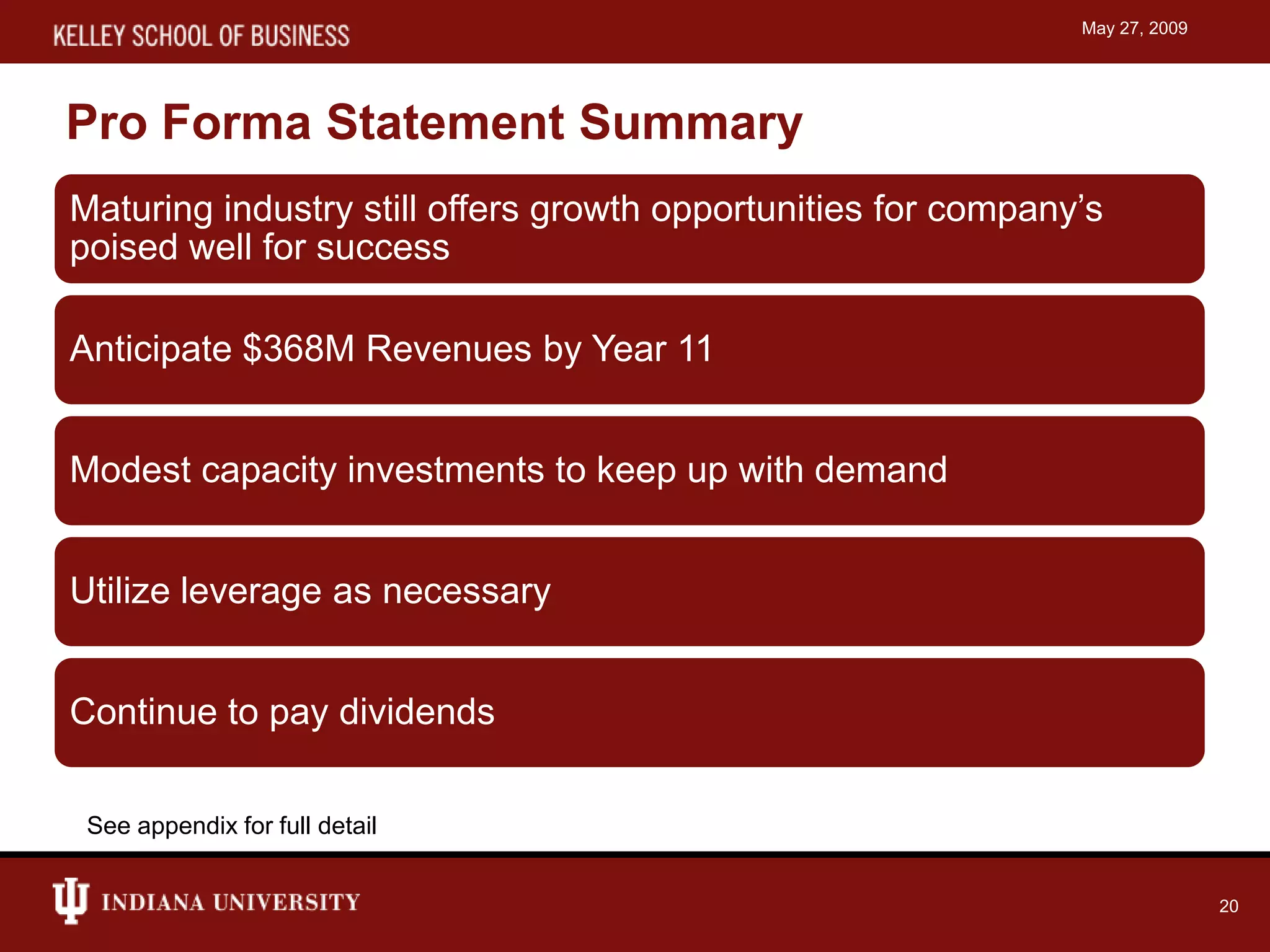

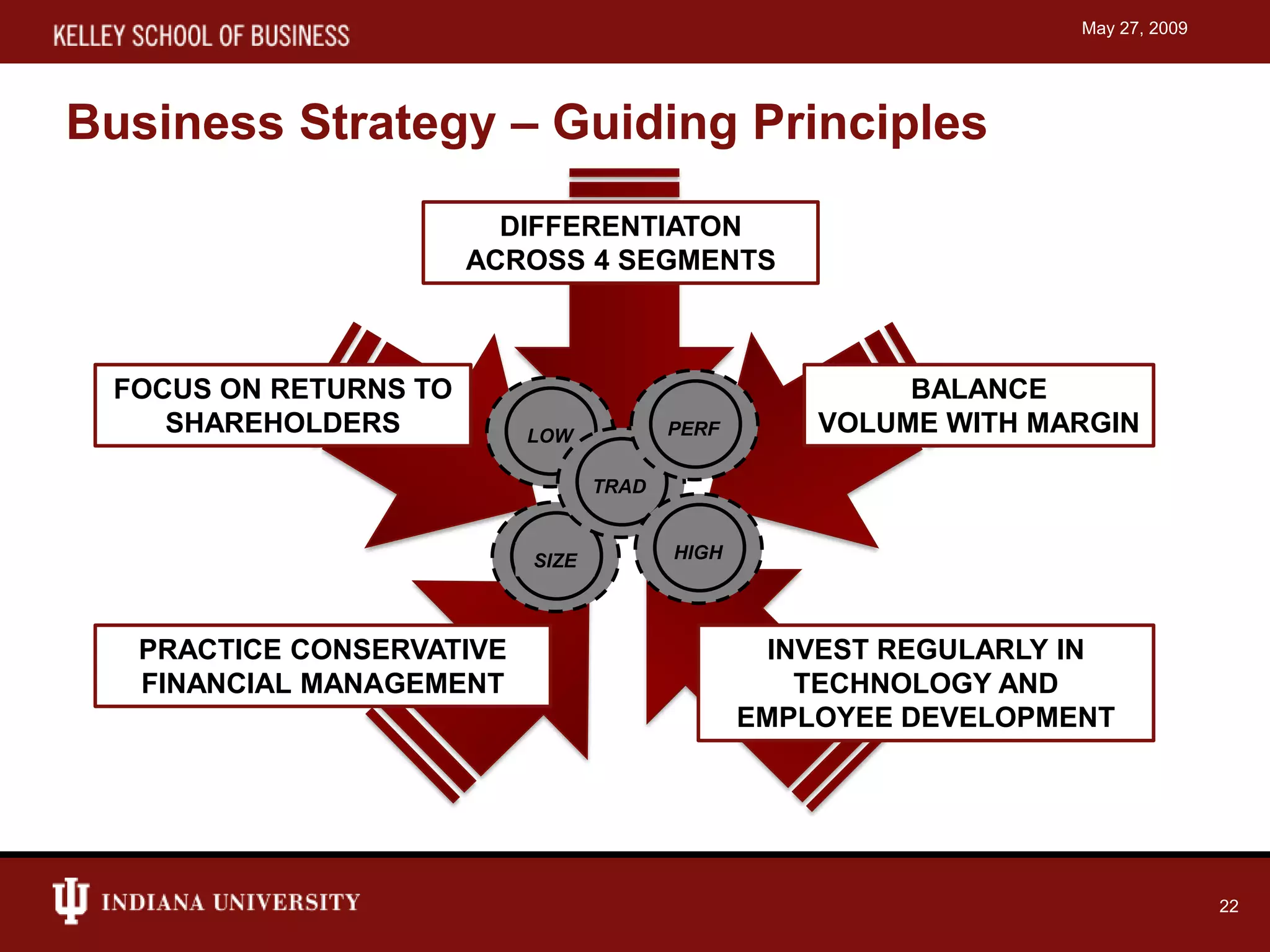

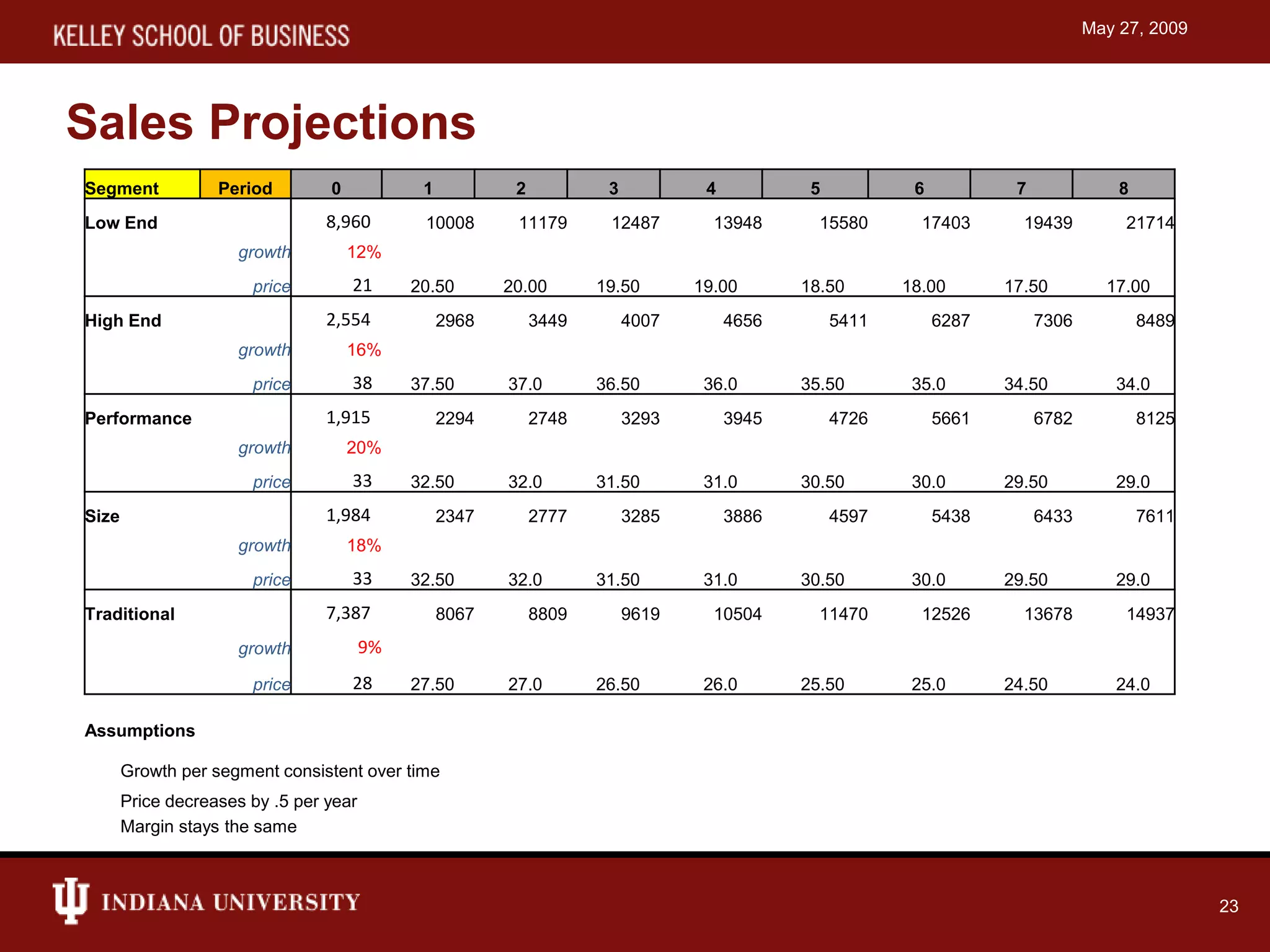

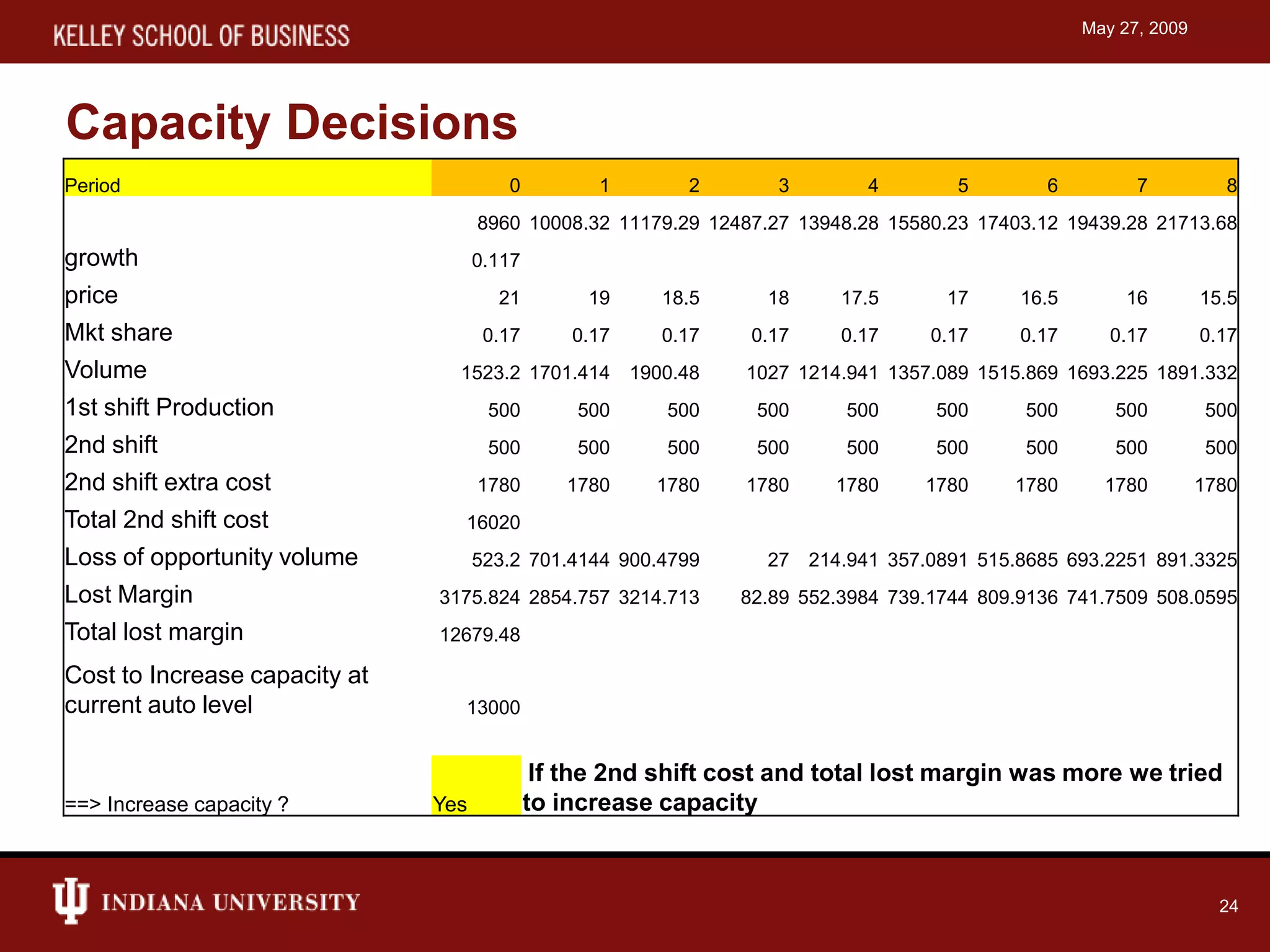

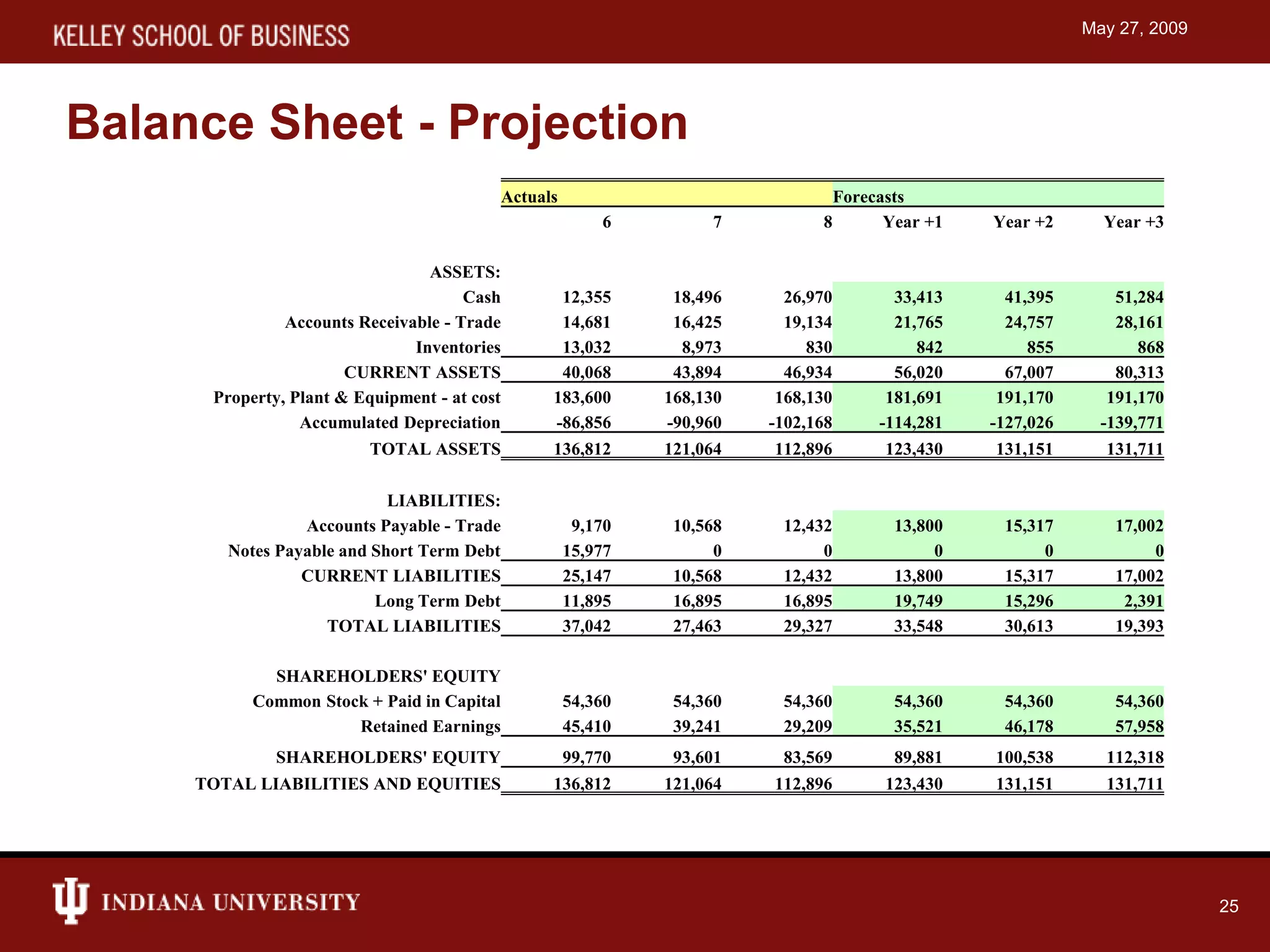

