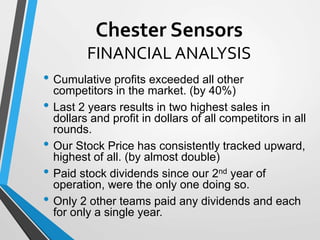

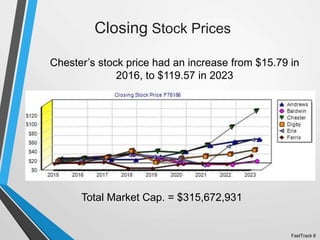

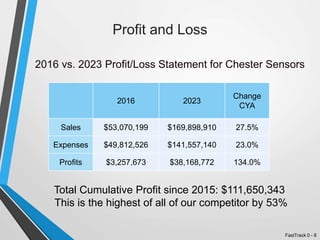

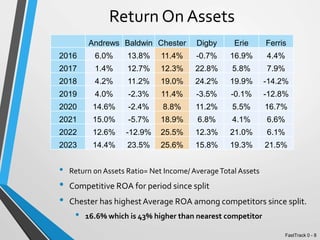

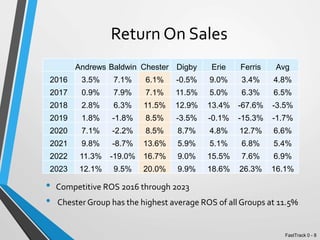

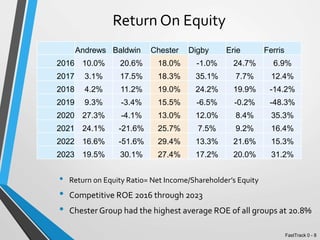

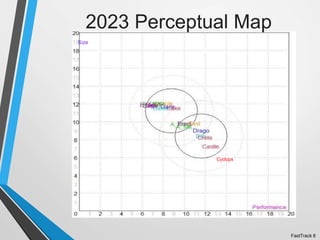

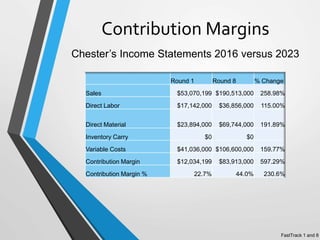

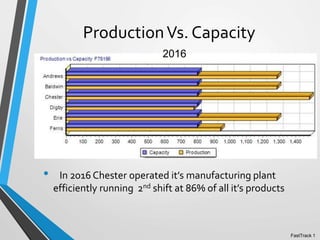

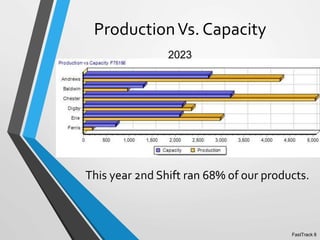

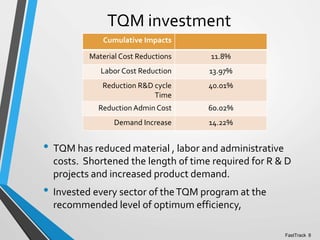

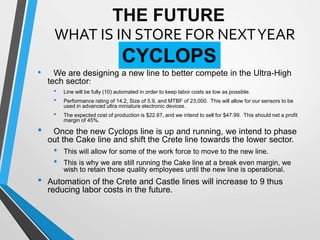

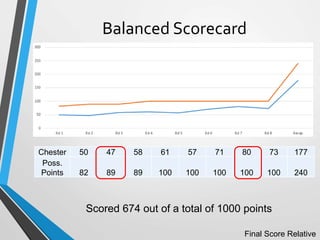

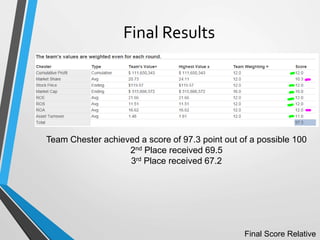

Chester Sensors achieved strong financial results over 8 rounds of simulation, with cumulative profits exceeding competitors by over 50% and the highest stock price. The company differentiated through reliable, cutting-edge sensors produced at affordable prices using automation. Looking ahead, Chester will introduce the highly automated Cyclops line to compete in ultra-high tech sectors while phasing out older product lines. Overall, Chester's focus on product lifecycle, R&D, and cost control supported consistent market leadership.