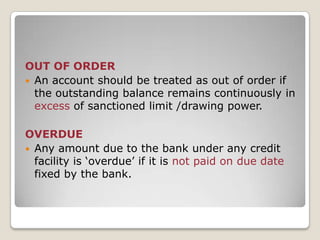

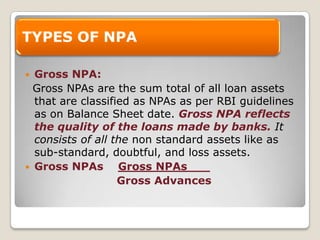

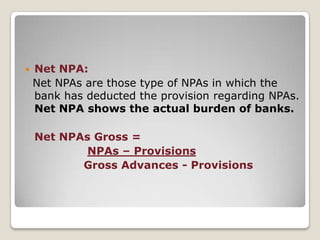

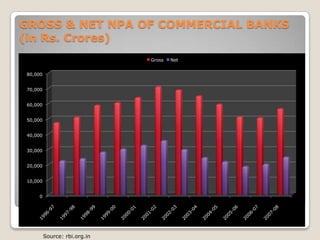

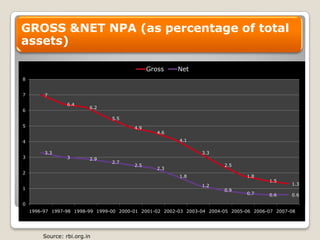

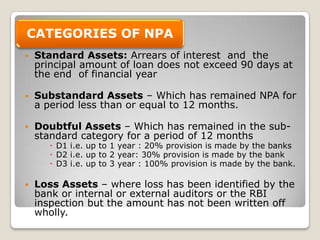

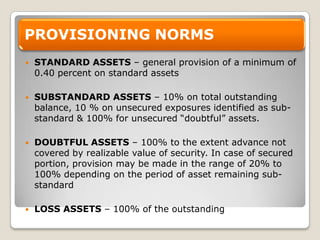

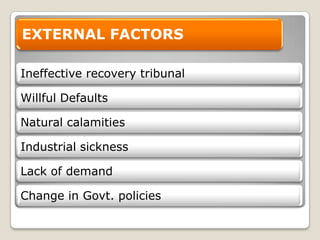

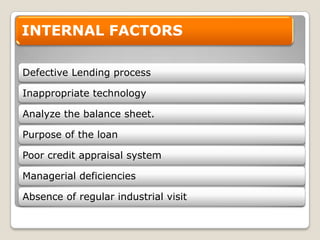

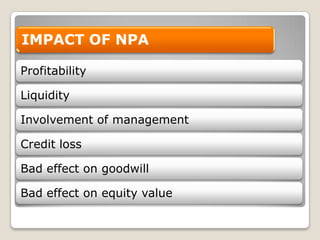

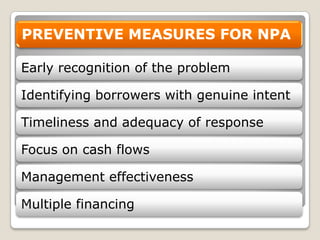

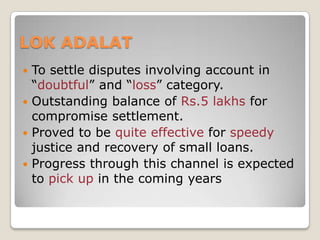

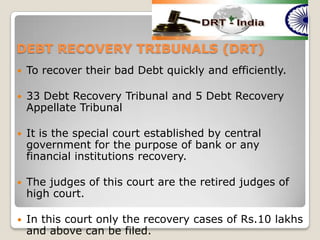

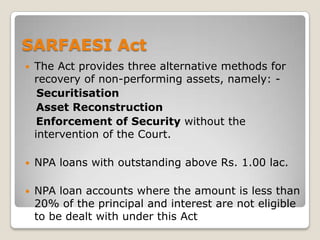

The document discusses non-performing assets (NPAs) in the Indian banking system. It defines key NPA terms like gross NPA, net NPA, and standard, substandard, doubtful, and loss assets. It identifies causes of NPAs on both the borrower side, like lack of planning and fund diversions, and banker side, like defective sanctioning and slow decision making. It outlines RBI guidelines on NPA classification and provisioning requirements. Methods for recovering NPAs like Debt Recovery Tribunals, Lok Adalats, SARFAESI Act, and asset reconstruction companies are summarized.