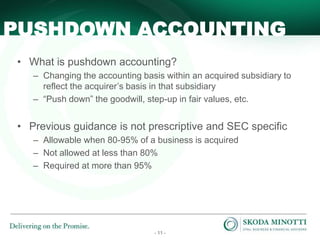

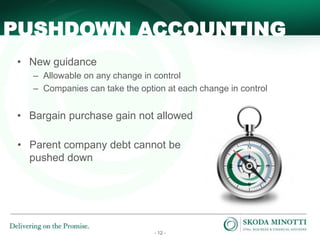

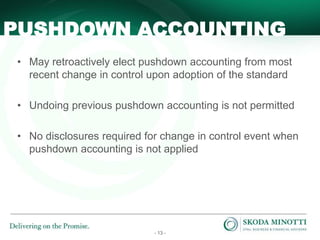

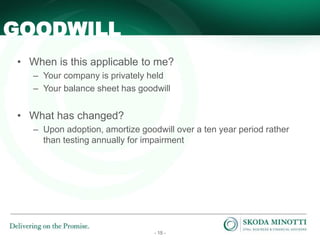

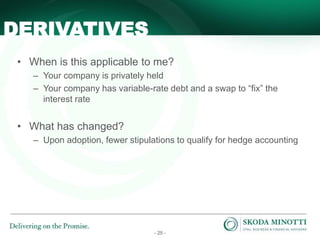

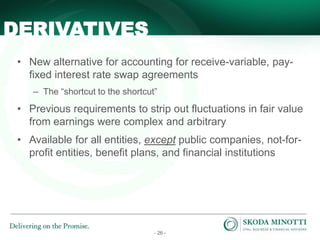

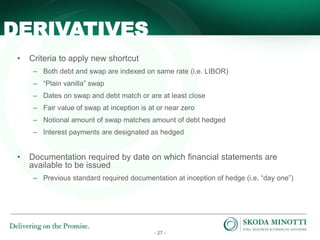

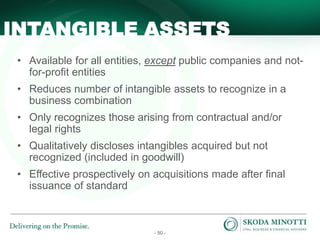

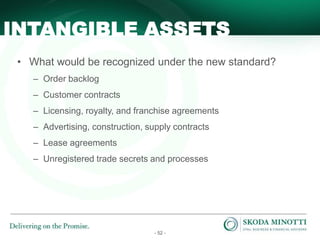

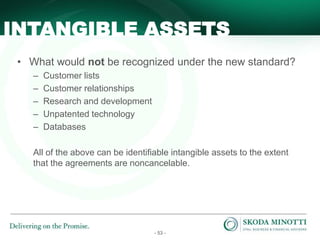

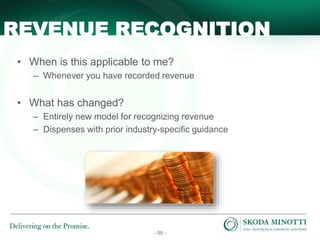

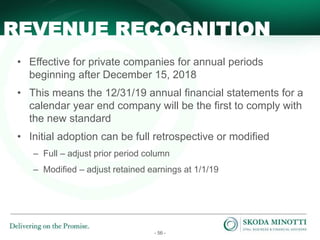

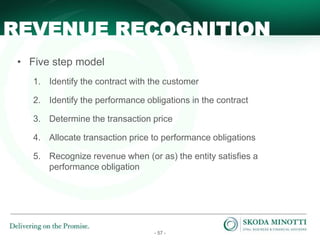

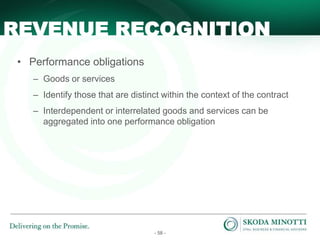

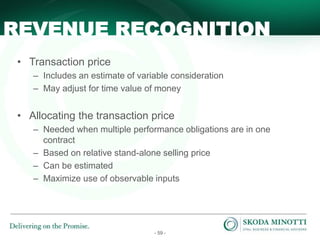

The document discusses various accounting standards updates relevant for private companies, including changes to discontinued operations, goodwill amortization, pushdown accounting, and derivatives. Key updates focus on reduced qualifications for discontinued operations, new amortization requirements for goodwill, and simpler hedge accounting for derivatives. Additional updates include changes in disclosure requirements and revenue recognition guidelines, effective for periods beginning after December 15, 2018.