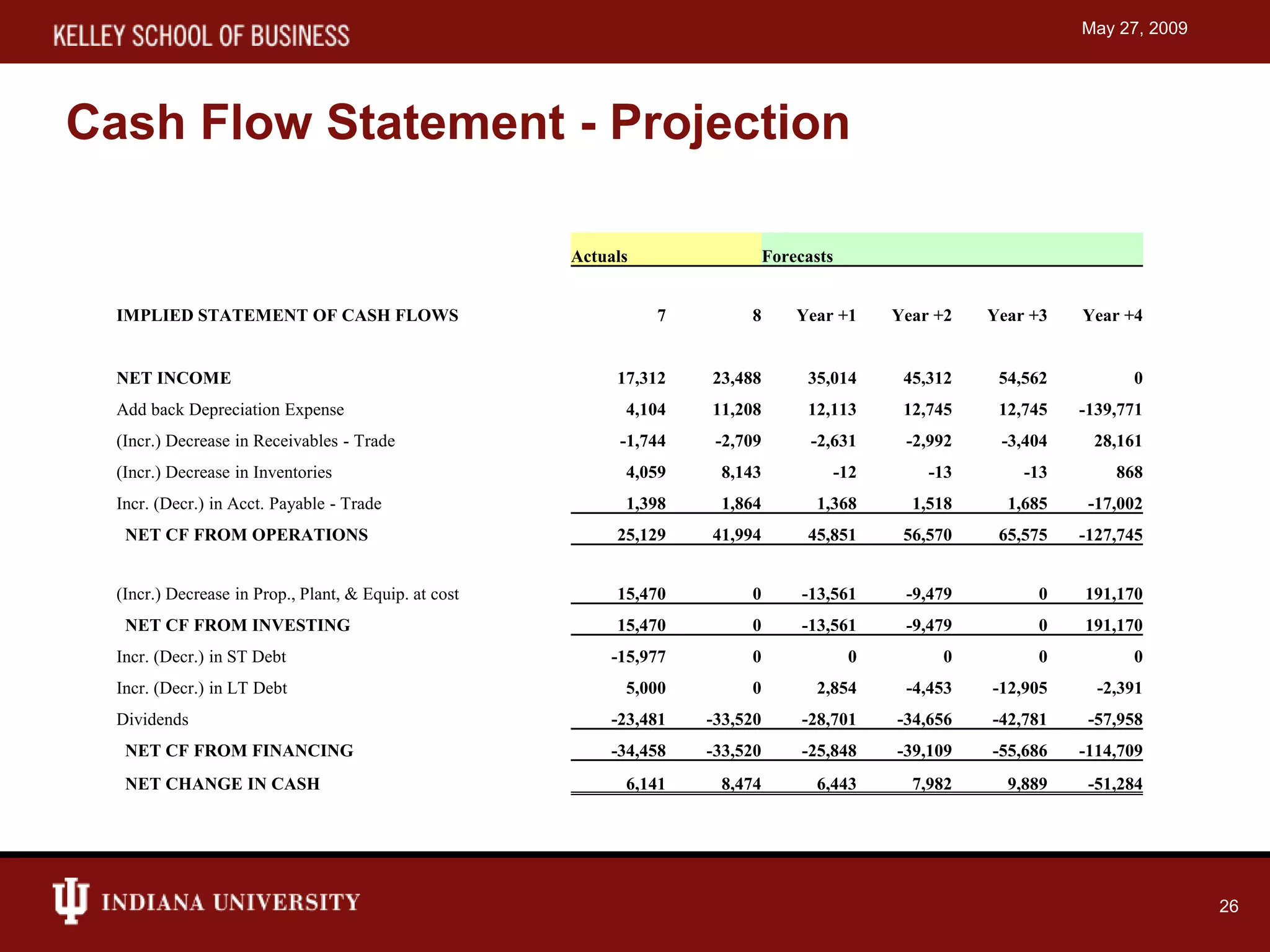

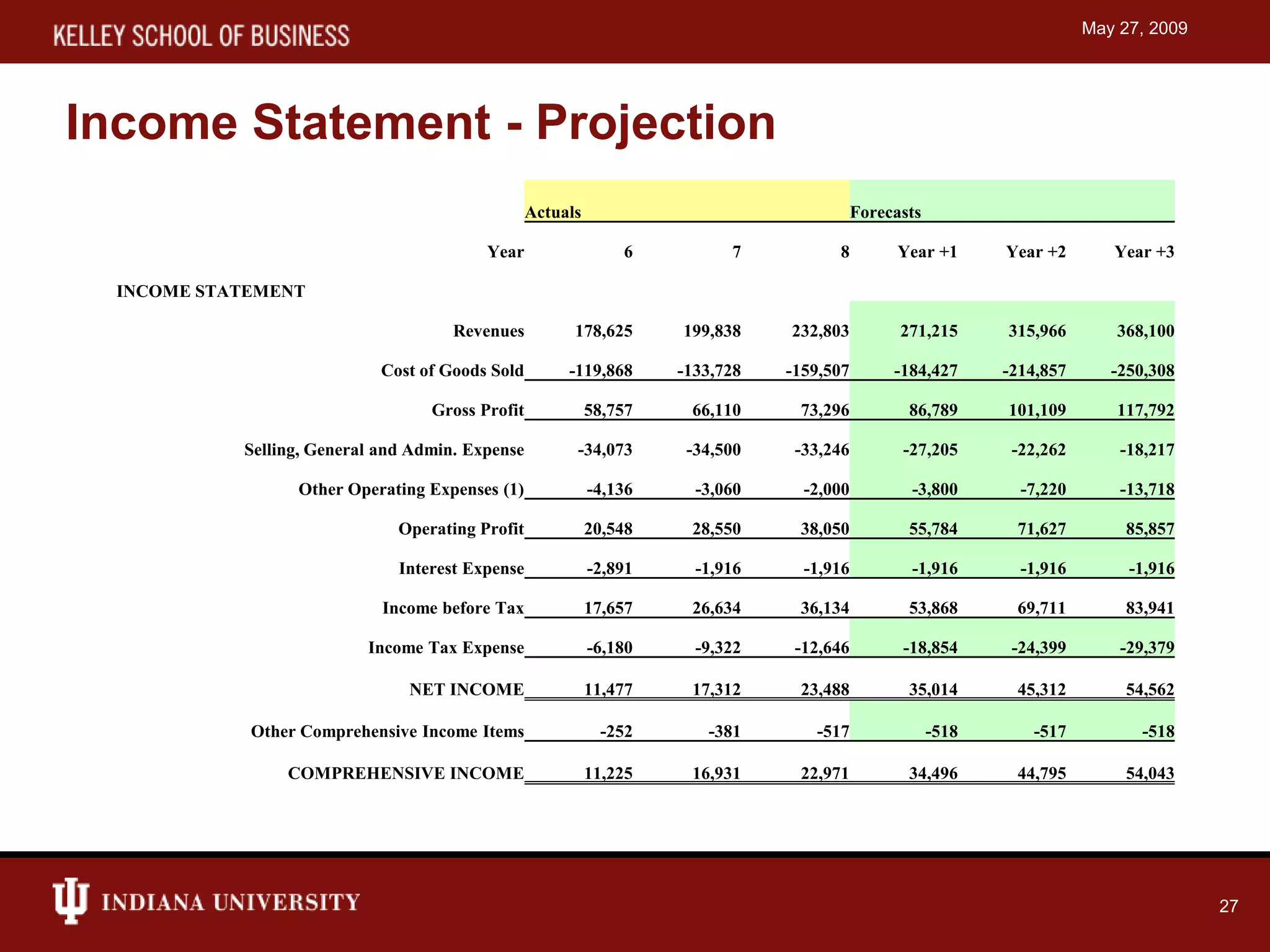

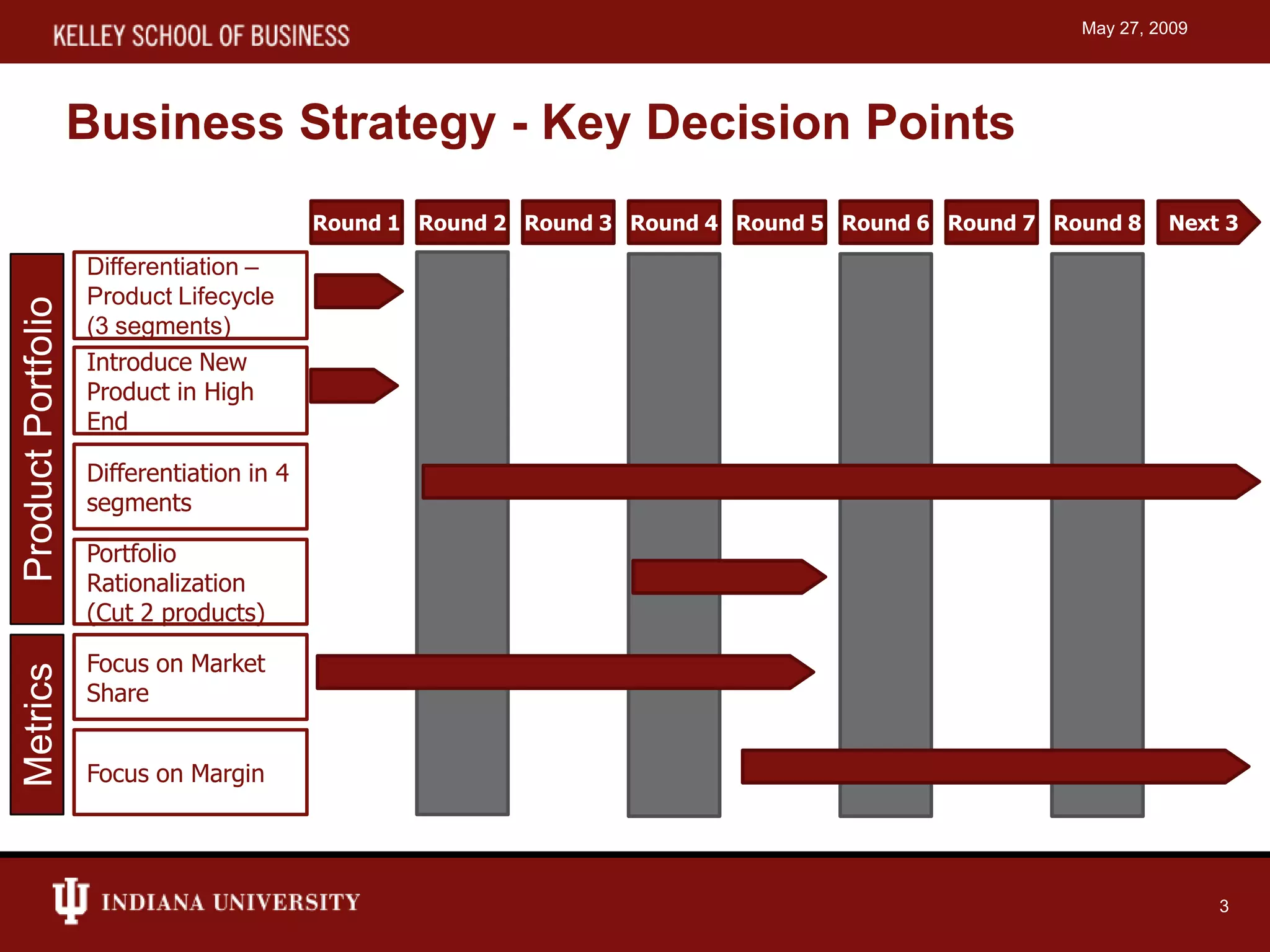

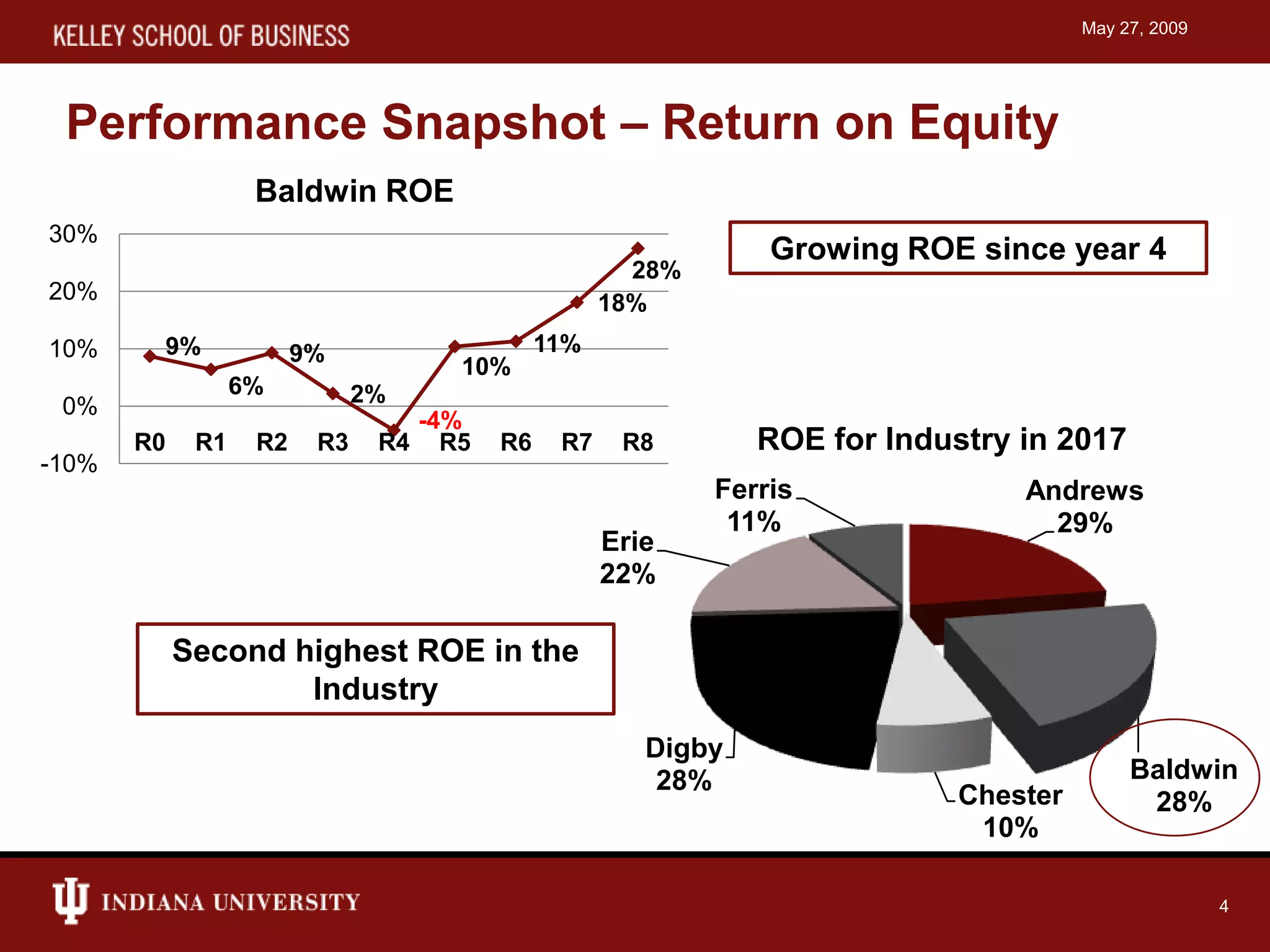

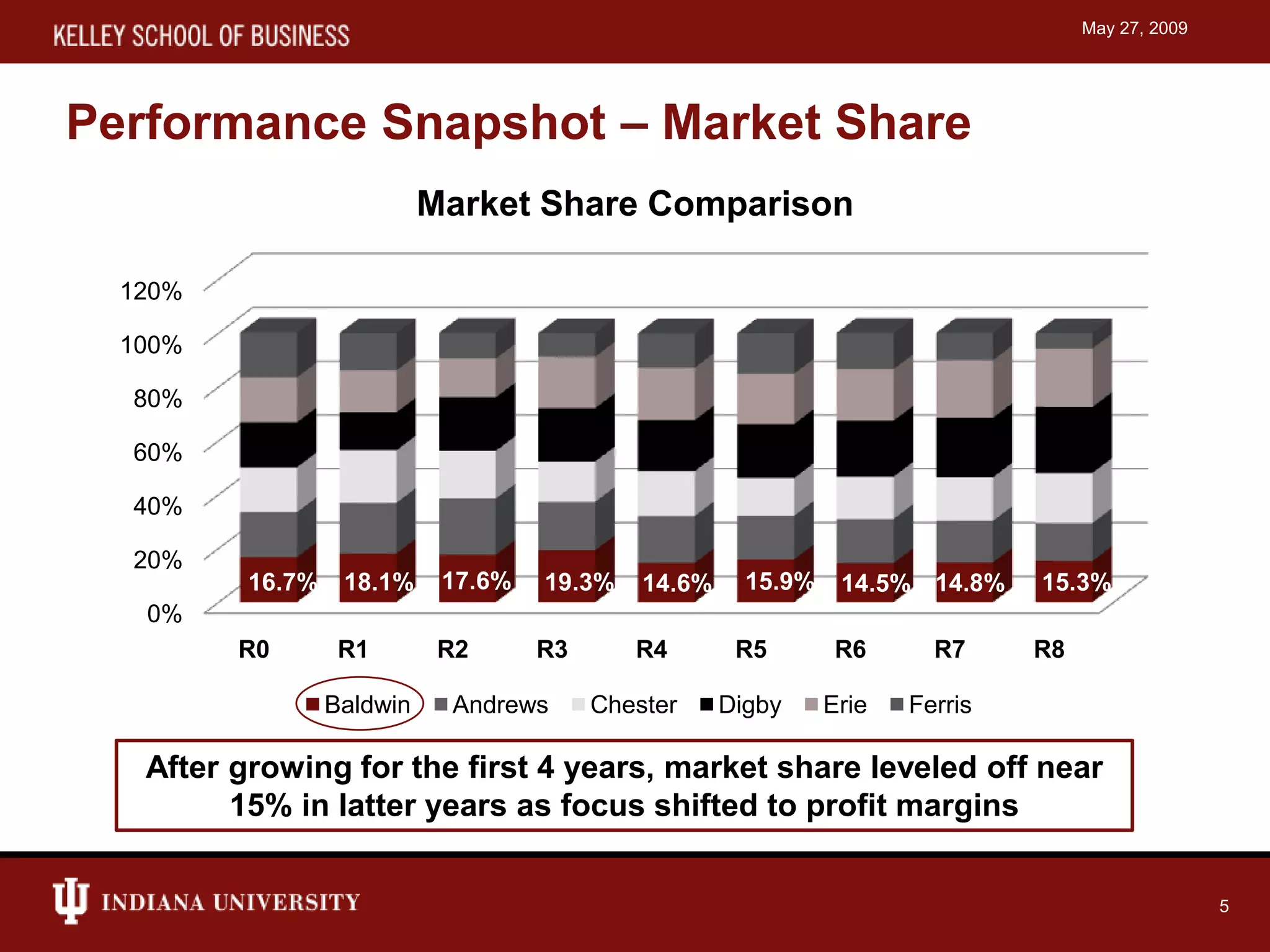

