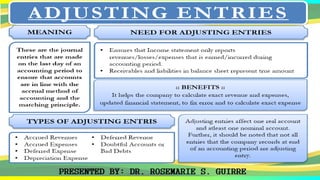

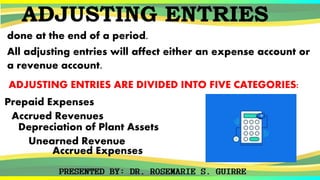

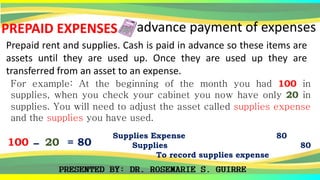

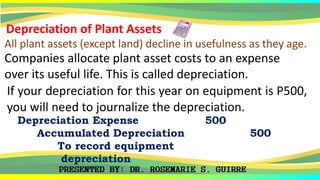

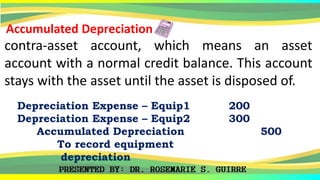

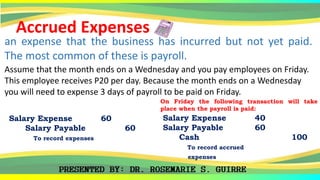

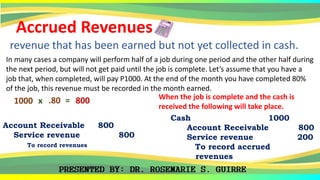

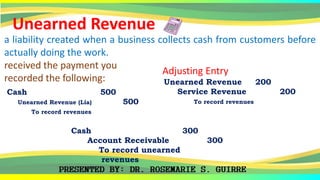

This document provides an overview of adjusting entries in accounting. It discusses five categories of adjusting entries: 1) Prepaid expenses where assets are adjusted as expenses are used up, 2) Depreciation of plant assets where asset costs are allocated to expenses over time, 3) Accrued expenses where expenses incurred but not paid are recorded, 4) Accrued revenues where revenues earned but not received are recorded, and 5) Unearned revenue where cash received before work is done creates a liability. Examples are provided for each category to illustrate the adjusting journal entries. The purpose of adjusting entries is to allocate revenues and expenses to the proper accounting periods.