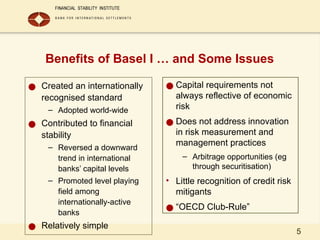

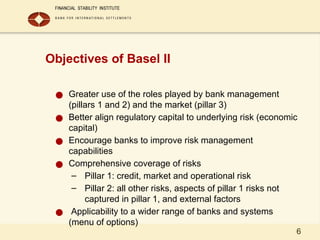

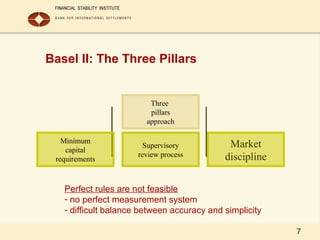

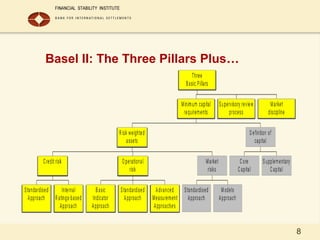

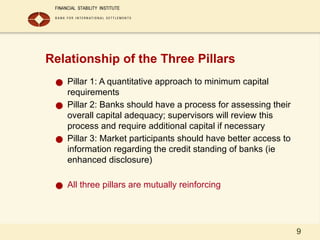

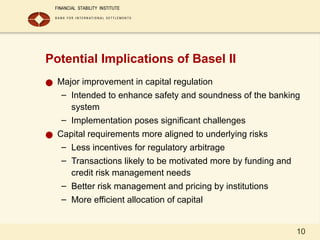

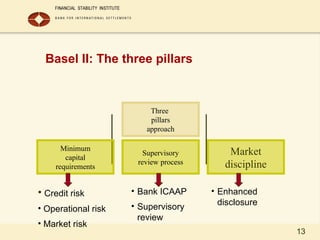

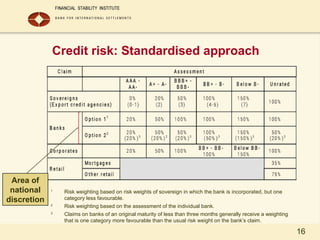

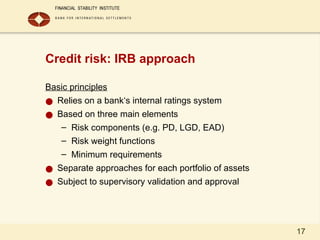

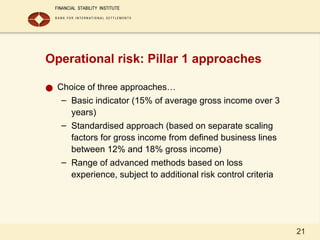

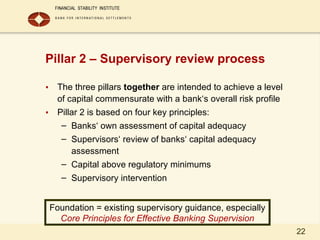

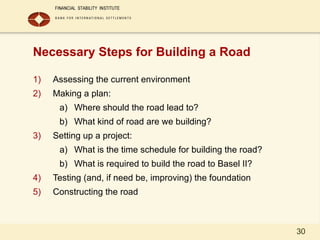

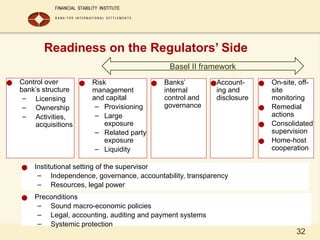

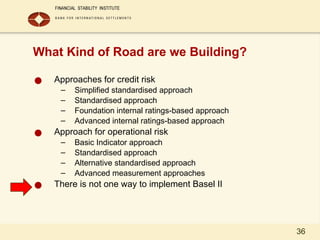

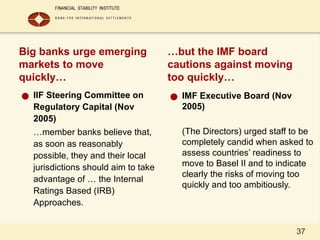

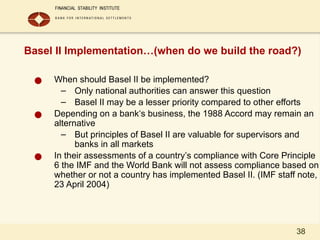

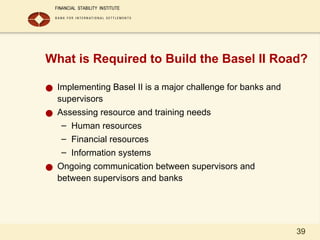

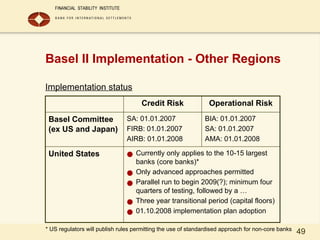

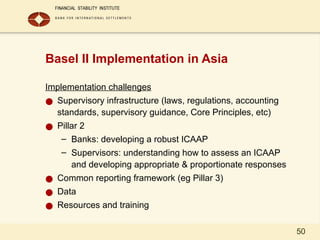

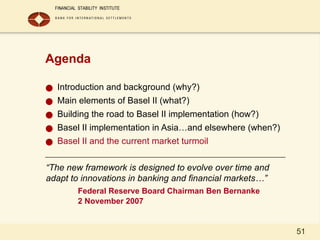

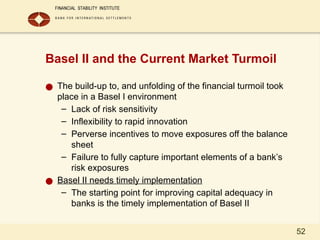

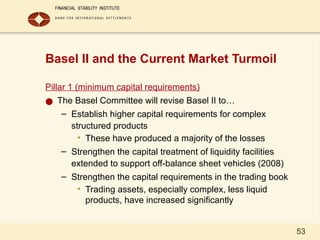

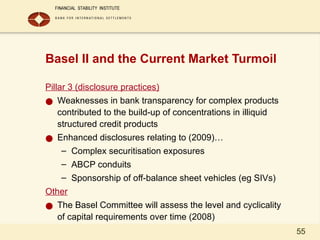

The document provides a comprehensive overview of Basel II, a regulatory framework aimed at enhancing capital adequacy and risk management for banks. It outlines the framework's three pillars: minimum capital requirements, supervisory review processes, and market discipline, and discusses the benefits and challenges associated with implementing Basel II, particularly in Asia. The need for aligned global standards and effective supervision is emphasized, alongside the importance of internal assessments and enhanced disclosures for improved risk management.