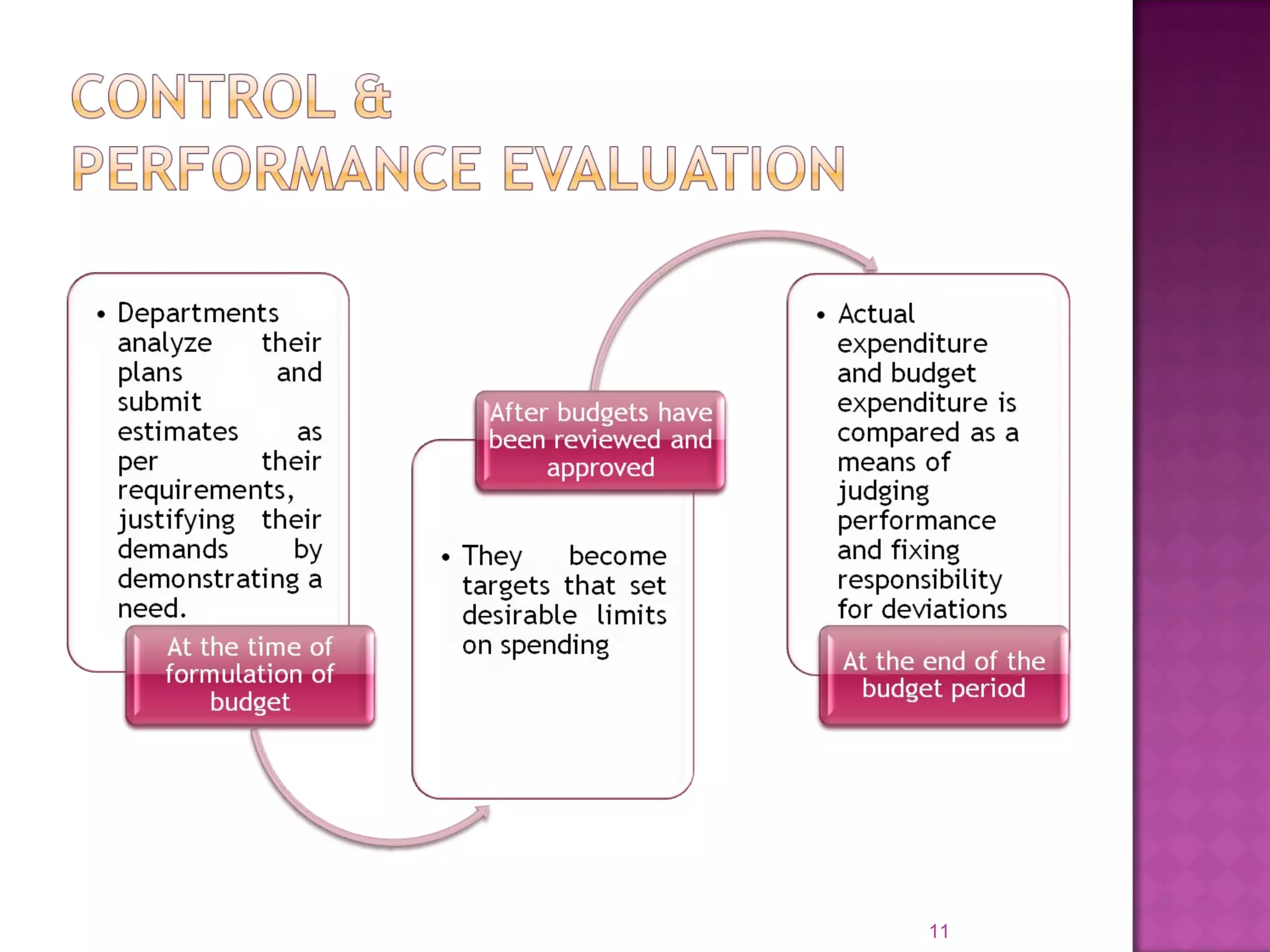

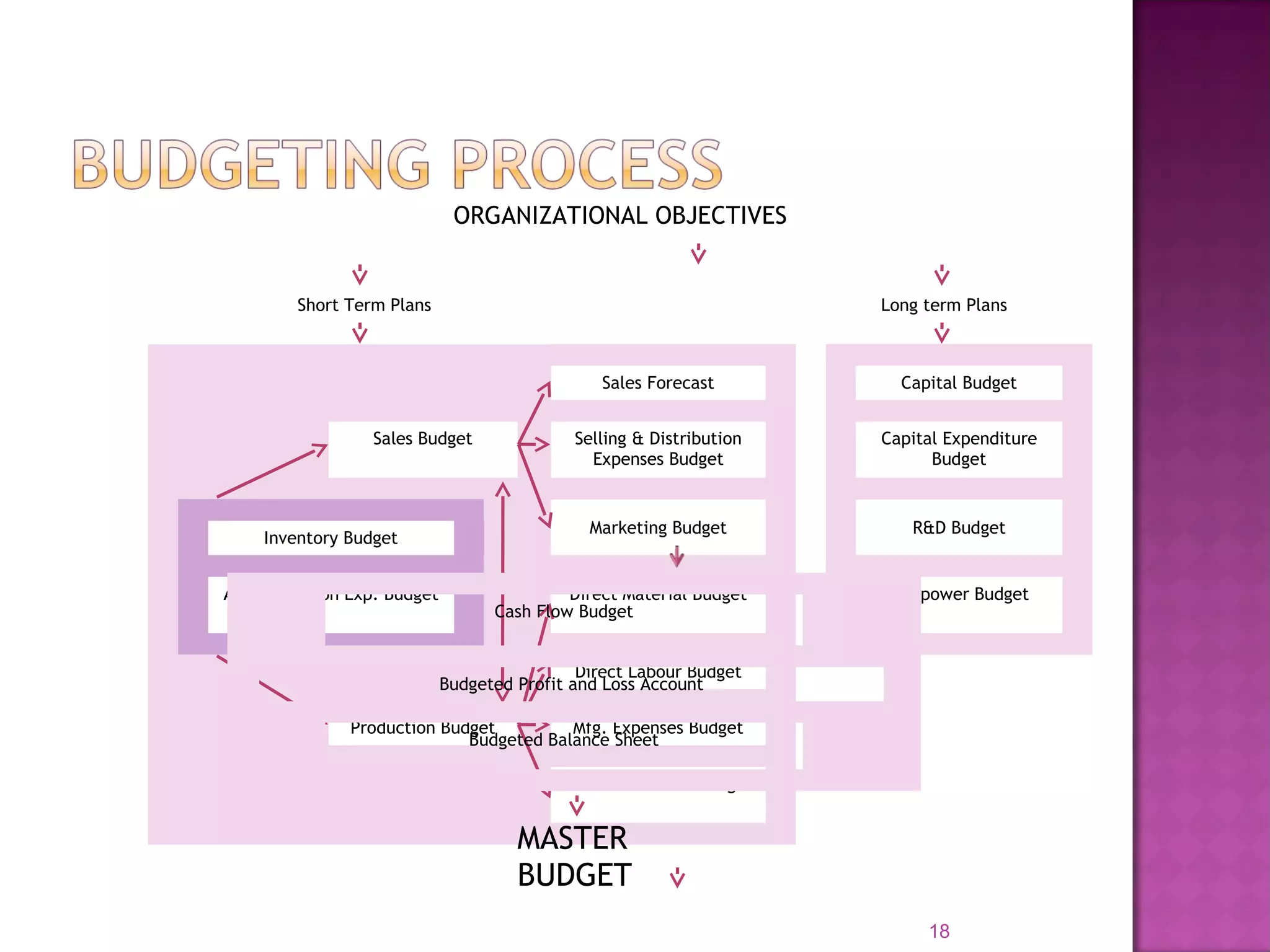

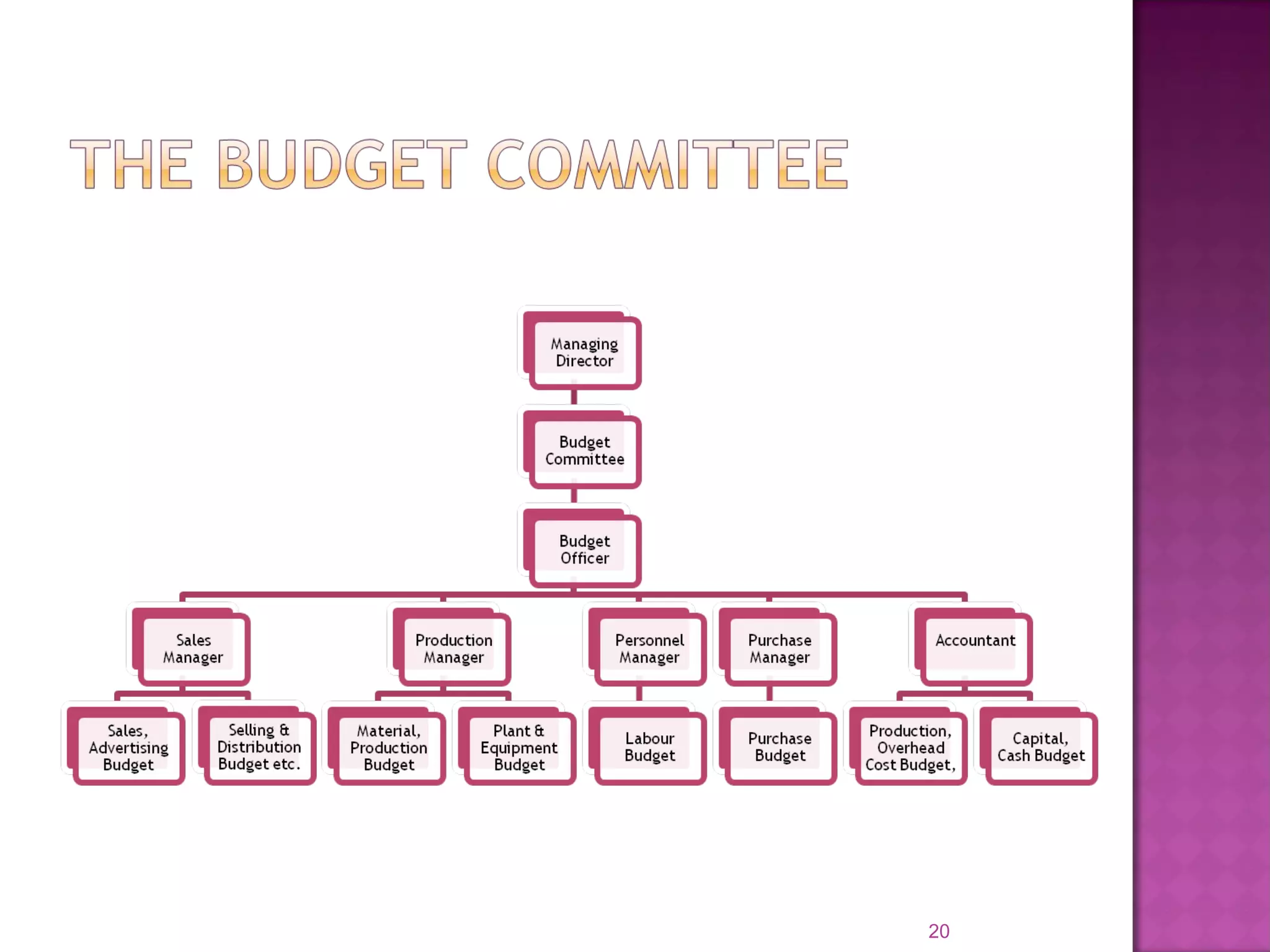