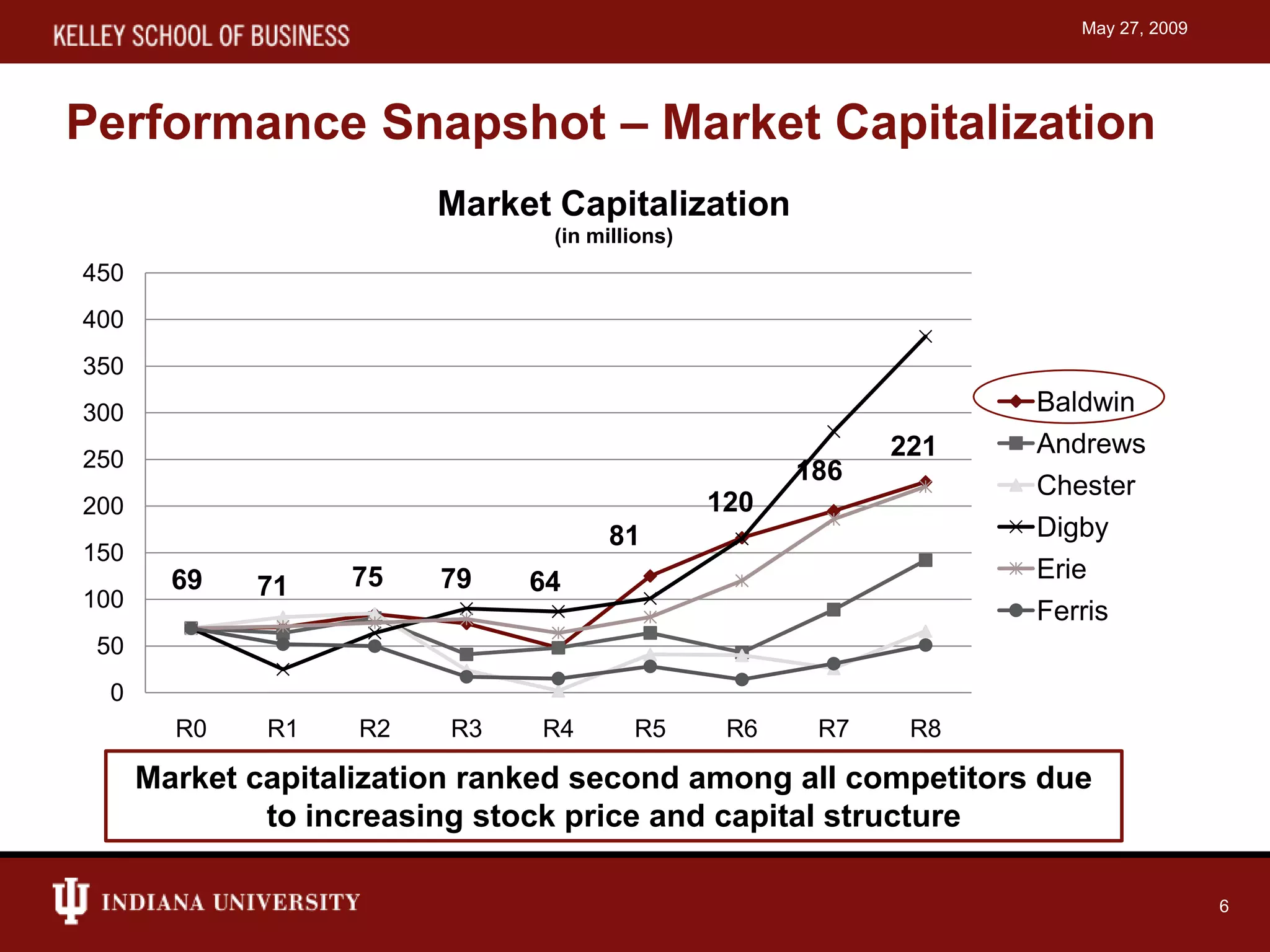

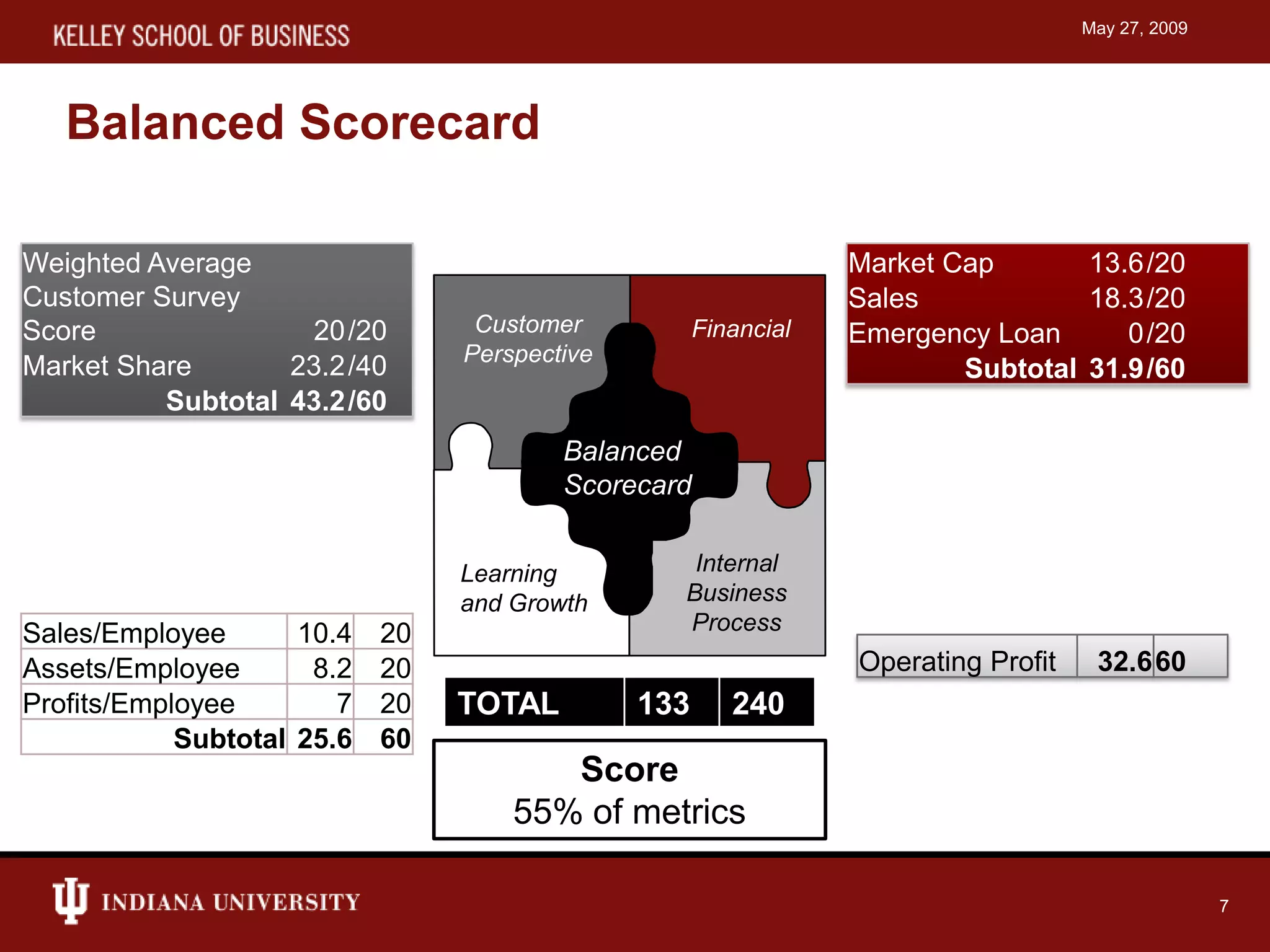

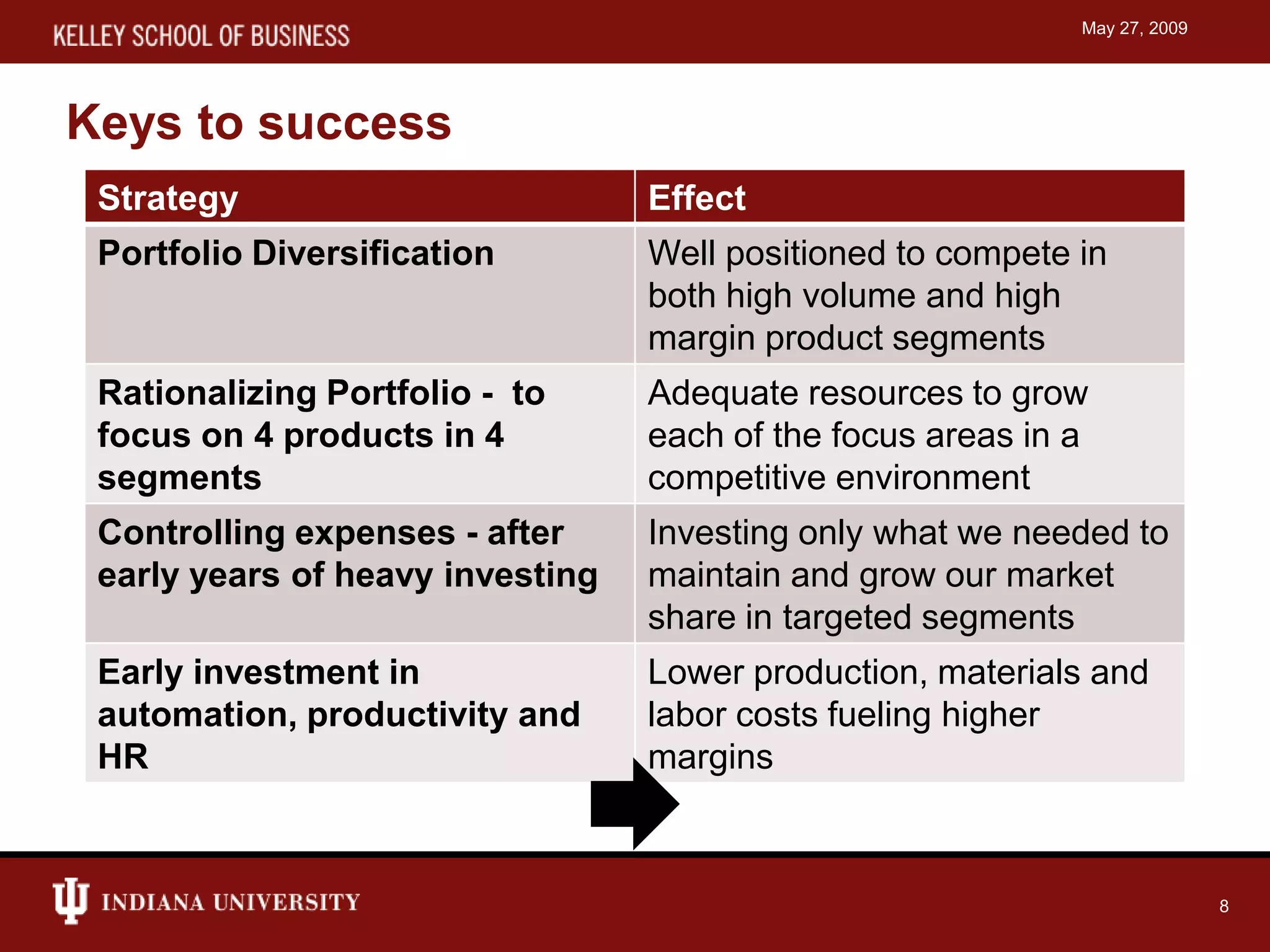

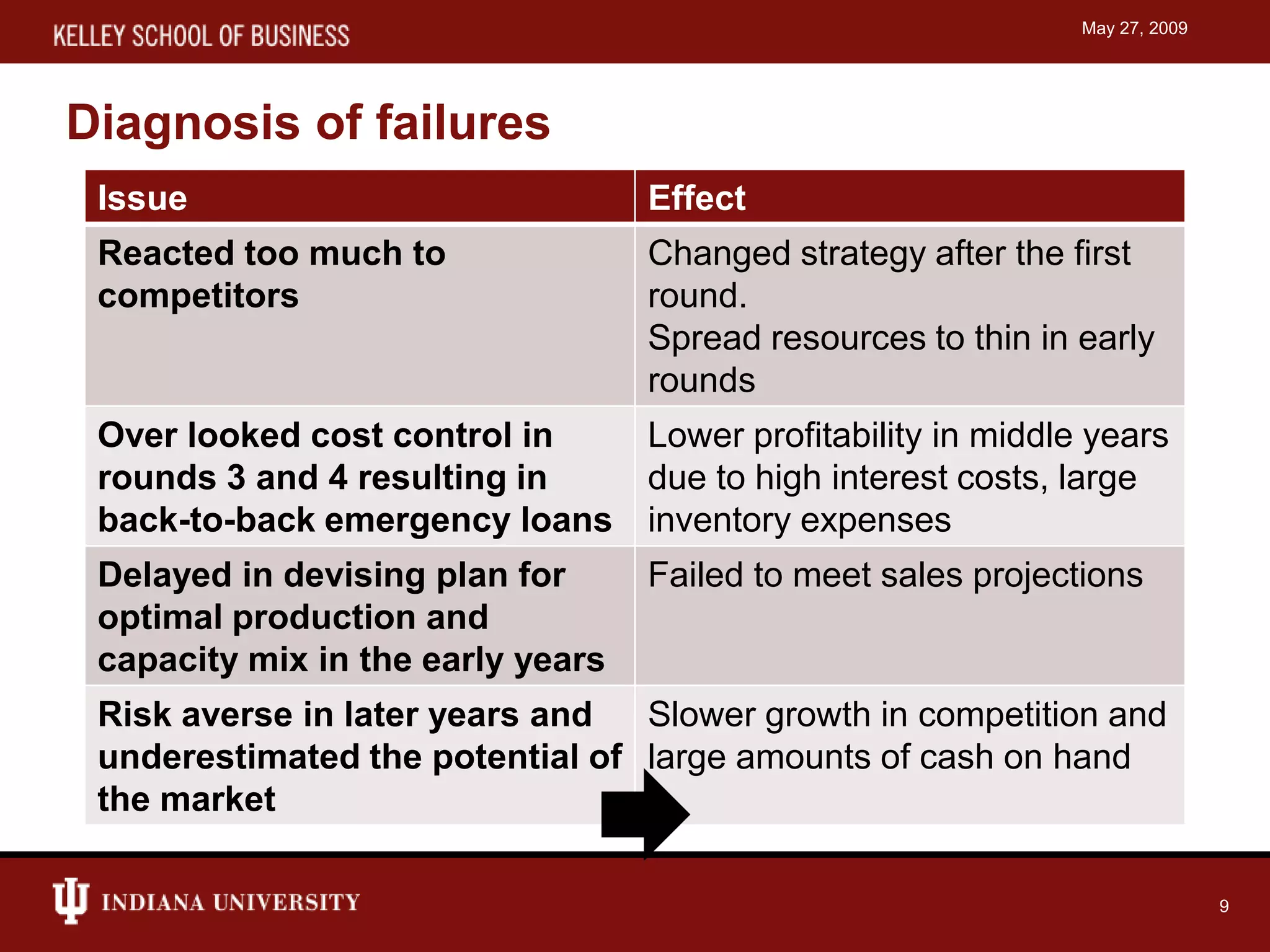

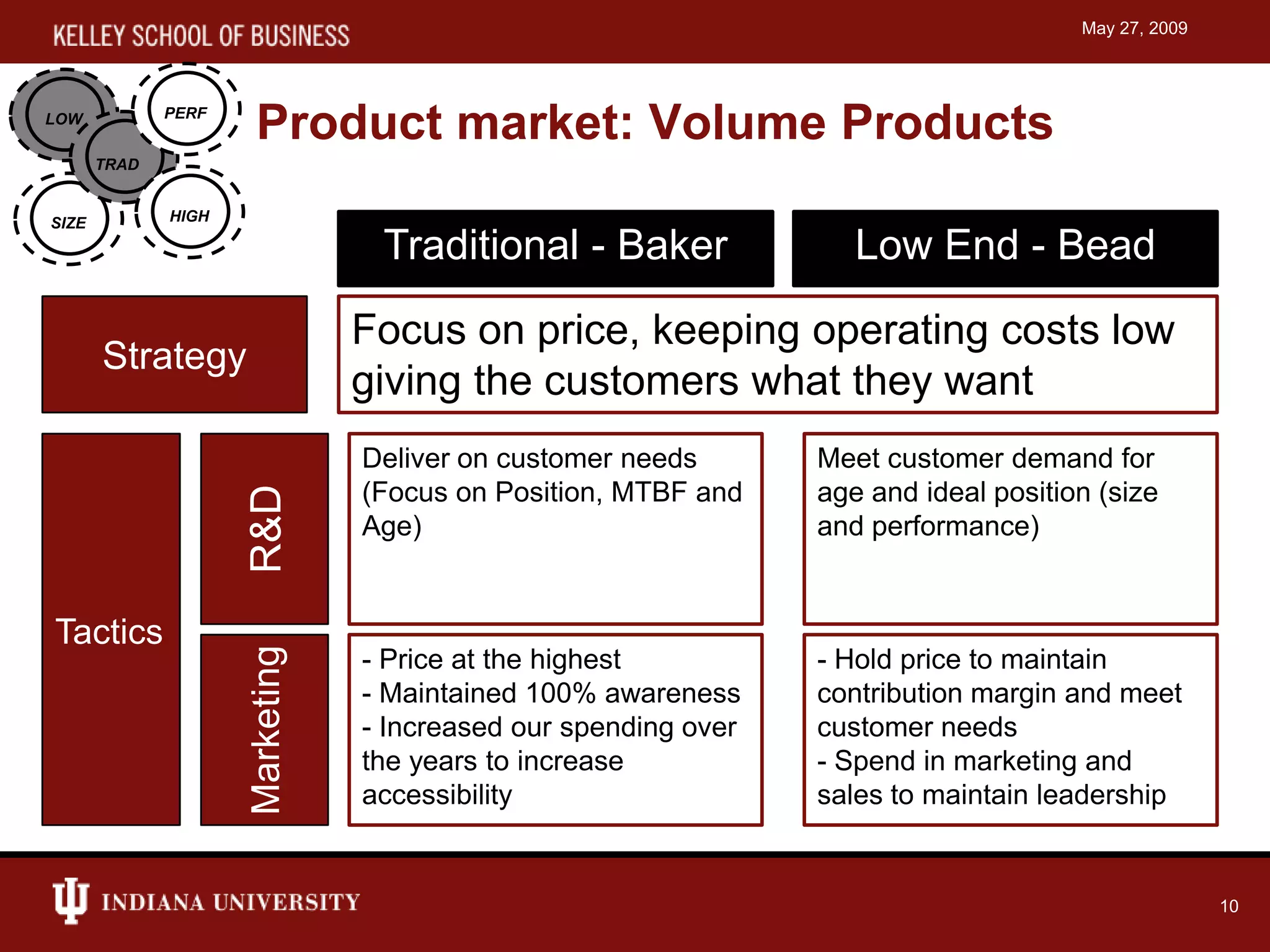

