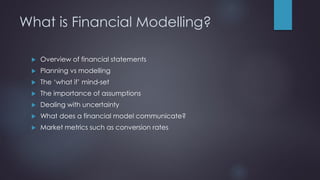

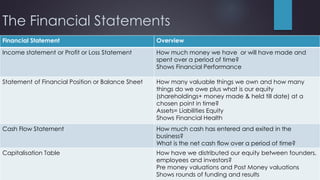

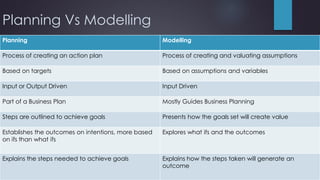

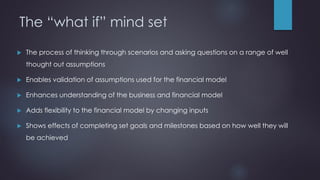

Financial modeling involves the creation of dynamic, assumption-based models that aid decision making and planning, primarily expressed through financial statements like income statements, balance sheets, and cash flow statements. It emphasizes the importance of a 'what if' mindset to explore various scenarios and improve understanding of the business and its potential outcomes, while also addressing uncertainty through well-researched assumptions. Marketing metrics play a crucial role in developing financial models for startups, guiding actions to achieve targeted business performance.