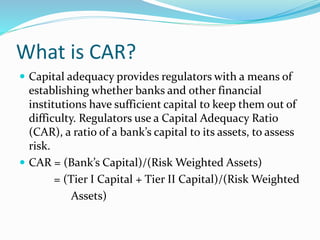

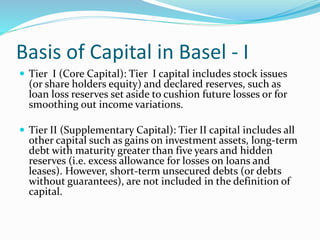

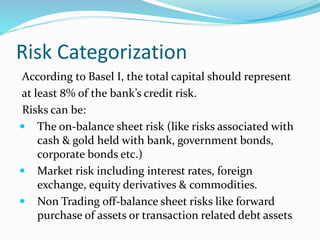

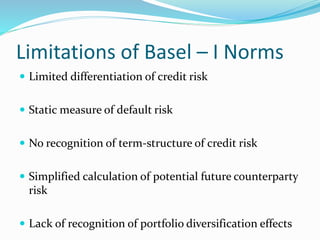

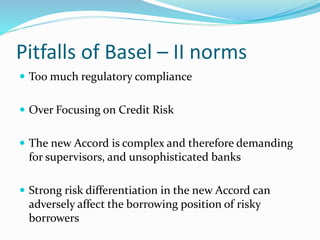

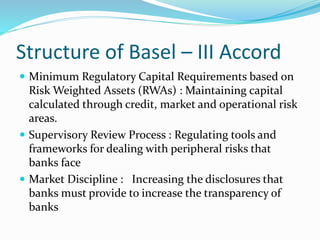

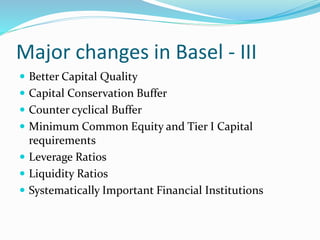

This document discusses the Capital Adequacy Ratio (CAR) and its evolution over time from Basel I to Basel III. It defines CAR as the ratio of a bank's capital to its risk-weighted assets. Basel I established an initial CAR requirement of 8% in 1988. Basel II introduced a more risk-sensitive approach and recognized additional risks. Basel III further strengthened regulations by improving capital quality and introducing liquidity requirements. The overall purpose was to increase stability in the banking system and strengthen a bank's ability to absorb financial and economic shocks.