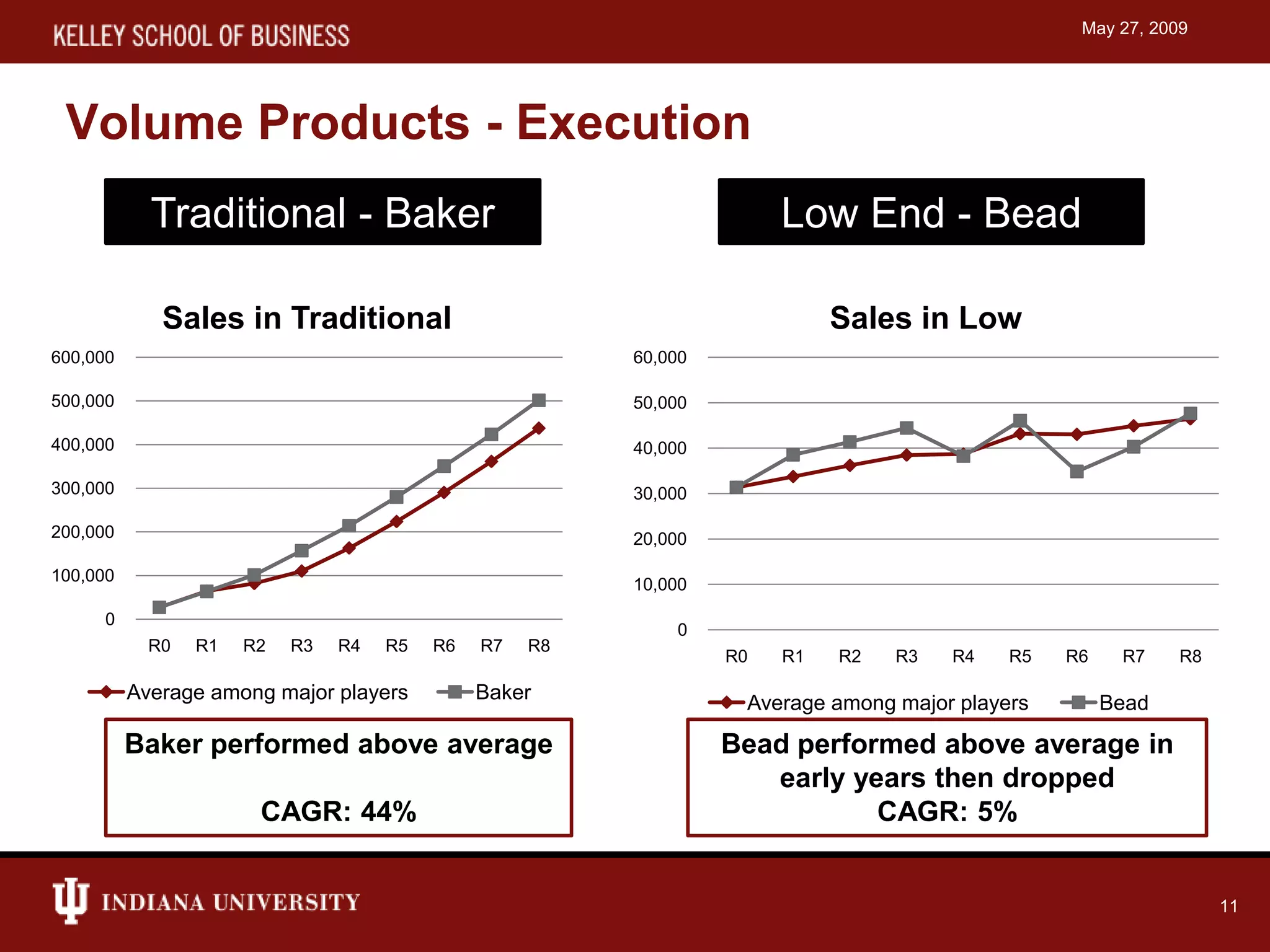

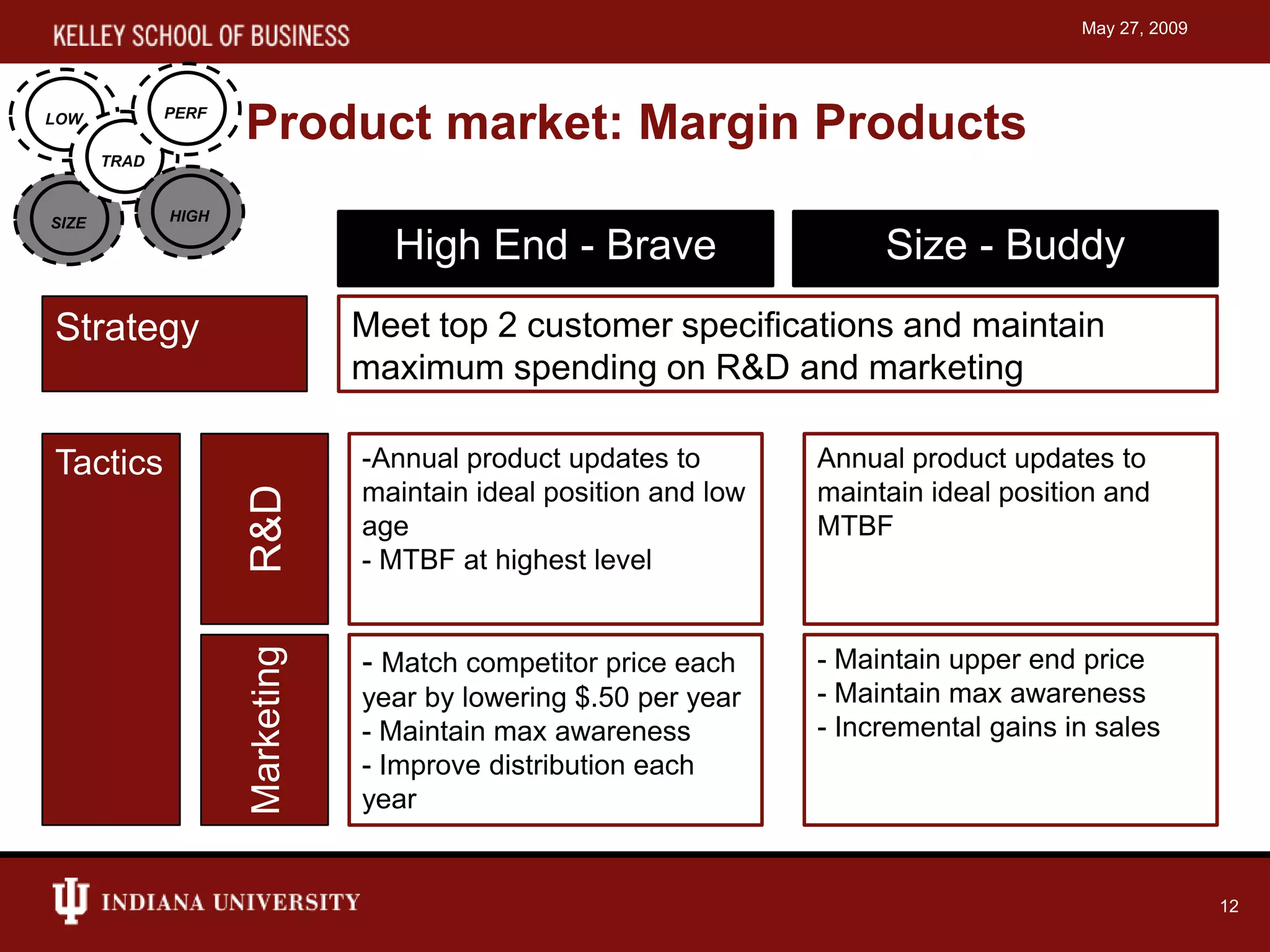

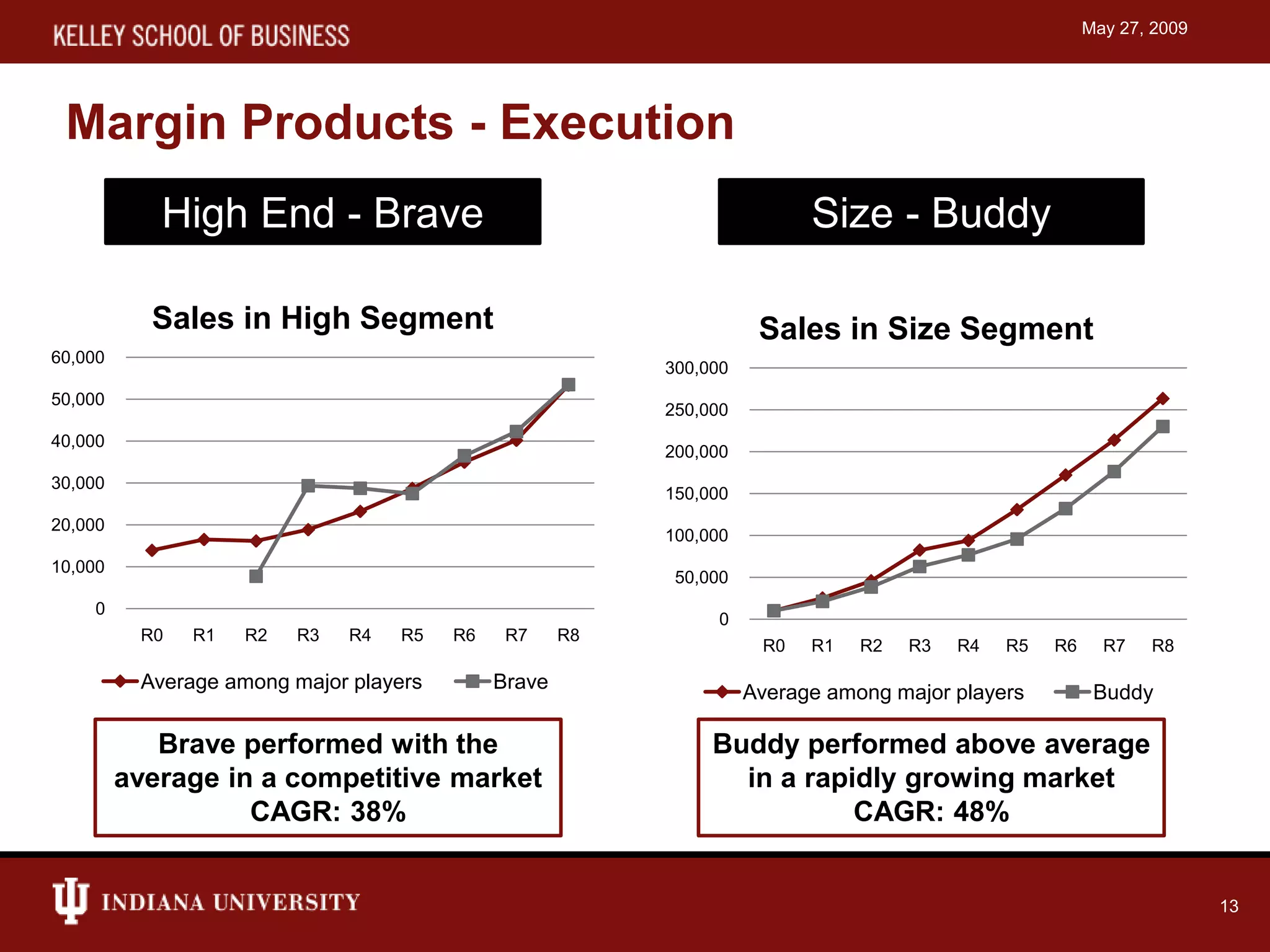

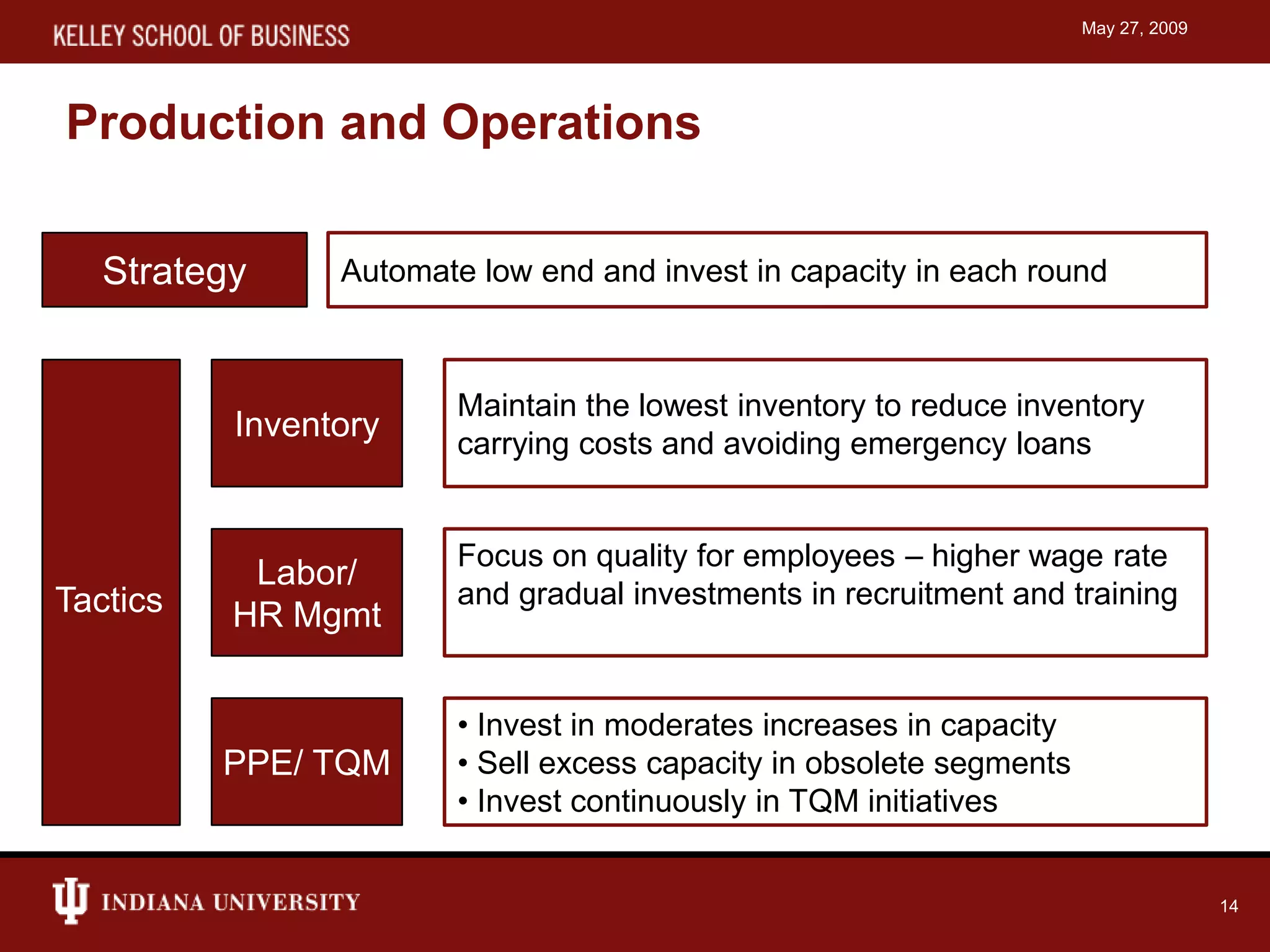

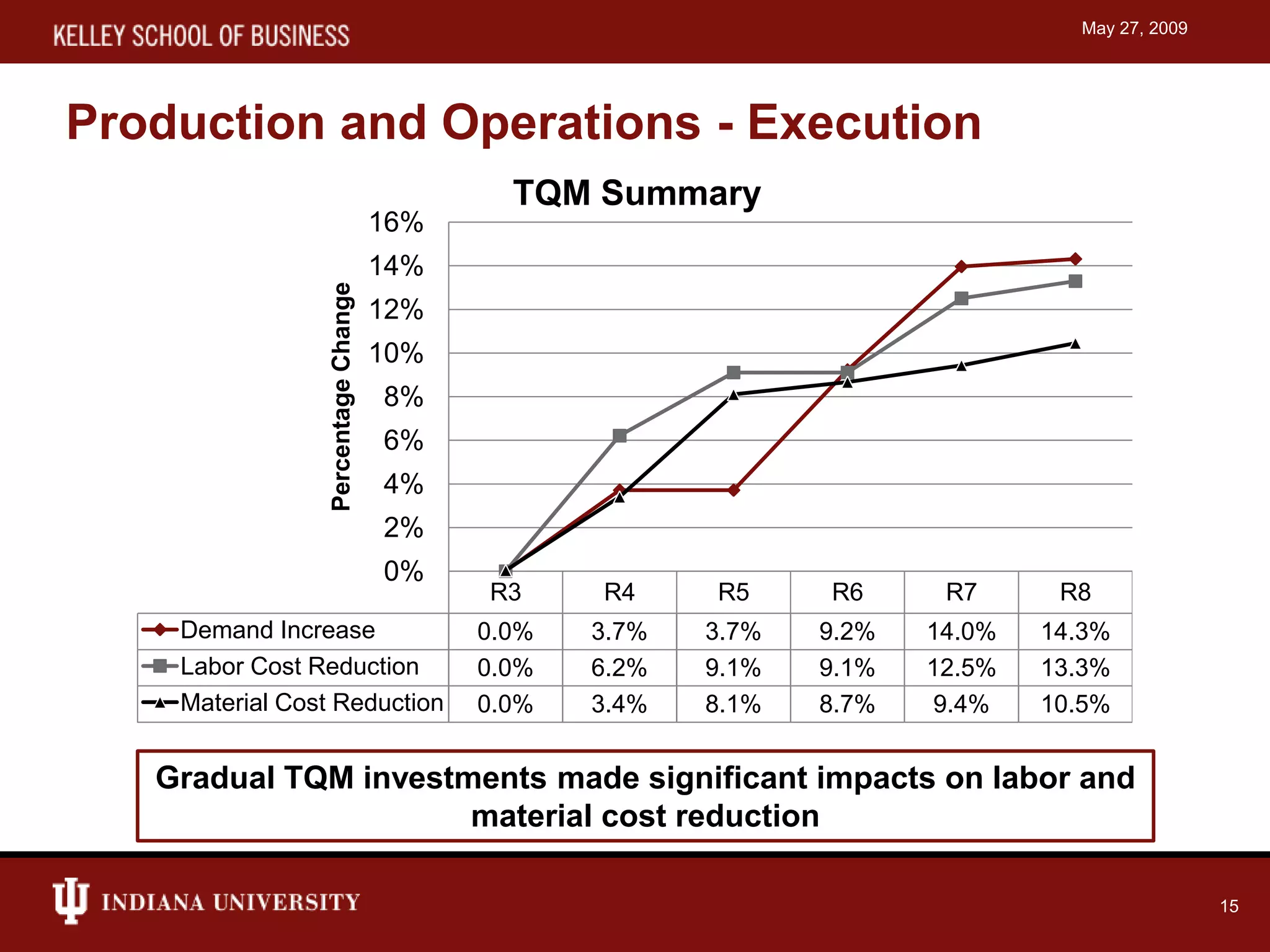

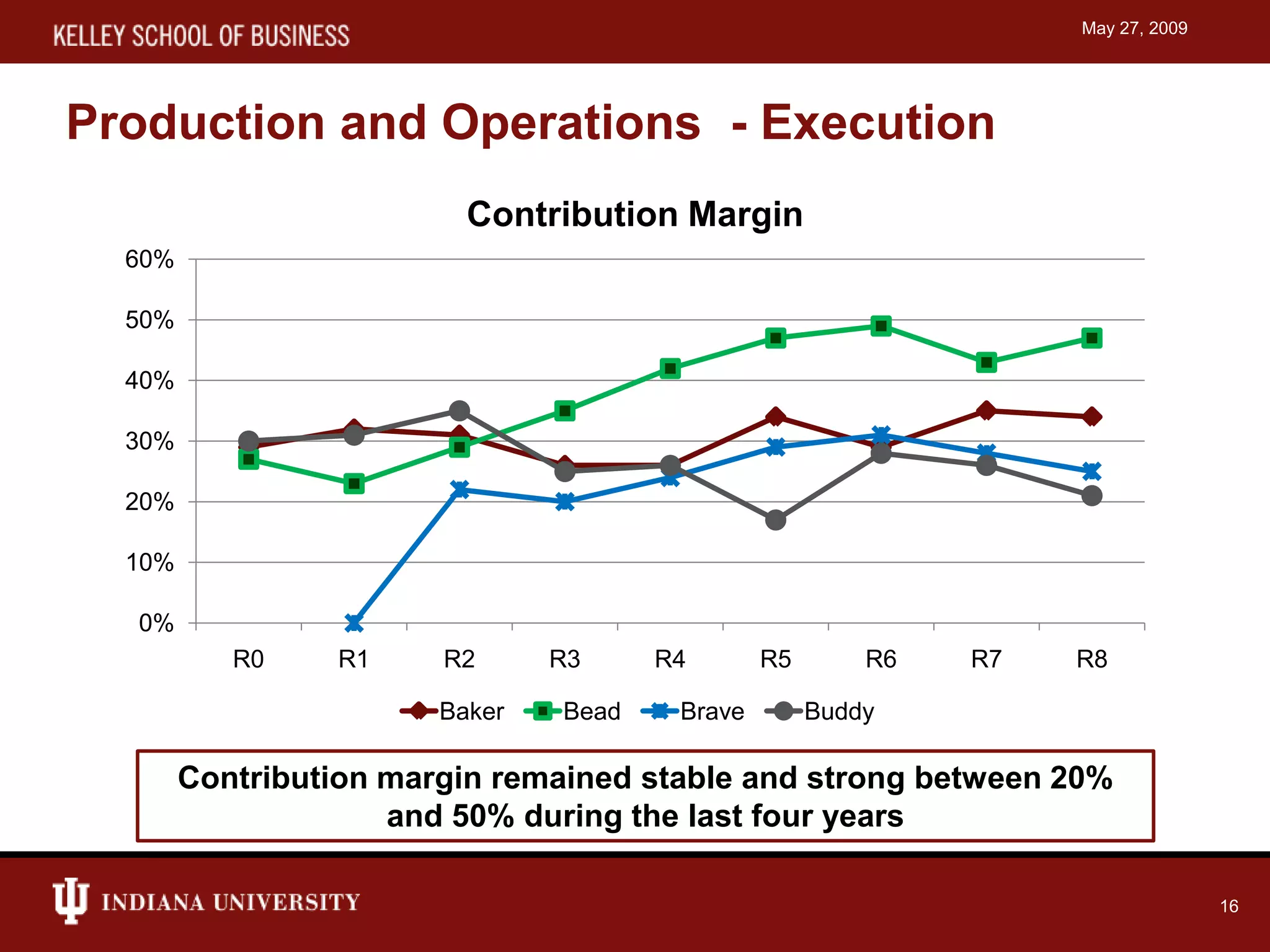

