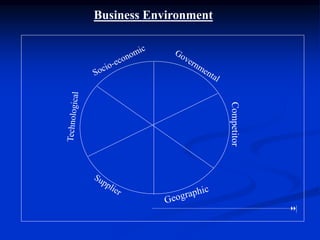

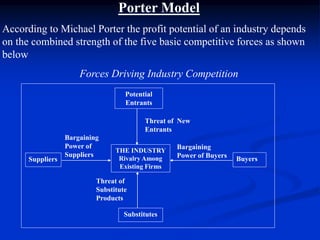

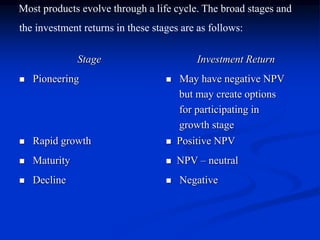

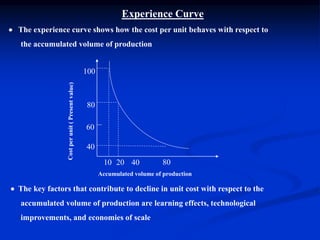

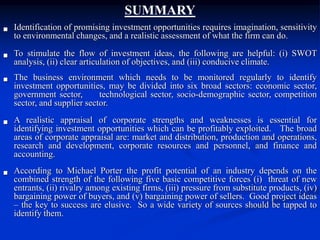

- The document discusses various tools and frameworks for identifying promising investment opportunities, including SWOT analysis, Porter's five forces model, and the product life cycle approach.

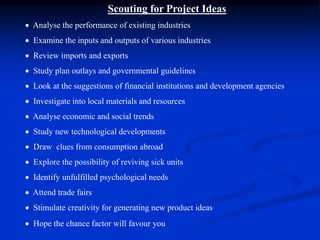

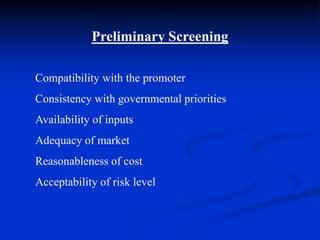

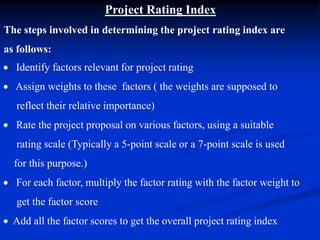

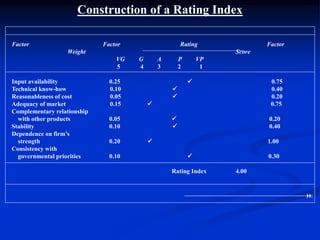

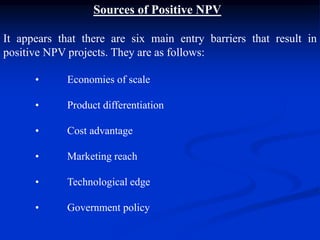

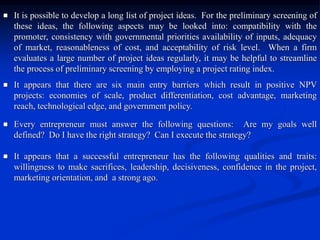

- It outlines the process of generating ideas, screening projects, and developing a project rating index to evaluate ideas. Factors like strategic fit, costs, risks and market potential are assessed.

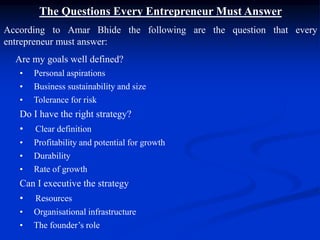

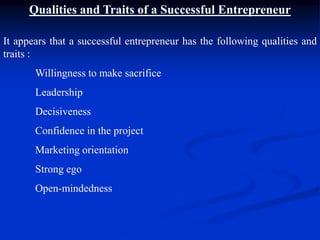

- Successful entrepreneurs ask important questions about goals, strategy, and execution capability. Qualities like leadership, marketing skills, and the willingness to sacrifice are also discussed.