This document discusses budget planning and management. It defines a budget as a statement that allocates monetary resources to achieve organizational objectives. Effective budgeting requires a strategic plan aligned with available funds.

It outlines principles like using budgets as a management control tool through resource allocation, financial planning, and improving efficiency. Different budget types are described, including income/expenditure, capital, and cash budgets. Approaches like incremental, zero-based, line-item, and performance-based budgeting are compared.

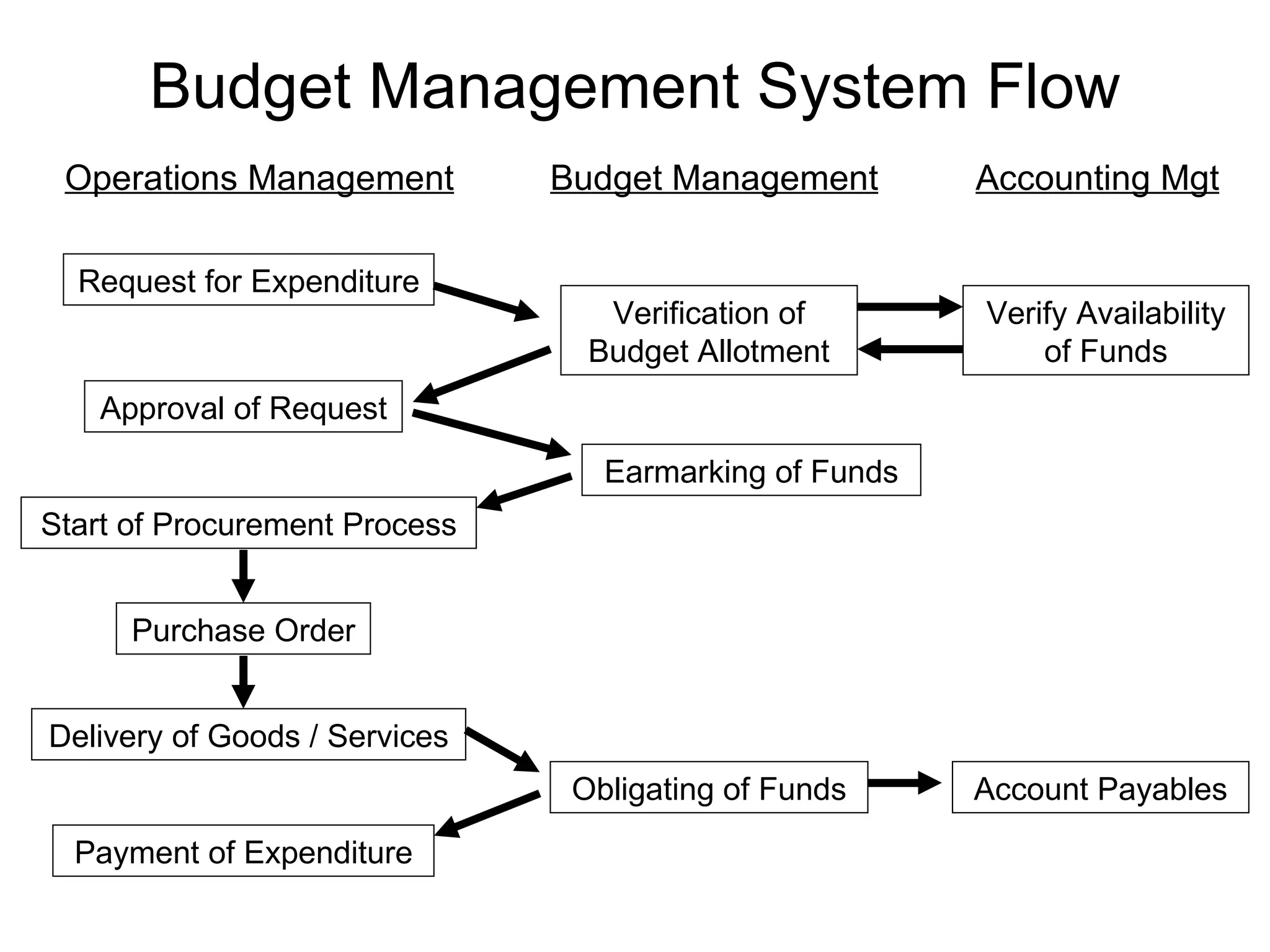

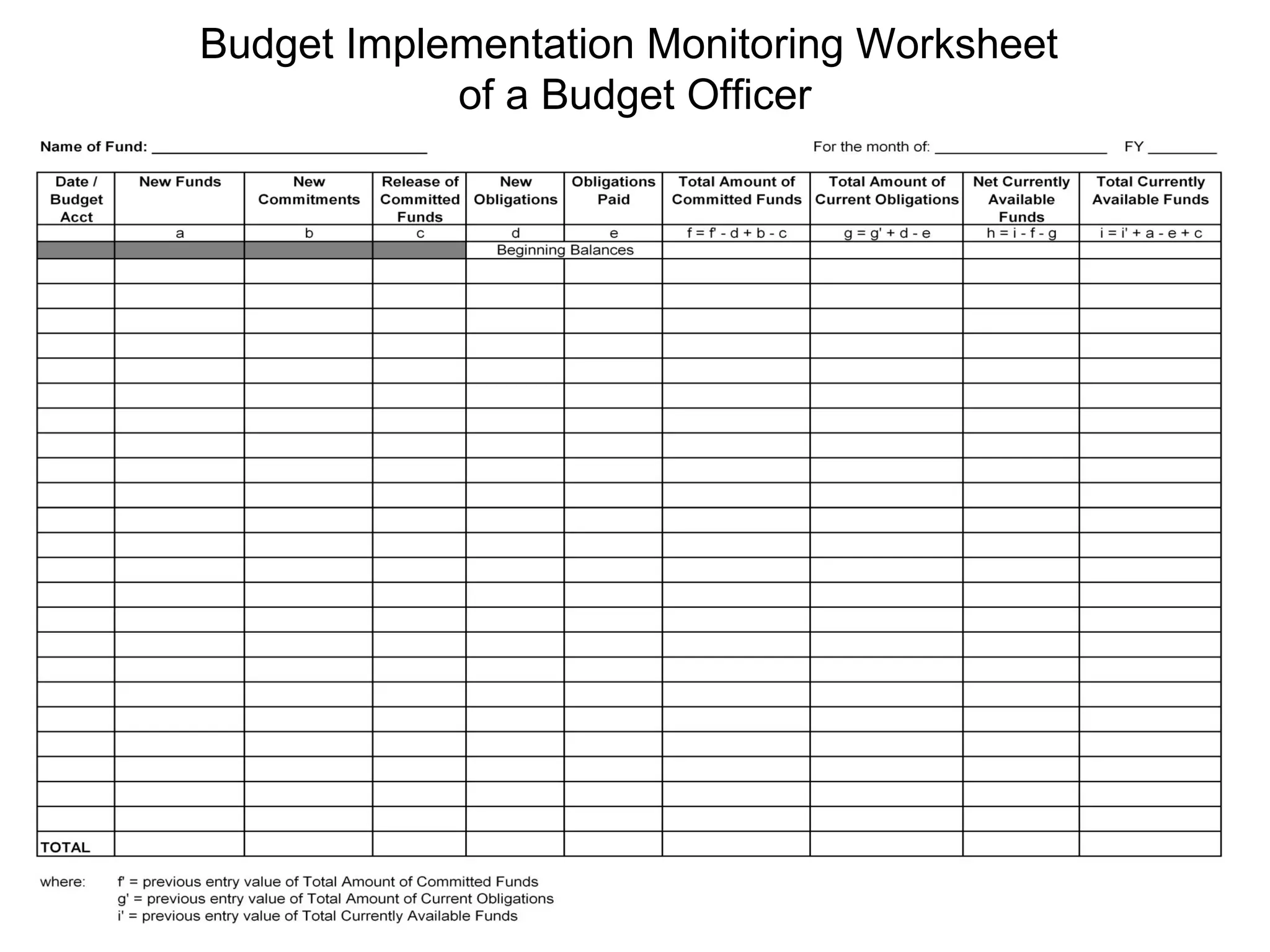