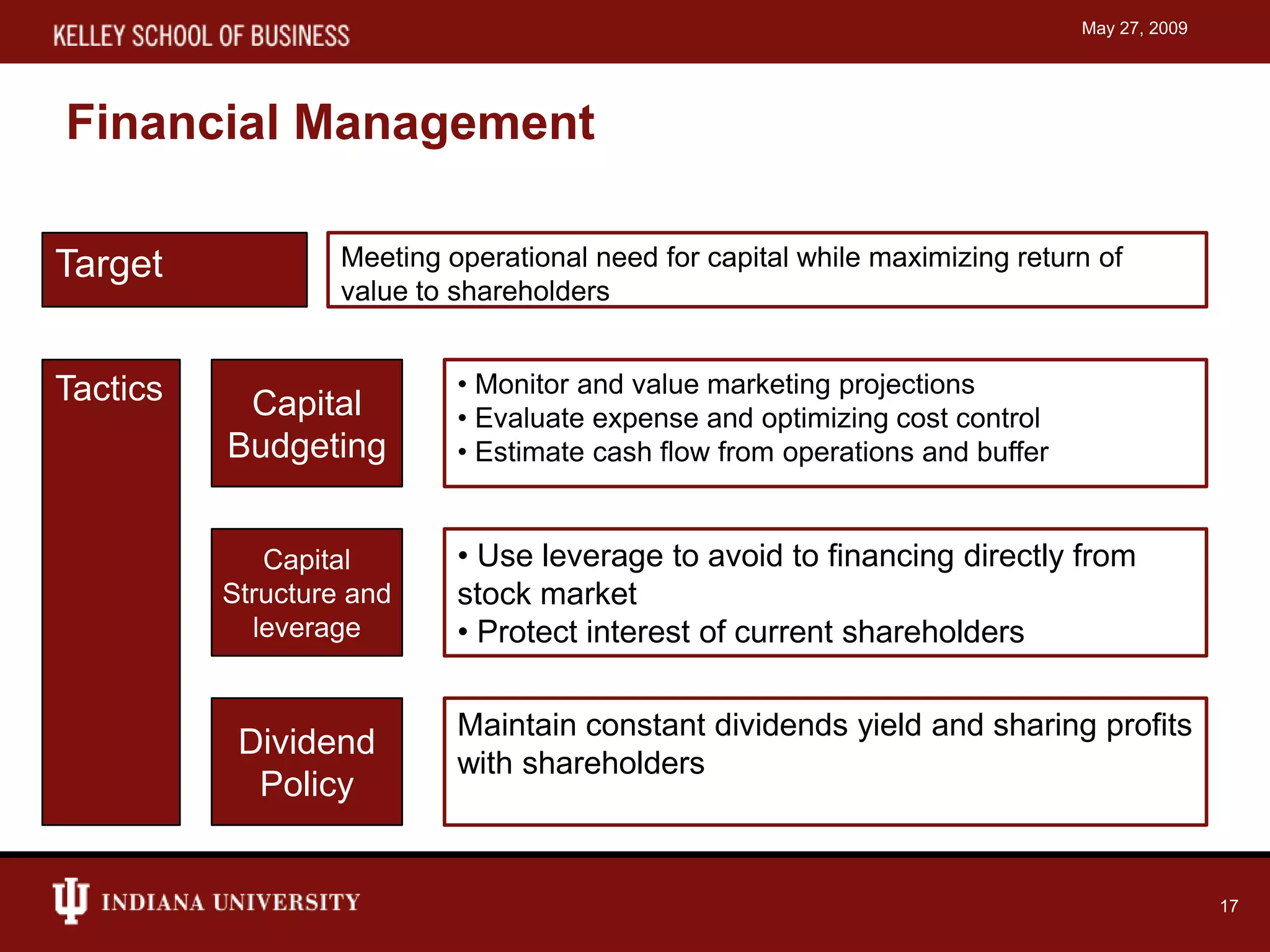

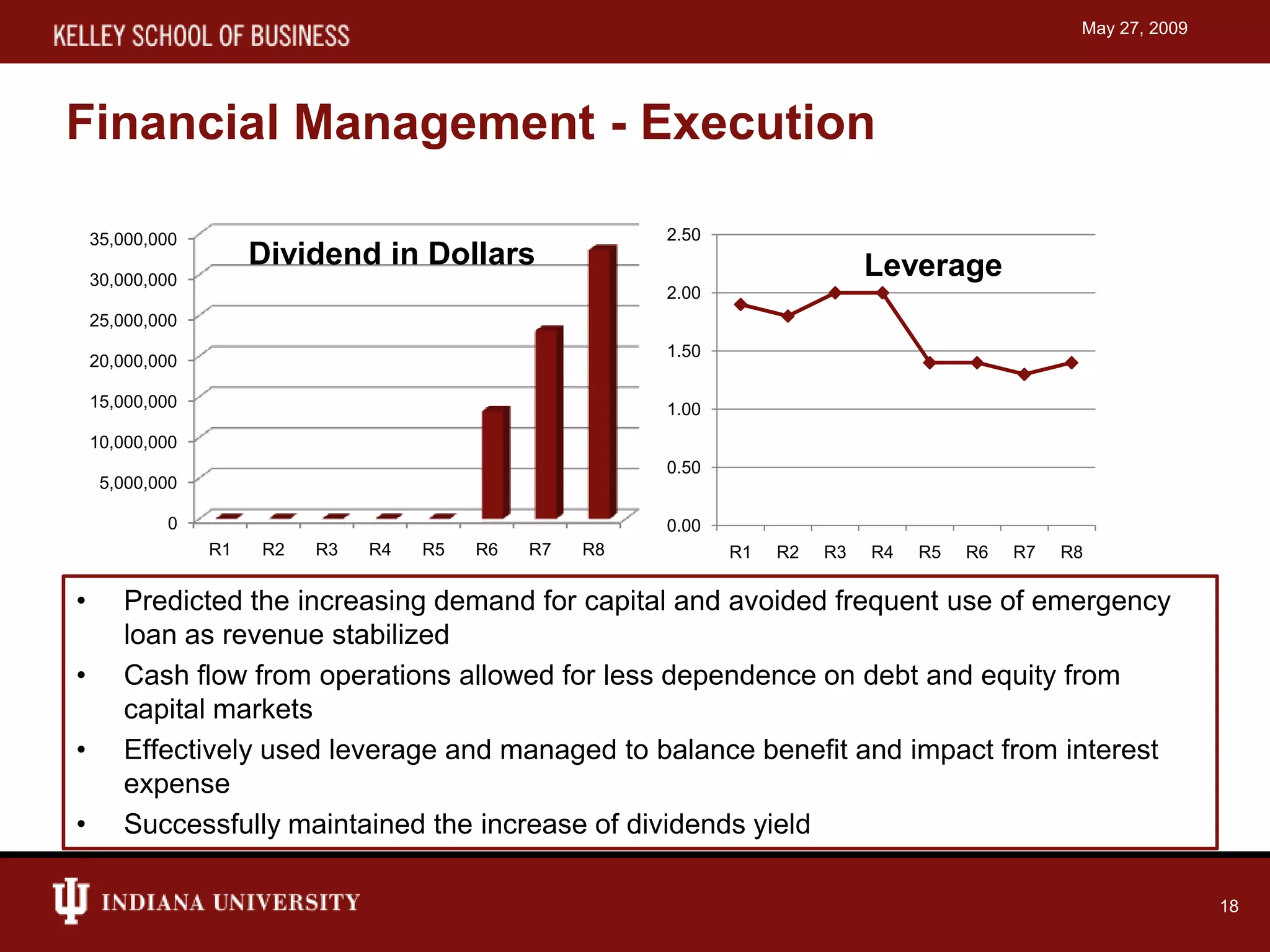

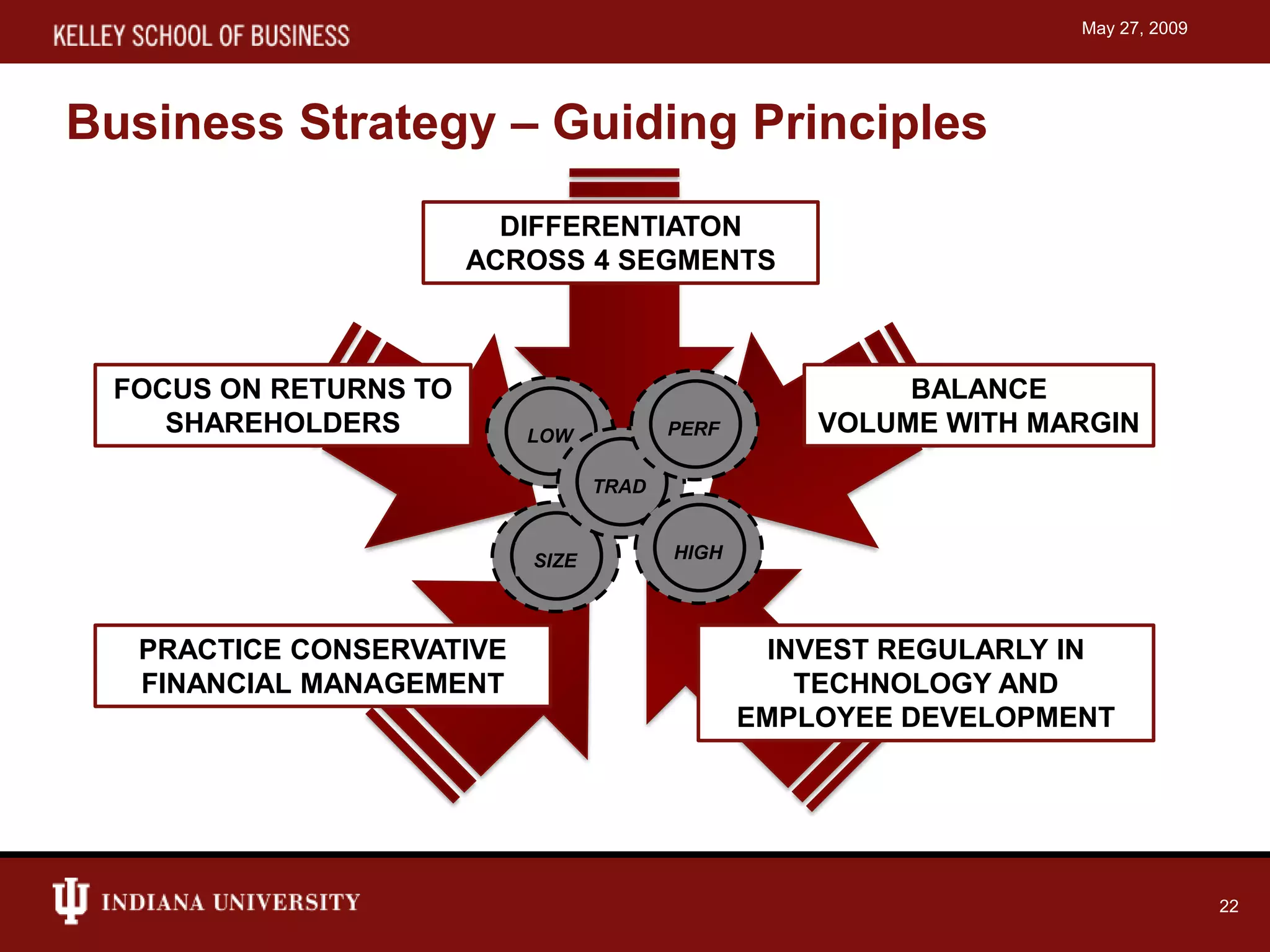

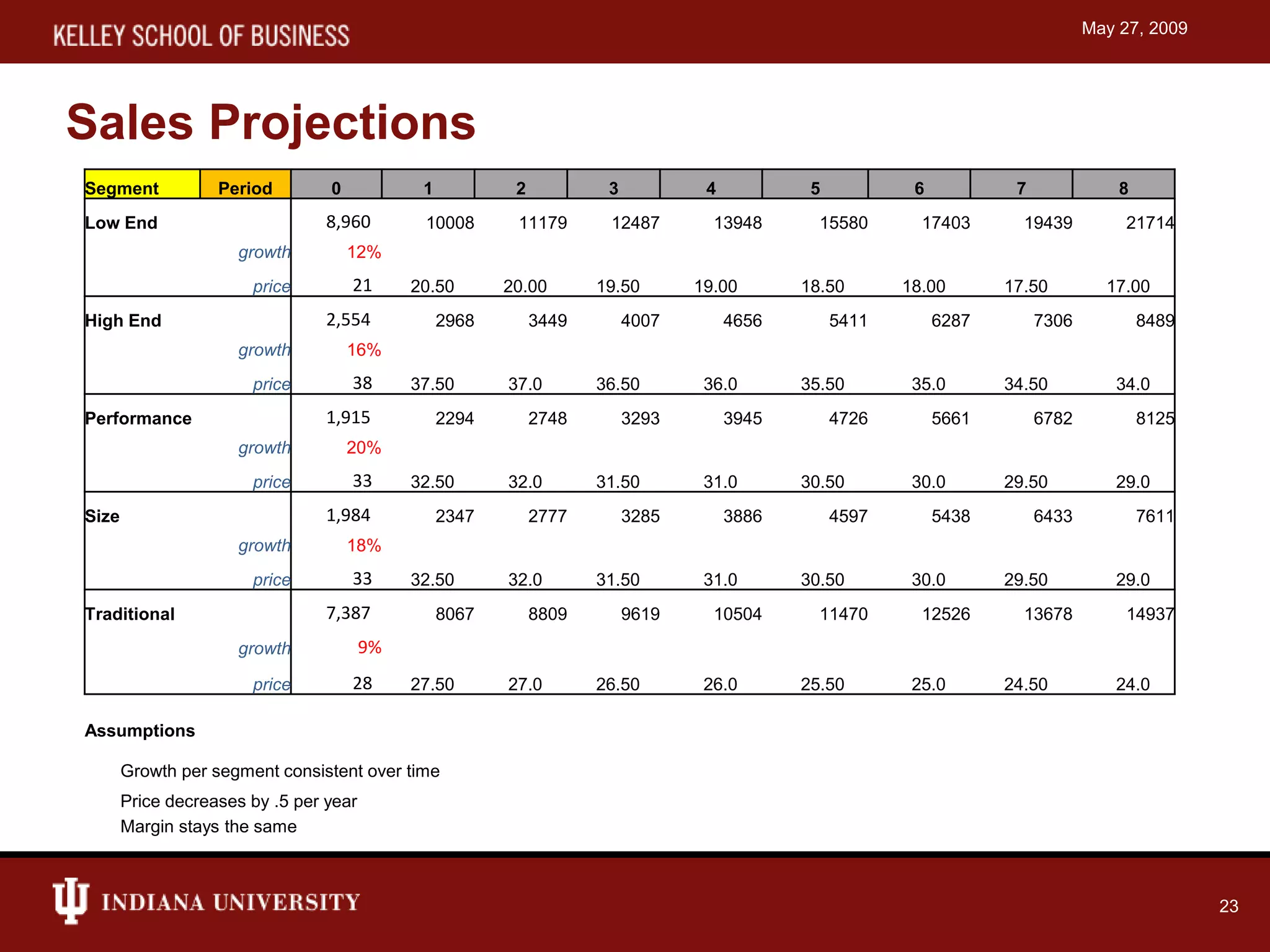

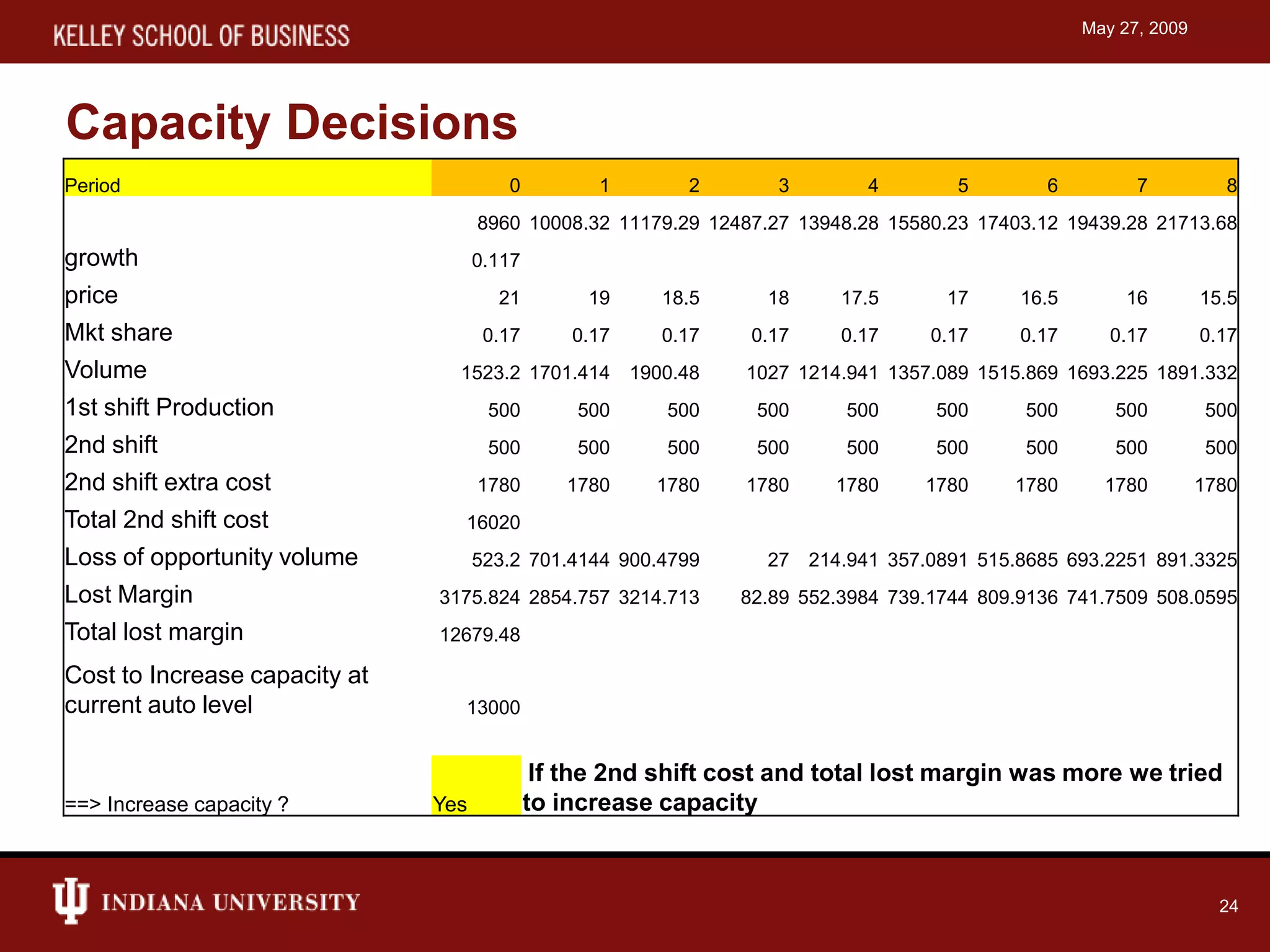

