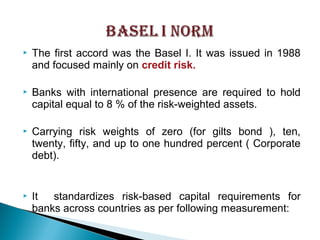

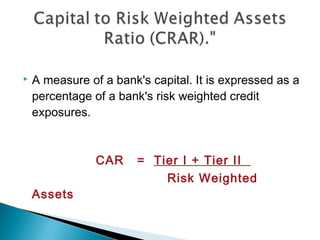

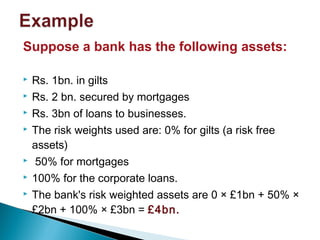

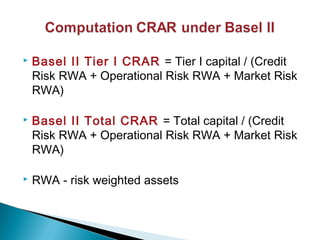

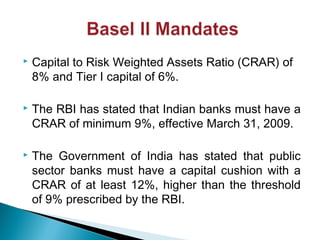

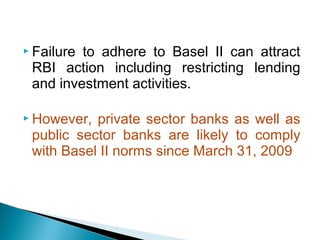

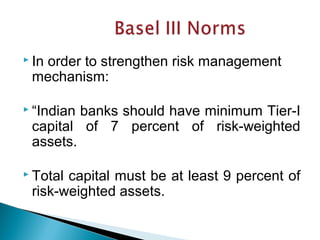

This document discusses various risks faced by banks such as credit risk, liquidity risk, market risk, and operational risk. It summarizes Basel I, Basel II, and Basel III capital adequacy frameworks which establish minimum capital requirements for banks. It outlines the key components of Tier 1 and Tier 2 capital and how risk weighted assets are calculated to determine the capital adequacy ratio. The Reserve Bank of India requires banks to maintain a minimum capital to risk-weighted assets ratio of 9% under Basel II norms.