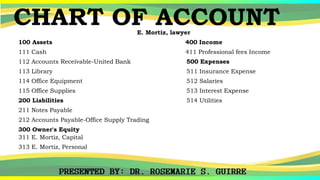

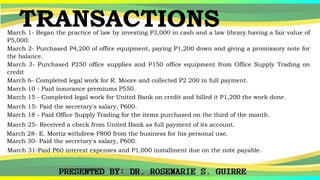

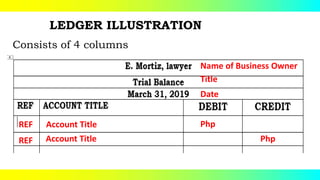

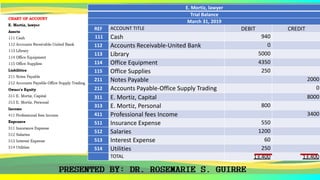

1. The document provides an example trial balance for E. Mortiz, a lawyer, for March 31, 2019. It includes a chart of accounts and list of transactions throughout March.

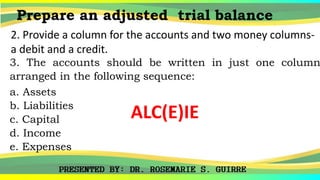

2. The transactions are then journalized and posted to accounts. The trial balance lists account titles in the specified order with debit and credit balances.

3. The trial balance shows total debits of 13,400 equal to total credits of 13,400, indicating the trial balance balances.