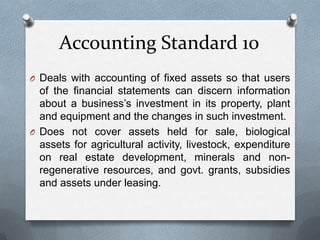

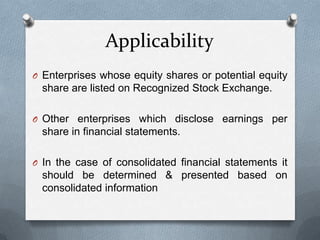

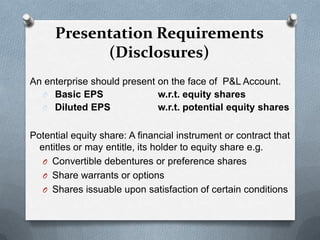

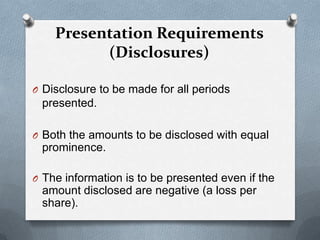

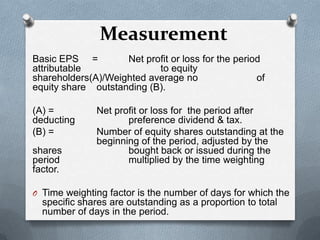

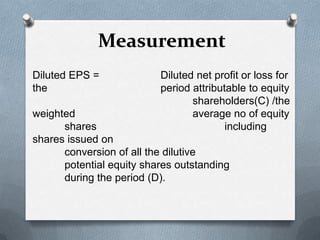

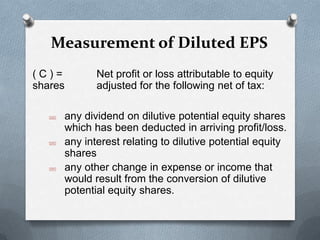

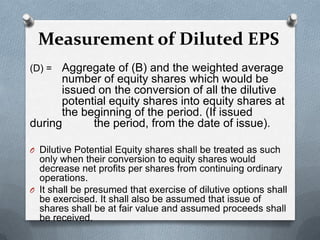

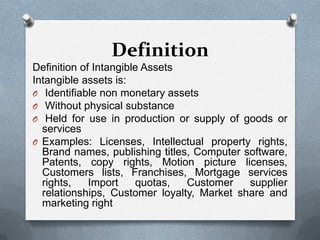

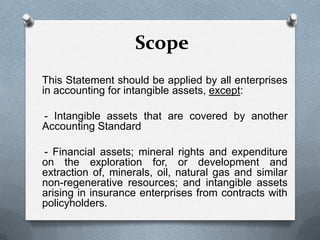

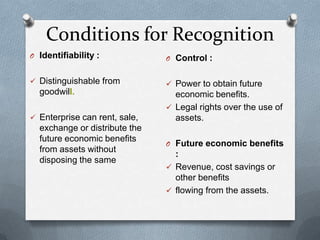

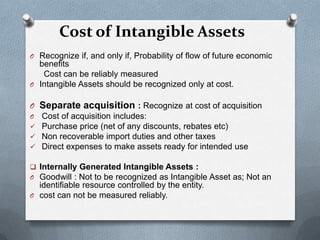

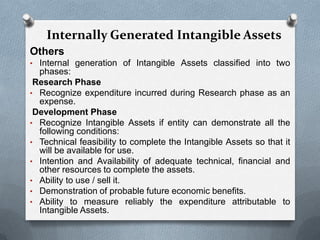

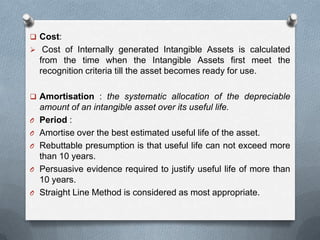

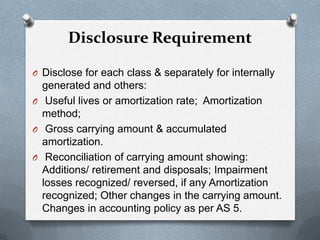

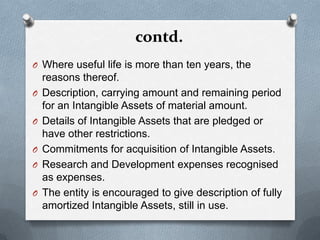

This document provides an overview of several accounting standards including AS 10 on fixed assets, AS 20 on earnings per share, and AS 26 on intangible assets. It discusses the key objectives, applicability, recognition criteria, measurement, and disclosure requirements for accounting and reporting for fixed assets, EPS calculation, and intangible assets according to the relevant accounting standards. The document also covers terminology, components of cost, impairment, amortization, and other accounting treatments for these items to ensure compliance with Indian accounting standards.