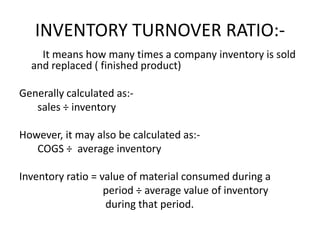

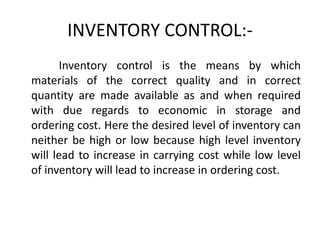

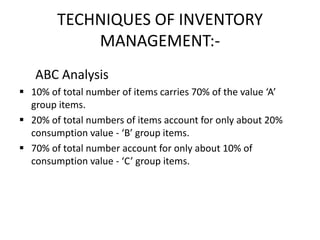

This document discusses working capital management and inventory management. It defines working capital and its sources, including short term sources like factoring, installment credit, bank overdrafts, commercial papers, and letters of credit. Long term sources include equity capital and loans. It also discusses estimating working capital needs using different approaches. The document then defines inventory and its management, including inventory turnover ratio and inventory control techniques like ABC analysis.