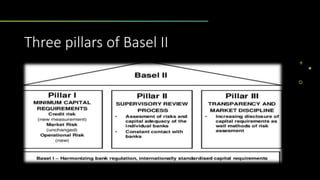

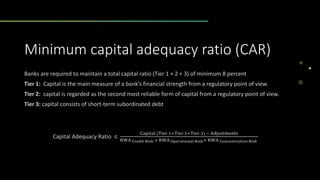

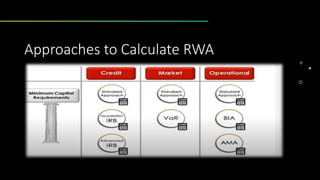

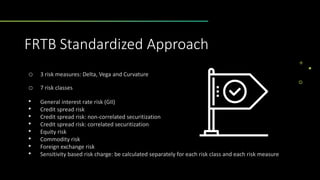

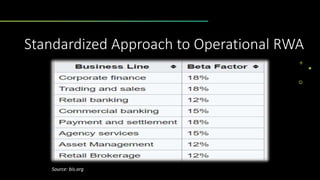

Basel II is a set of international banking regulations aimed at improving risk sensitivity in capital allocation, enhancing disclosure, and aligning economic and regulatory capital to minimize regulatory arbitrage. It consists of three pillars: minimum regulatory capital requirements (Pillar 1), supervisory review (Pillar 2), and market discipline (Pillar 3). Basel II.5 introduces reforms post-financial crisis to strengthen capital requirements and better address market risks, including charges for incremental and comprehensive risk, as well as standardized treatment for securitization.