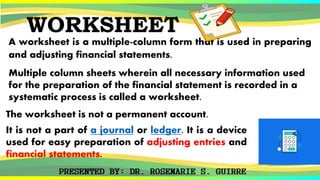

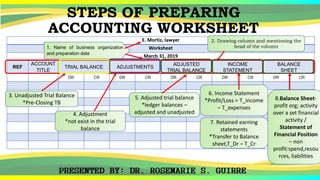

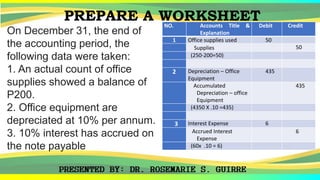

This document provides information about preparing an accounting worksheet. It discusses the purpose of a worksheet as a multiple-column form used to prepare and adjust financial statements. It describes the three main types of worksheets: general worksheets contain columns for trial balance, adjustments, adjusted trial balance, income statement, and balance sheet. Detailed worksheets contain more detailed accounts. Audit worksheets are used to prepare financial statements and lists for auditing purposes. Steps for preparing a worksheet are outlined, including naming the business, drawing columns, unadjusted trial balance, adjustments, adjusted trial balance, income statement, retained earnings, and balance sheet. An example is provided with adjustments for supplies used, depreciation of equipment, and accrued interest expense