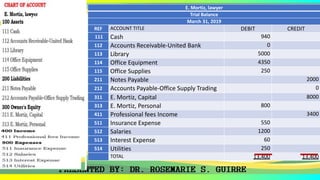

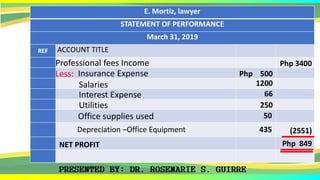

This document discusses how to prepare income statements from a trial balance worksheet. It begins by explaining that an income statement, along with a retained earnings statement and balance sheet, are business financial statements prepared at the end of an accounting period. It then describes the two main types of income statements: a general/single-step income statement and a multiple income statement. The general income statement deducts all expenses directly from revenues, while the multiple income statement deducts cost of goods sold from revenues to calculate gross profit first before deducting operating expenses to reach net operating income. The document provides an example income statement prepared from the trial balance of a lawyer's business.