Embed presentation

Downloaded 186 times

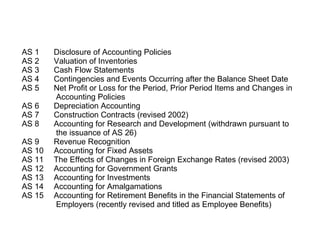

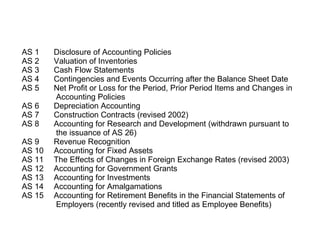

The document outlines the accounting standards established in India by the Accounting Standards Board of the Indian Chartered Accountants of India. It lists 29 accounting standards covering topics such as disclosure of accounting policies, valuation of inventories, cash flow statements, depreciation, revenue recognition, accounting for investments, borrowing costs, segment reporting, and provisions. The accounting standards were constituted on April 21, 1977 and provide guidance on preparing financial statements in accordance with Indian accounting principles.