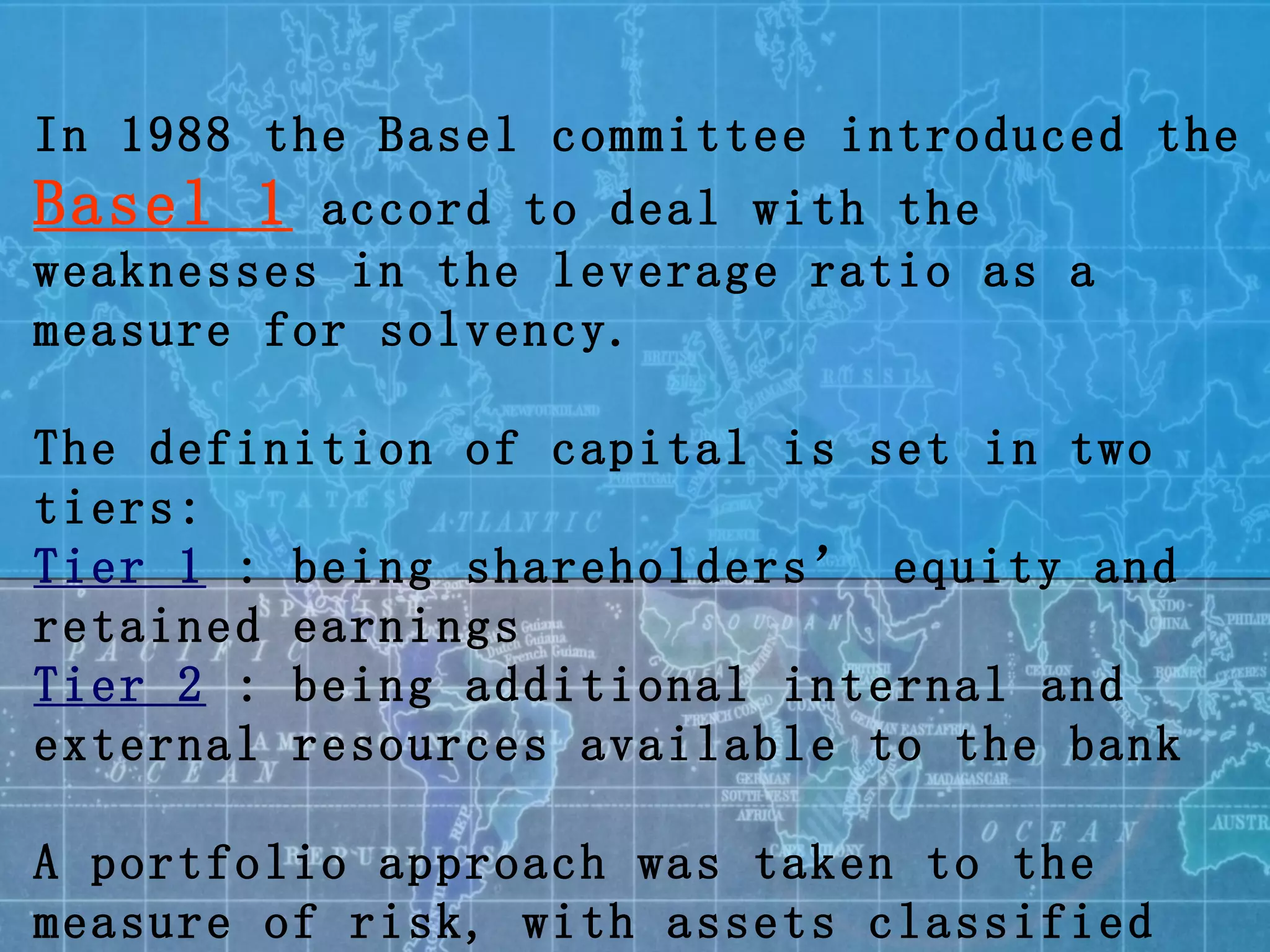

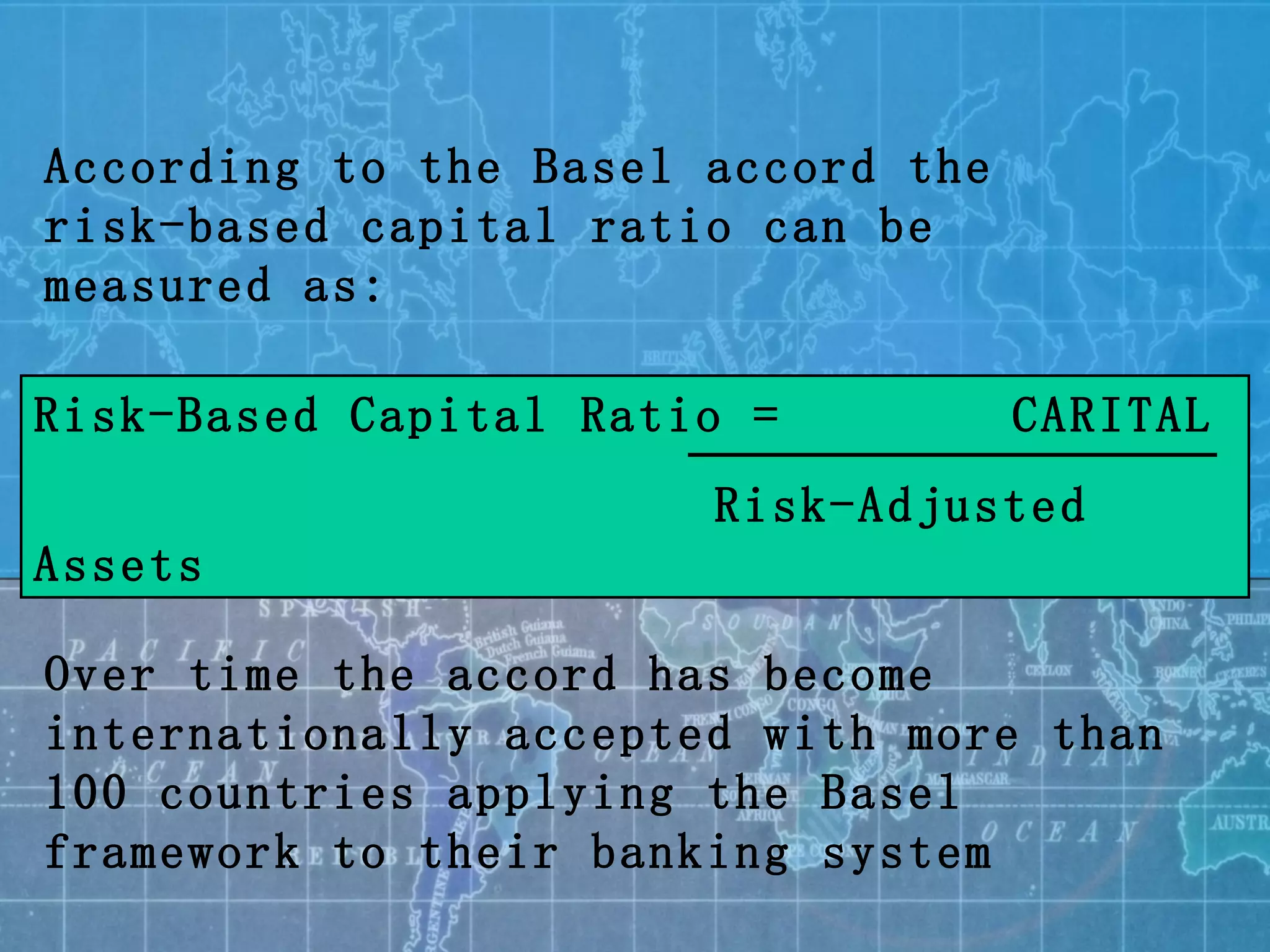

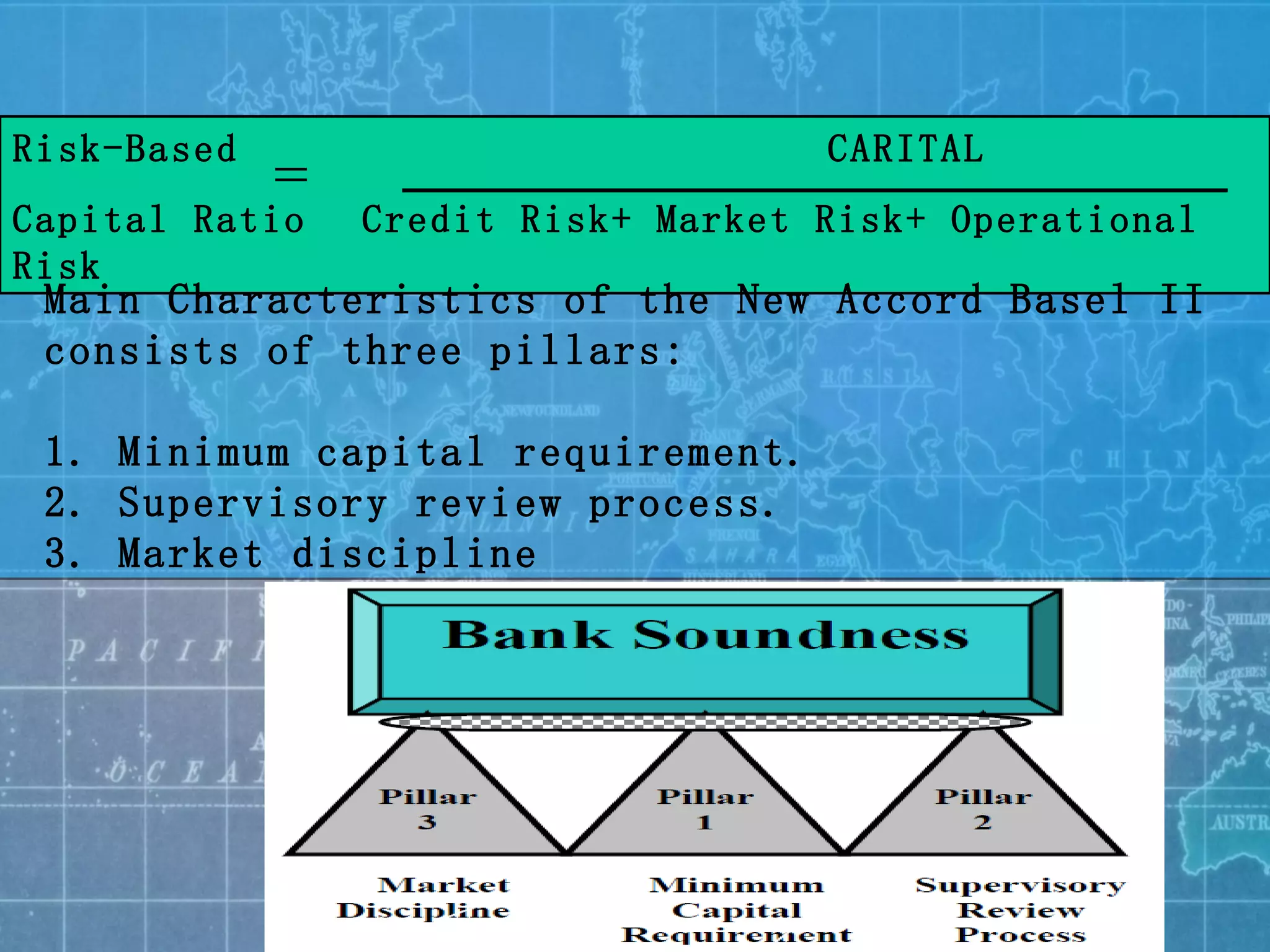

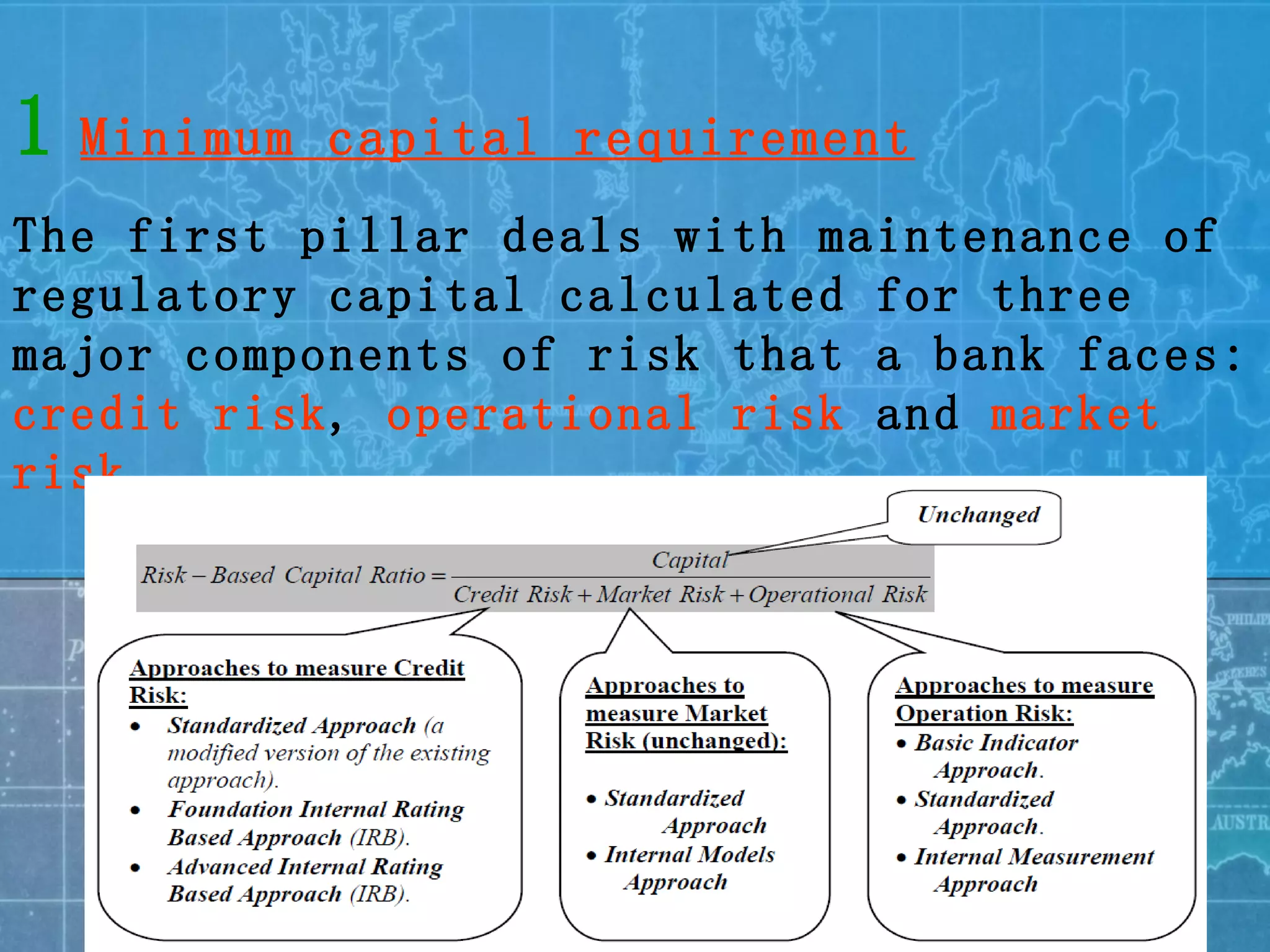

Basel 1 and Basel 2 promote banking safety and soundness. Basel 1 introduced risk-based capital requirements but had weaknesses. Basel 2 builds on Basel 1 with three pillars: minimum capital requirements calculated based on credit, market and operational risk; supervisory review of risk management; and market discipline through disclosure. It utilizes internal ratings-based and standardized approaches to determine capital requirements in a more risk-sensitive manner.

