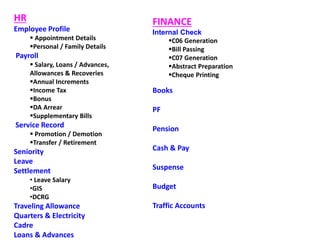

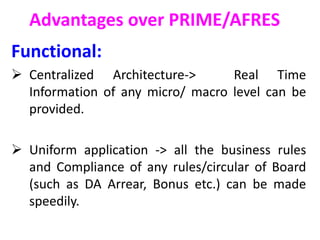

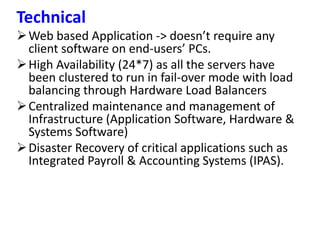

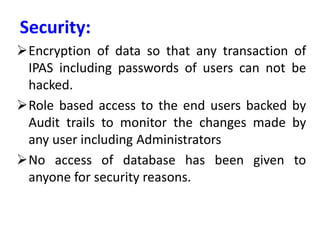

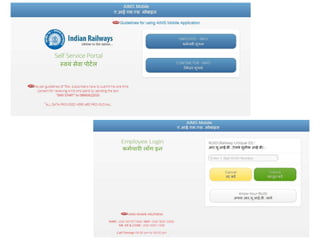

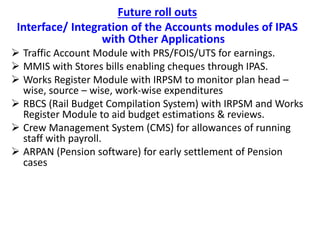

The document outlines the features and benefits of a centralized web-based payroll and HR management system for railway employees, detailing components such as employee profiles, payroll processing, and financial management. It emphasizes real-time information access, security measures including data encryption, and easy navigation for users. Future integrations with additional applications aim to enhance efficiency in payroll and budgeting processes.