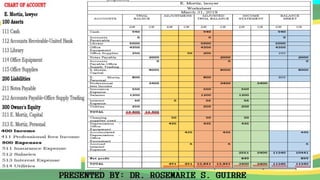

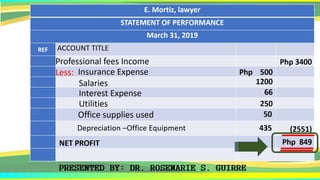

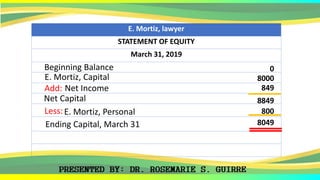

This document provides an overview of changes in equity accounting. It discusses the purpose and components of the statement of changes in equity, which helps users identify factors that cause changes in owners' equity over accounting periods. The components disclosed include opening balance, effects of accounting policy changes and prior period errors, changes in share capital, dividends, income/loss, revaluation reserves, other gains/losses, and closing balance. An example statement of equity is also provided.