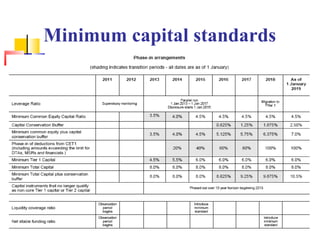

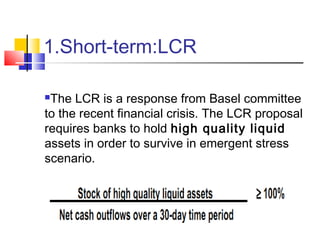

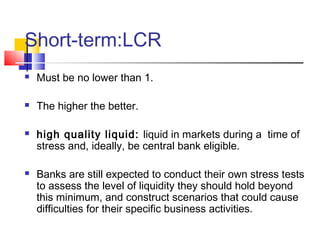

Basel III is a global regulatory standard that aims to strengthen bank capital requirements and introduce new regulatory requirements on bank liquidity and leverage. It was implemented in response to deficiencies in the previous Basel II framework that were exposed by the global financial crisis. The goals of Basel III include improving the banking sector's ability to absorb shocks, reducing systemic risk, and increasing transparency. It establishes stricter capital standards, introduces capital buffers, and imposes new liquidity measures including the liquidity coverage ratio and net stable funding ratio.

![References:

Basel II: a guide to capital adequacy standards for Lenders.

[Available at: http://www.cml.org.uk/cml/policy/issues/748]

Basel III regulations: a practical overview. [Available at:

www.moodysanalytics.com] [Accessed on 30/11/12].

Basel III: Issues and implications. [Available at: www.kpmg.com]

[Accessed on 30/11/12].

Federal Reserve Proposes Revised Bank Captial Rules.

[Available at:

http://blogs.law.harvard.edu/corpgov/2012/06/12/federal-

reserve-proposes-revised-ba...] [Accessed on 30/11/12].

Introduction to Basel II: [Available at:

http://www.rcg.ch/papers/basel2.pdf]

Introduction to Basel II. [Available at:

http://www.horwathmak.com/Literature/Introduction_to_basel_ii.

pdf]](https://image.slidesharecdn.com/baseliiipresentation-121227173011-phpapp02/85/Basel-iii-presentation-31-320.jpg)

![References: (Cont.)

http://mpra.ub.uni-muenchen.de/35908/ [Accessed

on 11/12/2012]

The New Basel III Framework: Implications for

Banking Organisations. [Available at:

www.shearman.com][Accessed on 30/11/12].](https://image.slidesharecdn.com/baseliiipresentation-121227173011-phpapp02/85/Basel-iii-presentation-32-320.jpg)