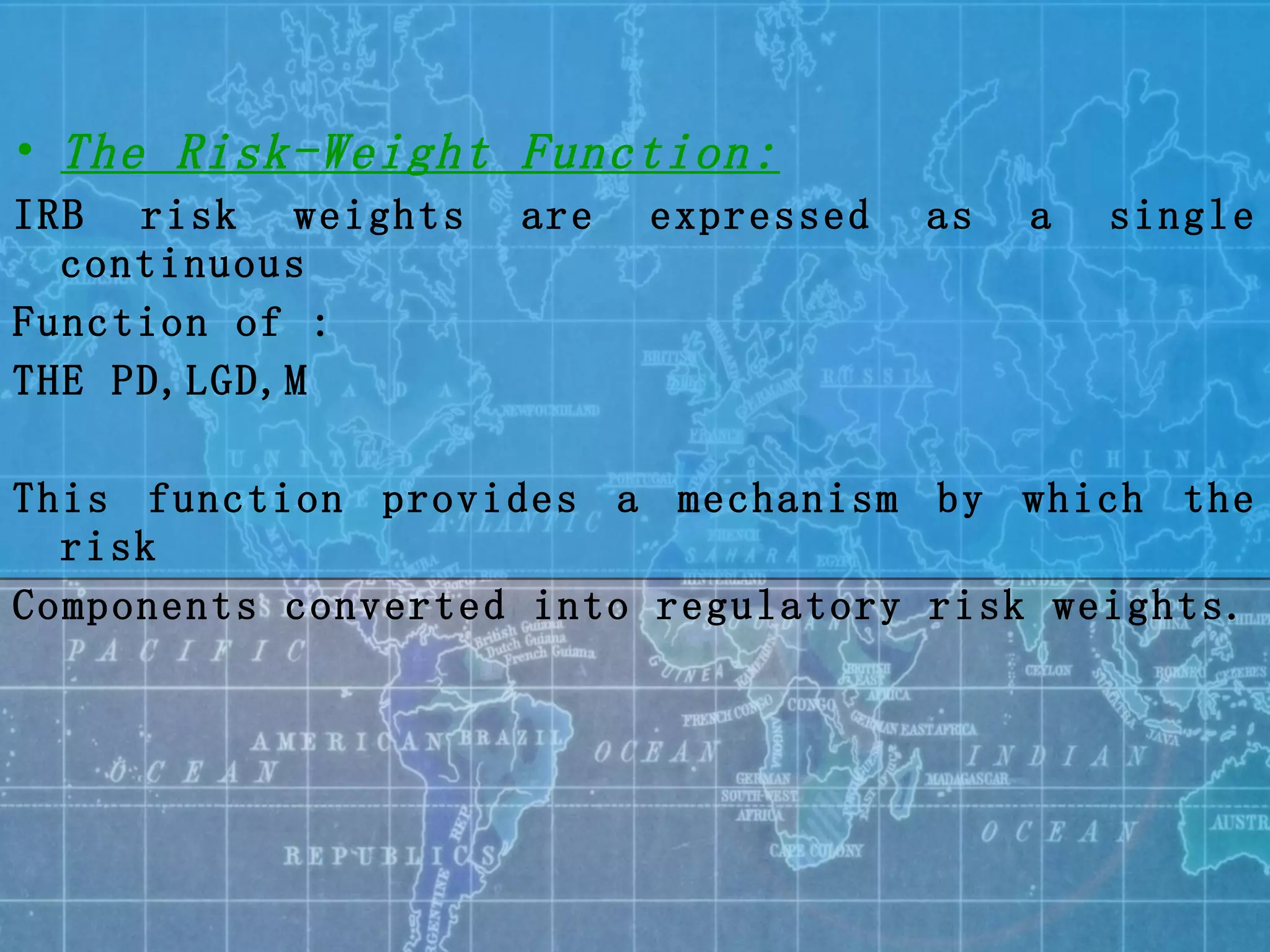

![The function of the risk weight can be defined as follows: Correlation (R) 0.10 1- EXP(-50 PD) / 1 EXP( 50)+ 0.20 [1 (1 EXP( 50 PD))/(1 EXP( 50))] Maturity factor (M) = 1+ .047× ((1- PD)/PD.44 ) Capital requirement (K) = LGD×M× N[(1− R)−.5 ×G(PD) + (R/(1− R)).5 ×G(.999)] EXP= stands for the natural exponential function](https://image.slidesharecdn.com/basel12-111024033908-phpapp01/75/Basel1-2-22-2048.jpg)