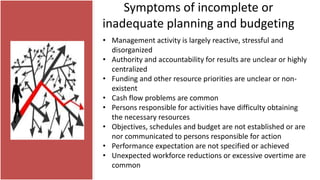

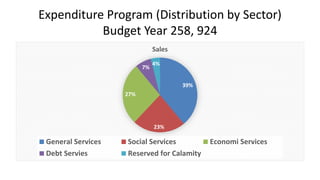

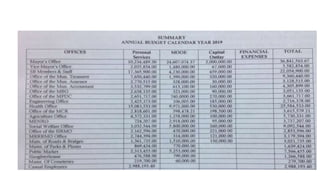

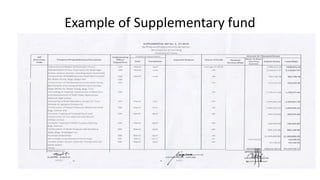

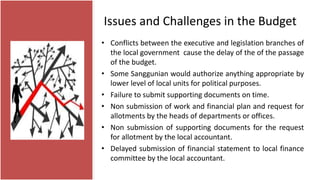

Planning and budgeting processes help management develop plans of action to achieve organizational goals and objectives. Planning establishes desired outputs while budgeting identifies necessary inputs. The summarized document outlines key aspects of planning and budgeting including uses, symptoms of inadequate processes, and an effective local government budgeting system example. Planning and budgeting are analytical tools that coordinate activities to implement strategic programs through quantitative resource expressions.