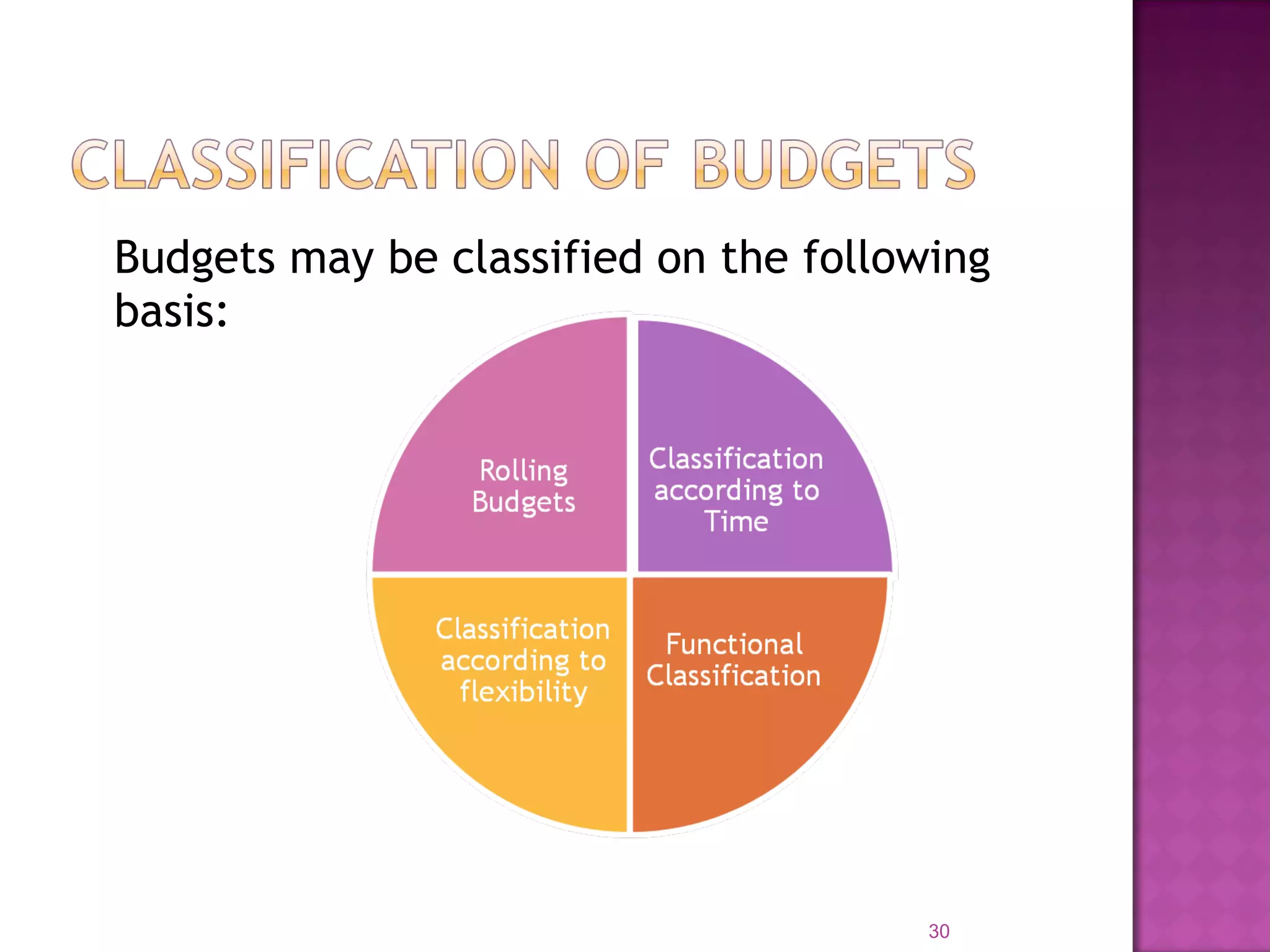

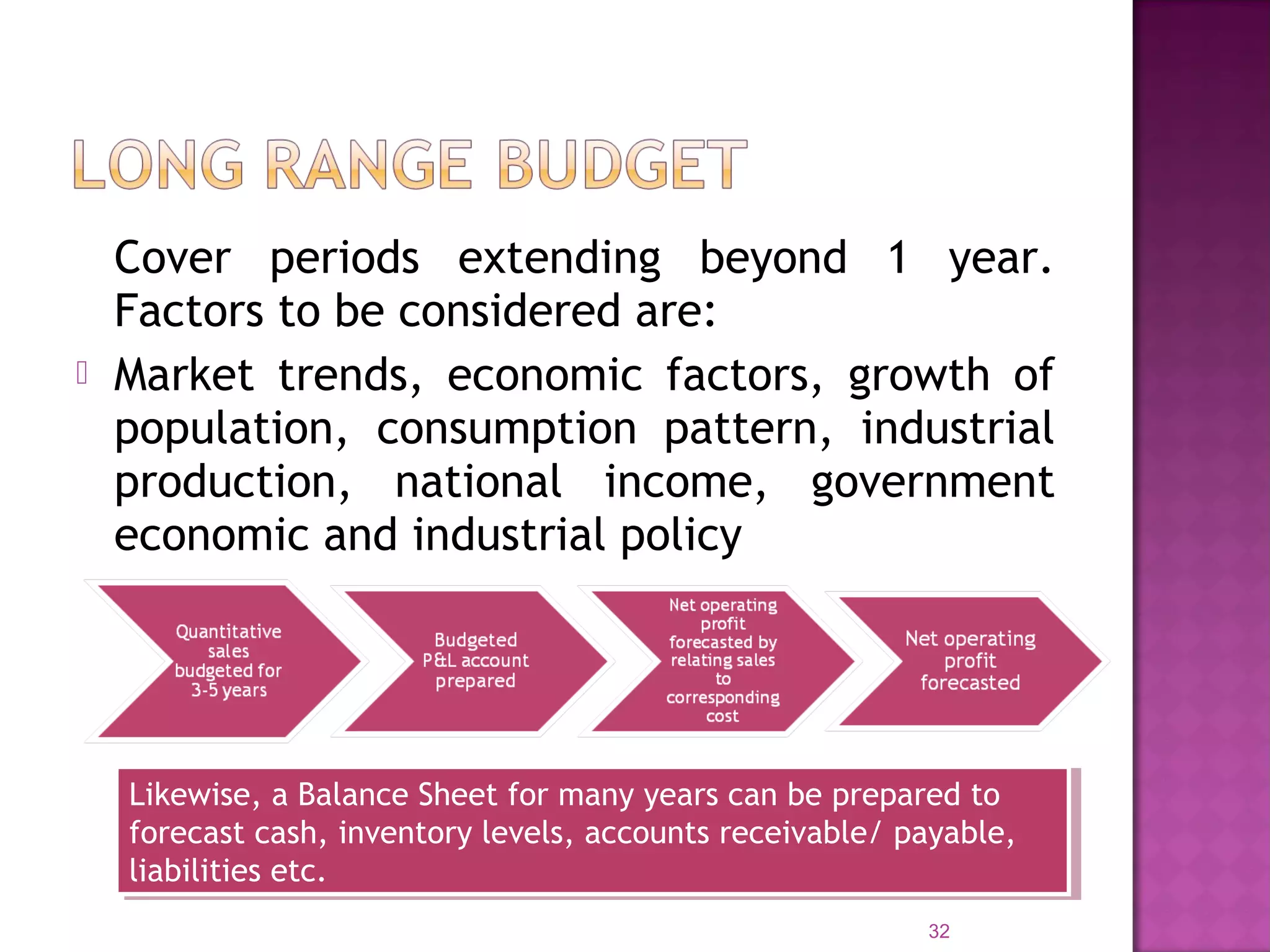

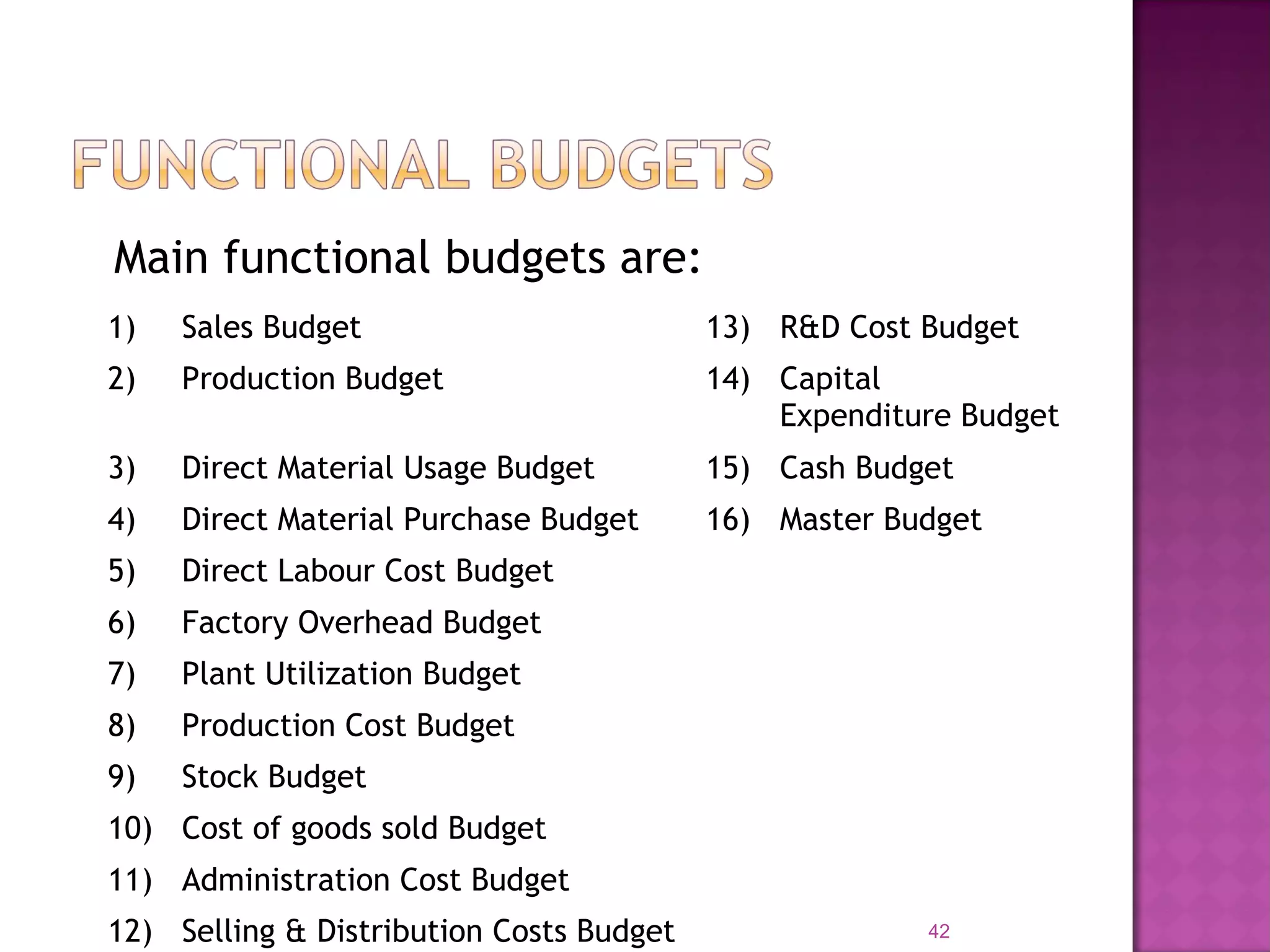