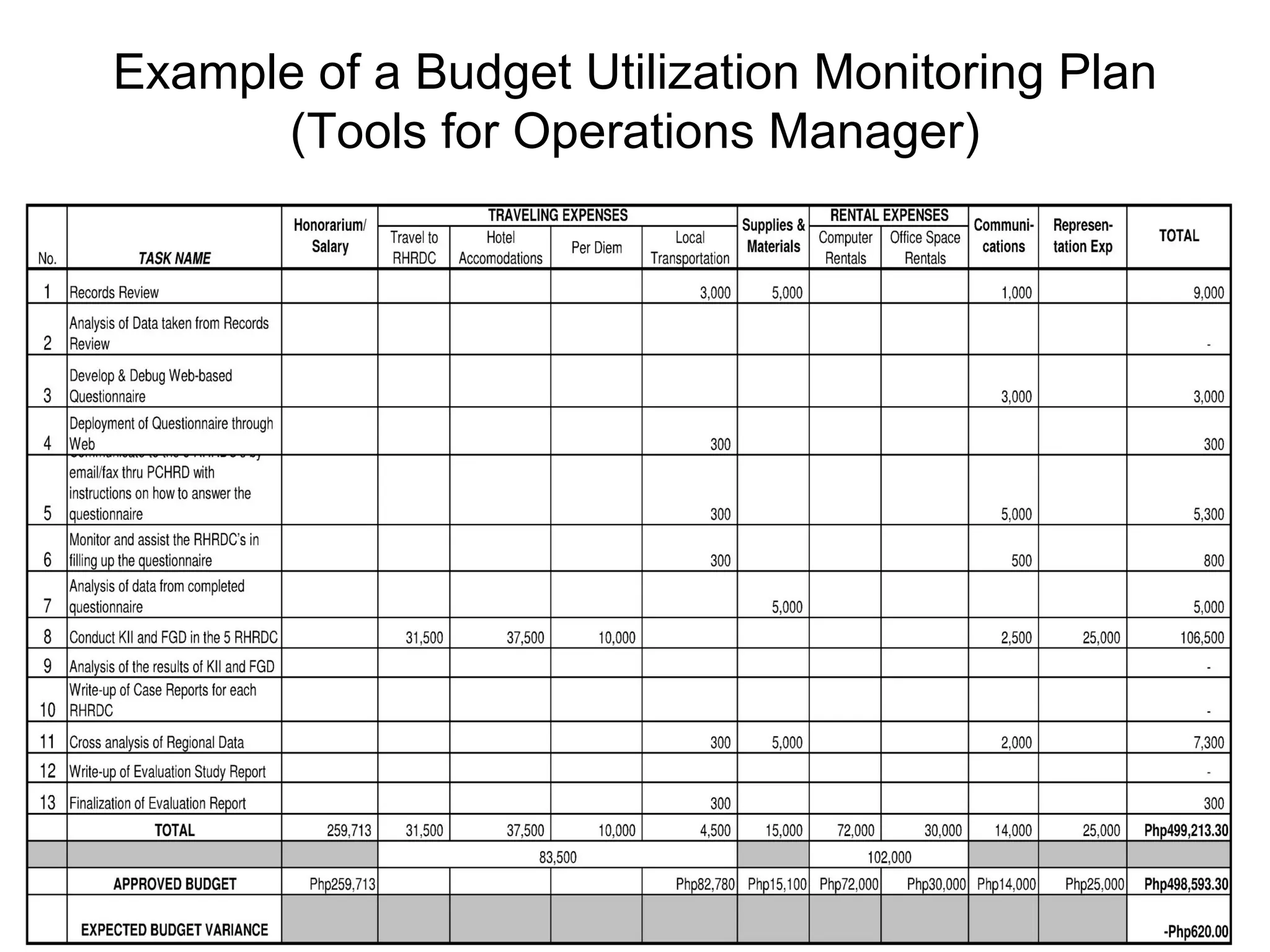

Operational budget planning methods involve creating an accounts chart, reviewing guidelines, forecasting revenues, and computing activity requirements. The framework shows budget allotment, allocation, expenditures, and working capital. Key management activities are ver