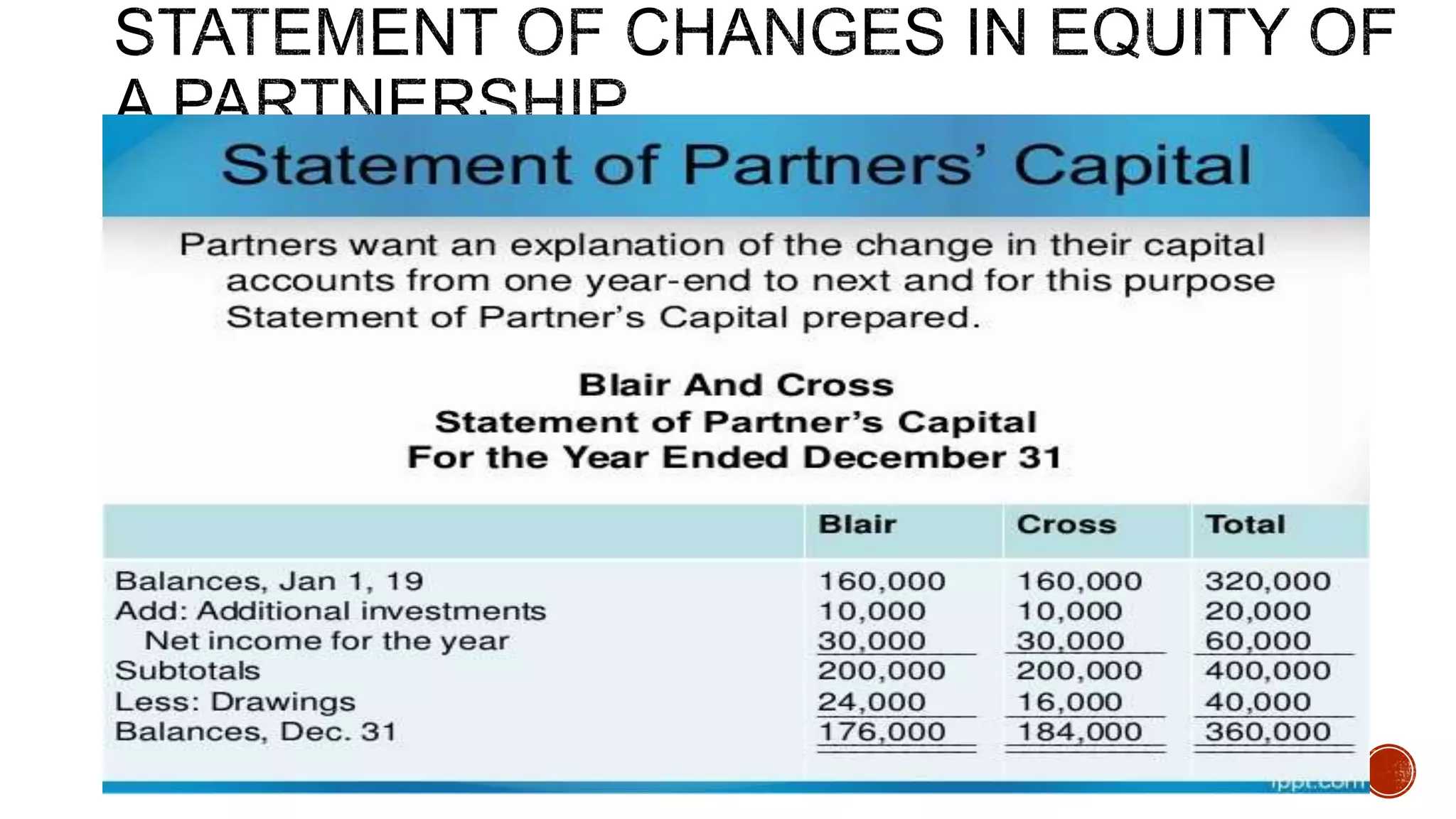

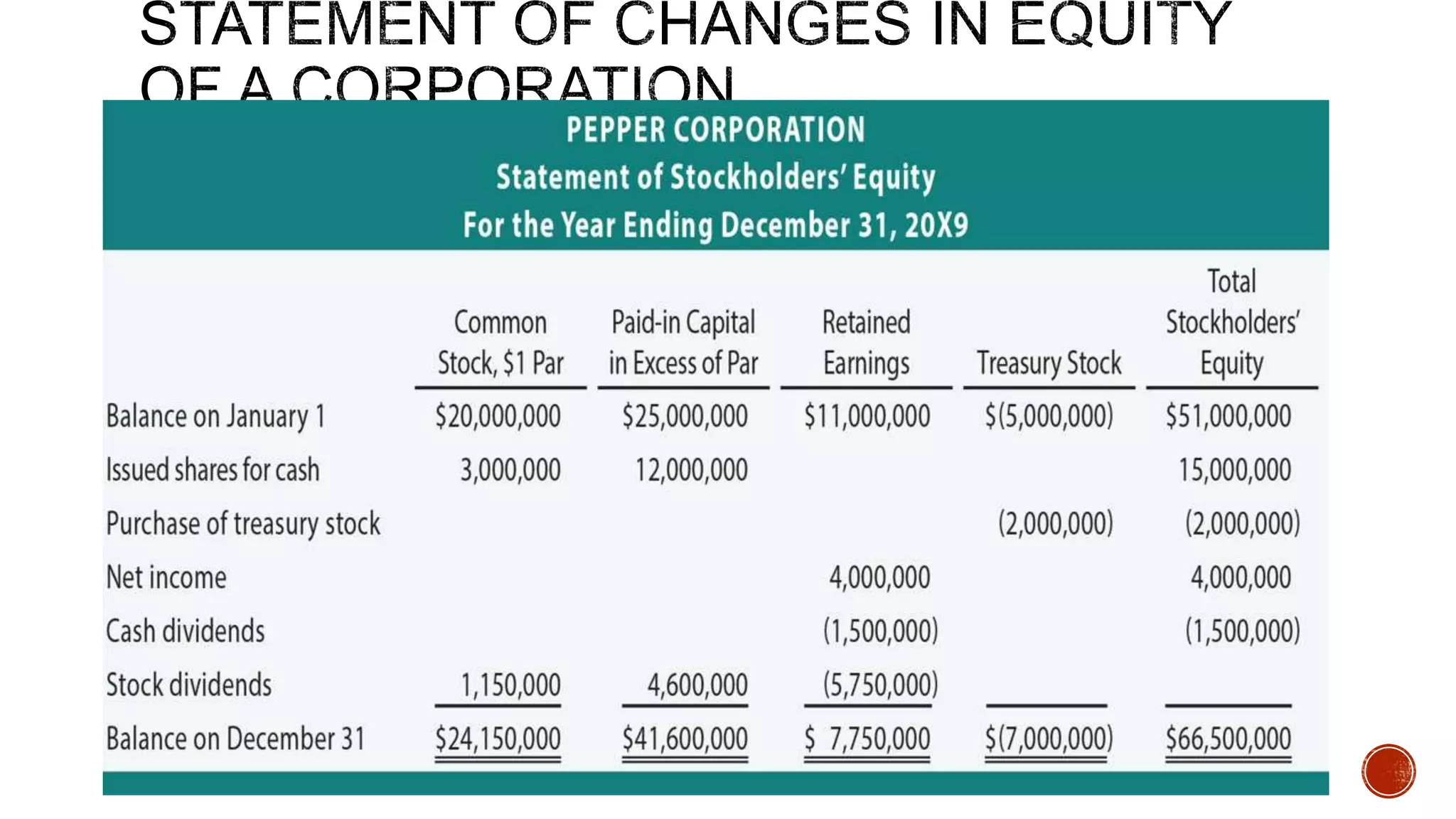

The document discusses the statement of changes in equity (SCE), including its purpose of reporting changes in equity over an accounting period. It defines key elements of the SCE for sole proprietorships, partnerships, and corporations. These include initial investment, additional investment, withdrawals, revenues, expenses, assets, and liabilities. Examples are provided of how to prepare the heading and sections for increases and decreases to equity on an SCE. Practice problems are included at the end to test comprehension.