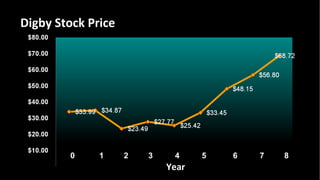

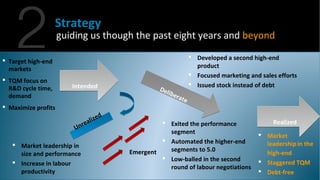

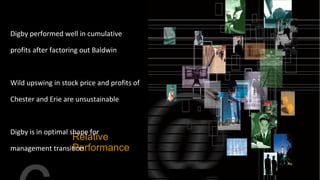

The board meeting agenda covered Digby's past performance, strategy, competitive advantages, competitor analysis, and management review. Over the past eight years, Digby achieved market leadership in the high-end segment through TQM focus on R&D cycle time, second product development, and exiting lower segments. Competitor analysis showed Baldwin and Erie posed threats that Digby responded to quickly. Management recommendations were to invest more in early TQM, sales/promotion, and product development to improve future performance.