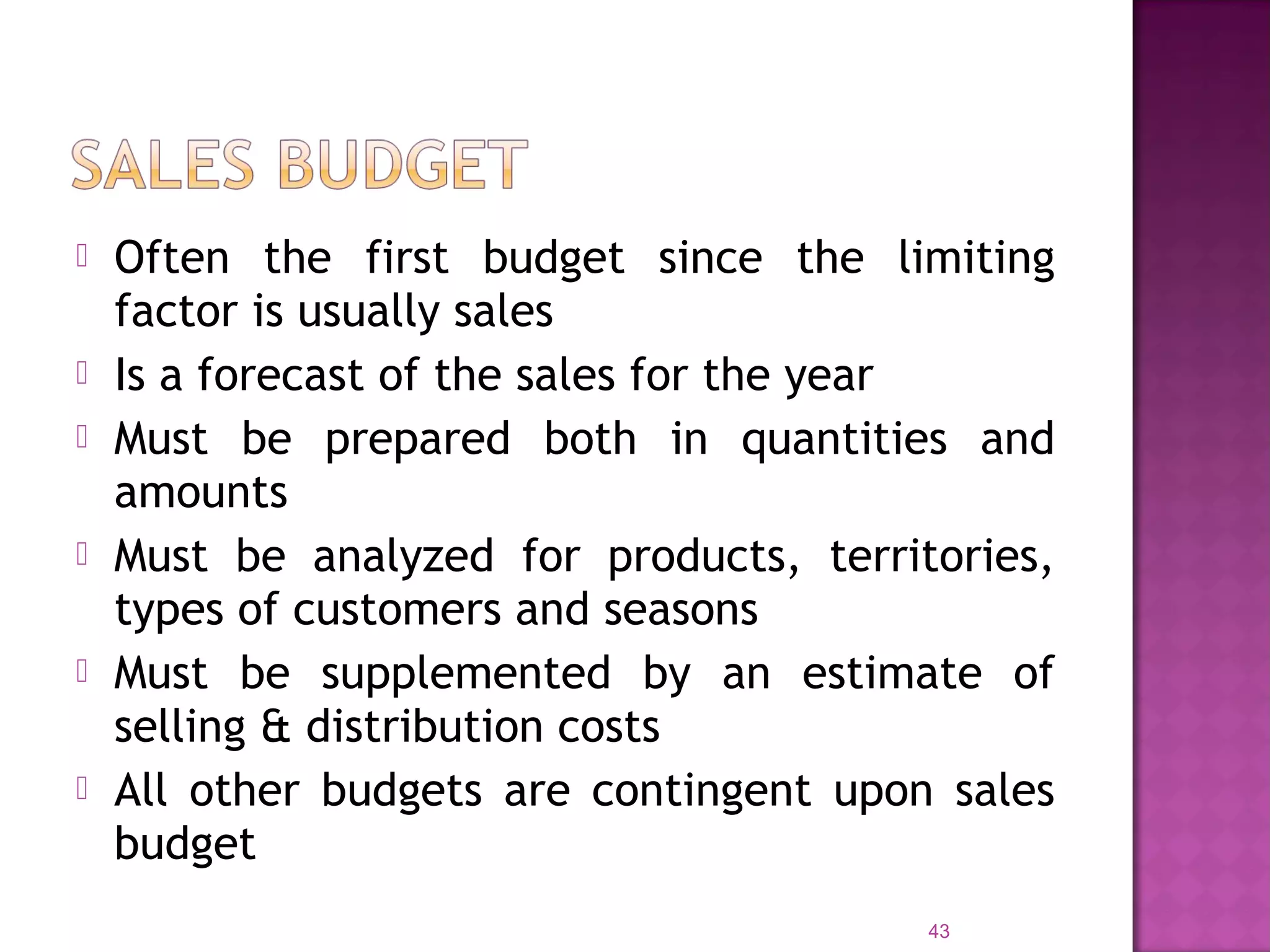

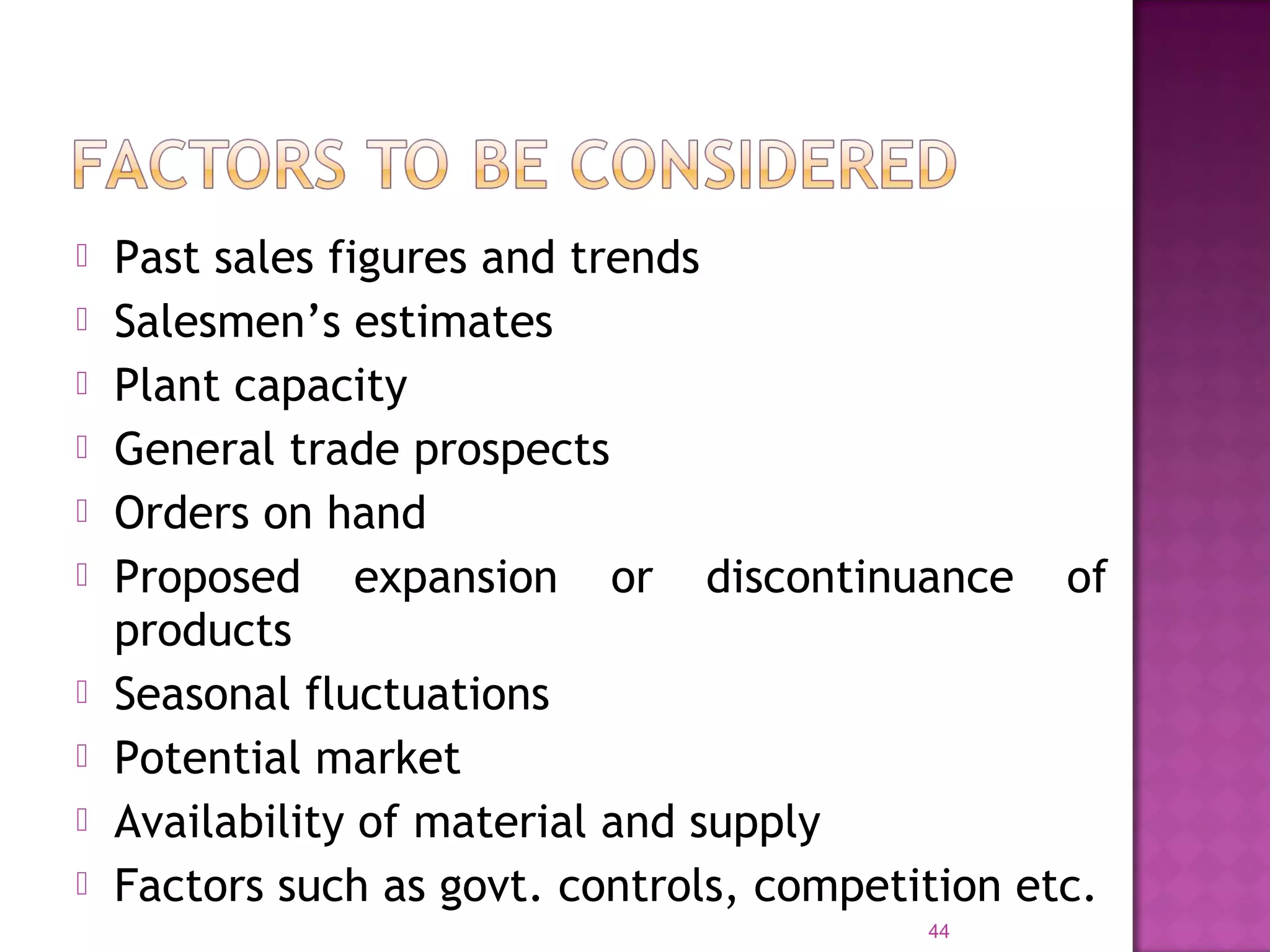

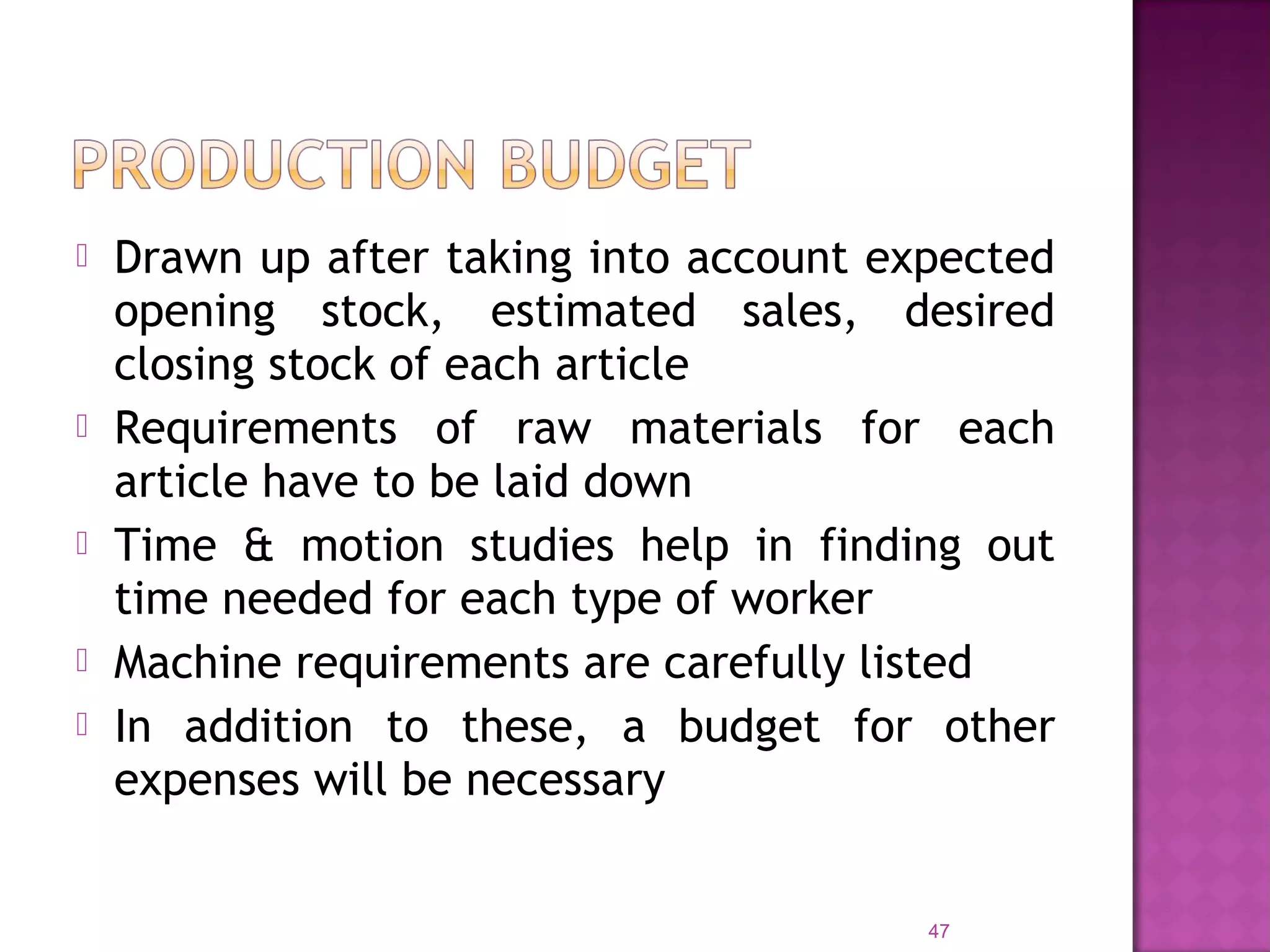

