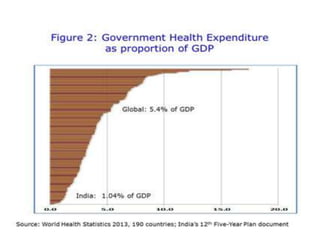

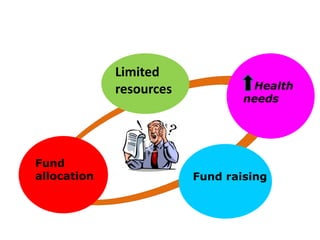

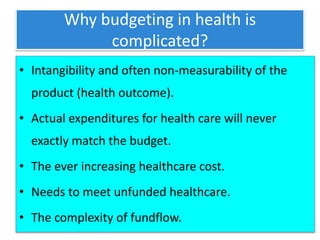

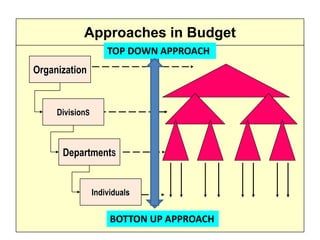

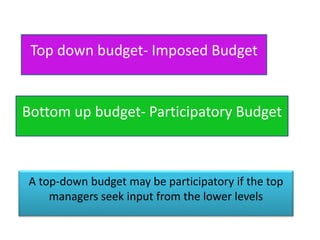

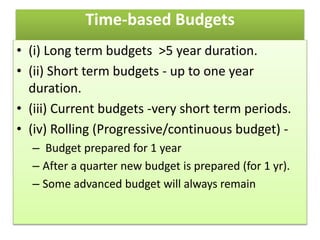

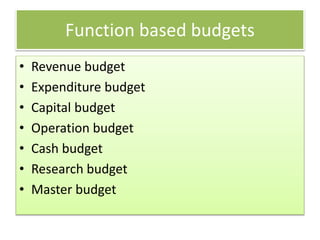

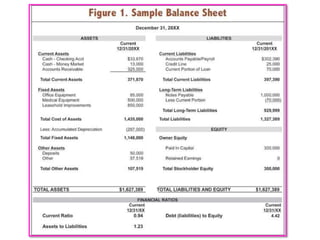

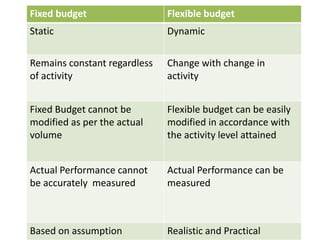

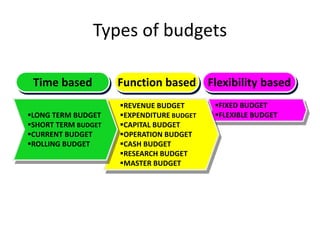

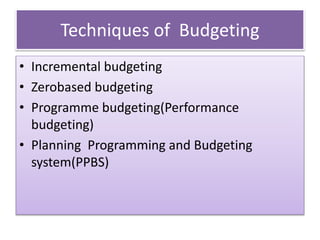

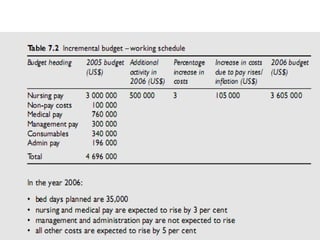

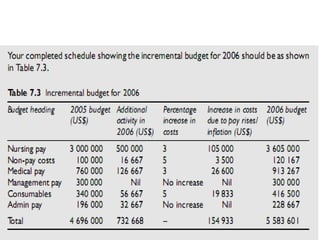

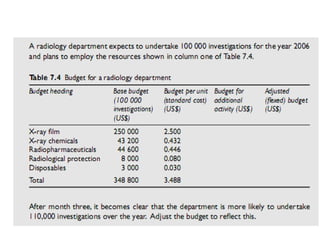

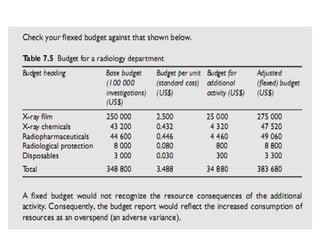

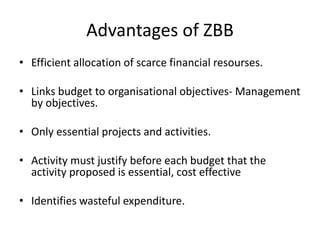

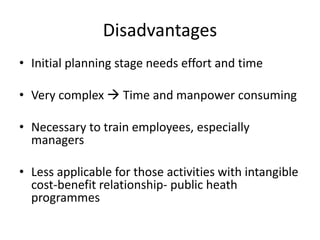

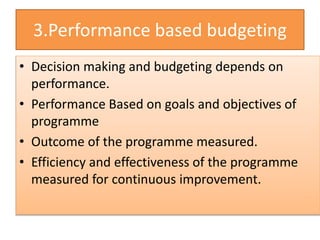

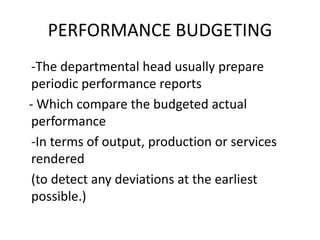

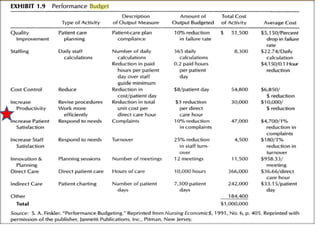

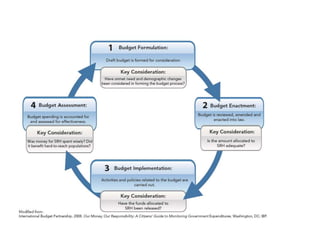

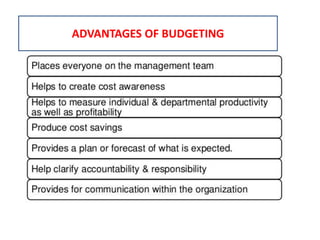

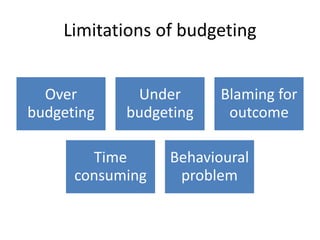

This document discusses budgeting in healthcare. It defines key terms like budget and budgeting. It explains the need for budgets in healthcare to communicate plans, monitor operations, reduce wastage, and assess manager performance. Different types of budgets are described based on time, function, and flexibility. Techniques like incremental, zero-based, performance, and planning-programming-budgeting systems are outlined. The challenges of budgeting in healthcare like intangible outcomes and increasing costs are also noted.