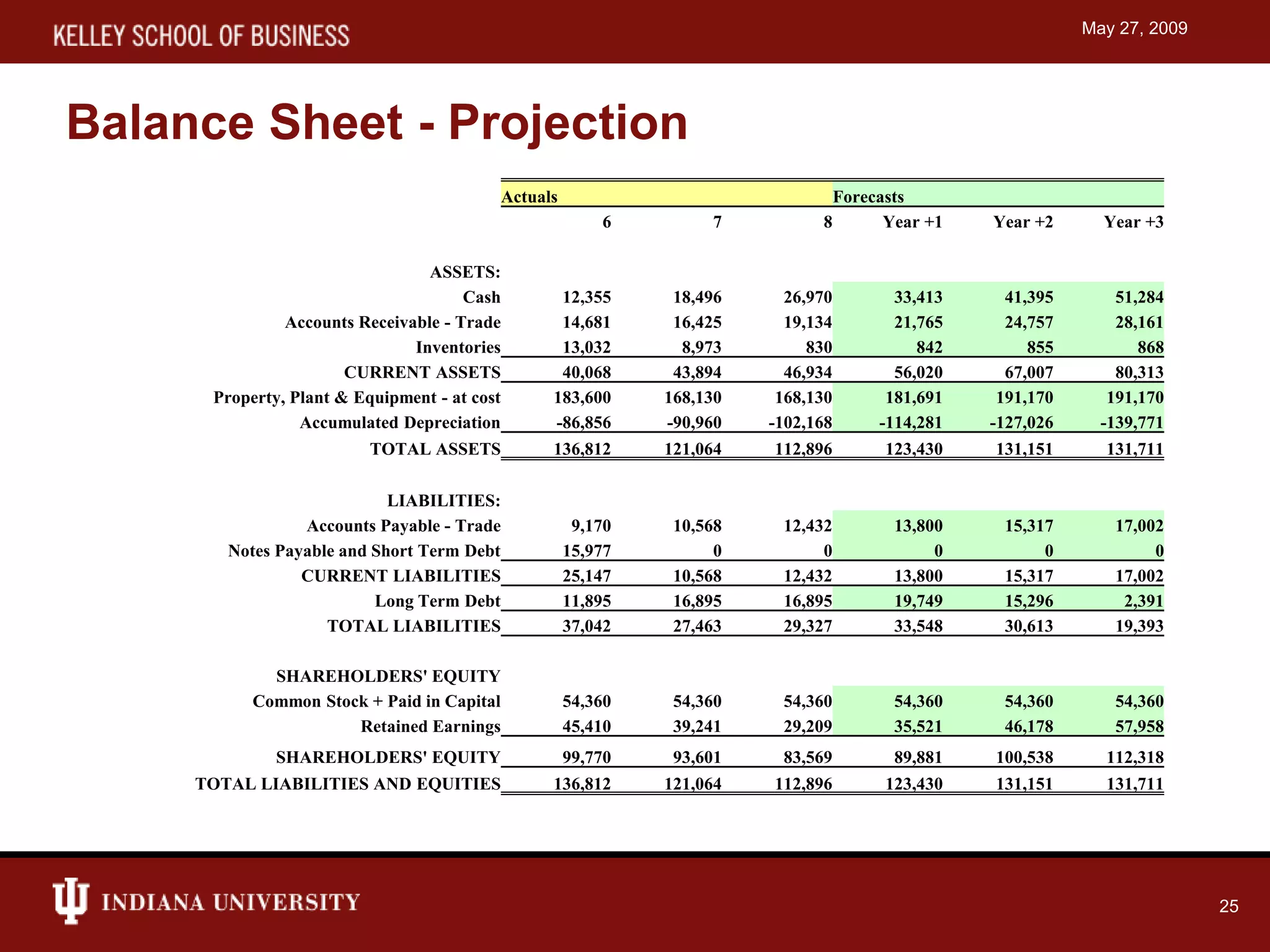

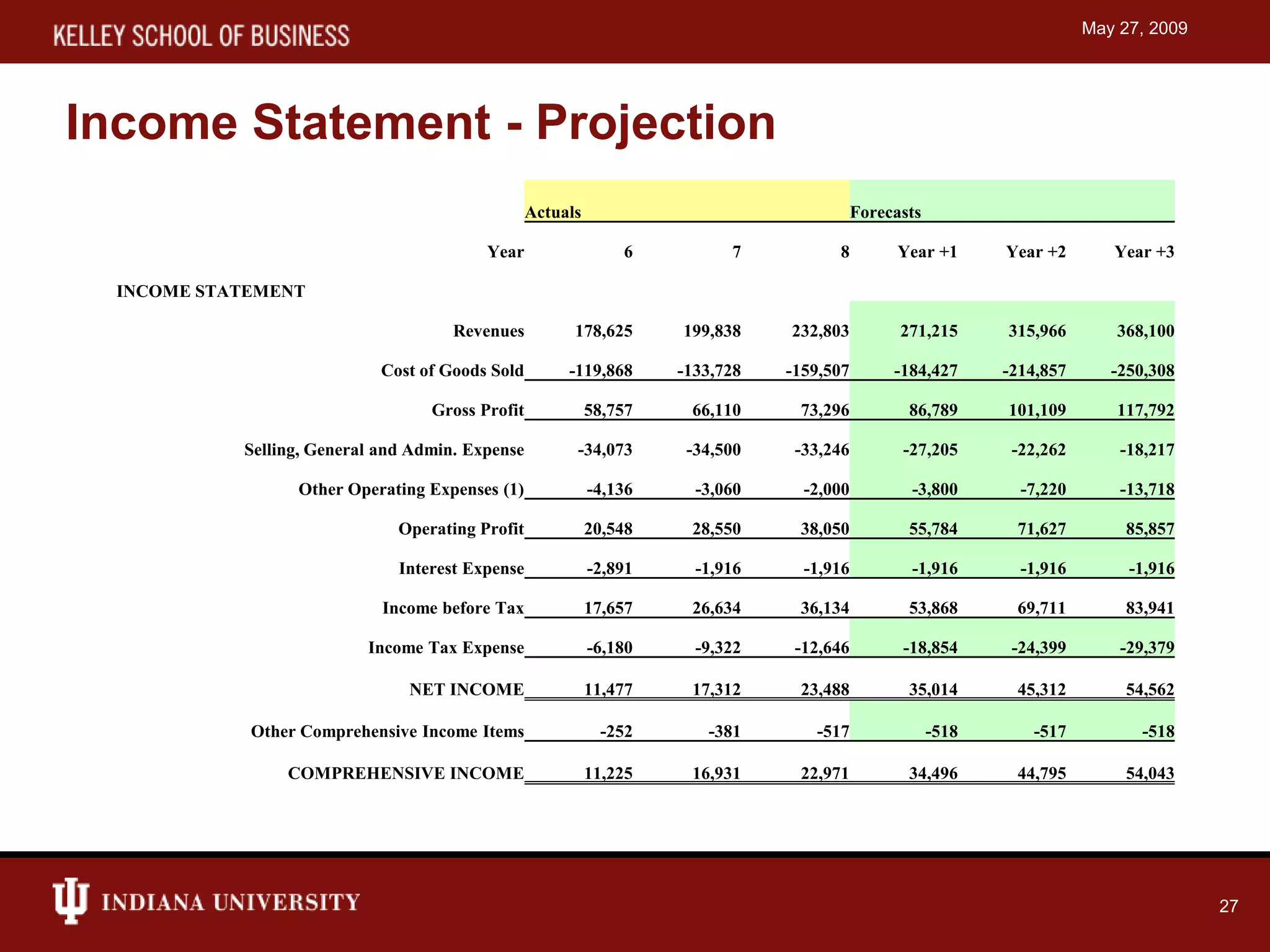

The document outlines the agenda and key insights from a board of directors meeting held on May 27, 2009, focusing on business strategy, performance metrics, financial management, and future strategies. It highlights Baldwin's strategy involving product differentiation and market positioning, achieving significant returns on equity, market capitalization, and customer satisfaction assessments. Recommendations include maintaining current strategies while aggressively investing in R&D for high-end products to capitalize on anticipated market opportunities.