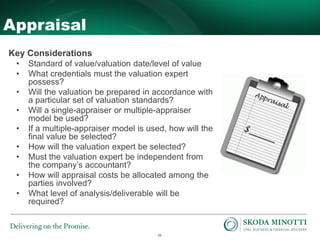

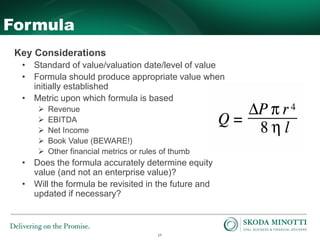

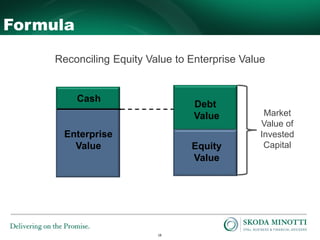

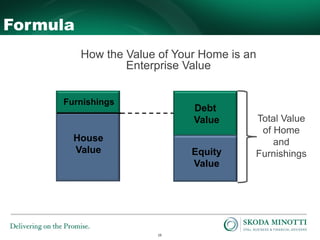

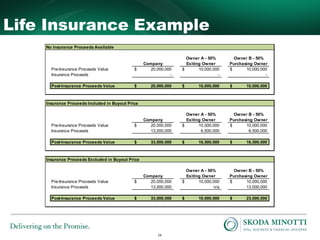

The document discusses essential considerations for developing and executing buy-sell agreements, particularly focusing on valuation issues that arise during ownership transactions. Key topics include standards of value, valuation dates, levels of value, and different valuation approaches like appraisal, formula, and agreed-upon value. Best practices are suggested for drafting these agreements, including defining valuation terms and incorporating input from qualified valuation experts.