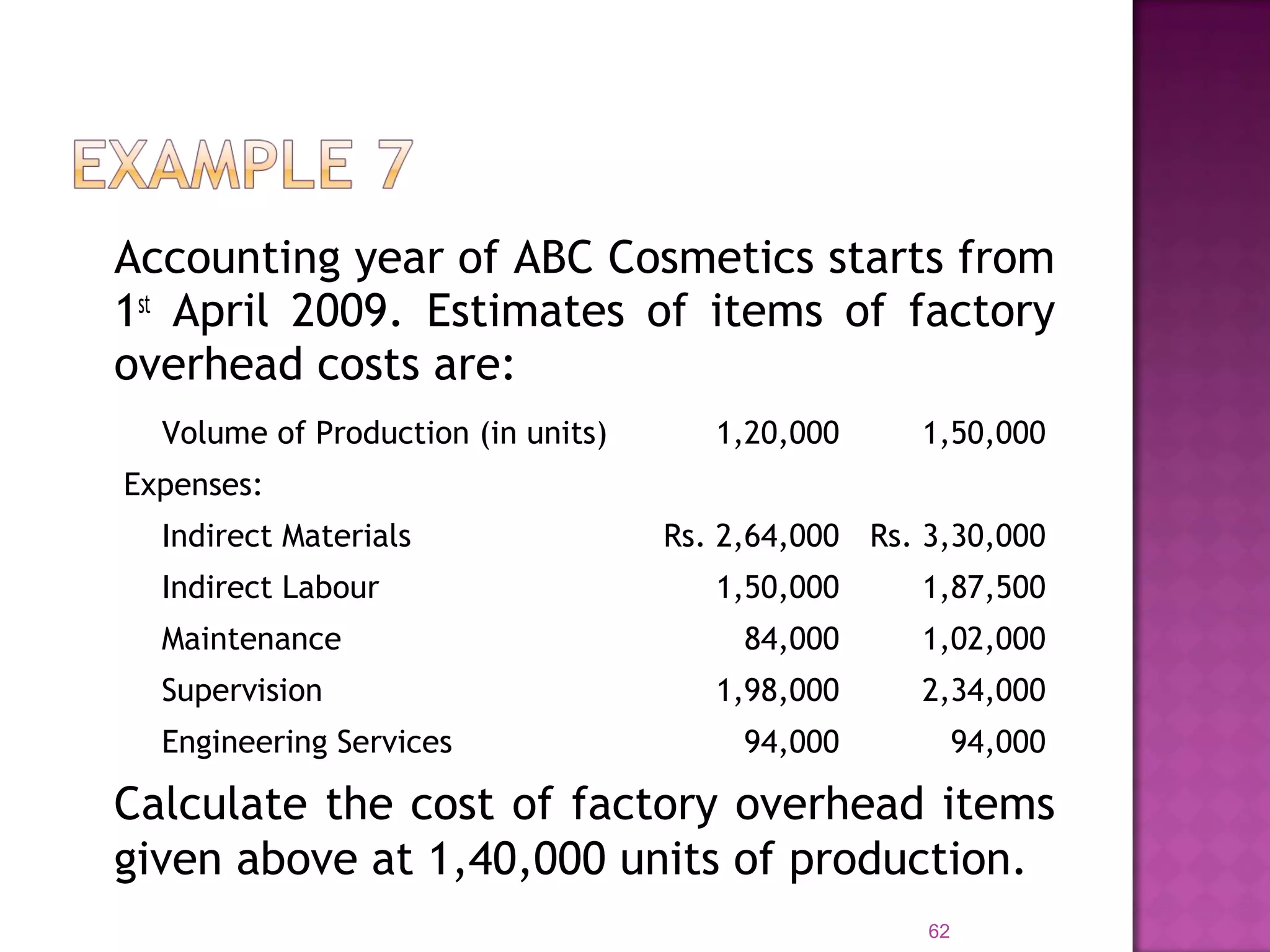

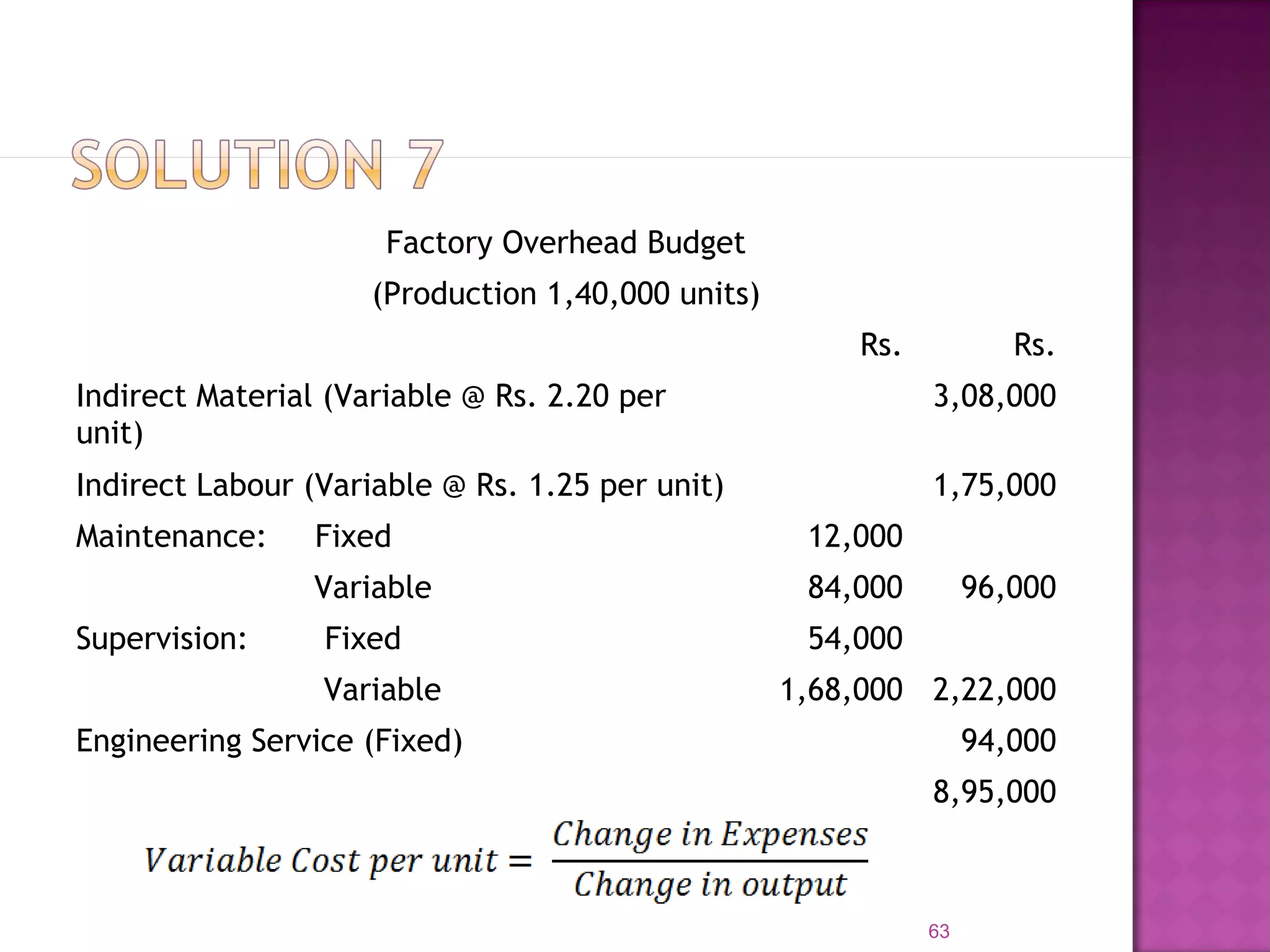

The document discusses budgets and budgetary control. It defines a budget as a written plan of action prepared in advance based on objectives to be attained, expressed in monetary and/or physical units. Budgets are prepared for the implementation of management policy and may provide sales targets or production targets. Budgets are used as a means of control by comparing actual results to the budget and taking corrective action for deviations. Budgetary control refers to using budgets to control a firm's activities.