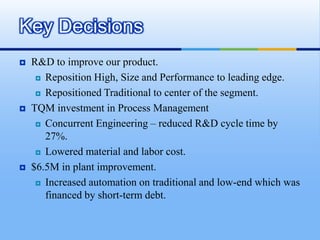

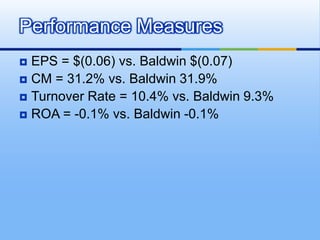

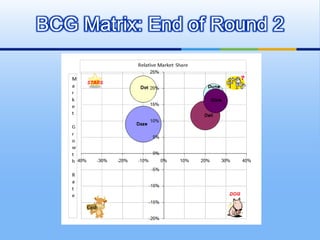

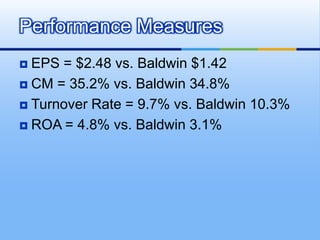

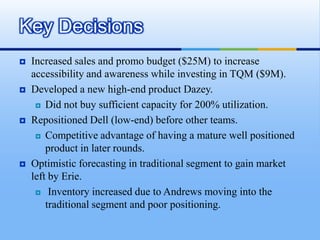

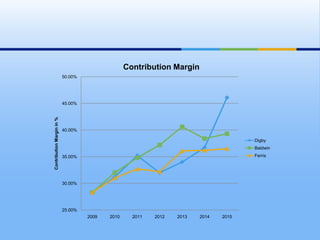

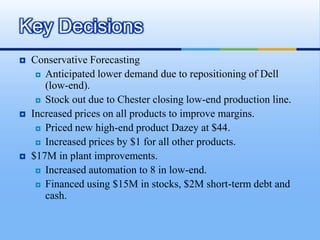

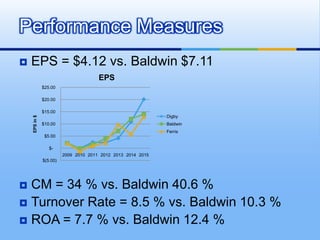

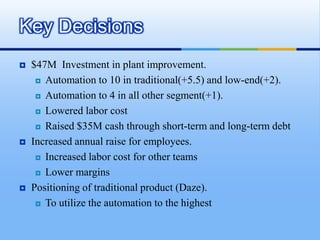

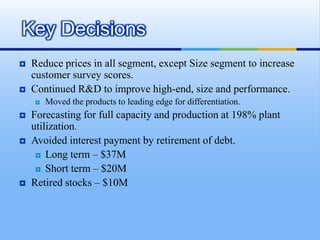

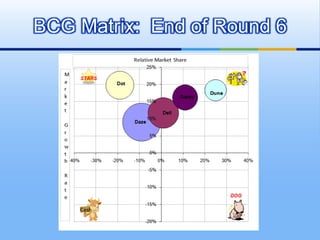

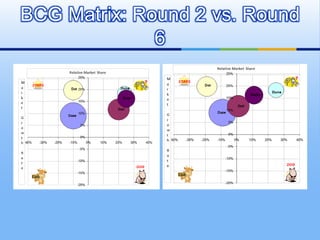

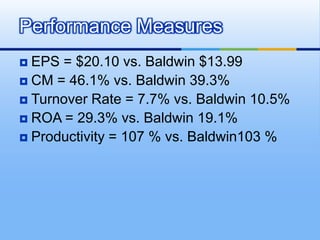

The document outlines the strategic management and performance of Digby from 2009 to 2015, emphasizing their mission to offer premium products and competitive advantages through broad differentiation. Key decisions made by various CEOs focused on R&D, marketing, labor management, and cost reduction strategies, resulting in fluctuating performance metrics such as EPS and contribution margins across different rounds. The future strategy includes capacity expansion, cost reduction, and establishing a dividend policy, supported by substantial retained earnings.